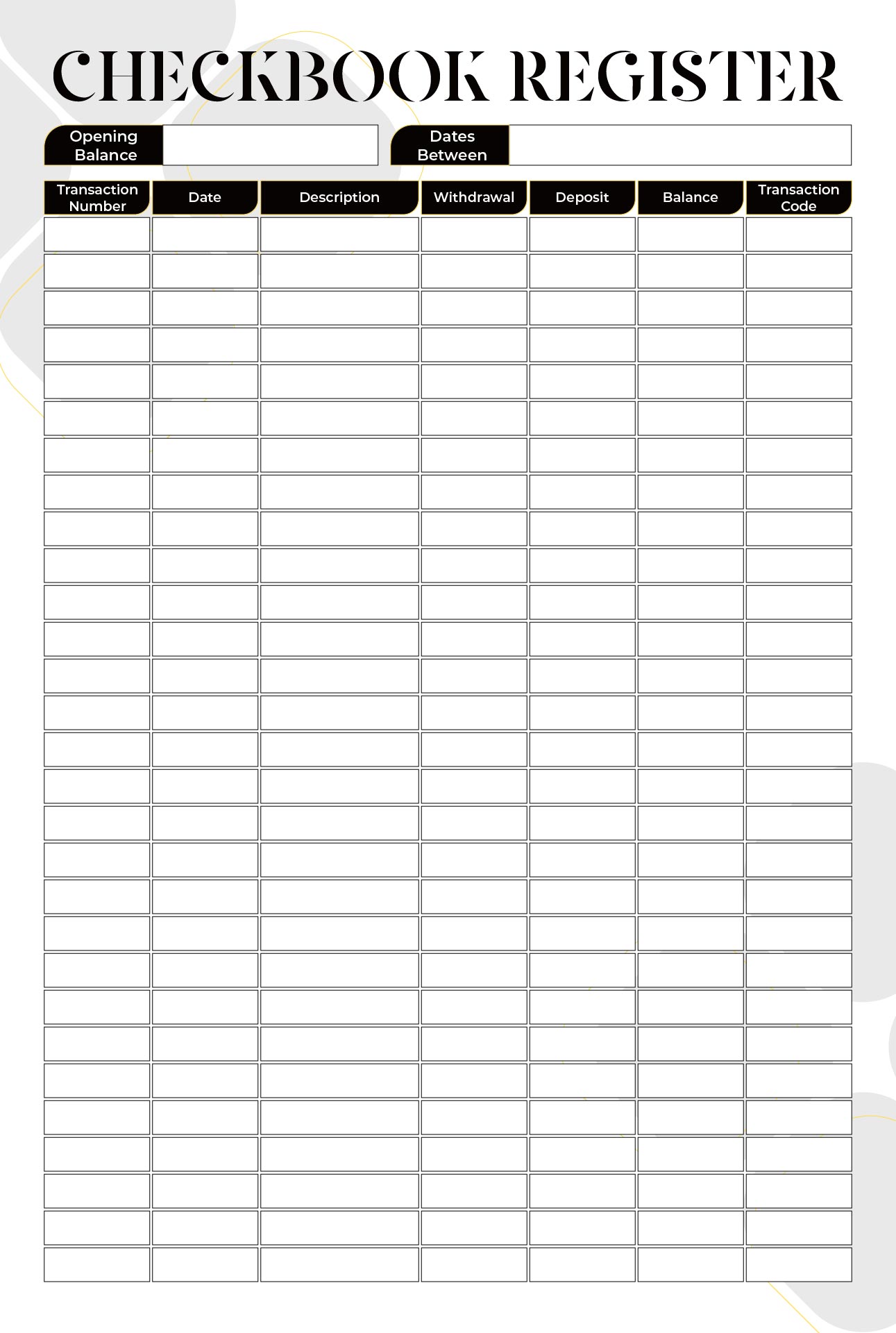

