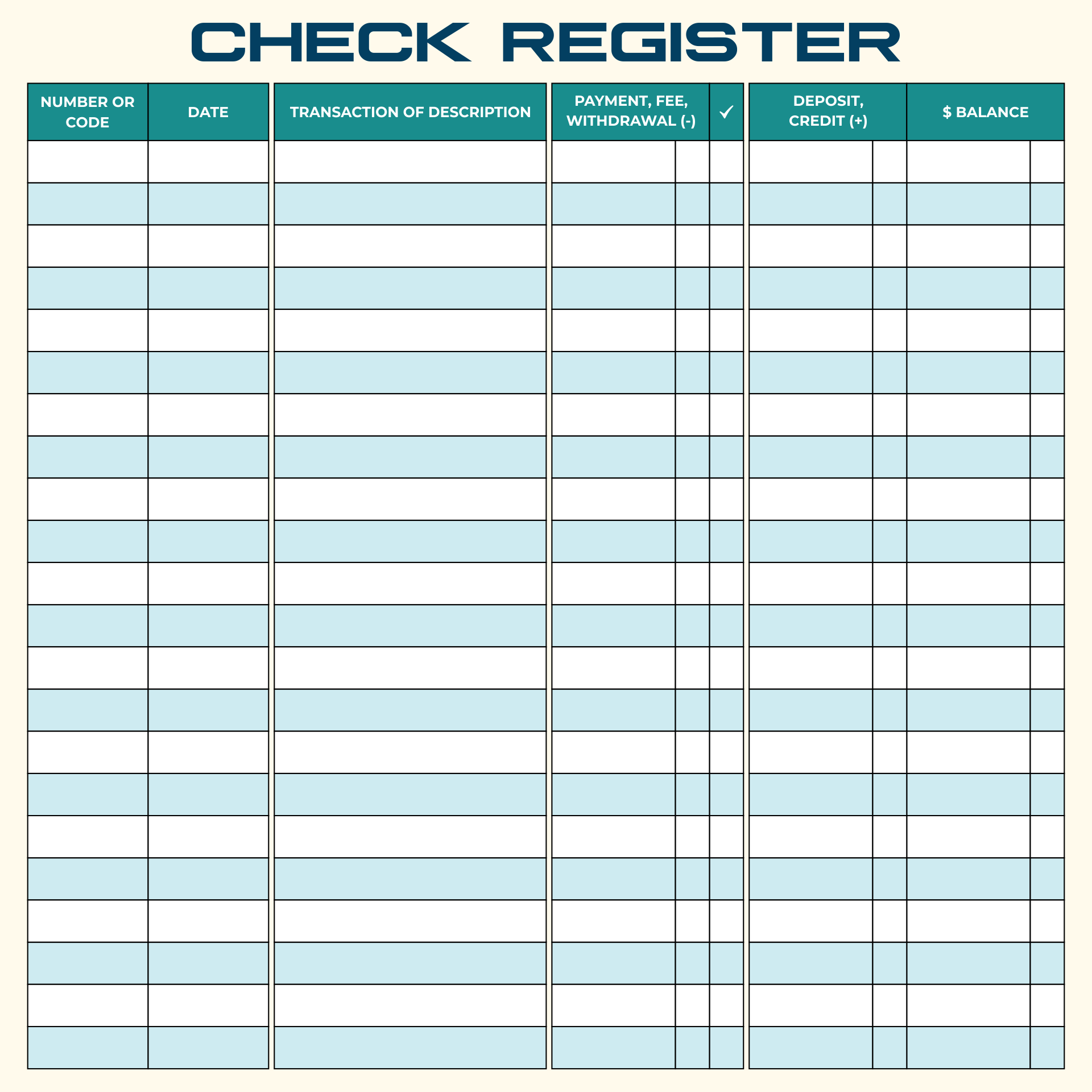

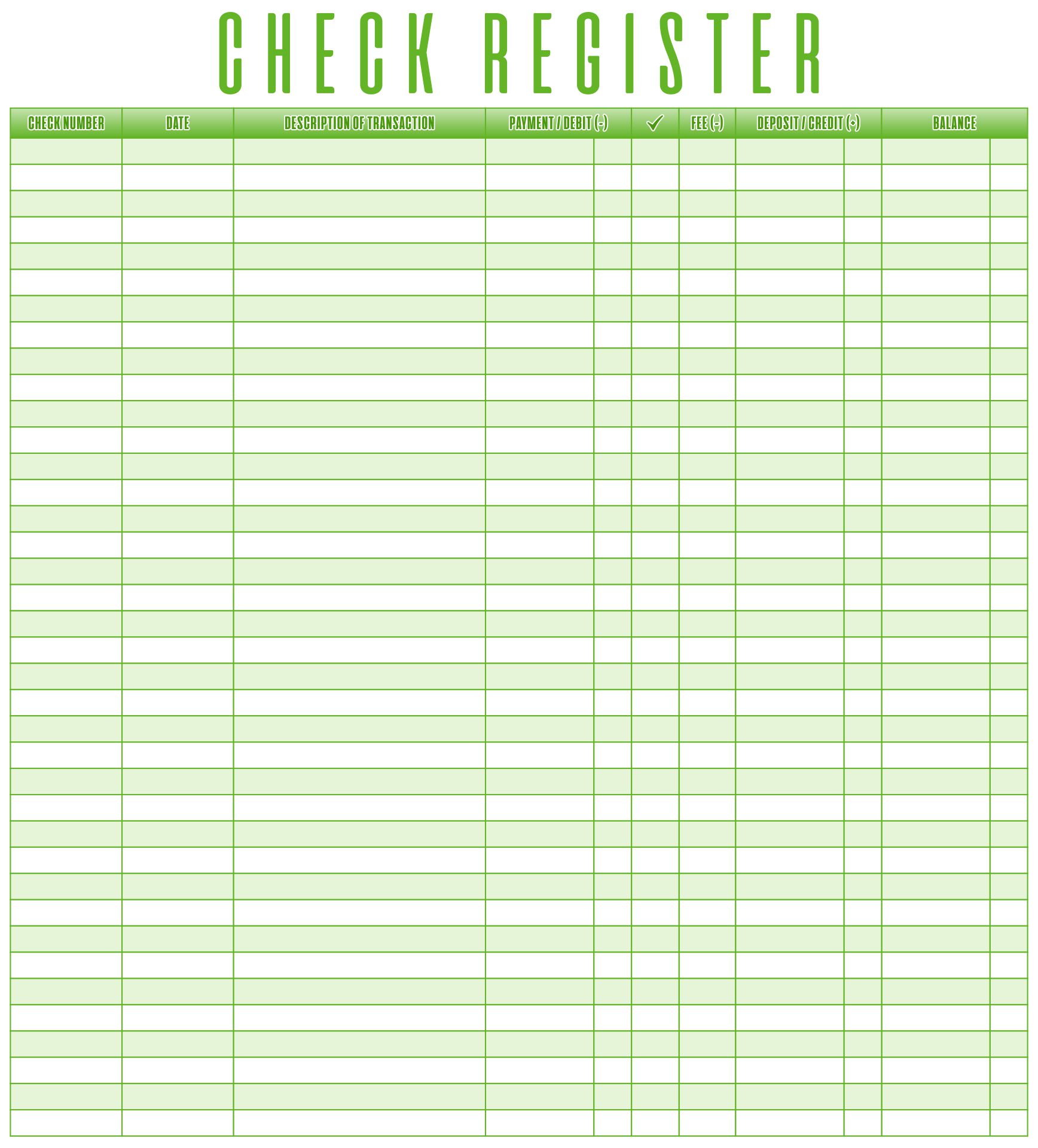

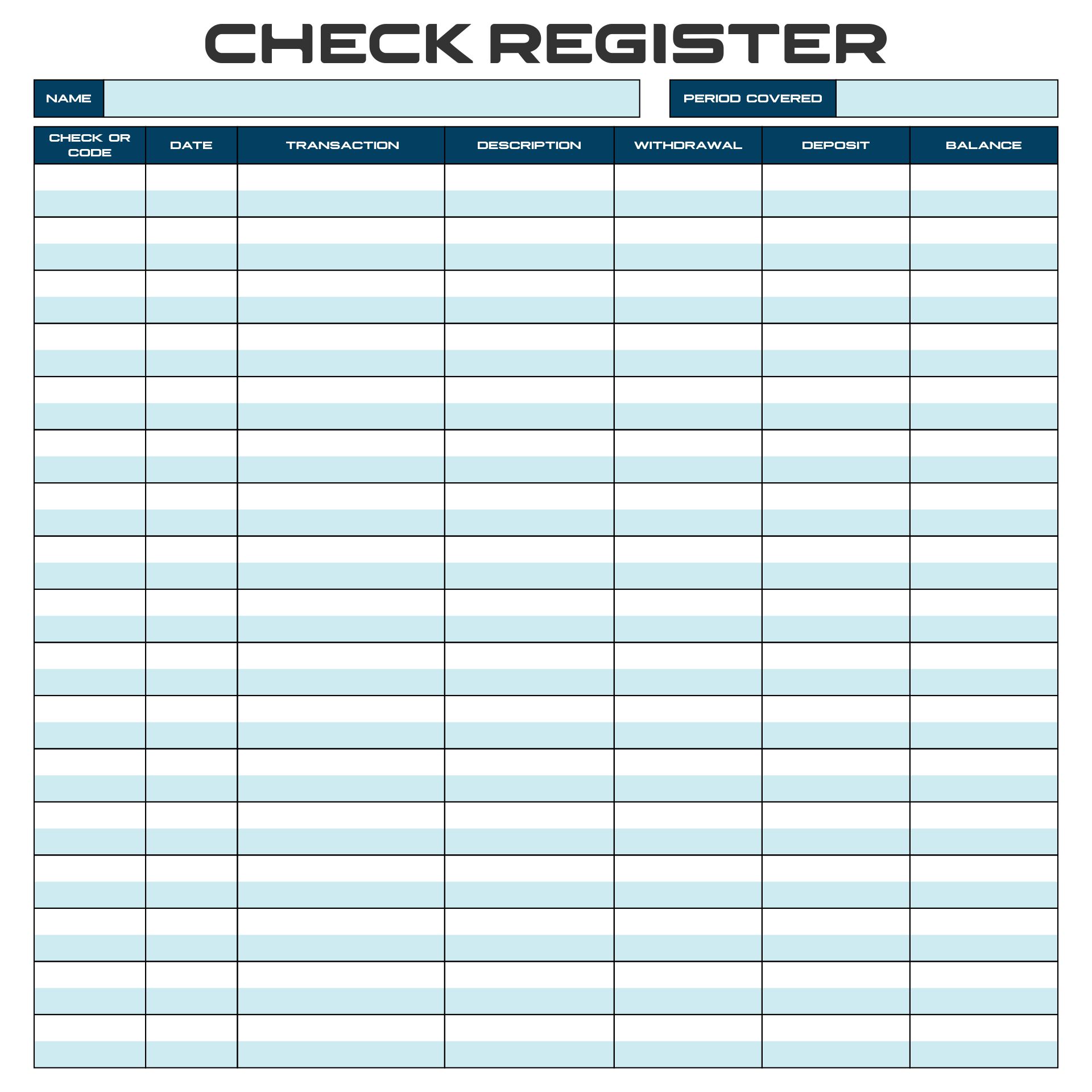

Maintaining a printable Check Register register for your checkbook is like having a financial dashboard at your fingertips. It allows you to track your spending, manage your account balance, and safeguard against overdraft fees by providing a real-time record of all transactions.

