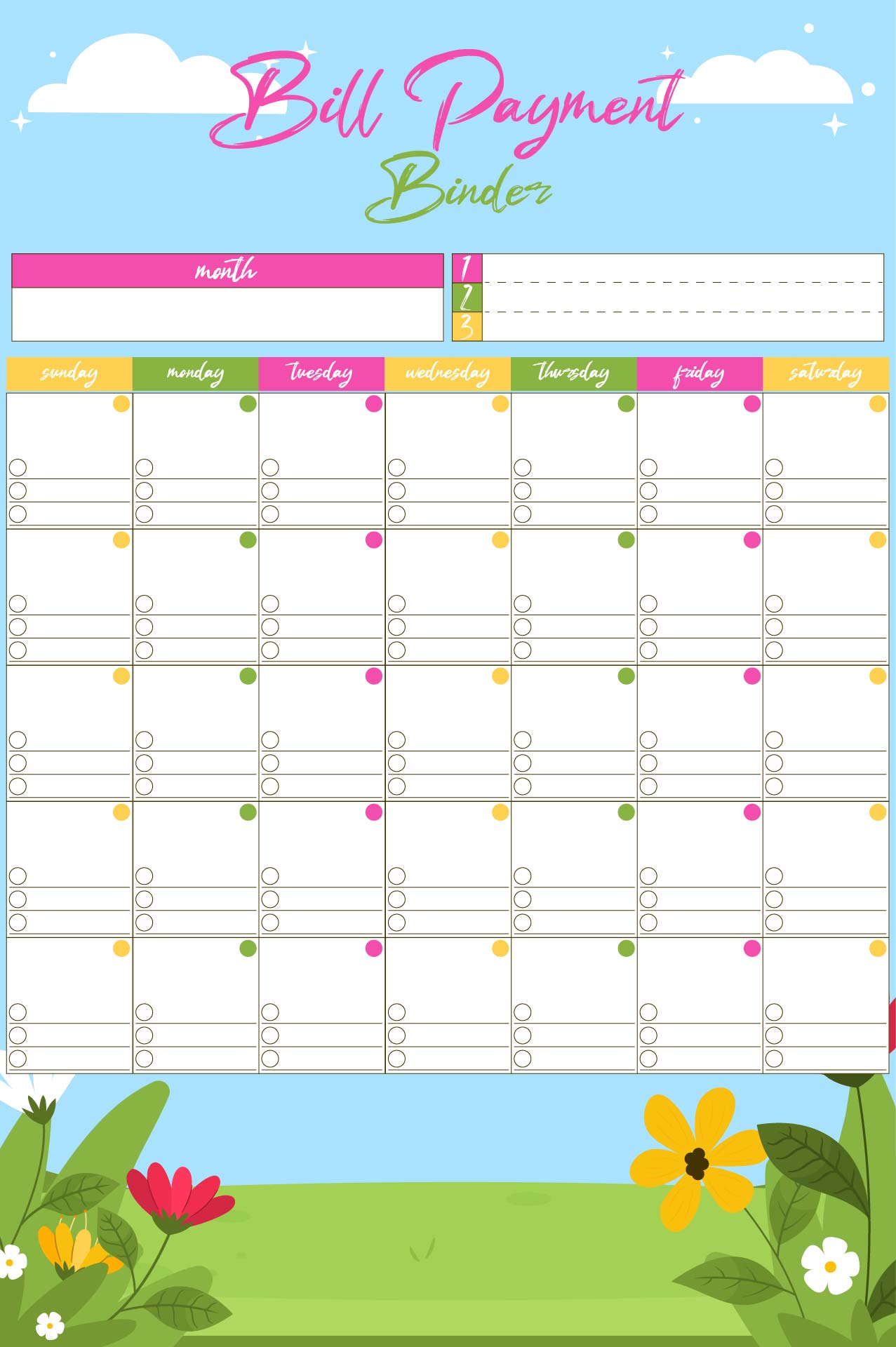

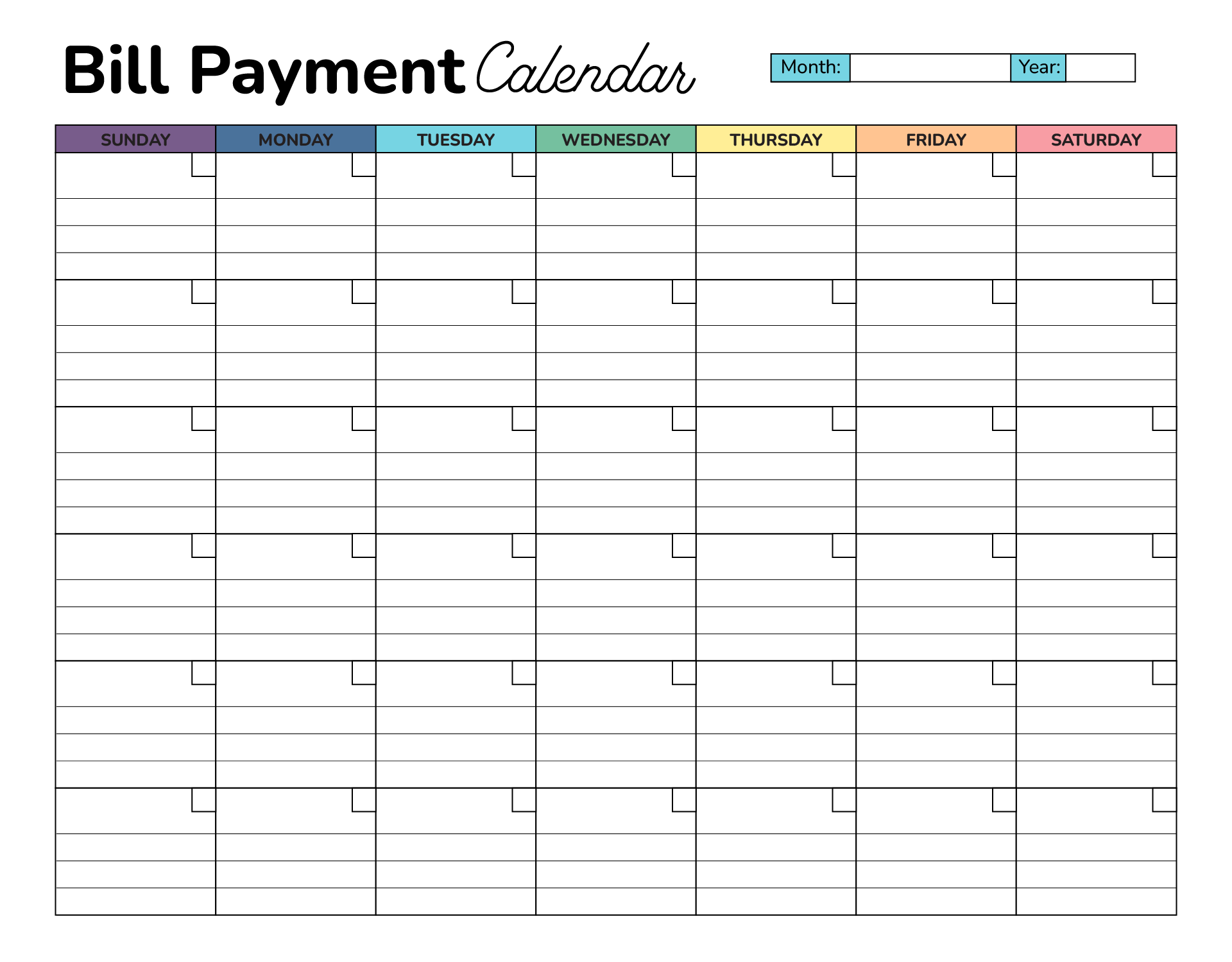

A Printable Monthly Bill Payment Calendar Booklet simplifies managing your finances by providing a clear overview of all your monthly expenses. By keeping track of due dates, you can ensure timely payments and avoid late fees.