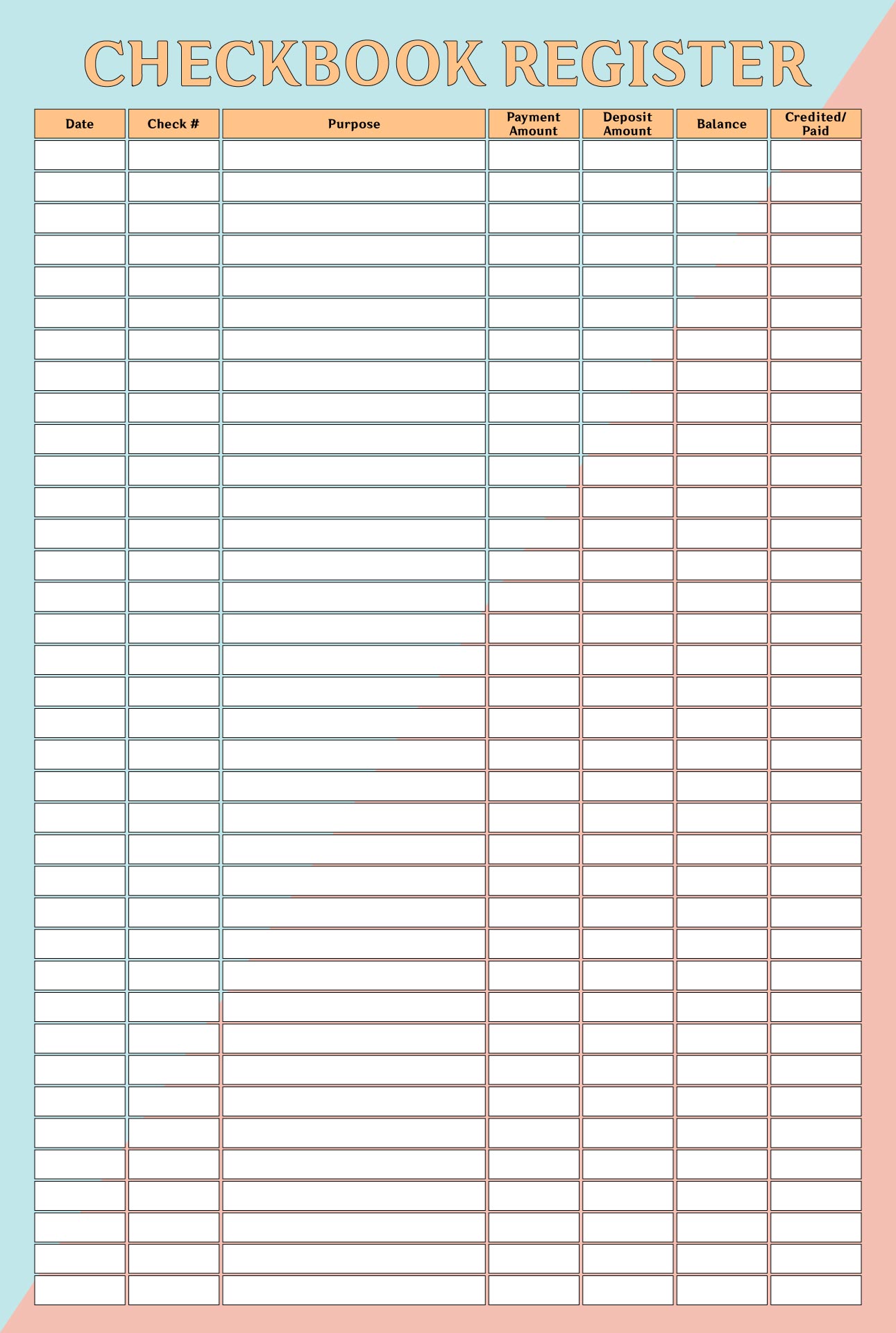

