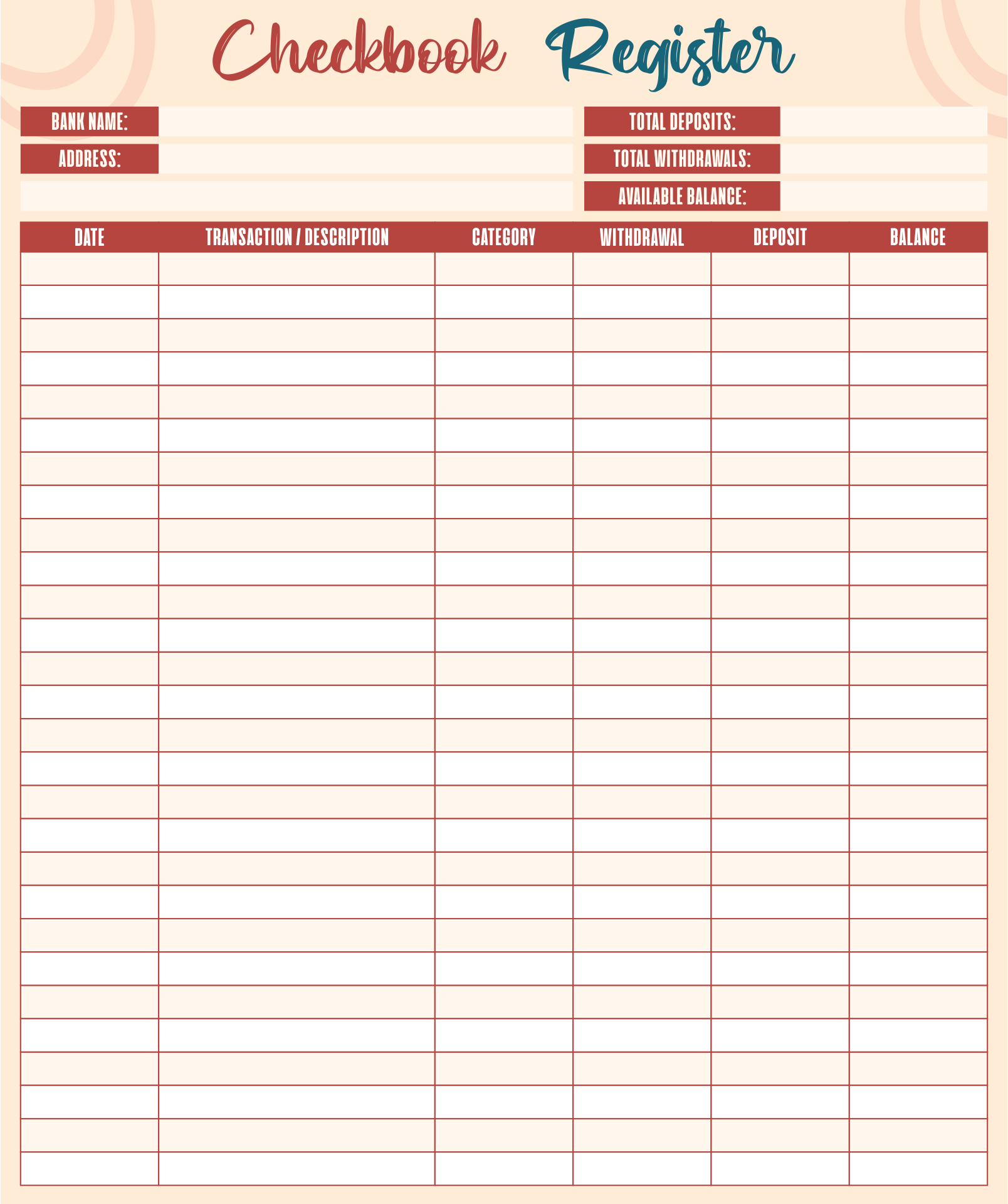

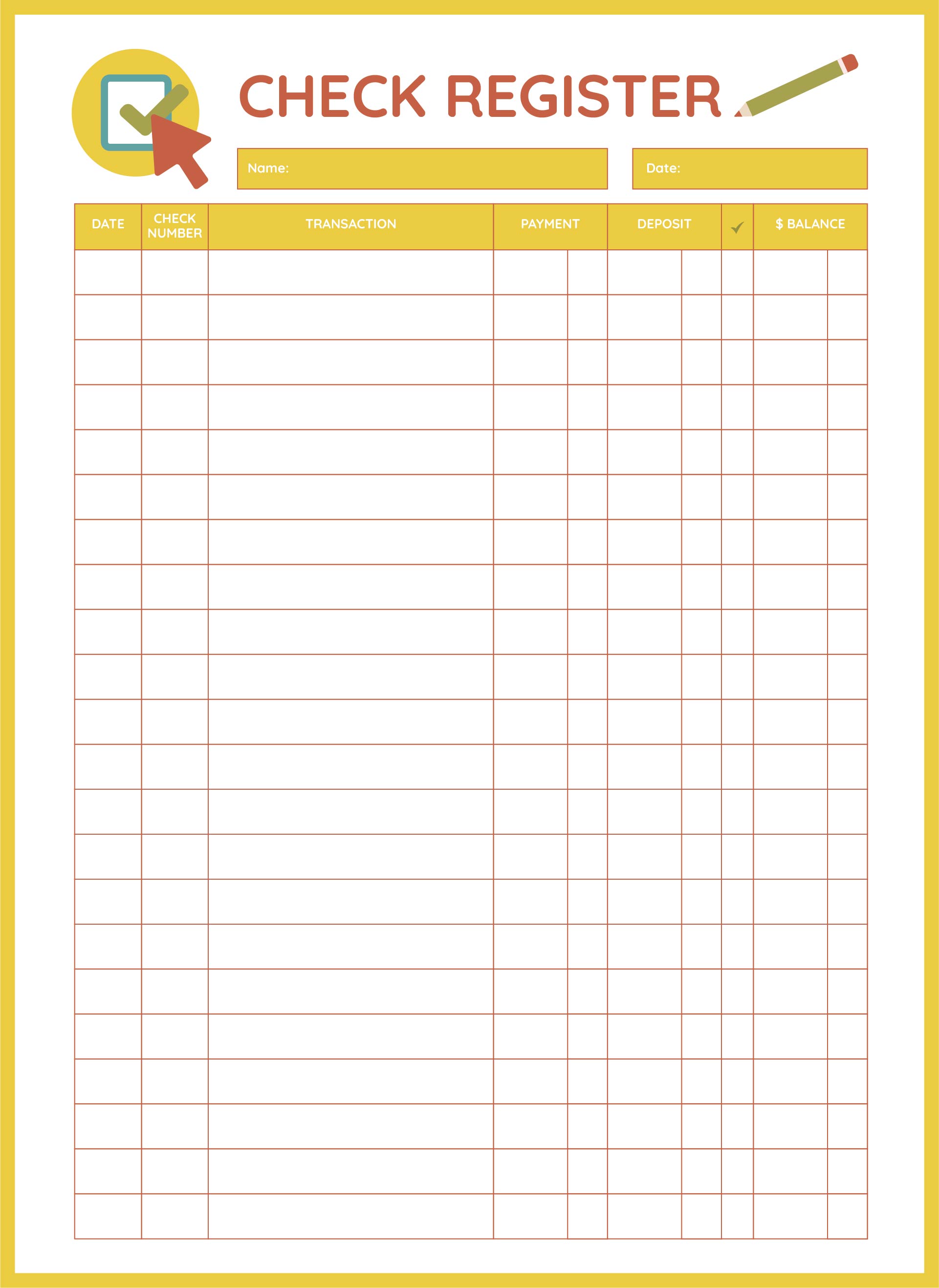