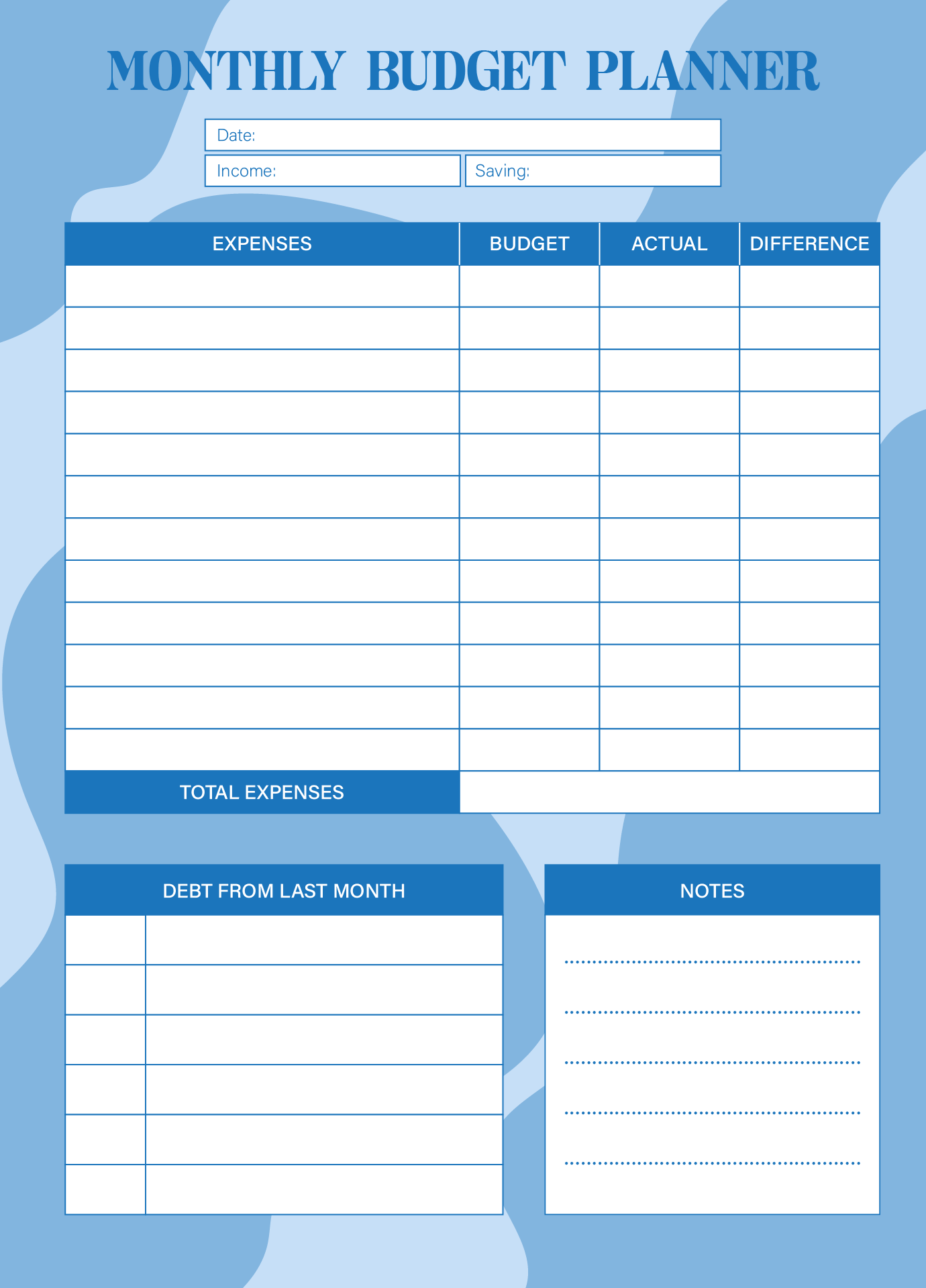

This method encourages better budgeting habits, making it easier for you to allocate your funds effectively and save money in the long run. Your financial planning becomes more organized and stress-free, giving you a clearer path toward achieving your financial goals.