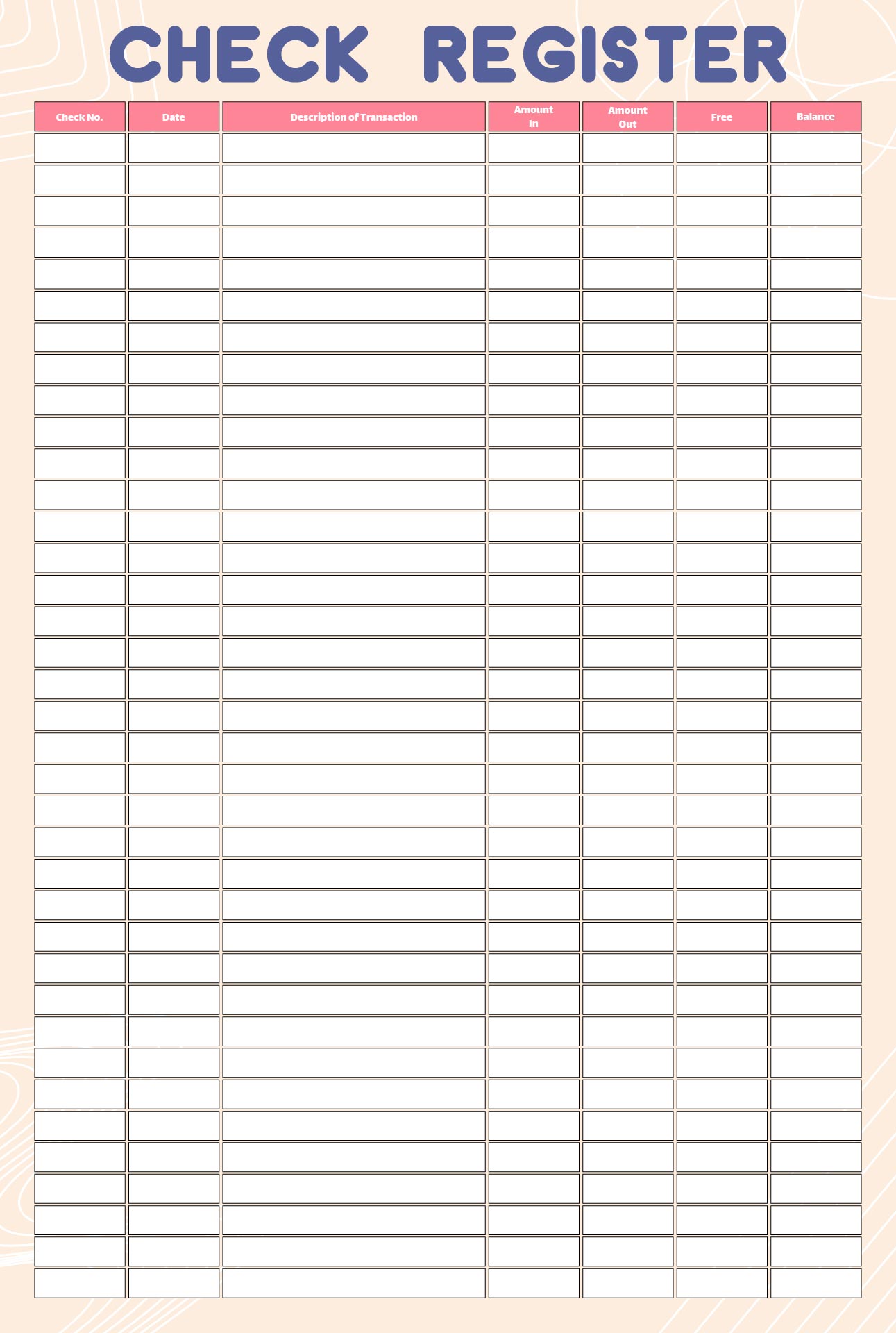

