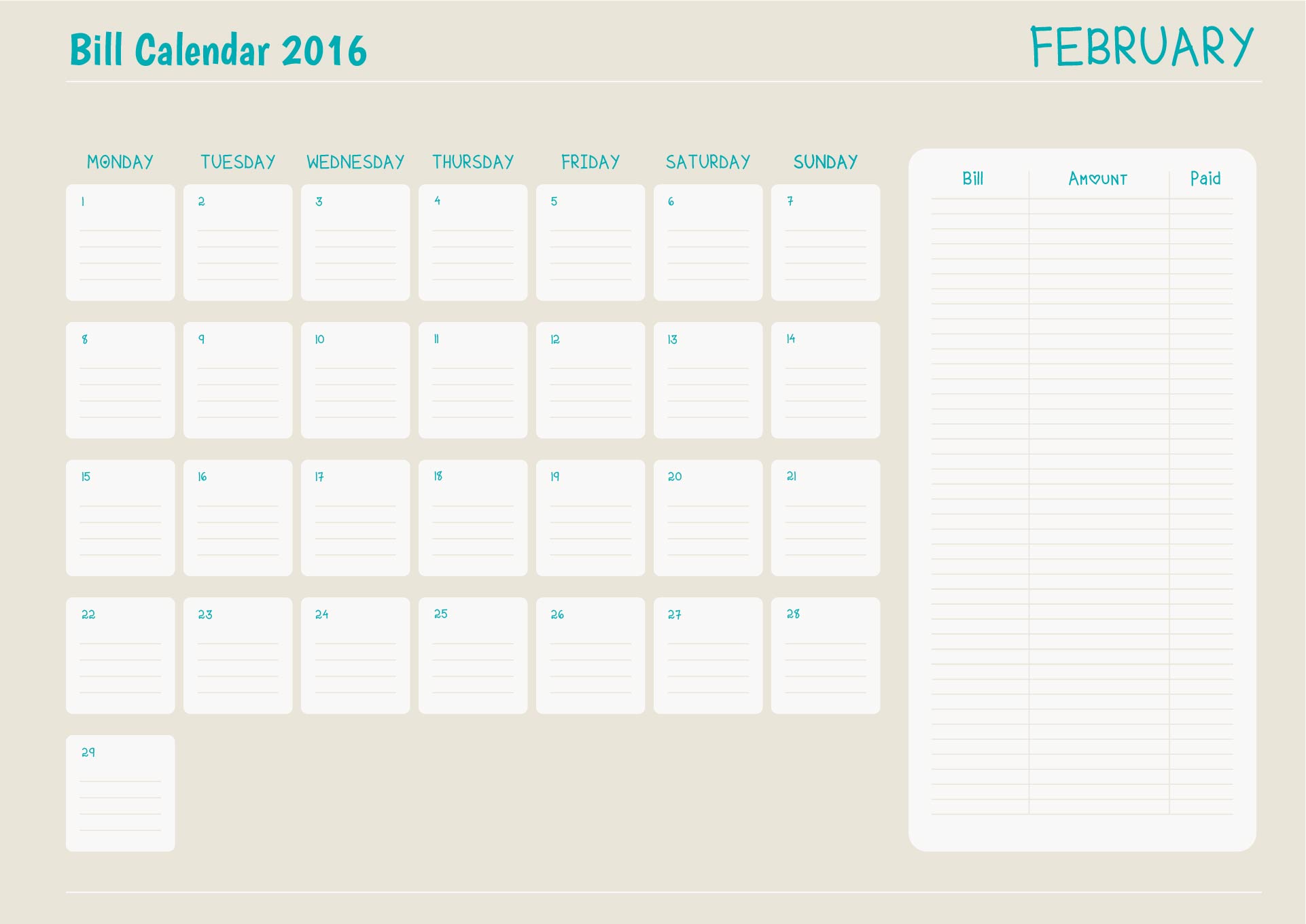

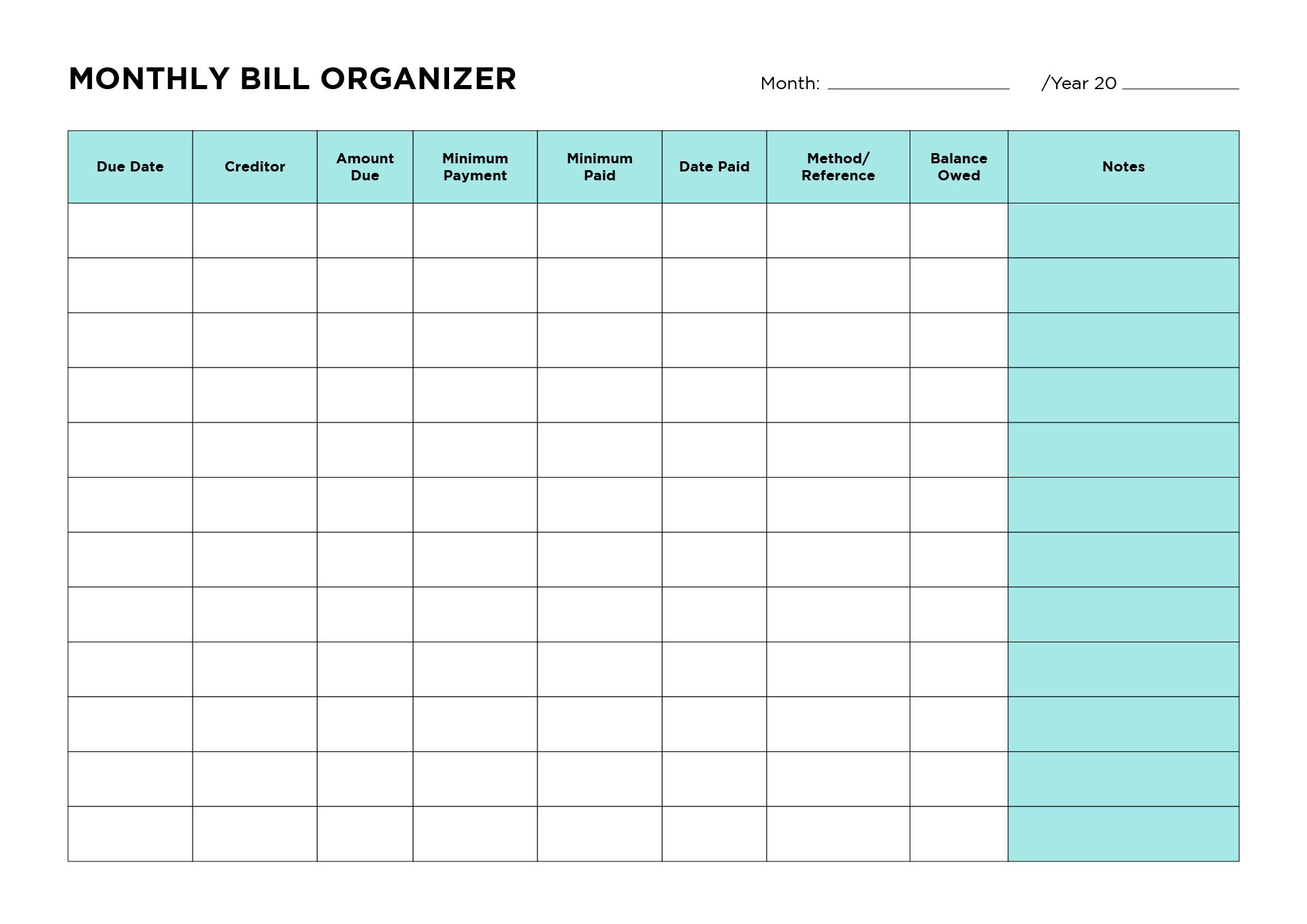

A printable Bill calendar is a straightforward tool that helps you manage your monthly payments effectively. By having all your bills and their due dates in one visible place, you can avoid late fees, maintain a good credit score, and keep your budget on track.

It simplifies your financial planning by giving you a clear overview of your expenses, enabling you to allocate your funds wisely. Your financial stress can be significantly reduced as this calendar acts as your personal reminder for all upcoming payments.

