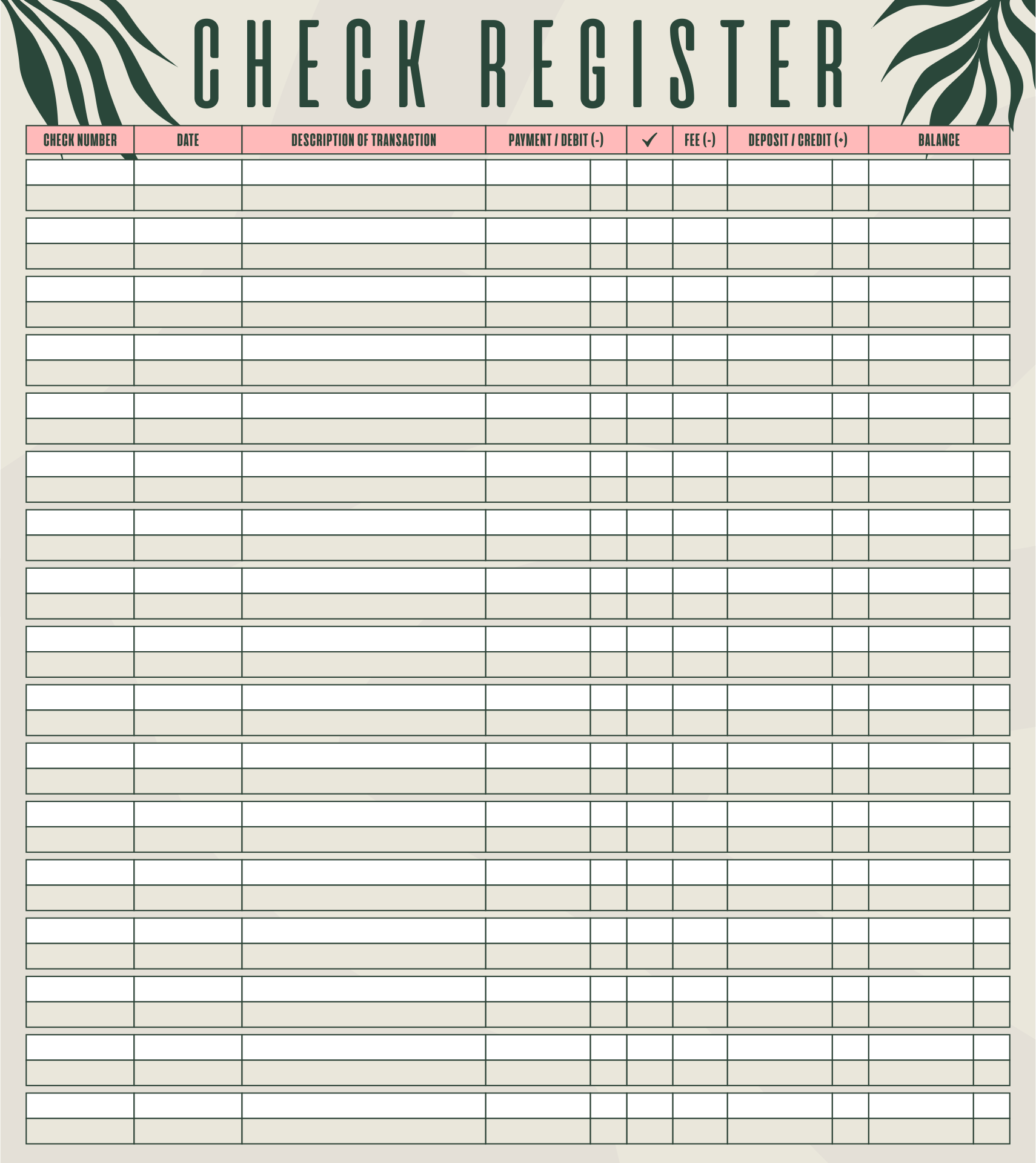

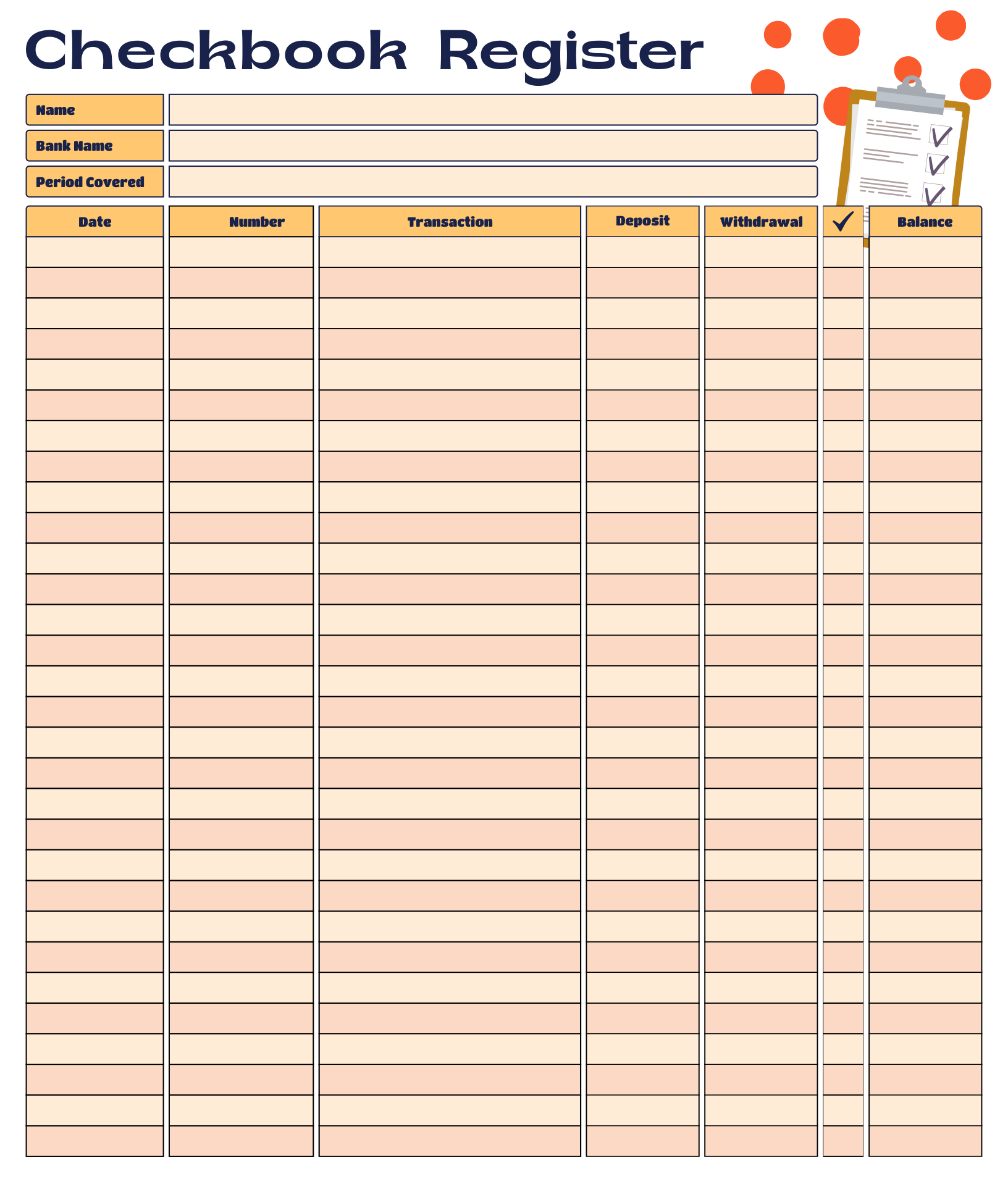

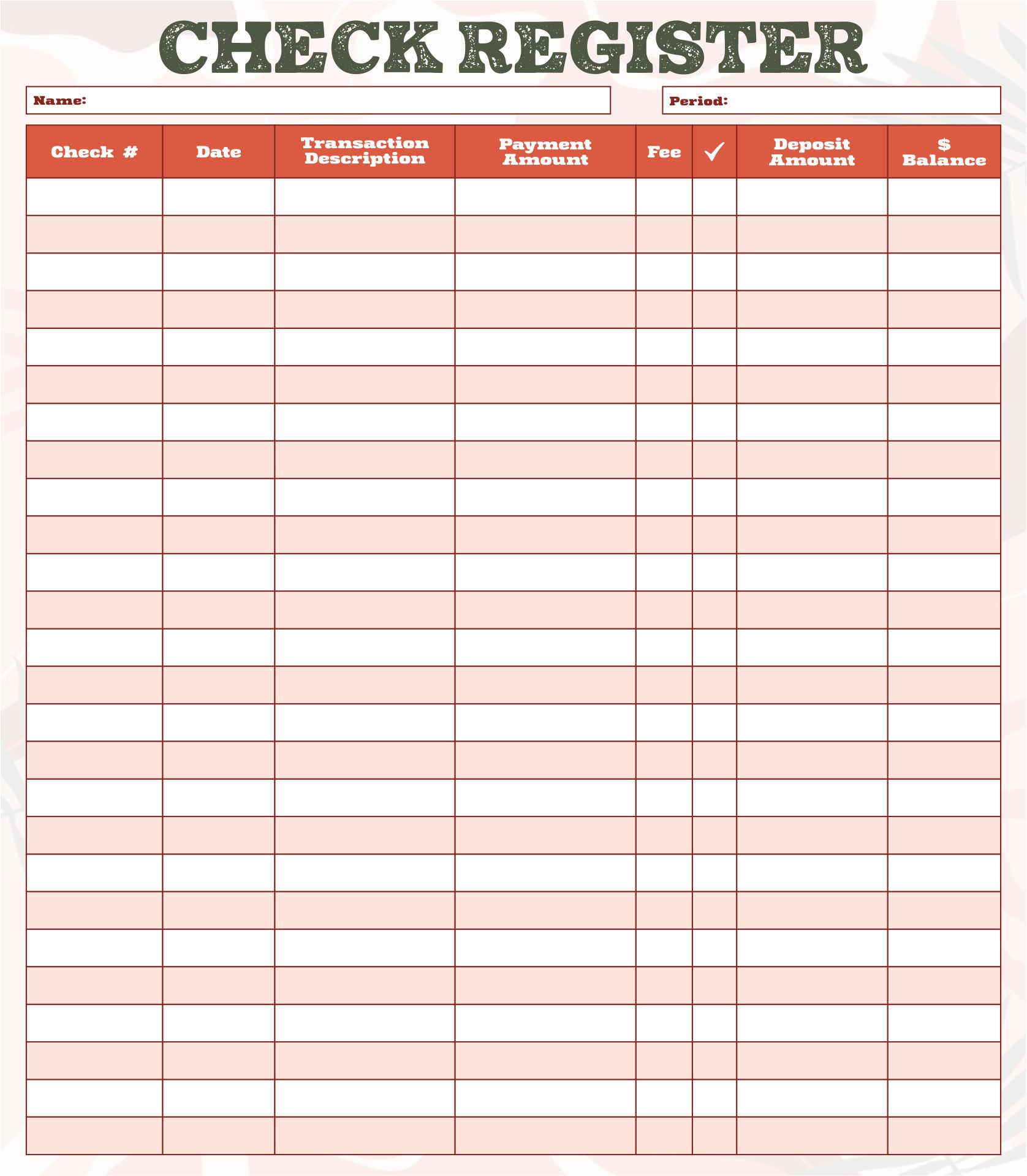

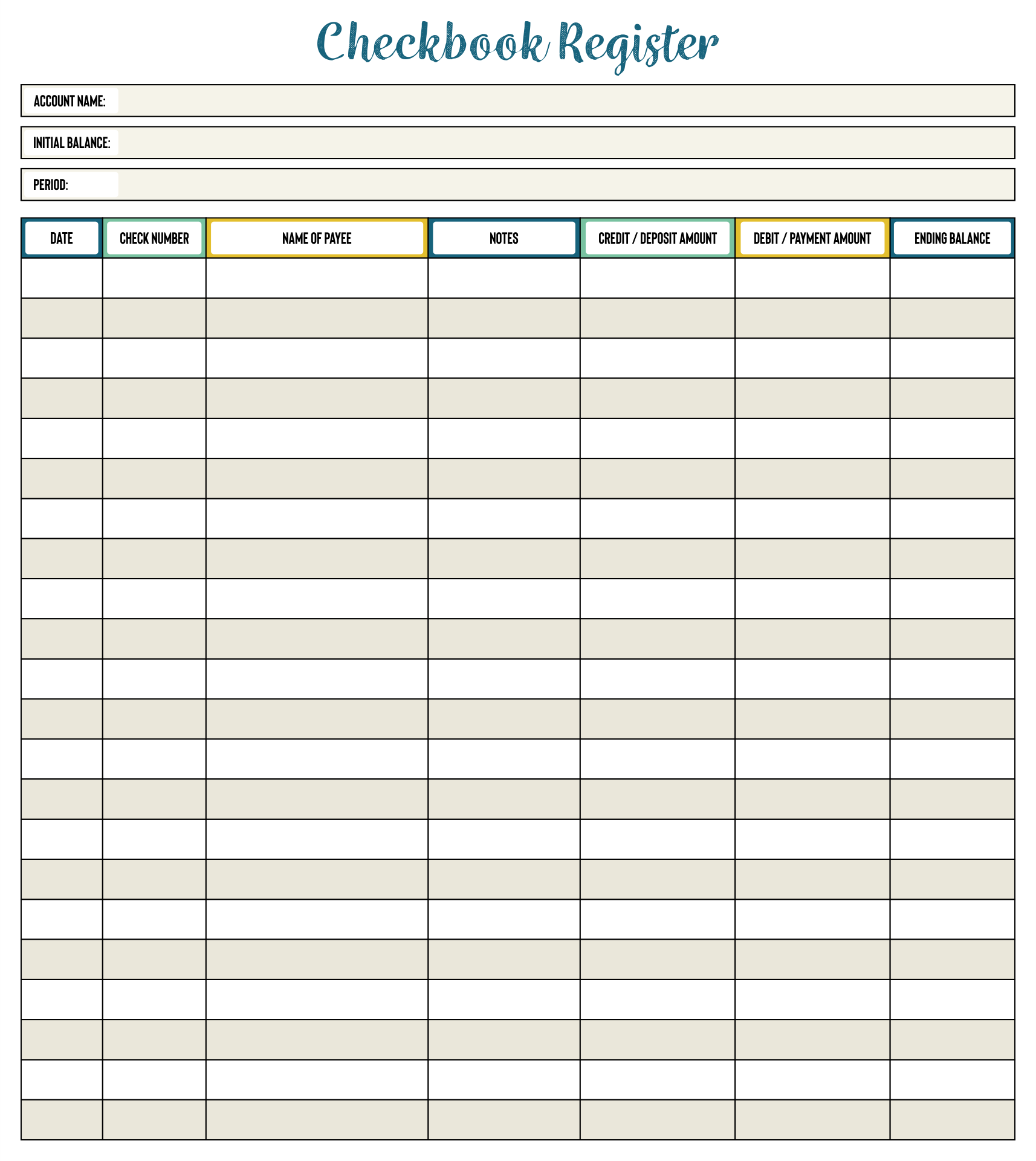

Printable Check Register register sheets offer a convenient and straightforward way for you to track your expenses, deposits, and current account balance. By using these sheets, you gain immediate insight into your financial health, helping you avoid overdraft fees and manage your budget more effectively. They serve as a tangible record of your transactions, making it easier for you to spot any discrepancies or fraudulent activities on your account.

Keeping a manual record of your transactions can help you manage your finances more effectively. A printable check register in checkbook size is convenient for everyday use, fitting perfectly with your existing checkbook. It allows you to track your cash flow, monitor account balances, and catch any discrepancies quickly, ensuring your financial health remains in good standing.

Maintaining up-to-date records of your financial transactions is crucial for budgeting and financial planning. Printable check registers for checkbooks provide an easy, accessible way for you to keep track of your spending, deposits, and balance adjustments. By manually entering your transactions, you can stay on top of your finances, helping you avoid overdrafts and fraud.

Using a printable checkbook register template simplifies the process of managing your personal or business finances. It encourages you to take a hands-on approach to your money, helping you identify spending patterns, manage budgeting more efficiently, and keep a close eye on account activity. With templates, you can customize your financial tracking to suit your specific needs, promoting greater financial discipline.

Have something to tell us?

Recent Comments

Free printable check register sheets are a useful tool for keeping track of your finances, helping you stay organized and manage your expenses efficiently.

I found these Free Printable Check Register Sheets incredibly useful in keeping track of my expenses. They are simple and convenient to use, making budgeting a breeze. Thank you for providing such a helpful resource!