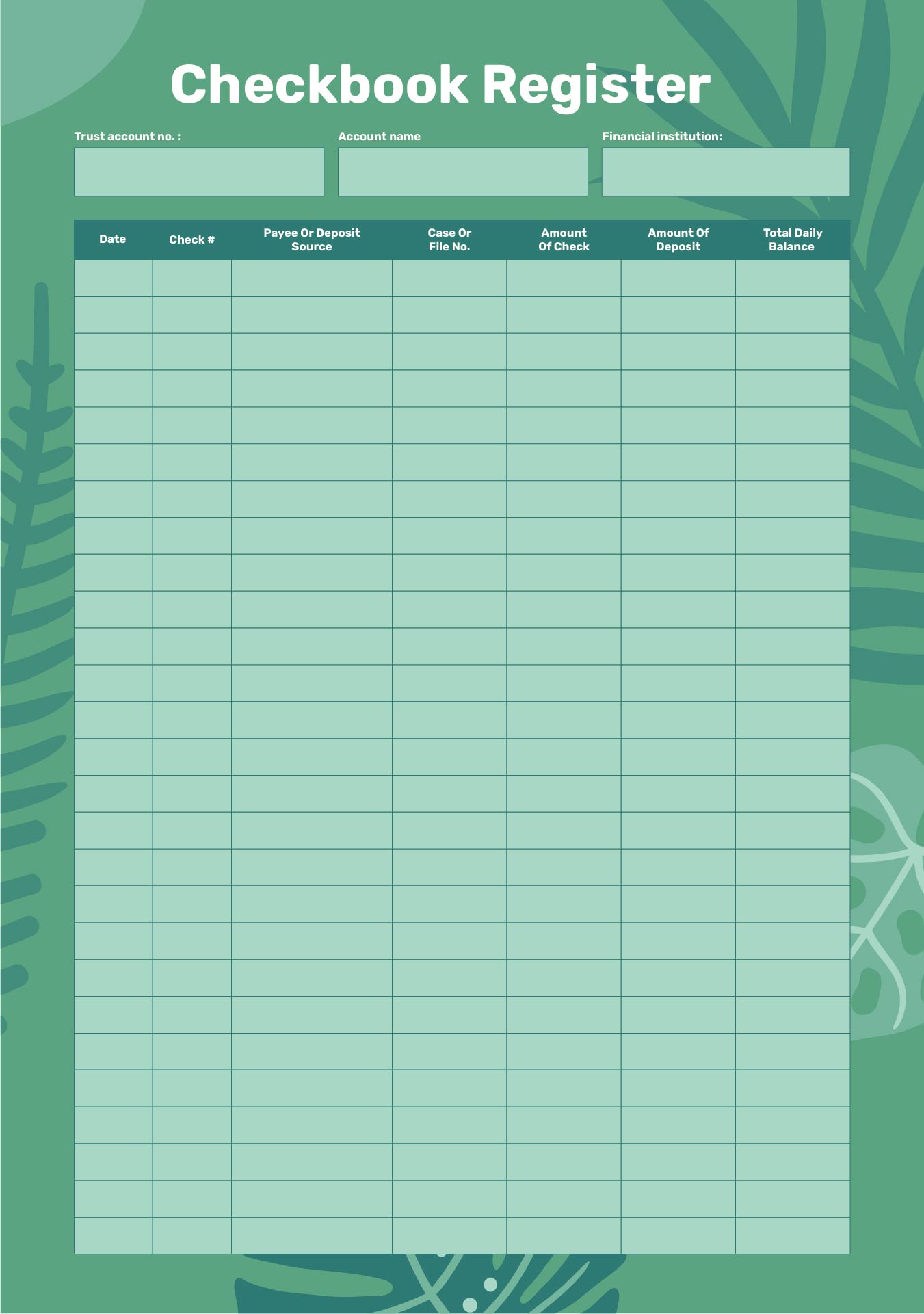

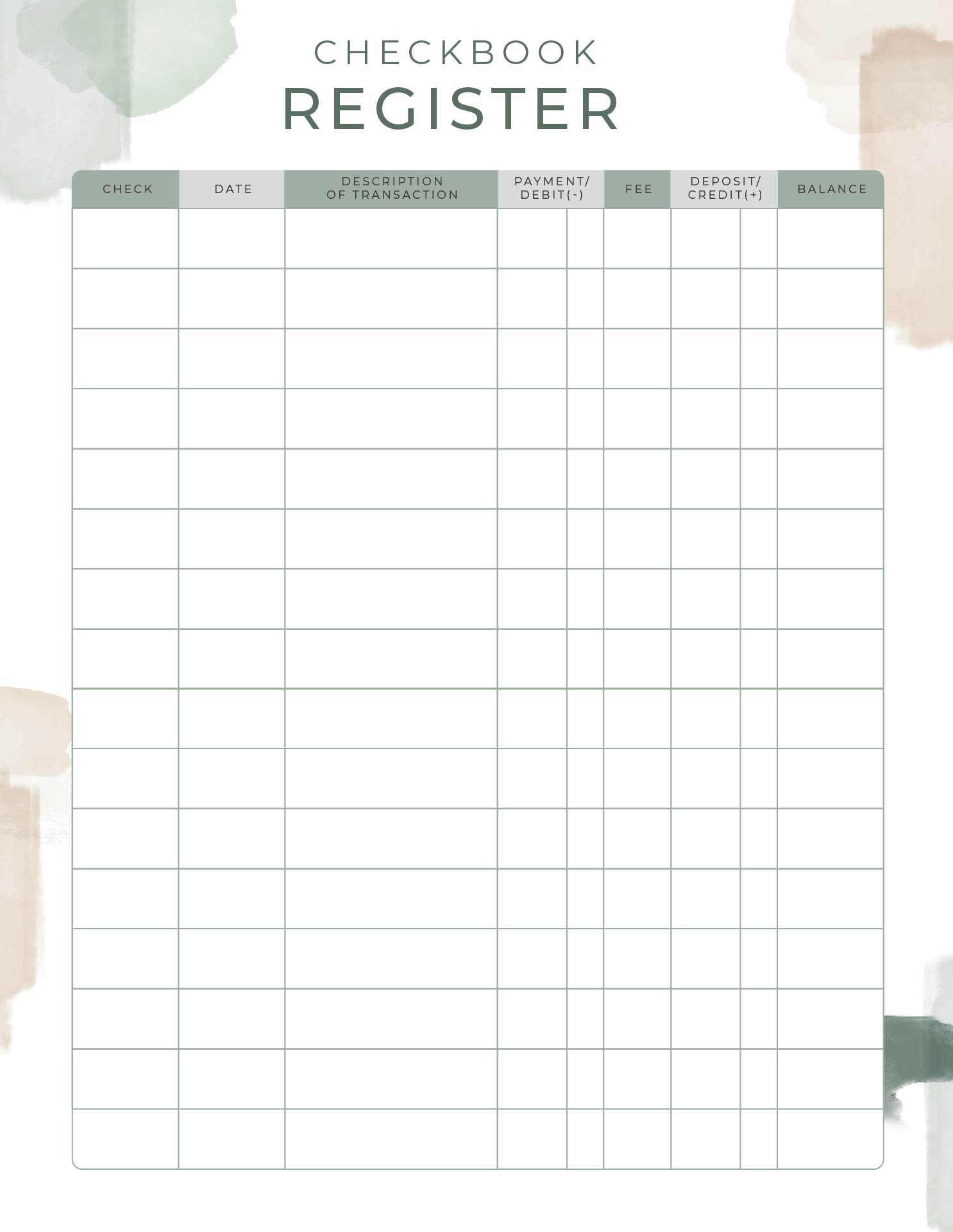

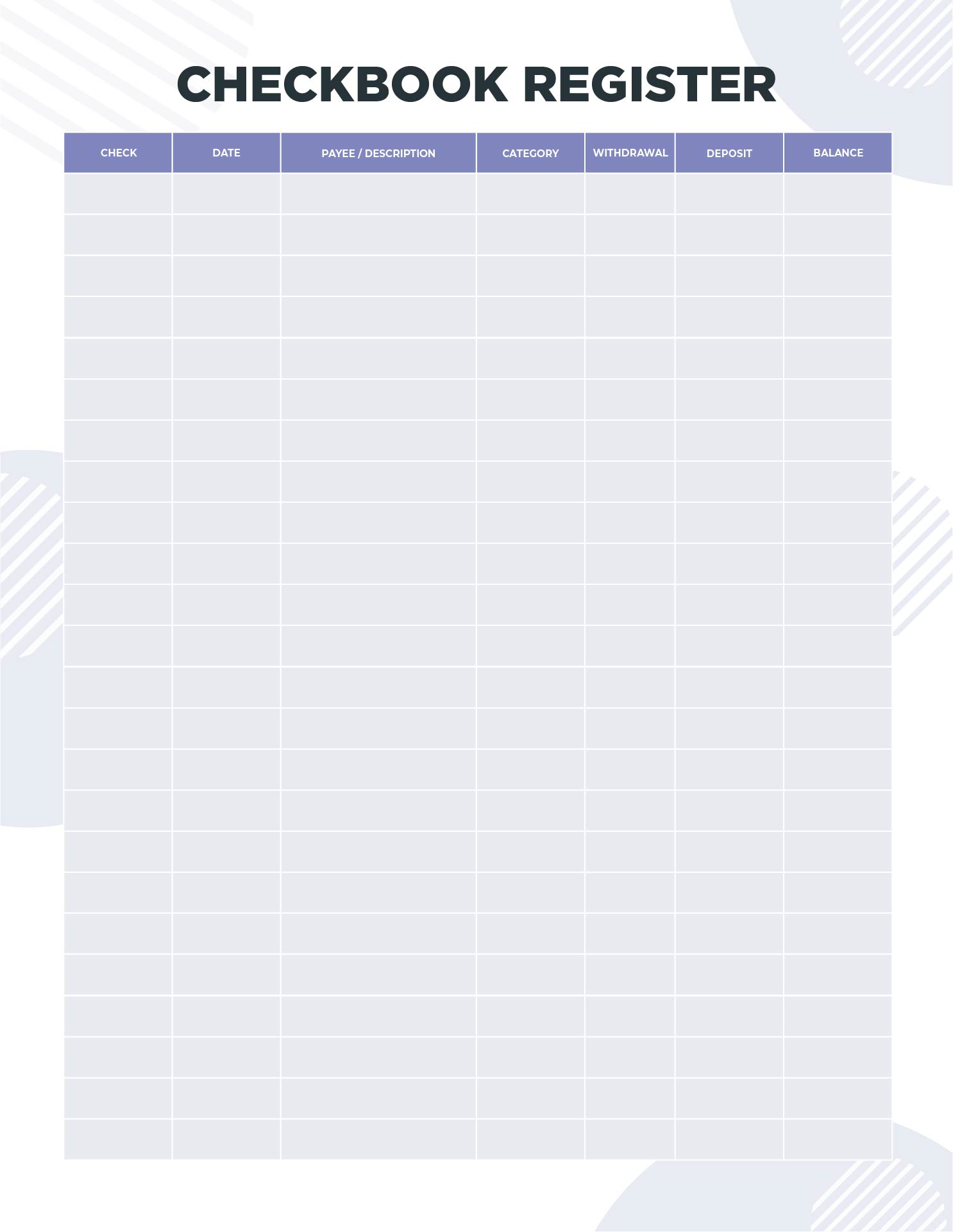

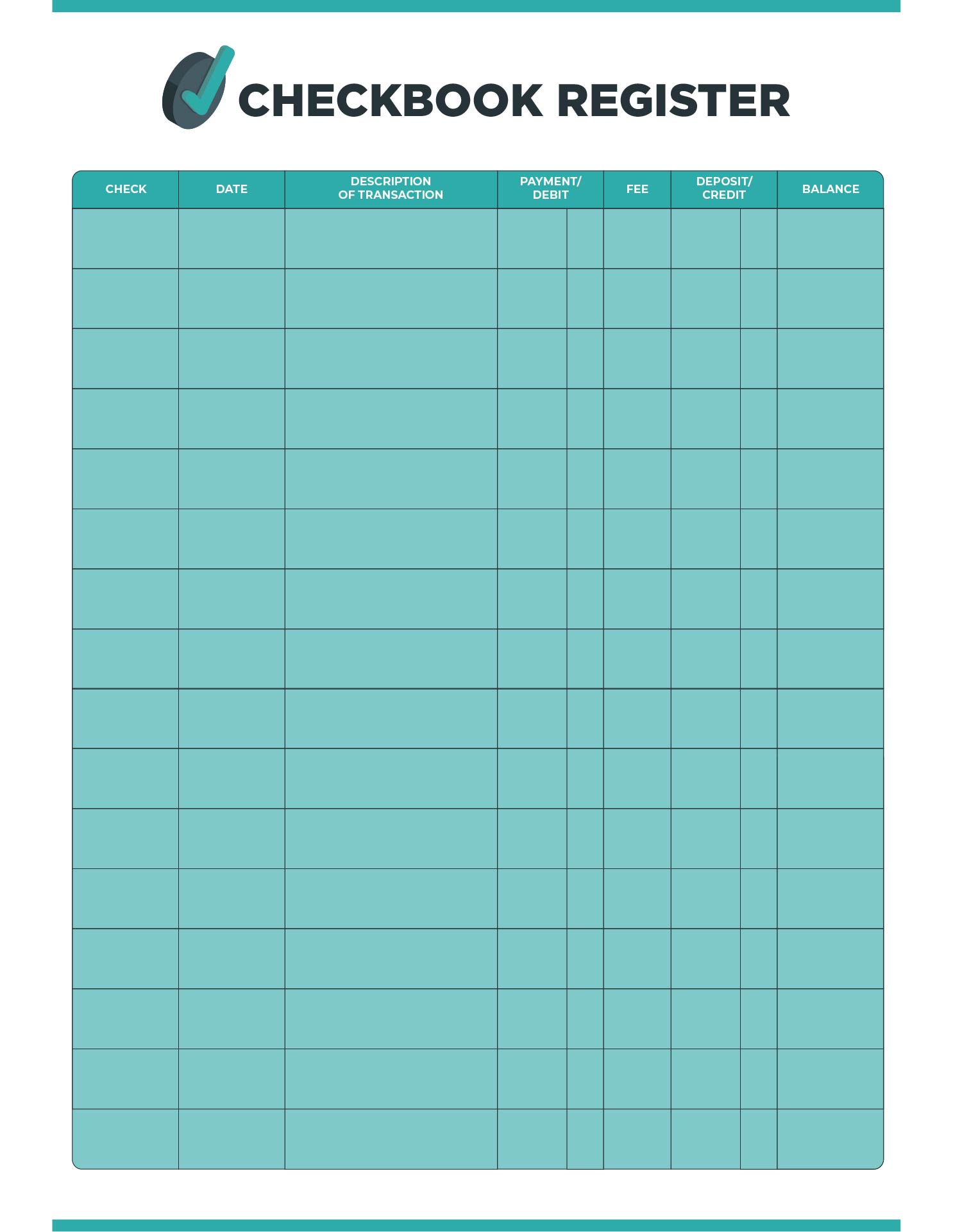

Maintaining a Personal check register in a printable format can significantly streamline your financial management. By tracking every check you write, deposit, and withdrawal, it effectively prevents overdrawing your account and aids in budgeting.

This simple tool enables you to quickly identify discrepancies with your bank's records, ensuring you always have a clear and current overview of your financial status. With your personal check register, managing your finances becomes a more organized and less stressful task.

