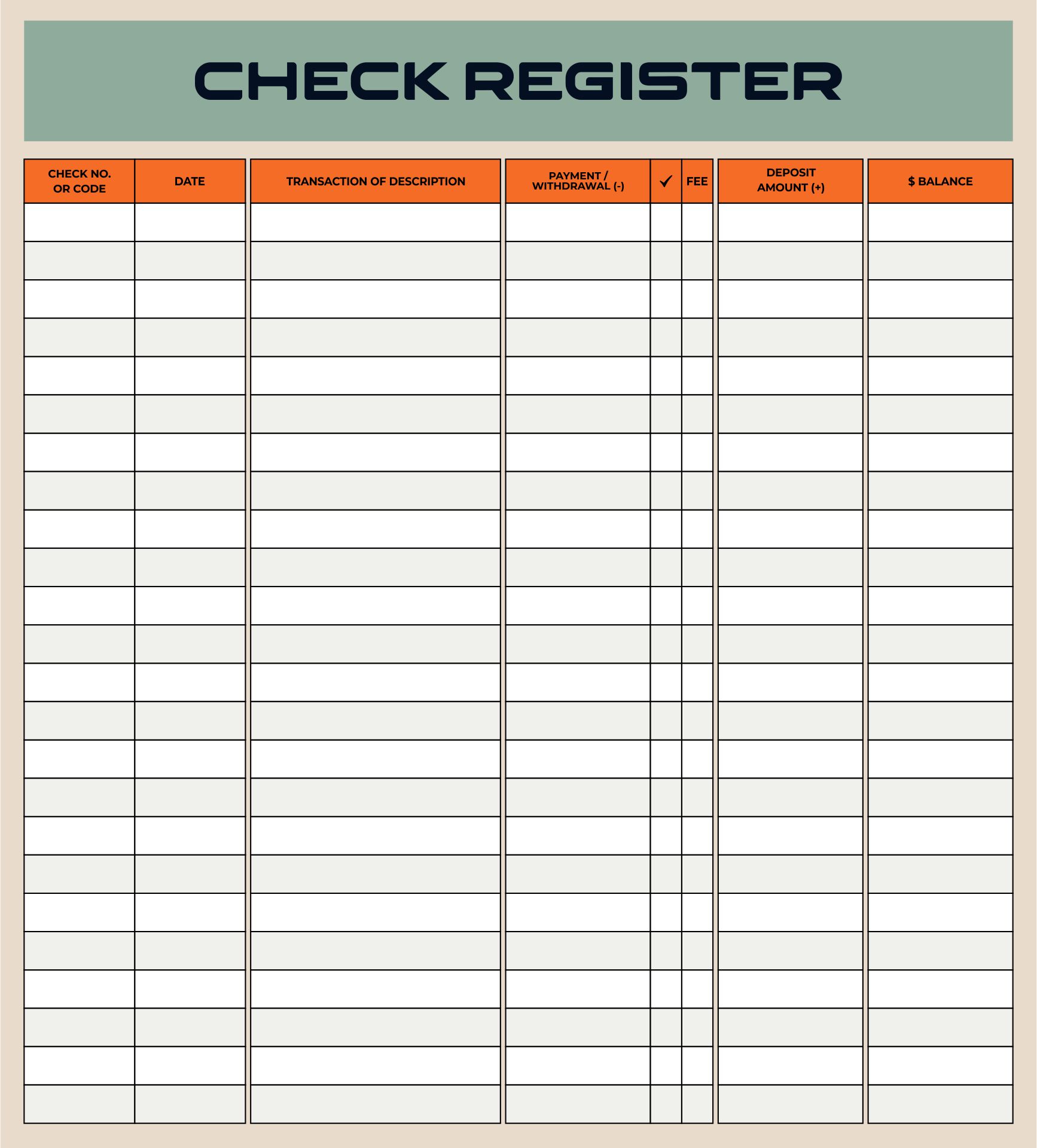

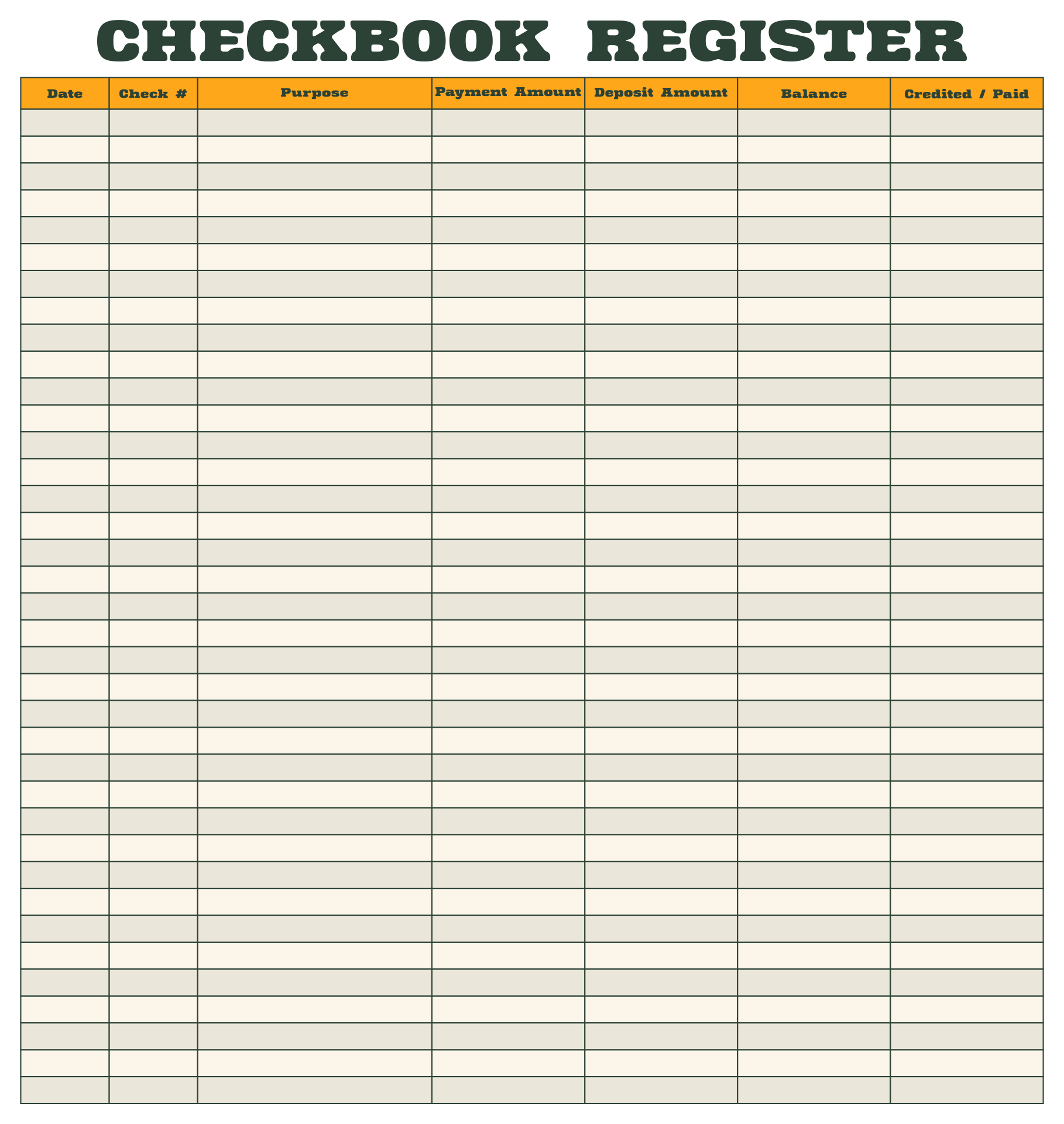

A printable check register is a valuable tool for accounting students to practice tracking financial transactions, enhancing their attention to detail and financial management skills.