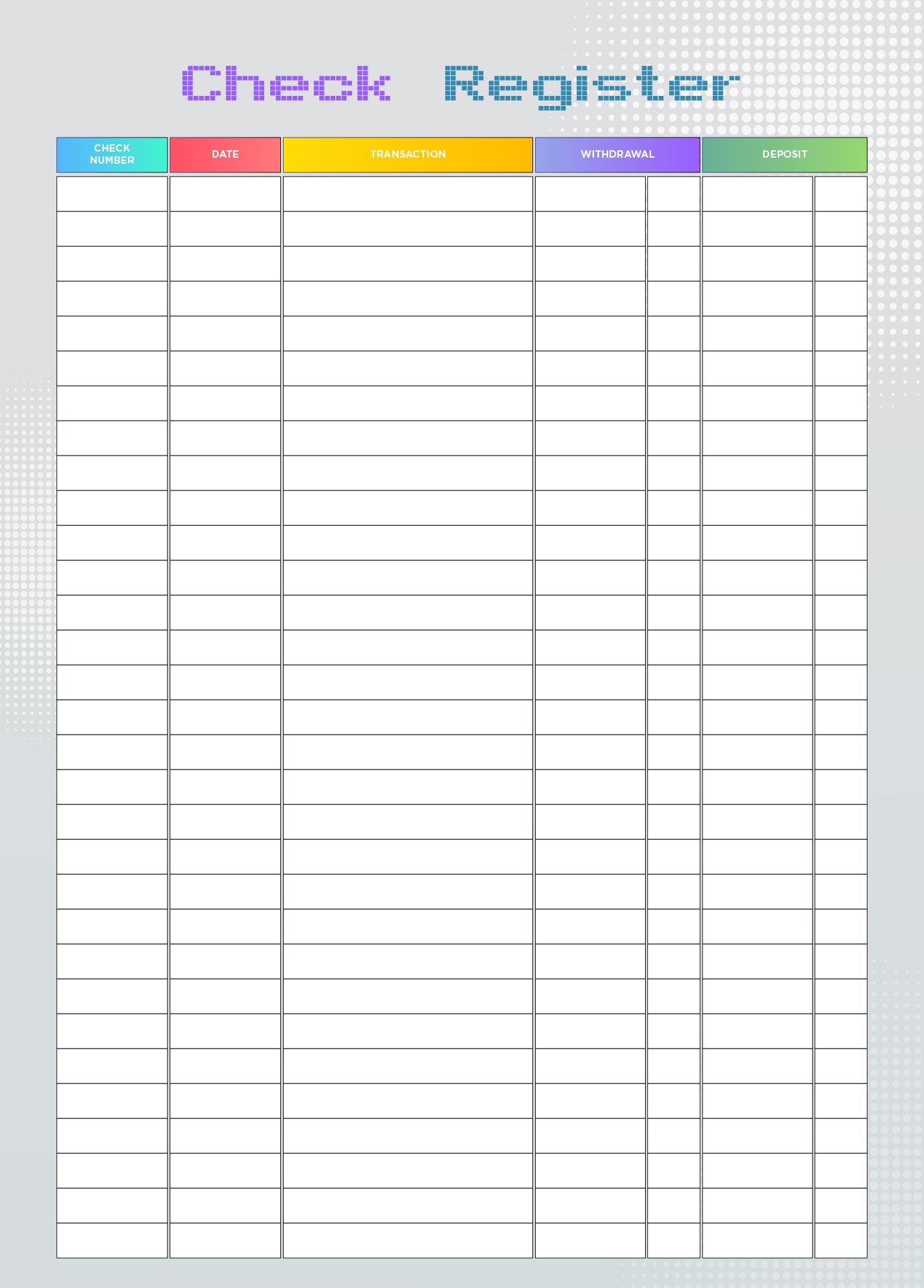

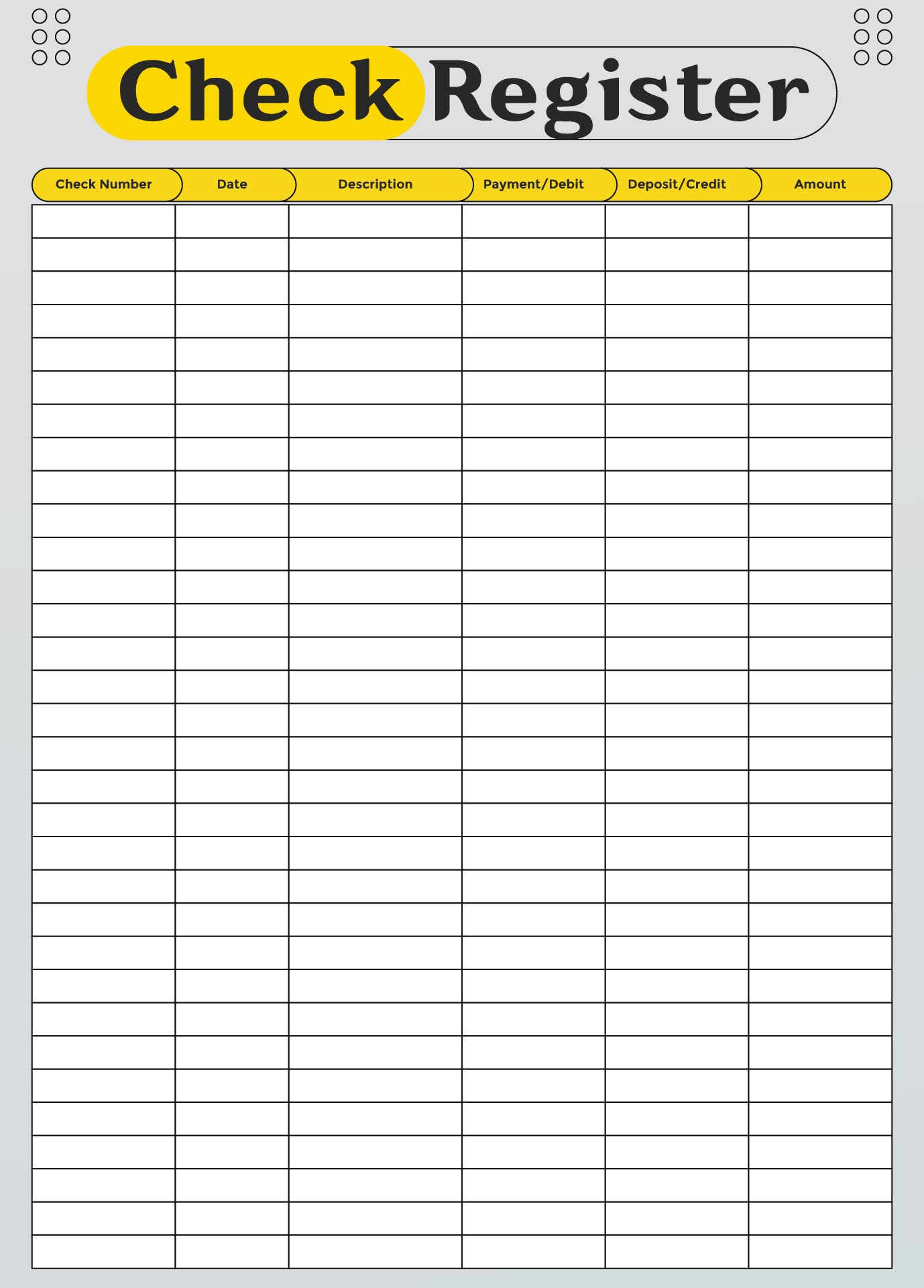

Free printable check registers can aid in financial tracking by providing a detailed record of your transactions, including checks, deposits, and withdrawals. It helps in staying organized and controlling your finances.

