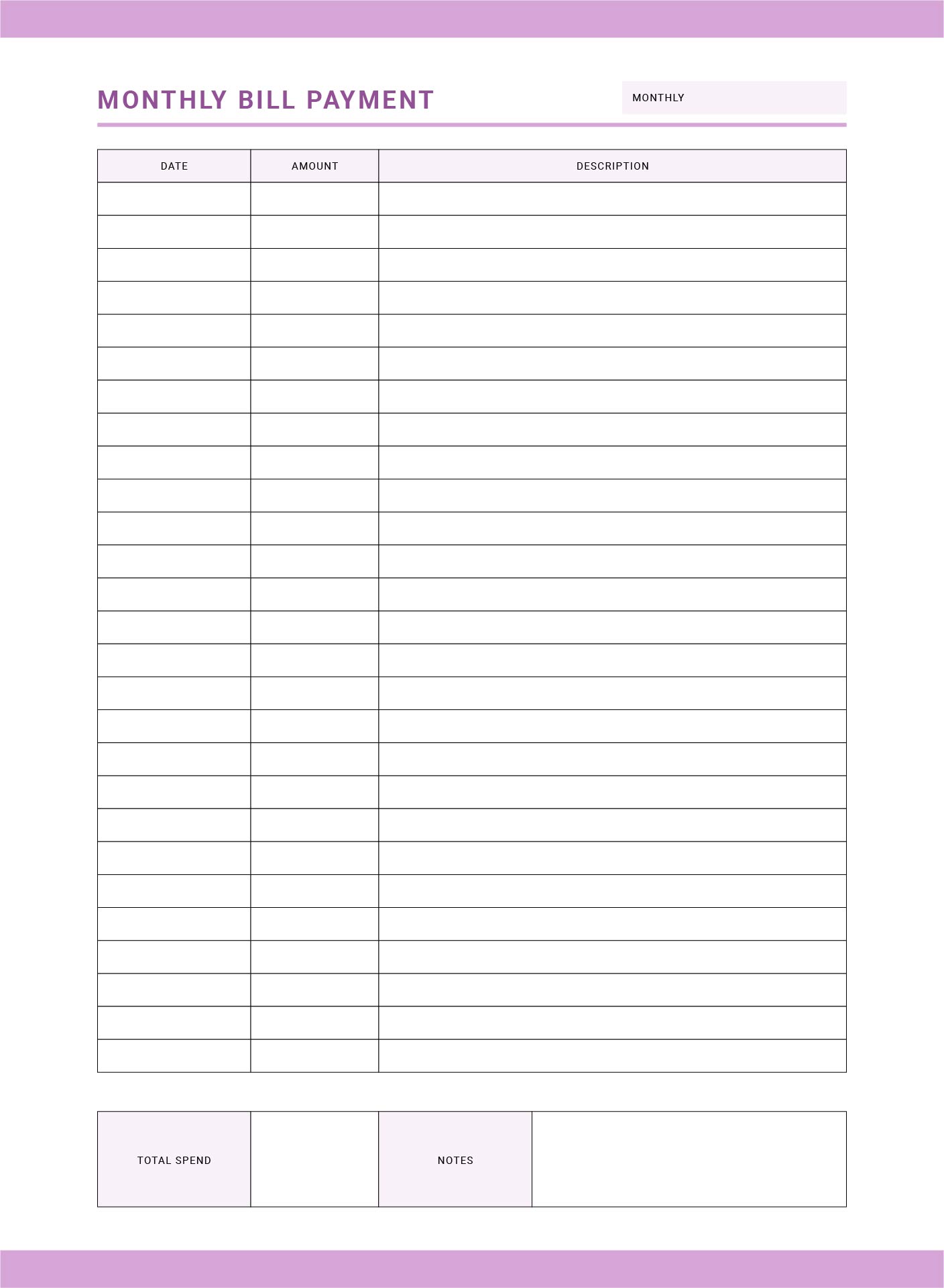

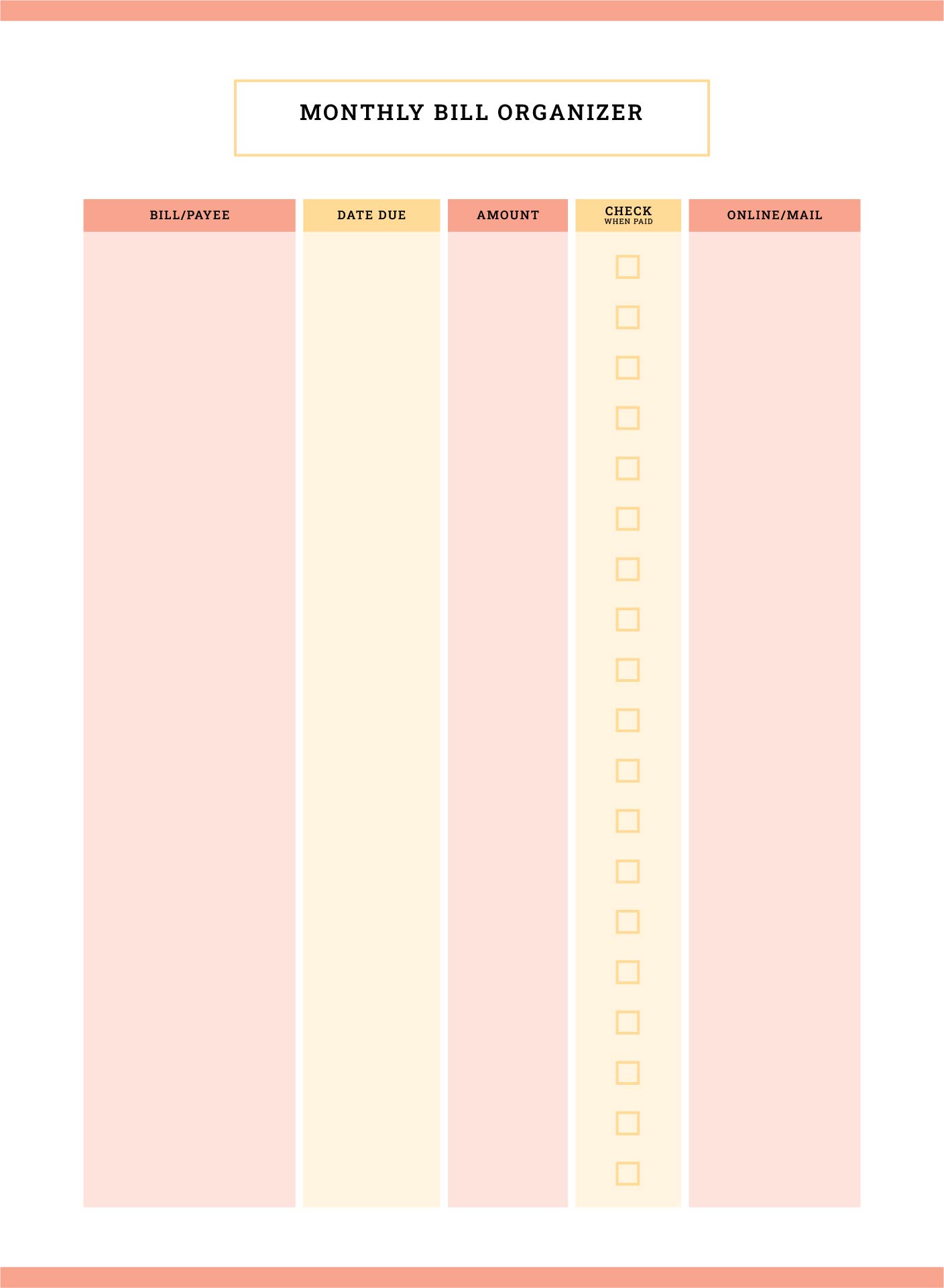

A Monthly Bill Log Printable can streamline your financial tracking by enabling you to organize all your bills in one place. With this tool, you can easily record due dates, amounts, and payment statuses, helping to prevent late fees and manage your budget more effectively. It provides a clear overview of your monthly obligations, making it easier to plan and allocate your finances accordingly.

This simple yet powerful system can be a game-changer in enhancing your financial management and ensuring you stay on top of your bills each month.