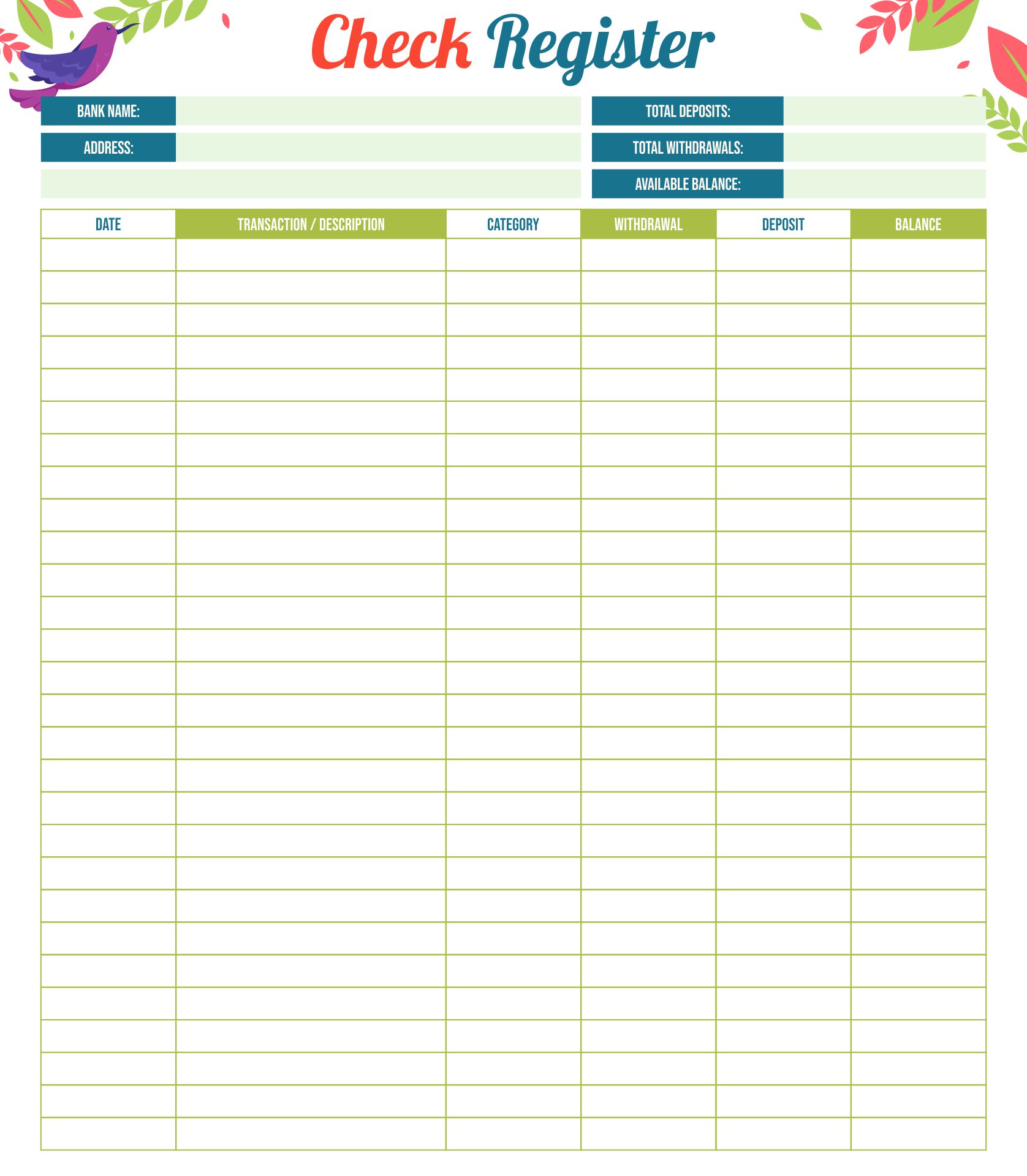

Small business owners can effectively track financial transactions and maintain accurate records using a printable full-size check register, aiding in reconciling accounts and understanding cash flow.

A printable full-size check register can assist personal finance enthusiasts in managing and understanding their finances by tracking expenses, deposits, and account balances, and avoiding overdrafts and late fees.

A printable full-size check register provides a neat and organized way for bank employees to track, retrieve and manage financial transactions while ensuring accuracy.