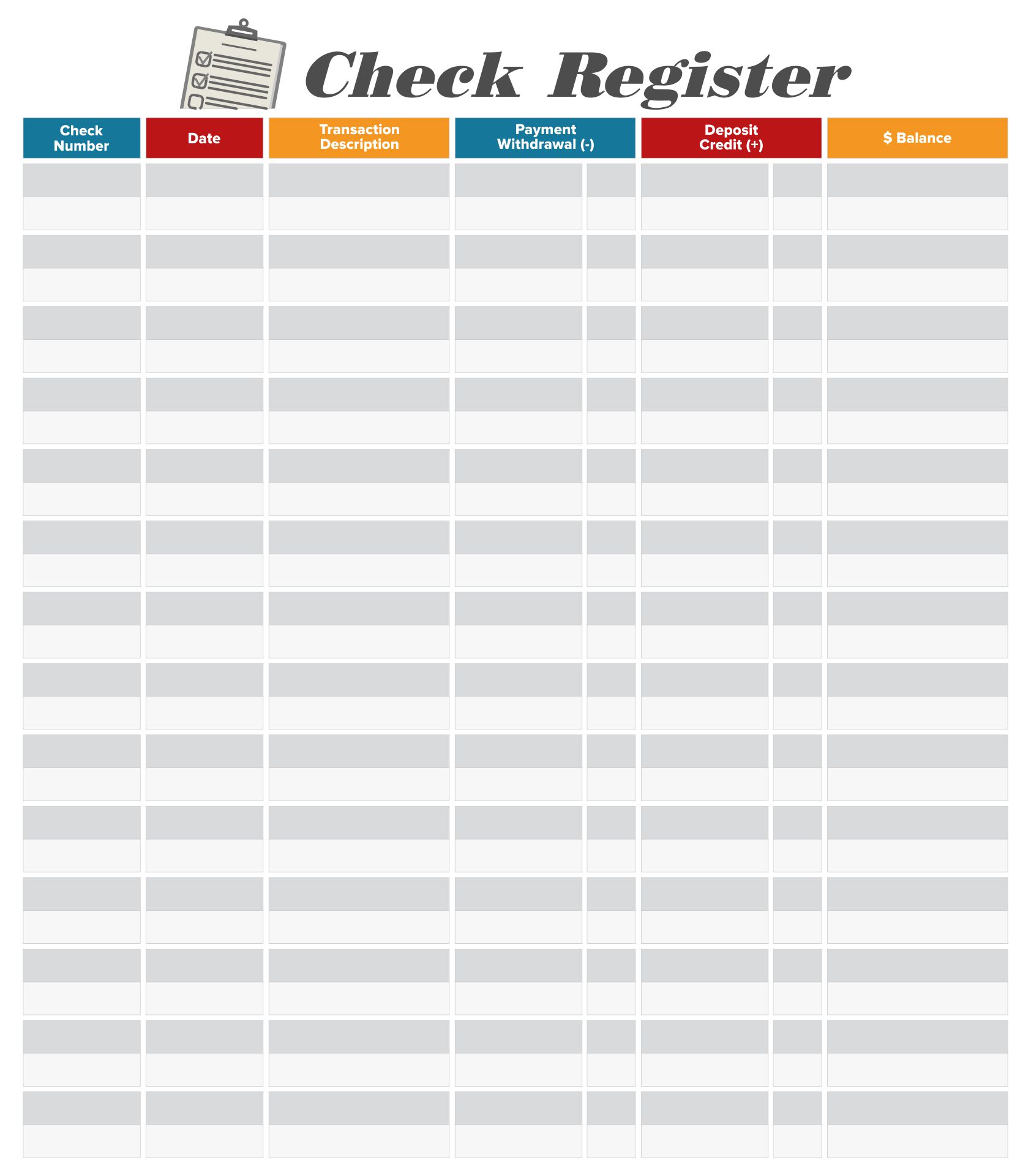

For small business owners, a cost-effective solution for maintaining accurate business expense records is the free printable checkbook-sized check register. It eliminates the need for expensive software or professional accountants, and is easy to carry and reference.