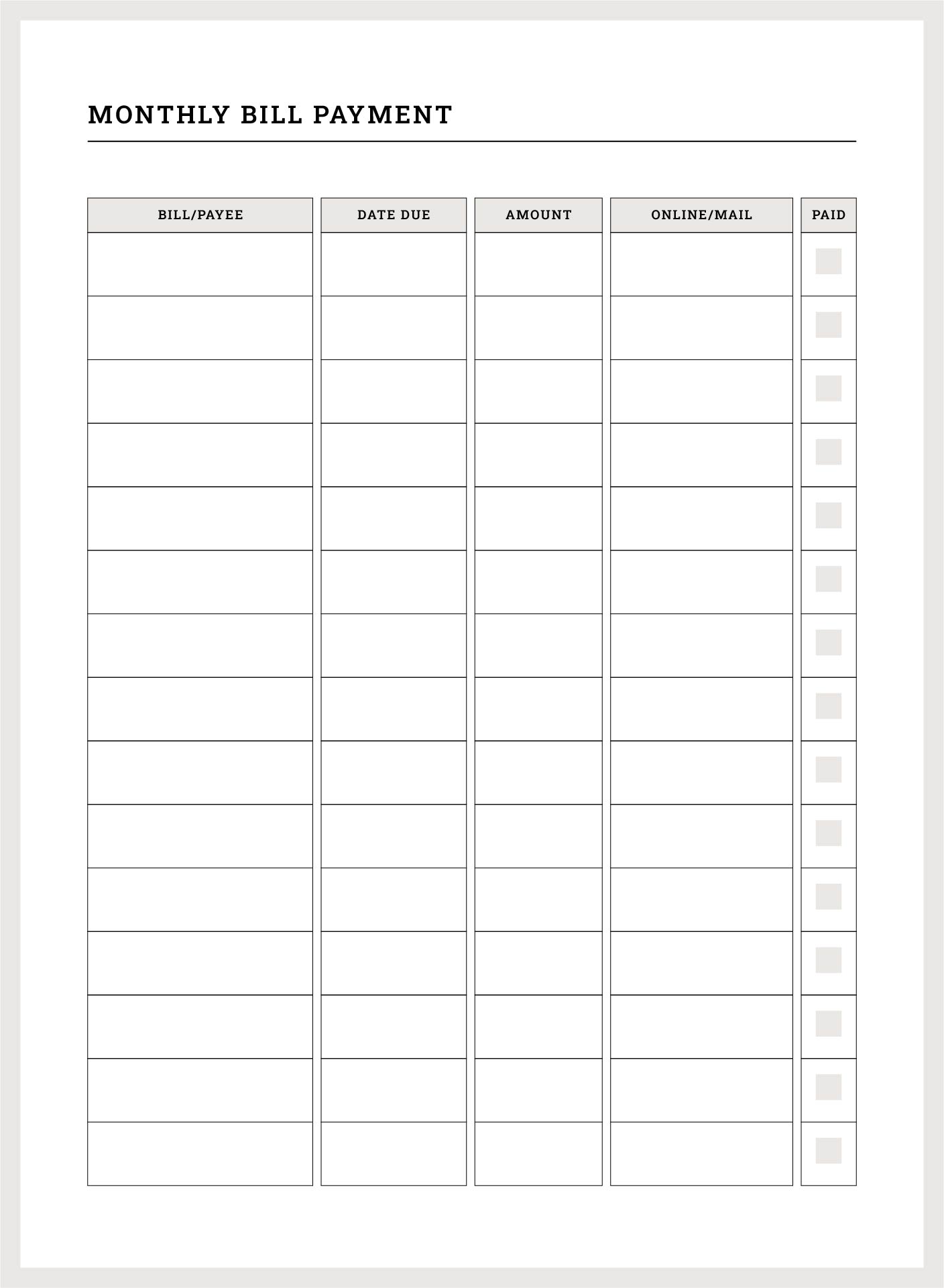

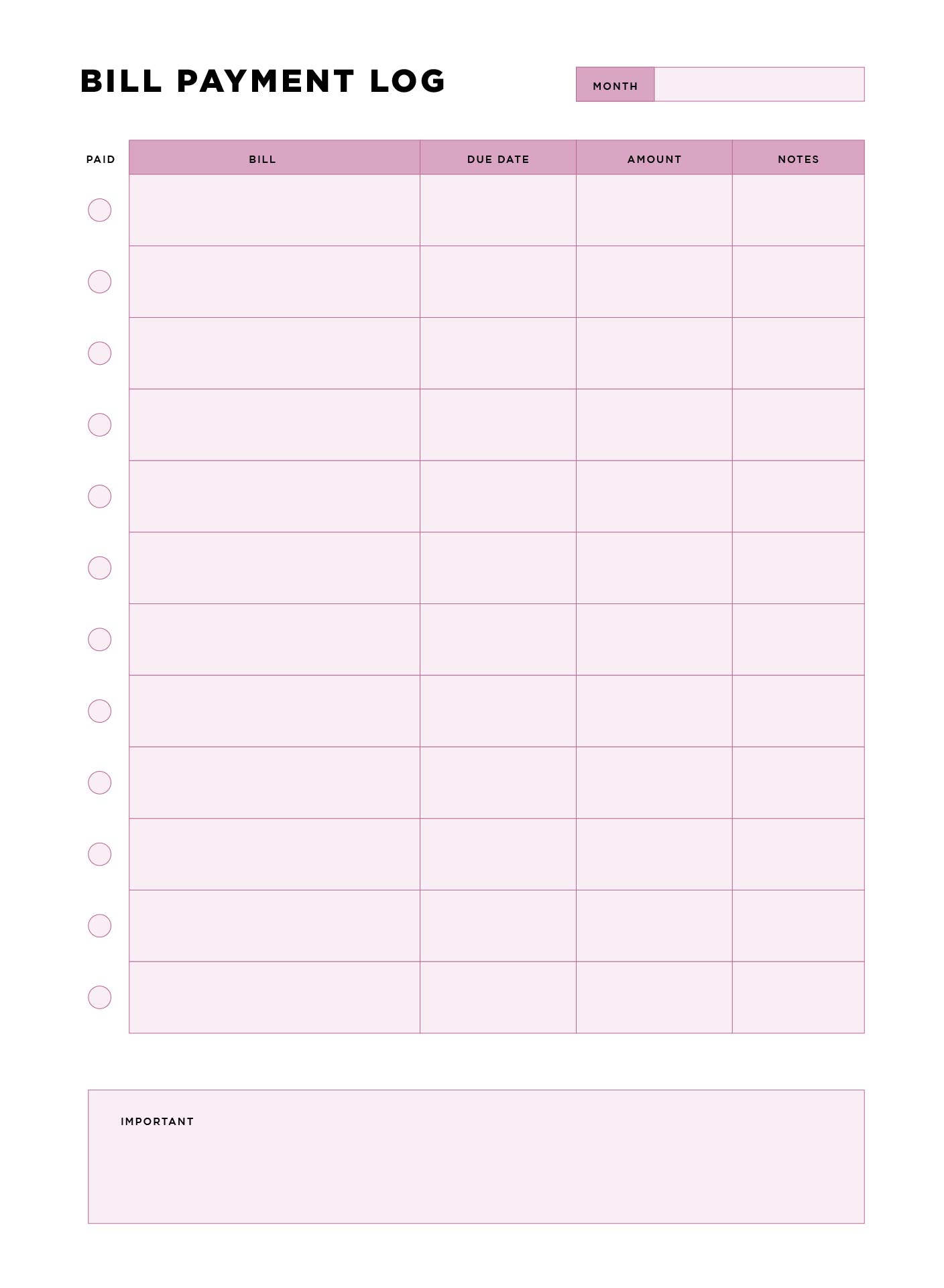

Keeping track of your bill payments becomes more manageable with a printable bill payment log. It allows you to record due dates, amounts, and payment statuses, ensuring you never miss a payment. This tool can aid in budgeting and financial planning, helping you to maintain a clear overview of your monthly expenses.