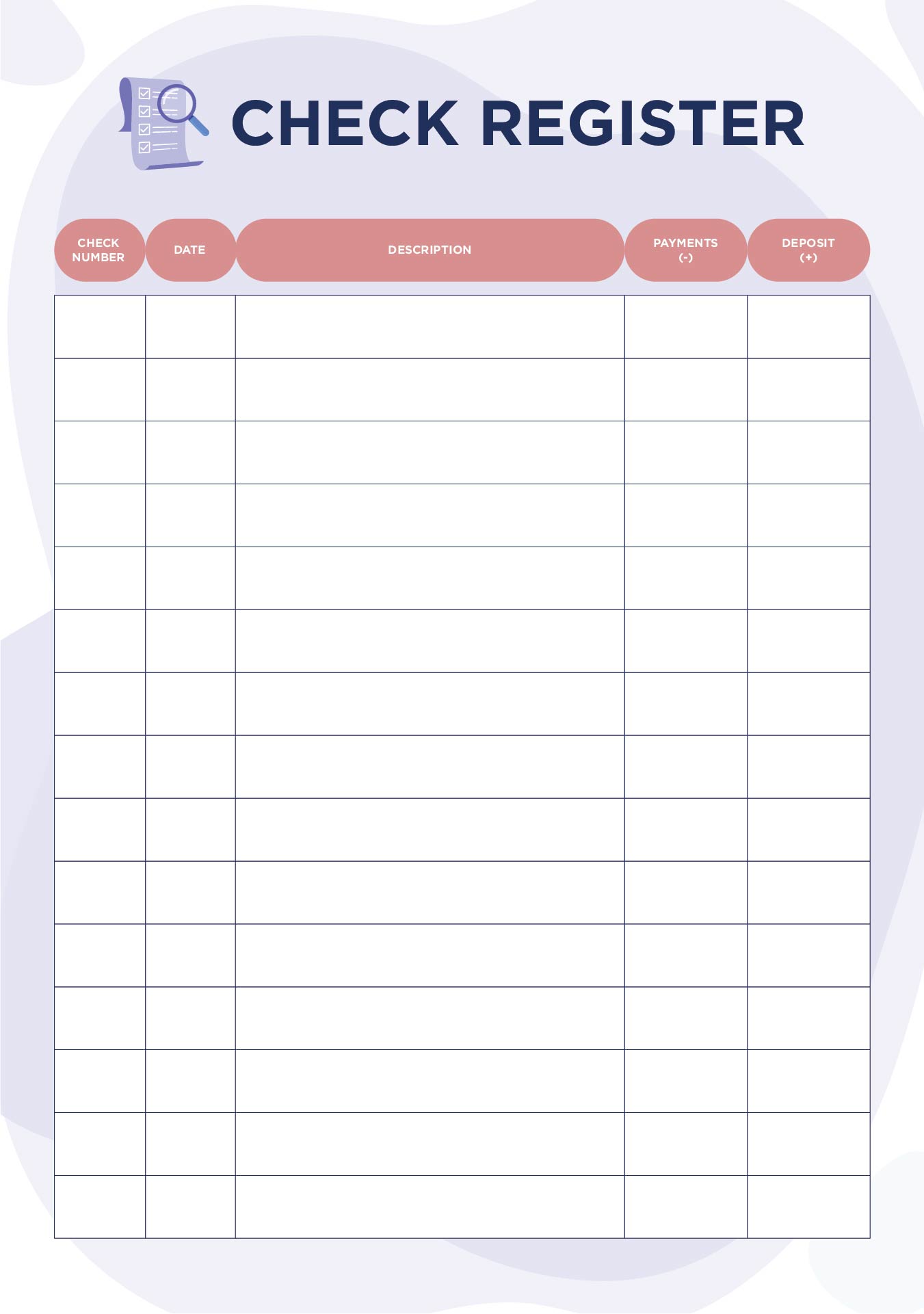

Keeping track of your checking account is streamlined with a printable check register PDF. This tool allows you to easily record deposits, withdrawals, and current balance, ensuring you stay on top of your finances. Its digital format means you can access and print it anytime, making it a convenient option for managing your money effectively.