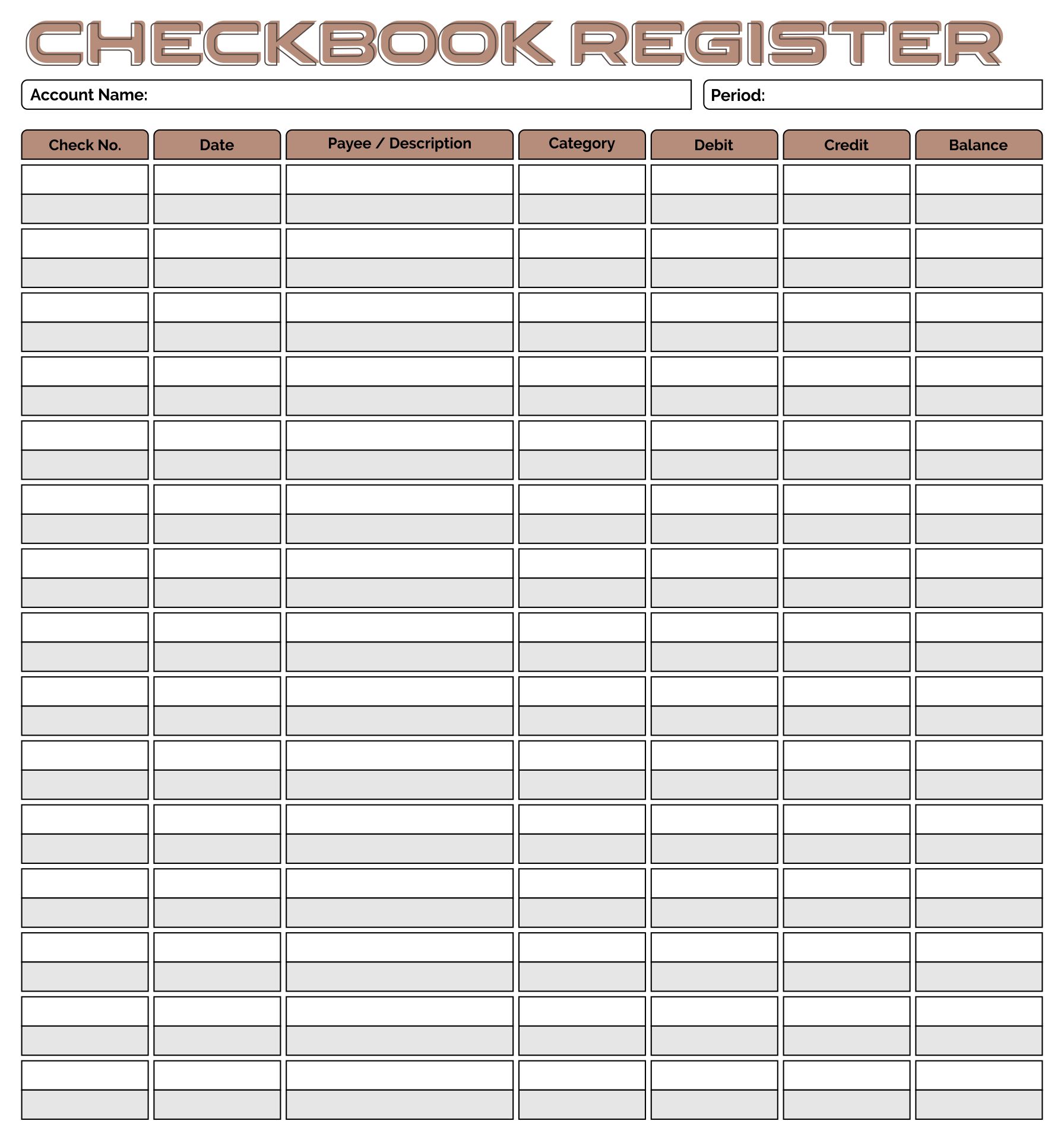

Checkbook-sized printable check registers are useful for budgeting and money management. They help monitor expenses, income, and savings, thus giving a better understanding of your financial position for informed decisions about your financial future.

The checkbook-sized free printable check register is a valuable financial management tool, especially for college students and young adults. It helps track expenses, stay within budget, cultivate financial responsibility, and is conveniently portable.

A printable check register in checkbook size is a useful tool for keeping track of your personal or business finances. It provides a convenient and organized way to record your transactions, including checks written, deposits made, and withdrawals. By using a printable check register, you can easily monitor your account balance and ensure that you have an accurate record of all your financial activities.