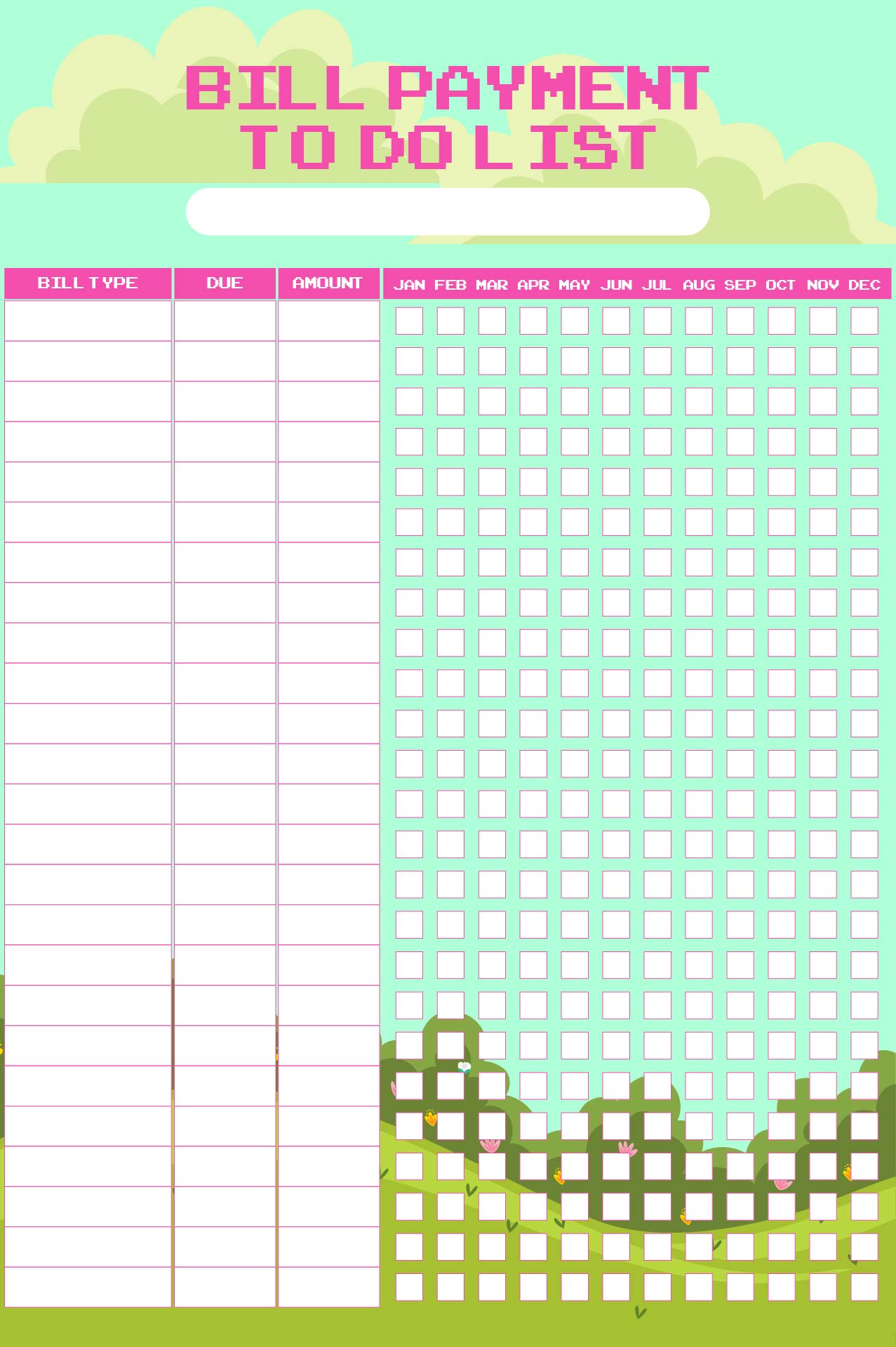

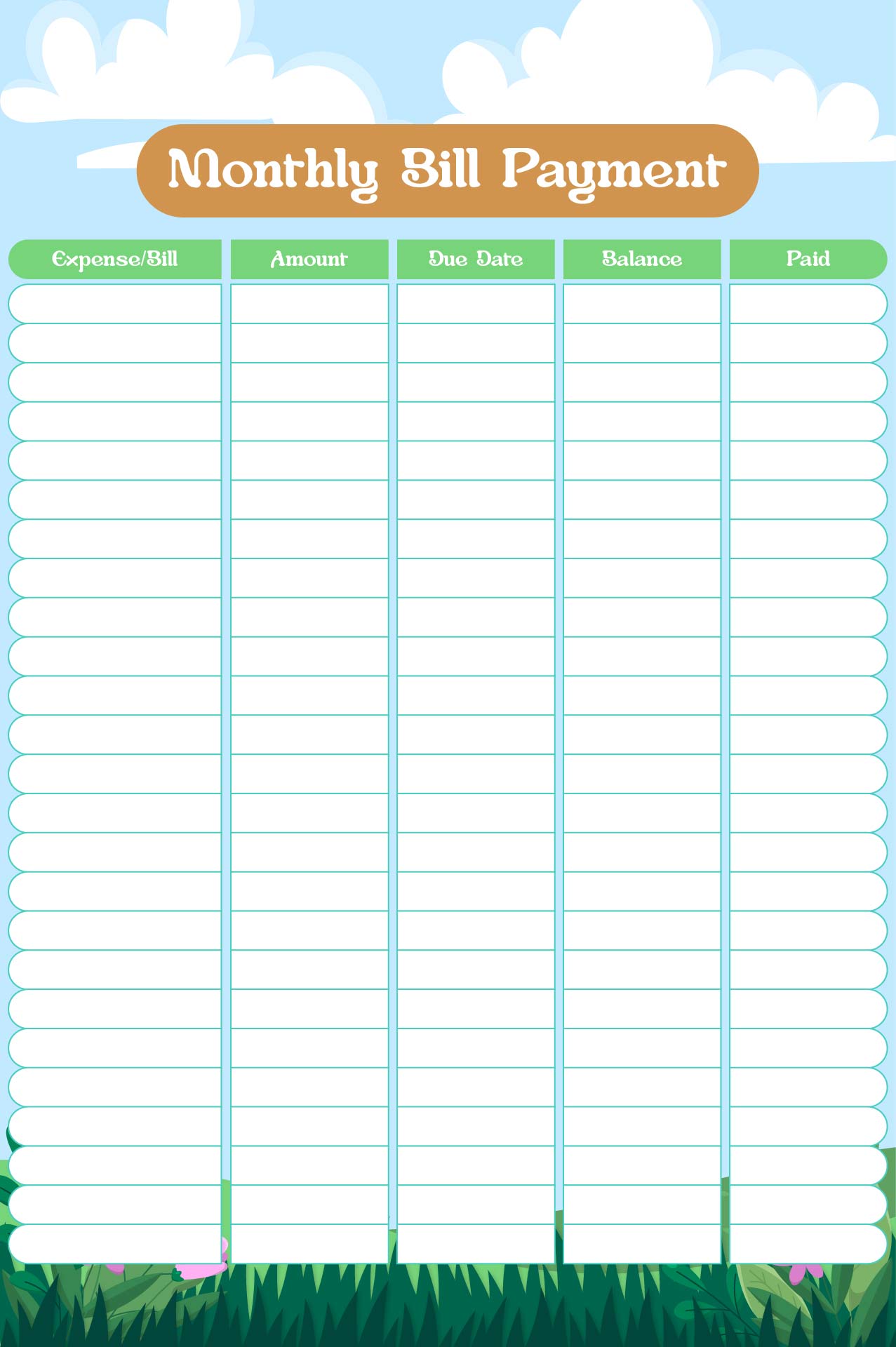

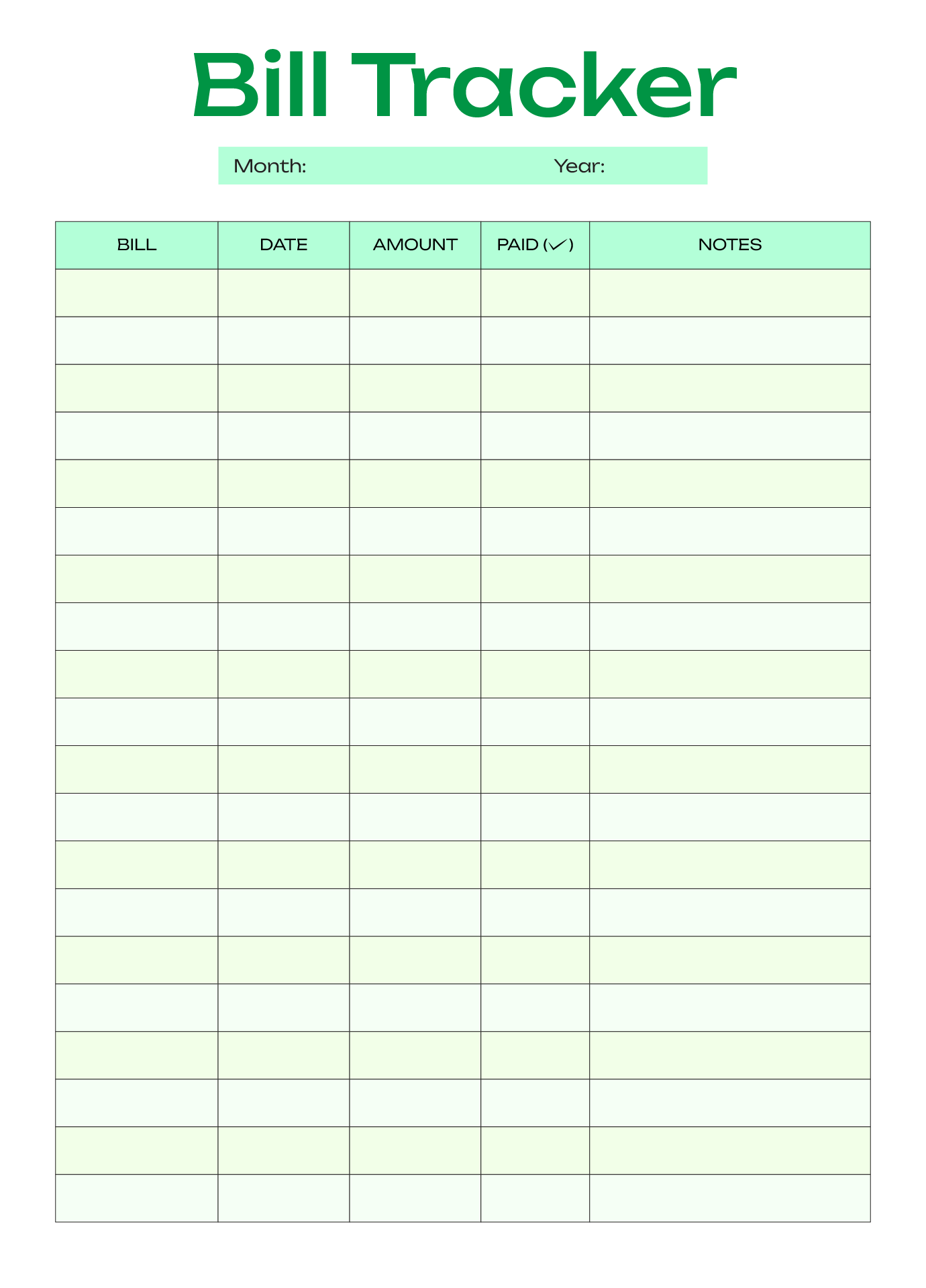

Your financial organization can be significantly improved with a Printable Monthly Bill Payment Log Template. This tool allows you to keep a concise record of all your monthly payments, ensuring you never miss a due date. It's perfect for visualizing your financial commitments and planning your budget accordingly.