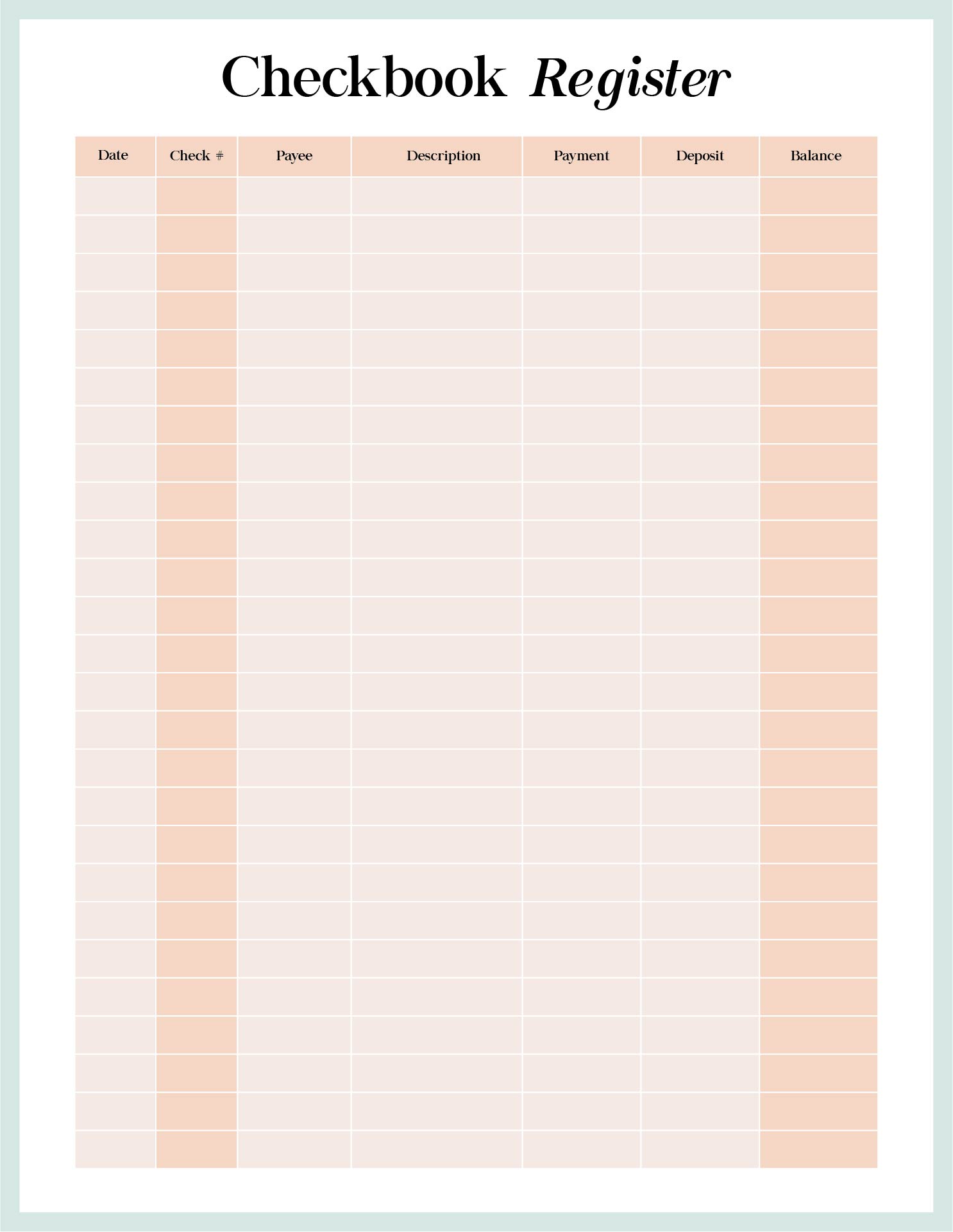

A printable check register in checkbook size is perfect for those who prefer a more traditional method of record-keeping. It fits neatly into your checkbook, making it easy to update your transactions on the go. This ensures that your financial records are always up-to-date, helping you to avoid overdraft fees and manage your spending more efficiently.

For those with visual impairments or anyone who prefers larger text for ease of reading, a large print check register is an excellent choice. This version provides clear, easy-to-read fields for documenting each transaction, which can reduce errors and make the process of managing your checks and balances more accessible and less strainful on your eyes.

Have something to tell us?

Recent Comments

Printable personal check register templates enable individuals to efficiently track their expenses and maintain a clear record of their financial transactions in a convenient and organized manner.

A personal check register printable is a convenient tool to keep track of your finances, allowing you to easily record and monitor your income and expenses in an organized manner.

A personal check register printable allows you to efficiently track and manage your finances by easily recording and organizing your transactions in a convenient format.