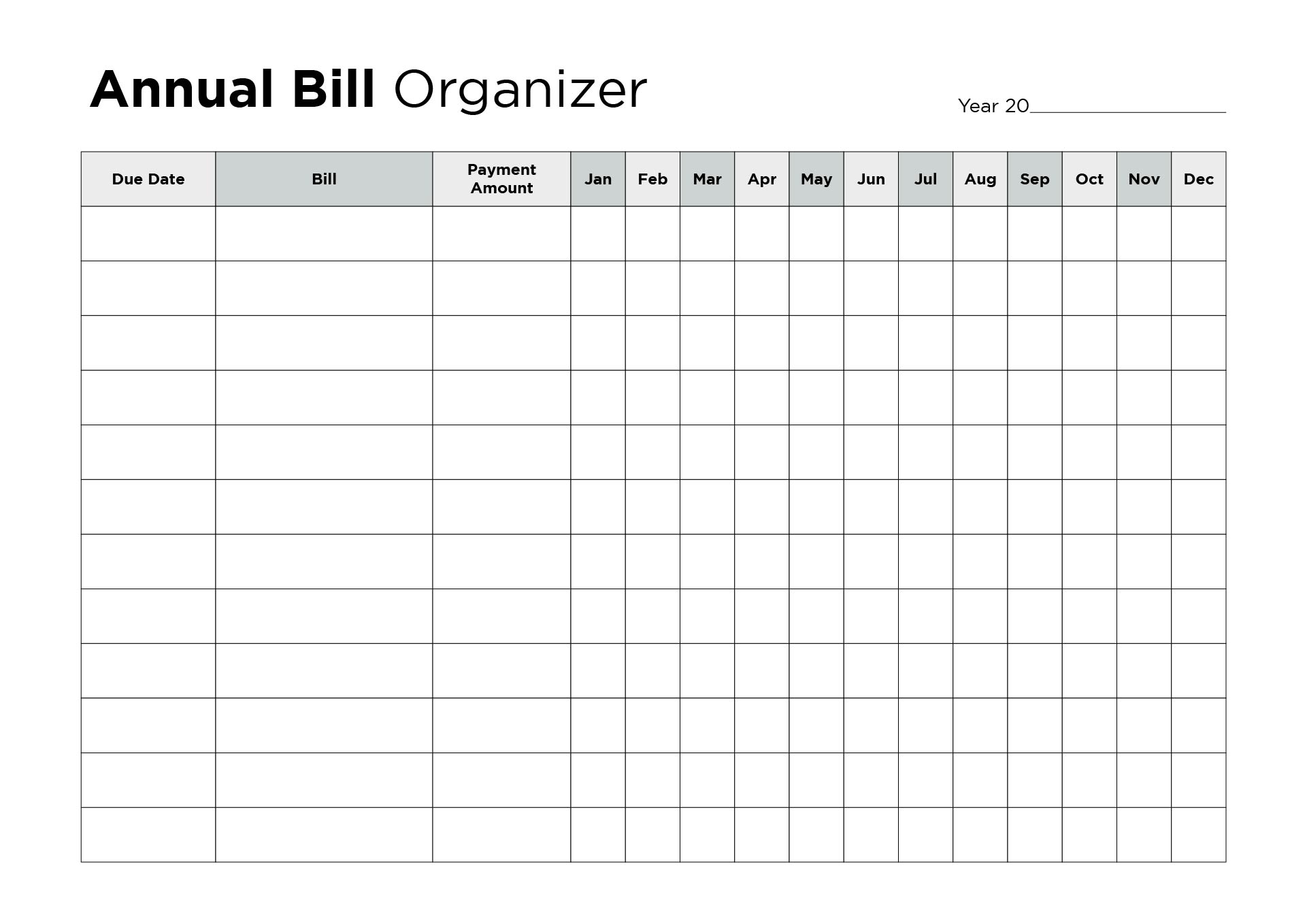

Keeping track of your yearly expenses becomes straightforward with a Printable Annual Bill Organizer. This tool helps you maintain a clear overview of all your bills in one place, ensuring you never miss a payment deadline. It's an efficient way to manage your finances, plan for future expenses, and potentially save money by avoiding late fees.

A Printable Bill Calendar from 2016 can serve as a useful template for organizing your current financial obligations. By analyzing past payment schedules and expenditures, you can identify patterns or opportunities for budget optimization. This retrospective view can assist in better financial planning and allocation of funds for the present year.