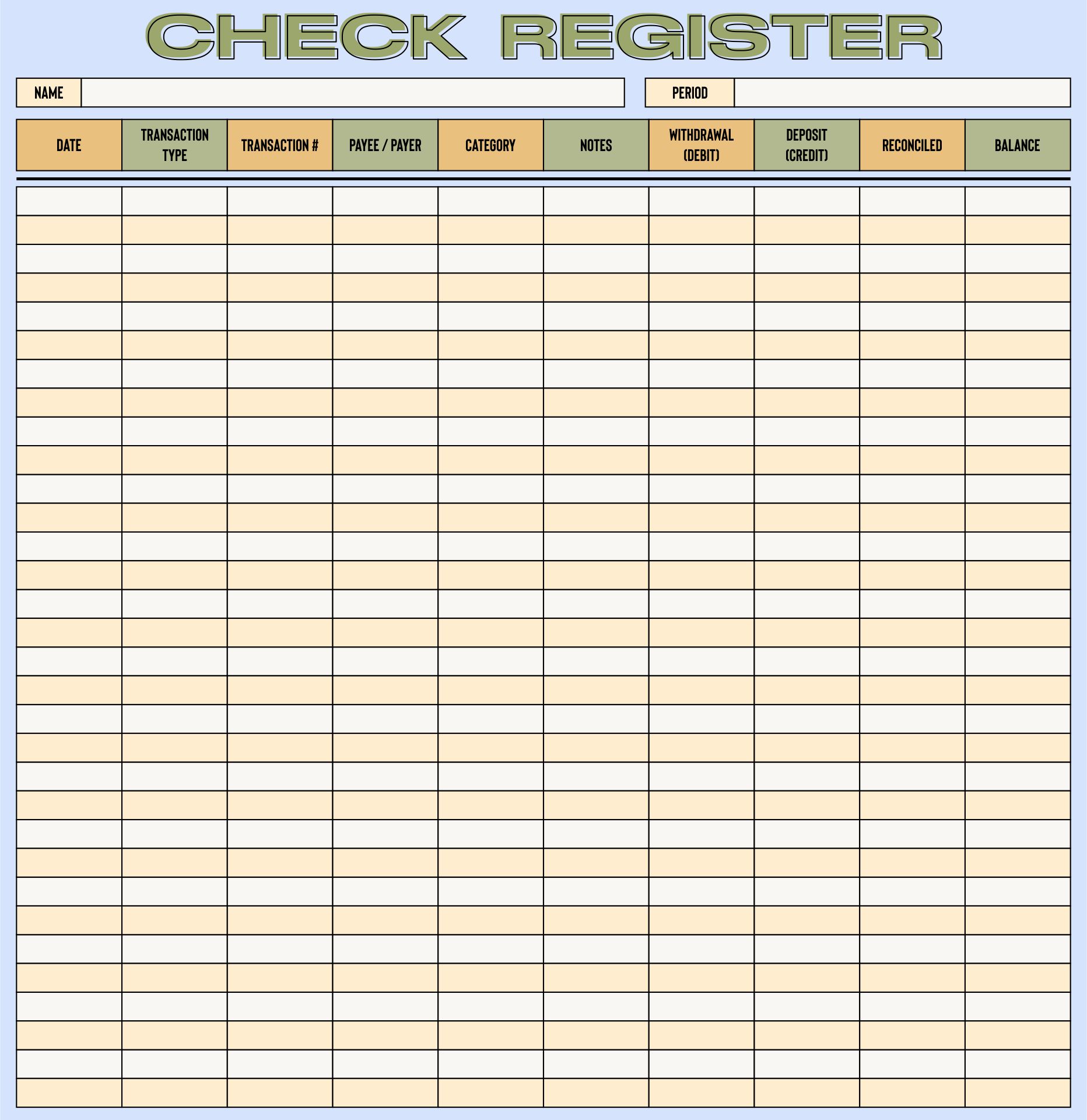

A printable check register for your checkbook size is incredibly helpful in managing your finances efficiently. It allows you to track all your transactions, deposits, withdrawals, and current balance in one place.

This ensures you have a clear overview of your spending habits and helps avoid overdraft fees by keeping a timely and accurate record of your financial movements. For personal use or managing a small business's finances, this tool promotes financial discipline and budgeting effectiveness.

A printable check register offers a practical finance tracking method. Its compact size makes it easy to carry and store. This register aids in recording debits, credits, and balances, ensuring organized and updated financial records.

For budgeting and money management students, a small-sized printable check register is recommended. It fits in a backpack or a purse and enables expense tracking, aiding in organization and informed financial decision-making. It's a useful tool for maintaining financial order on the go.

The printable check register is tailored for seniors who prefer physical expense tracking. It provides easy usage and portability. This tool helps seniors maintain accurate financial records by recording spending, offering a clear overview of their finances. Its larger size enhances usability for seniors.

A printable check register in checkbook size is a useful tool that allows you to easily keep track of your transactions and monitor your account balances. It provides a convenient space to document each check number, date, payee, and amount, making it easy to reconcile your bank statements and stay organized. By using a printable check register in checkbook size, you can effectively manage your finances and have a clear overview of your spending.

Have something to tell us?

Recent Comments

This free printable check register is an incredibly handy resource! It's perfect for keeping track of my finances in a neat and organized way. Thank you for providing such a useful tool!