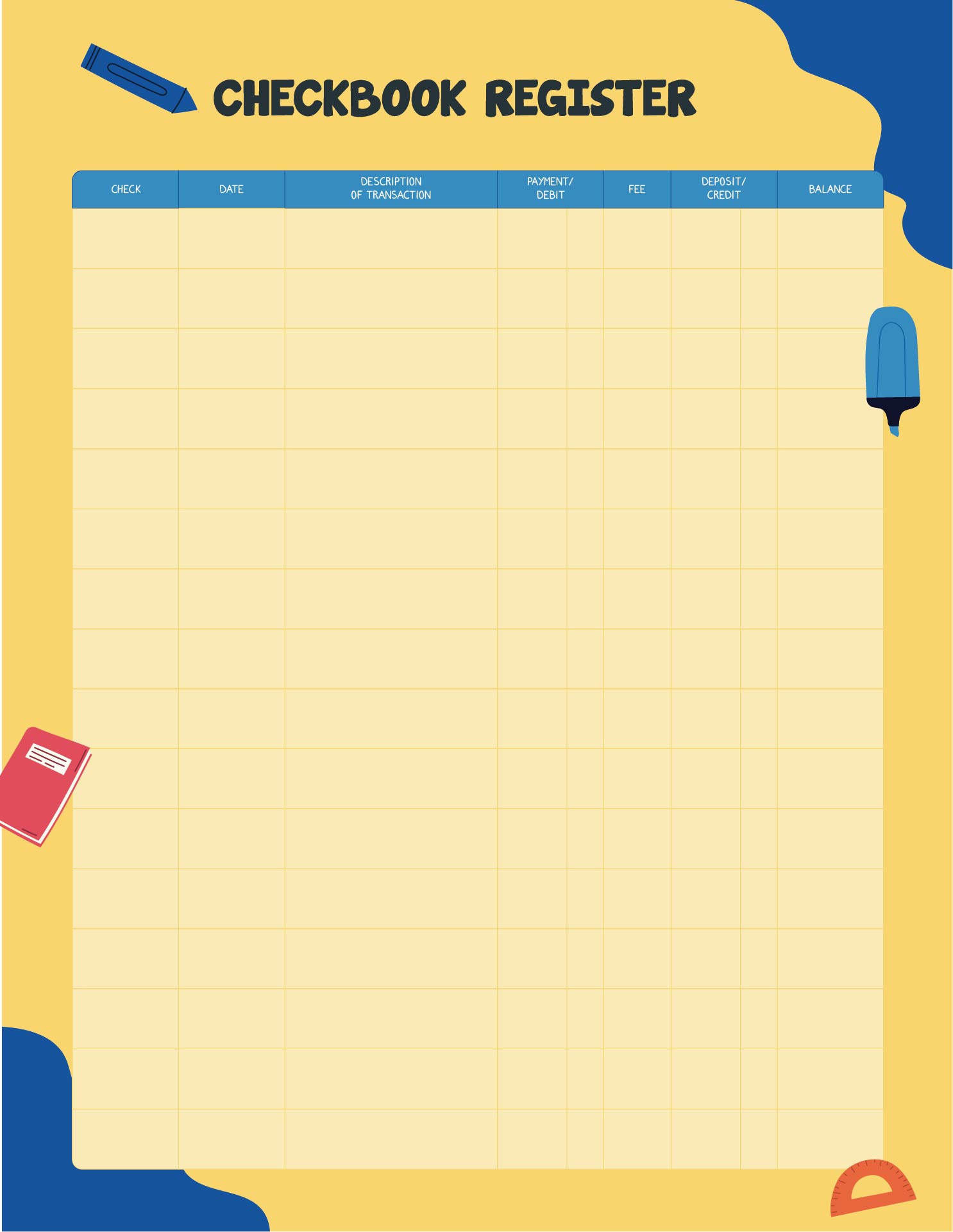

Monitoring personal expenses or managing a small business, this tool helps in budgeting and ensuring financial accuracy.

You can quickly spot discrepancies, avoid financial pitfalls, and make informed decisions about your money.