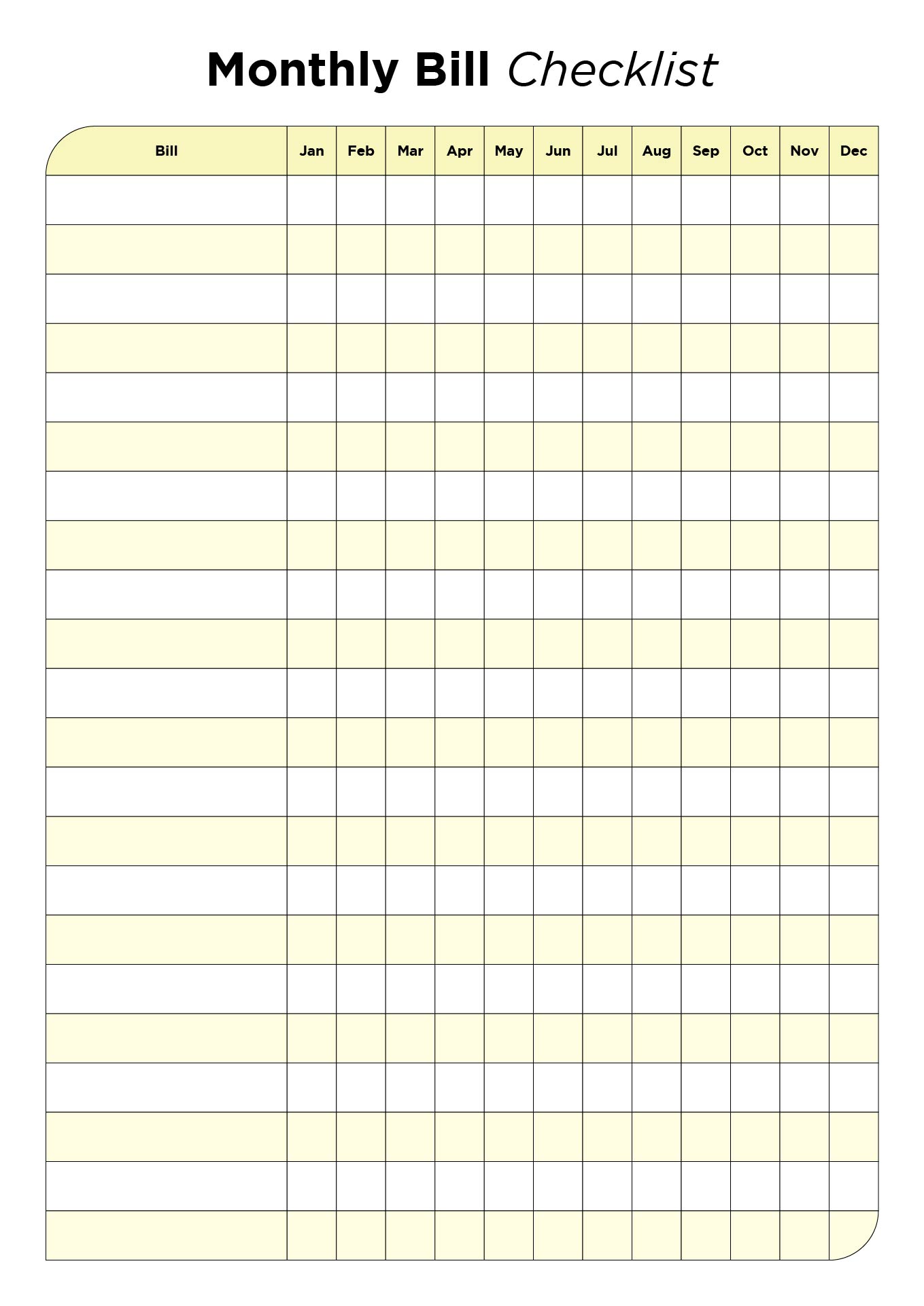

A Printable Monthly Bill Checklist simplifies tracking your monthly financial obligations. It ensures that you stay organized, pay your bills on time, and maintain a good credit score by avoiding late payments. This checklist can be a pivotal tool in budget management, helping you allocate your resources wisely and avoid unnecessary financial strain.

Have something to tell us?

Recent Comments

I found the Free Printable Bill Calendar very helpful in keeping track of my monthly bills in a simple and organized manner. Thank you for providing this practical resource!

Thanks for sharing this practical and helpful Free Printable Bill Calendar! It's great to have a visual tool to keep track of my monthly expenses. Much appreciated!