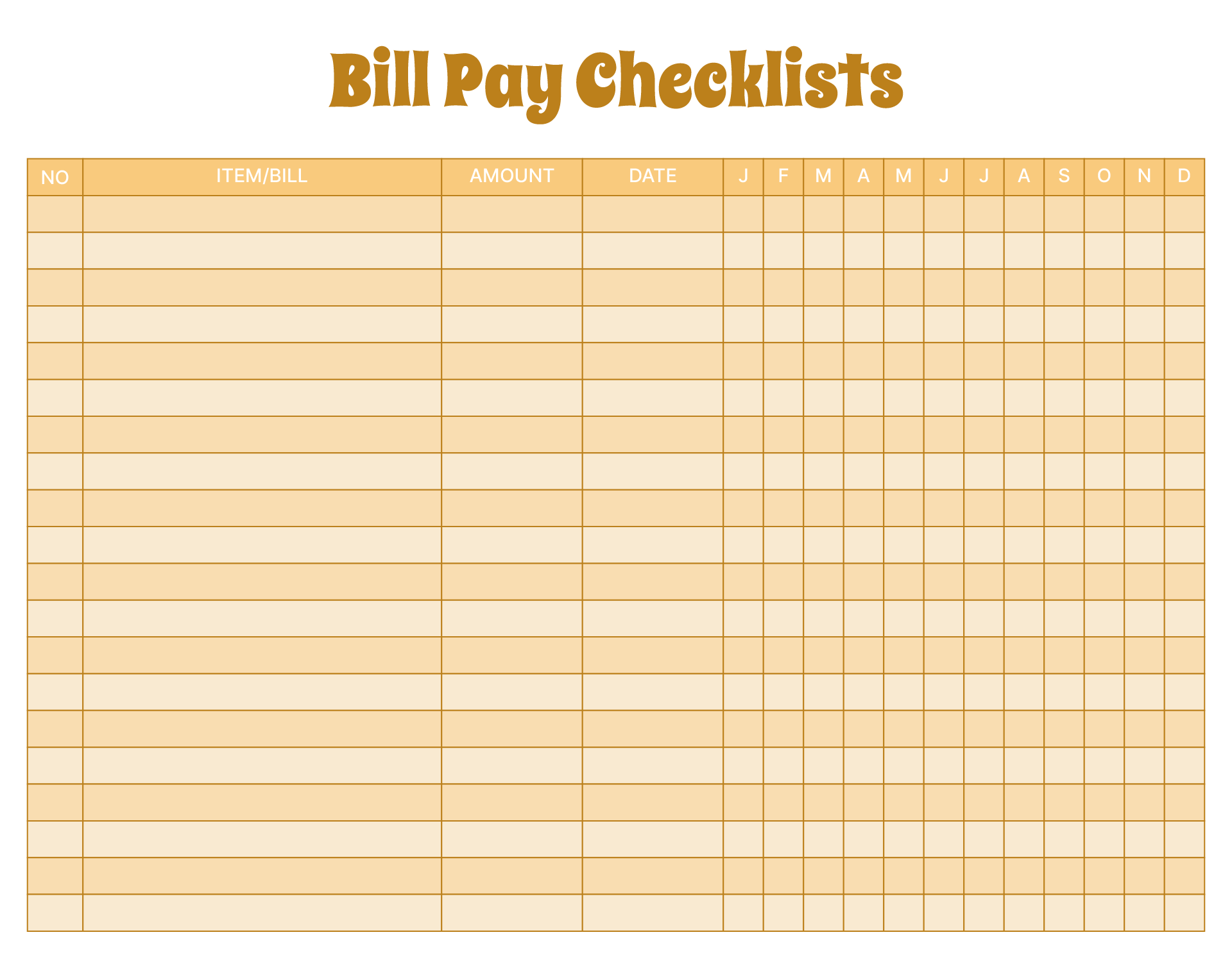

A Printable Bill Payment Tracker simplifies tracking your expenses, helping you stay on top of your financial obligations. By having a clear overview of when bills are due, you can avoid late fees and manage your cash flow better. This is particularly useful for visual learners who benefit from seeing their payments laid out.

Creating a Monthly Bill Payment Schedule can transform how you handle your finances, promoting timely bill payments and financial discipline. Using this schedule, you can allocate your income effectively, ensuring that all your bills are covered while also identifying areas for savings. It's a strategic approach to managing your monthly expenses.

Have something to tell us?

Recent Comments

The printable monthly bill payment calendar booklet is a convenient tool that helps you stay organized and never miss a payment, allowing you to easily track your expenses and ensure timely bill payments.

I love using the Printable Monthly Bill Payment Calendar Booklet! It's been incredibly helpful in keeping track of my expenses in an organized and efficient way. Thank you for creating such a great resource!

The printable monthly bill payment calendar booklet is a practical tool that helps you stay organized and on top of your financial responsibilities, ensuring that you never miss a payment deadline again.