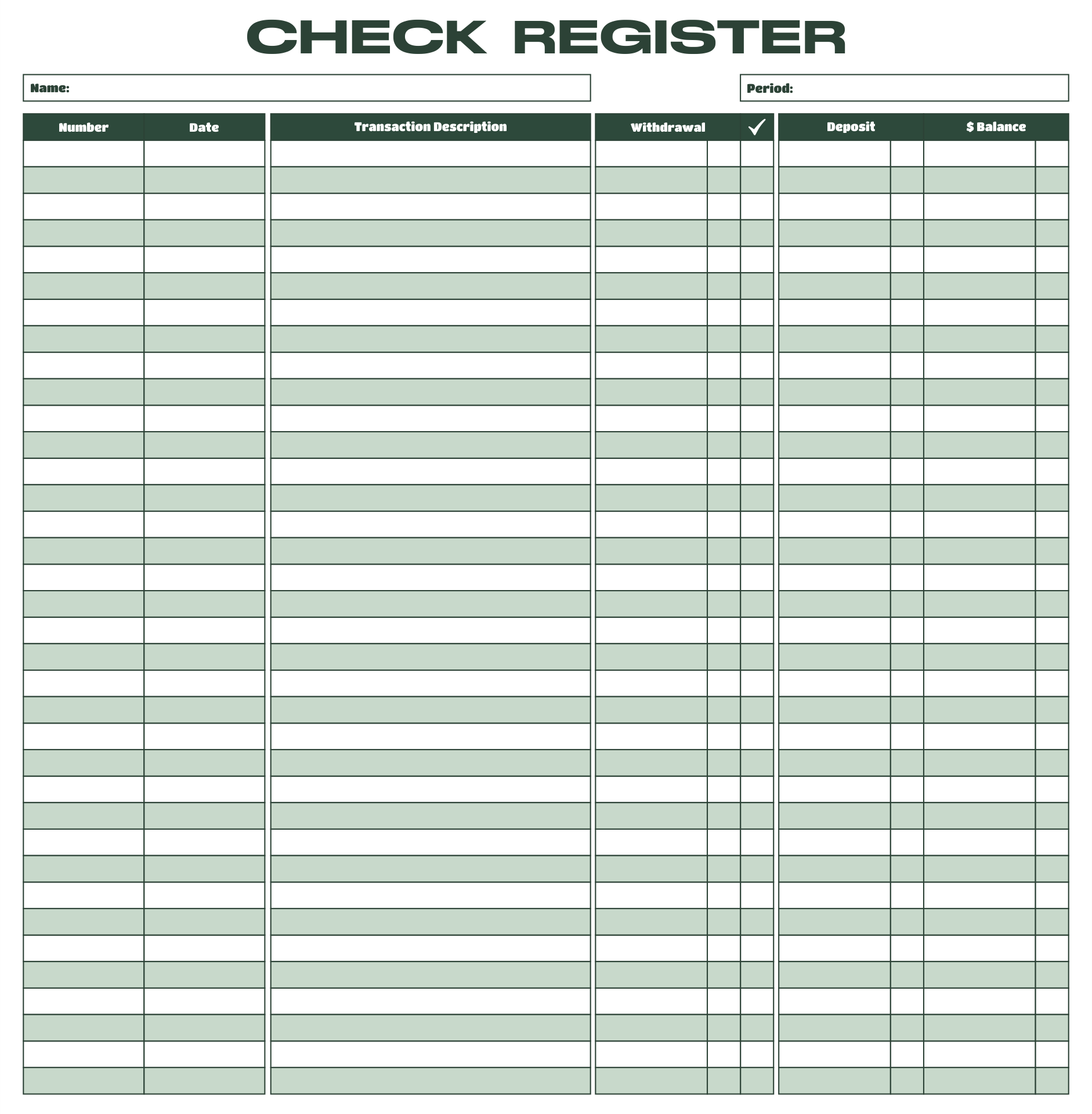

A check register is an immediate record keeper for transaction activities. Businesses, be it retail or manufacturing, have different applications for this tool, influencing its pros and cons.

The chief advantage of a check register is its ability to provide real-time balance updates on your checking account. It assists in tracking cash flow, giving data required for ratio analysis. It also includes check numbers for transaction integrity and error prevention.

The downsides include redundancy with digital payments and receipts and the absence of non-checkbook transactions. You'll need to manually record transactions using cash, which can be a hassle.

Despite its pros and cons, a check register remains a useful tool for managing account balances and transactions. Consistent usage and inclusion of non-book transactions can improve its potency.

Have something to tell us?