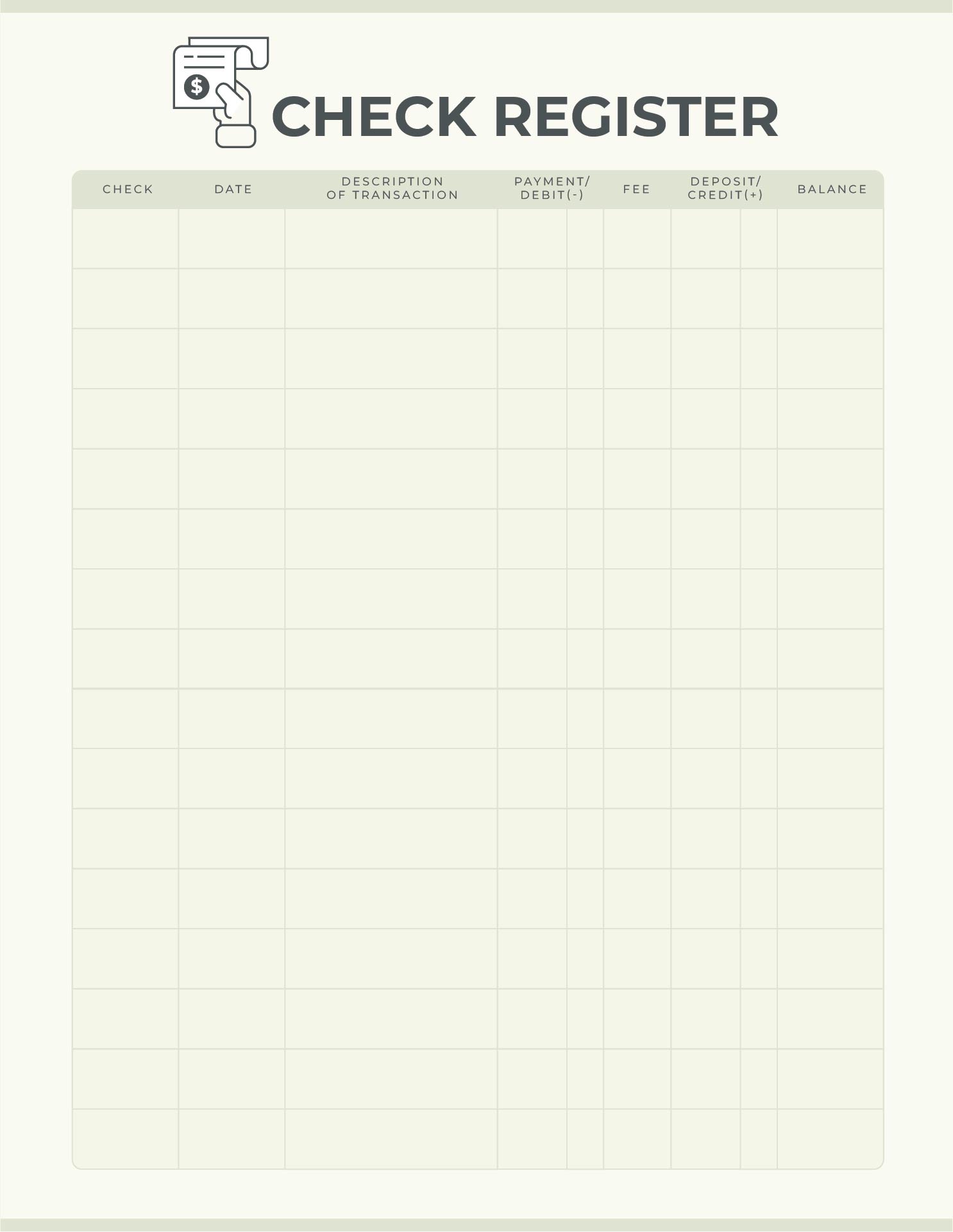

A printable check register simplifies expense and payment management. It records all transactions to offer a clear overview of your financial situation, thereby aiding in effective financial control.

A printable check register improves your control over finances. It provides an organized system to track income and expenses, identify errors, and gain insight into your financial activities for making informed monetary decisions.

Students can benefit from a printable check register to develop responsible financial habits. It provides a practical system for monitoring income and expenditure, promoting informed spending decisions.