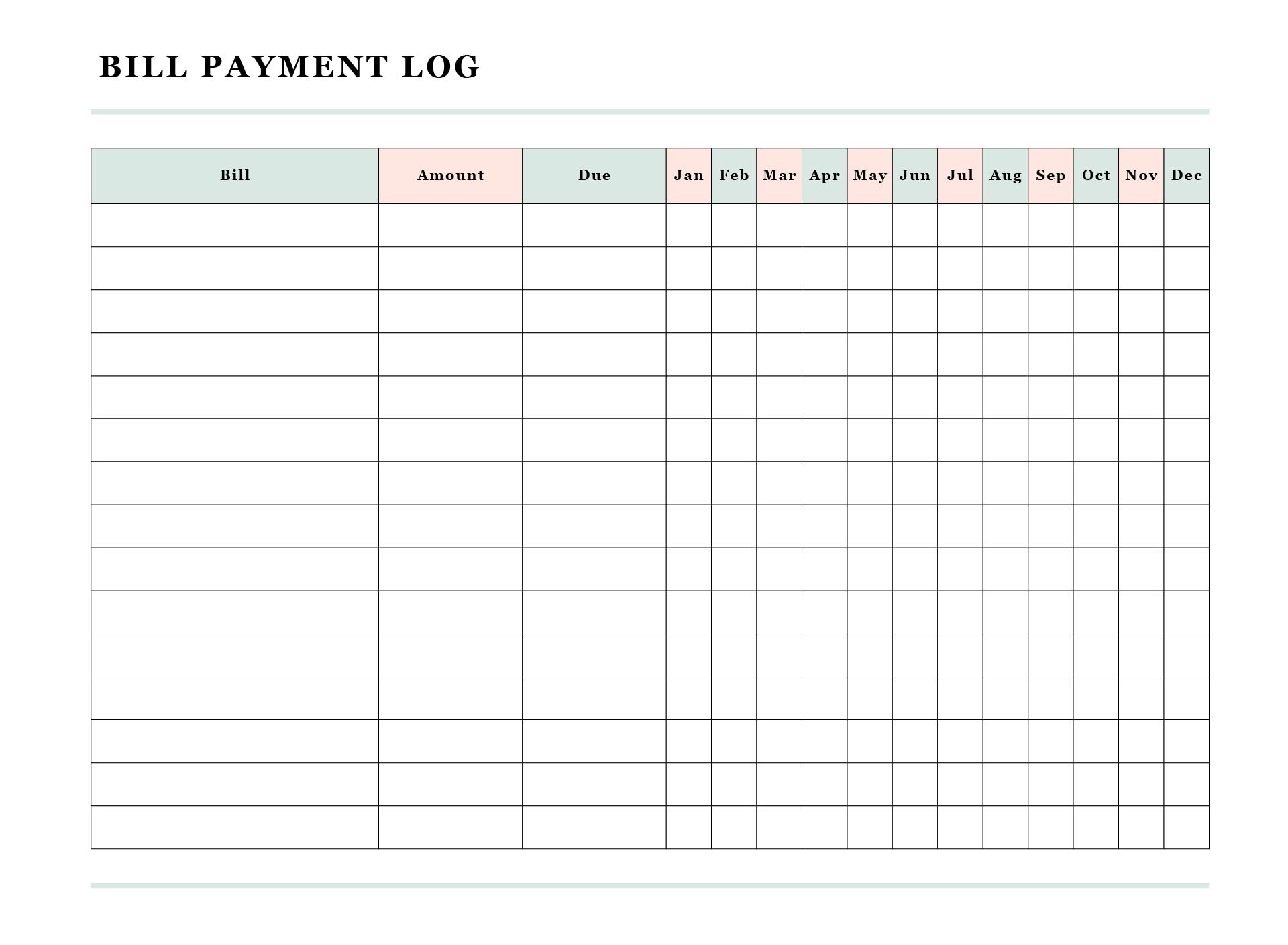

A printable monthly bill chart serves as a visual guide to your financial obligations. You can quickly glance at what’s due and when, making it easier to organize your finances. By having all your bills laid out in one place, you can better anticipate upcoming expenses and adjust your budget accordingly.

Using a printable monthly bill log helps you track your expenses over time, offering an organized way to see where your money is going each month. This can be instrumental in identifying areas where you might reduce spending or notice trends in your financial habits, ultimately aiding in more effective money management.

Have something to tell us?

Recent Comments

A monthly bill log printable is a convenient tool that helps individuals keep track of their expenses and stay organized by providing a clear and concise way to document and manage their monthly bills.

The monthly bill log printable is a helpful tool that allows you to organize and keep track of your expenses, making it easier to manage your finances effectively.

The monthly bill log printable is a useful tool for tracking and keeping a record of your expenses, allowing you to stay organized and easily manage your finances.