Recent Comments

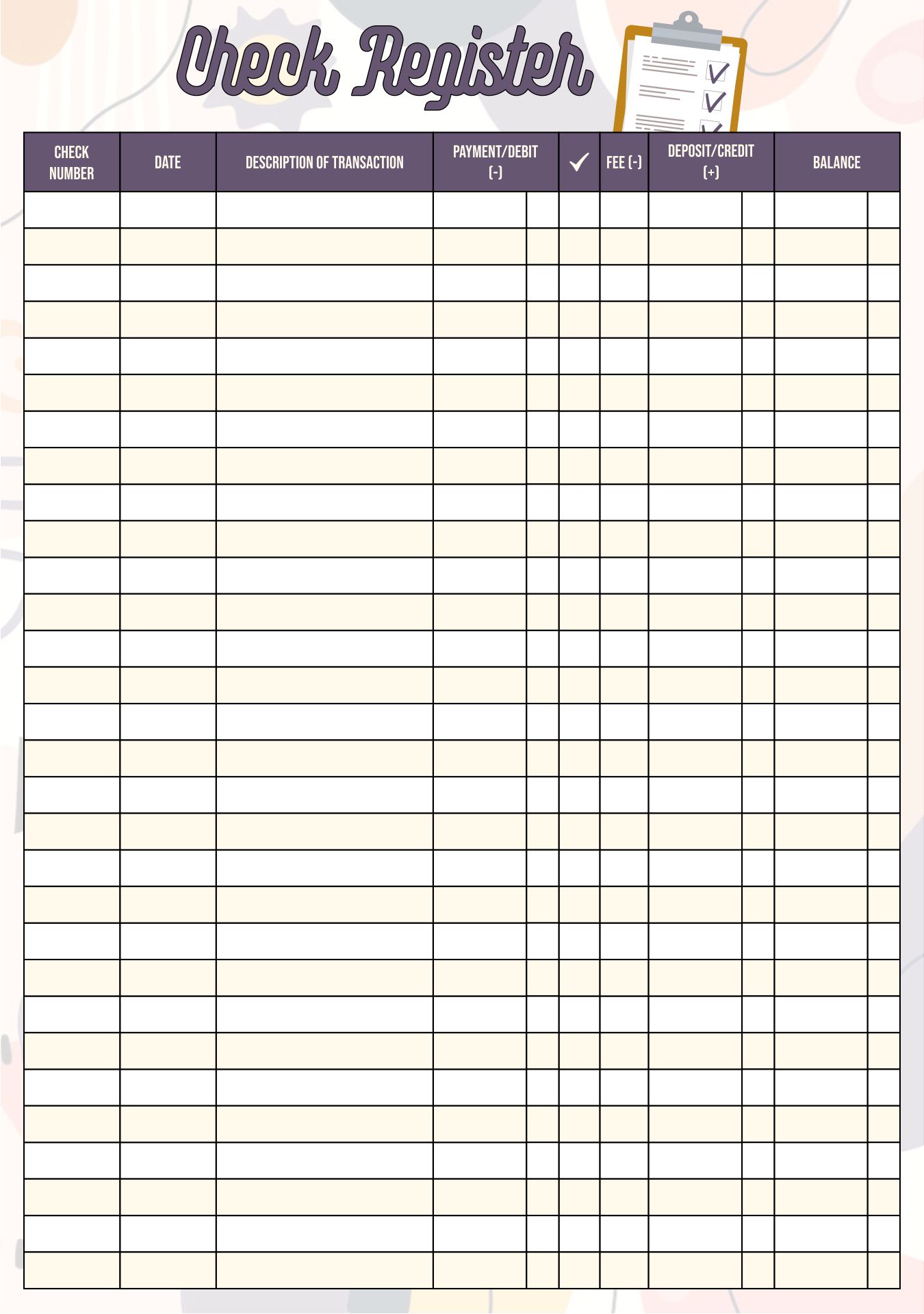

Just what I needed! This printable check register is a practical tool that helps me stay organized and keep track of my expenses effortlessly. Thank you!

Thank you for providing this Full Size Printable Check Register! It's such a helpful tool for keeping track of my finances efficiently. Great resource!

This printable check register is a convenient tool for organizing my finances efficiently. It's simple and user-friendly, helping me track my expenses accurately. Highly recommend!