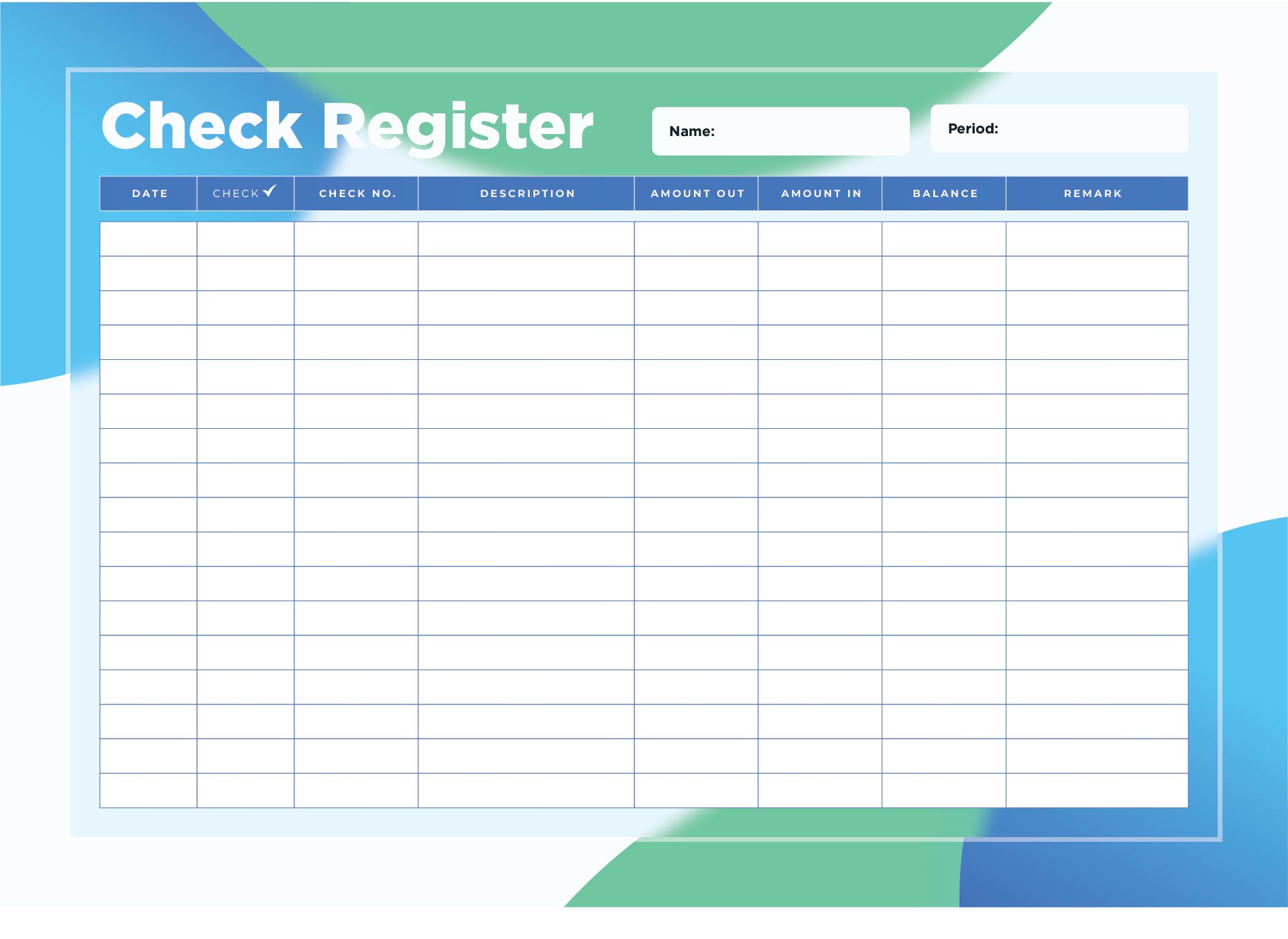

A printable check register is a helpful tool that allows you to keep track of your transactions and balance in your checkbook. It provides a neat and organized way to record important information such as the date, description, amount, and check number. With a printable check register, you can easily monitor your spending, reconcile your bank statement, and ensure that your account remains accurate and up-to-date.

Have something to tell us?

Recent Comments

A printable check register for your checkbook provides a convenient and organized way to keep track of your financial transactions, ensuring accurate record-keeping and helping you maintain a clear overview of your account balance.

Great resource for keeping track of expenses! The printable check register is a simple and effective solution for managing my checkbook. Thank you for providing this helpful tool!

A printable check register for your checkbook is a convenient tool to keep track of your expenses and ensure accurate record-keeping, helping you easily monitor your finances and stay organized.