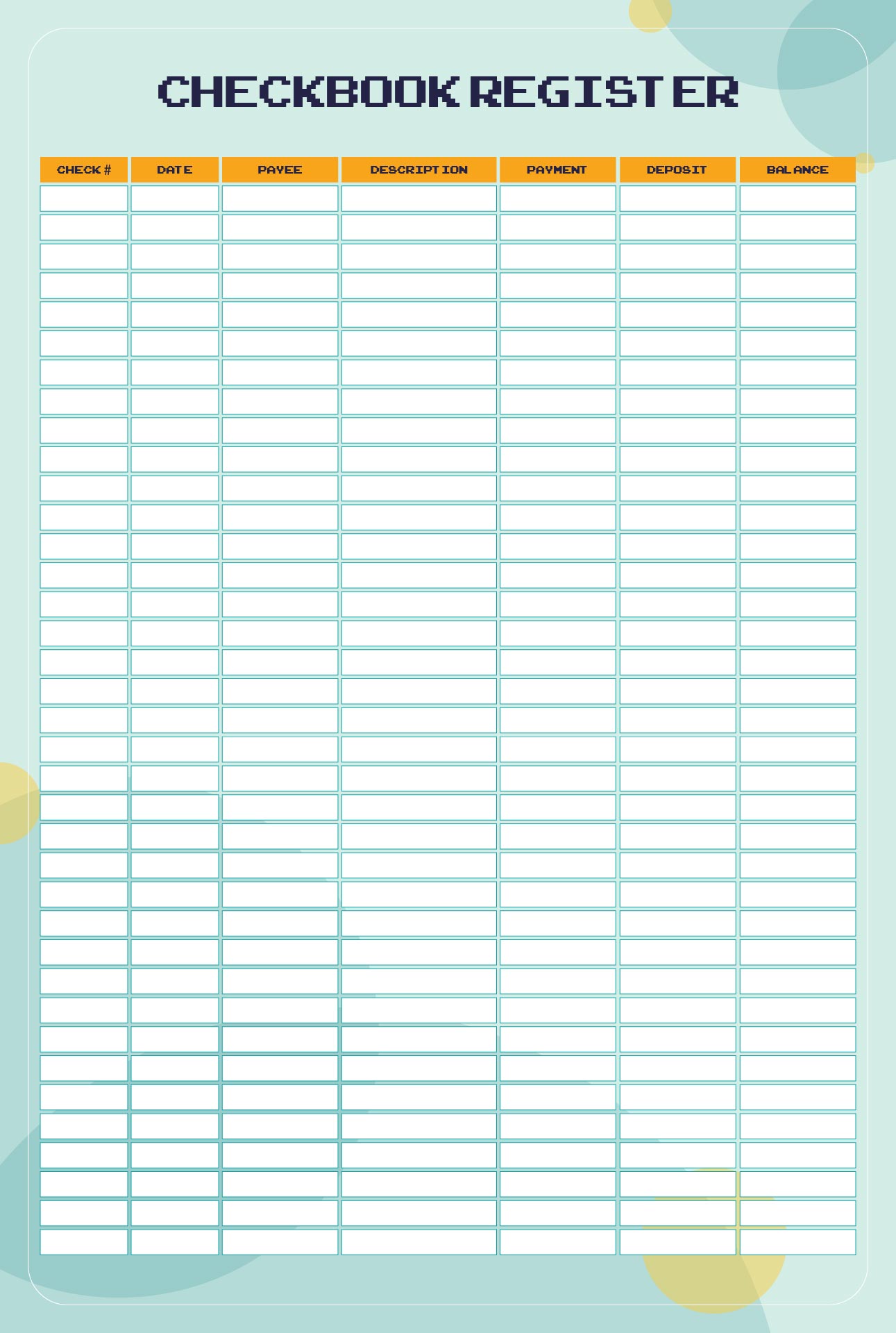

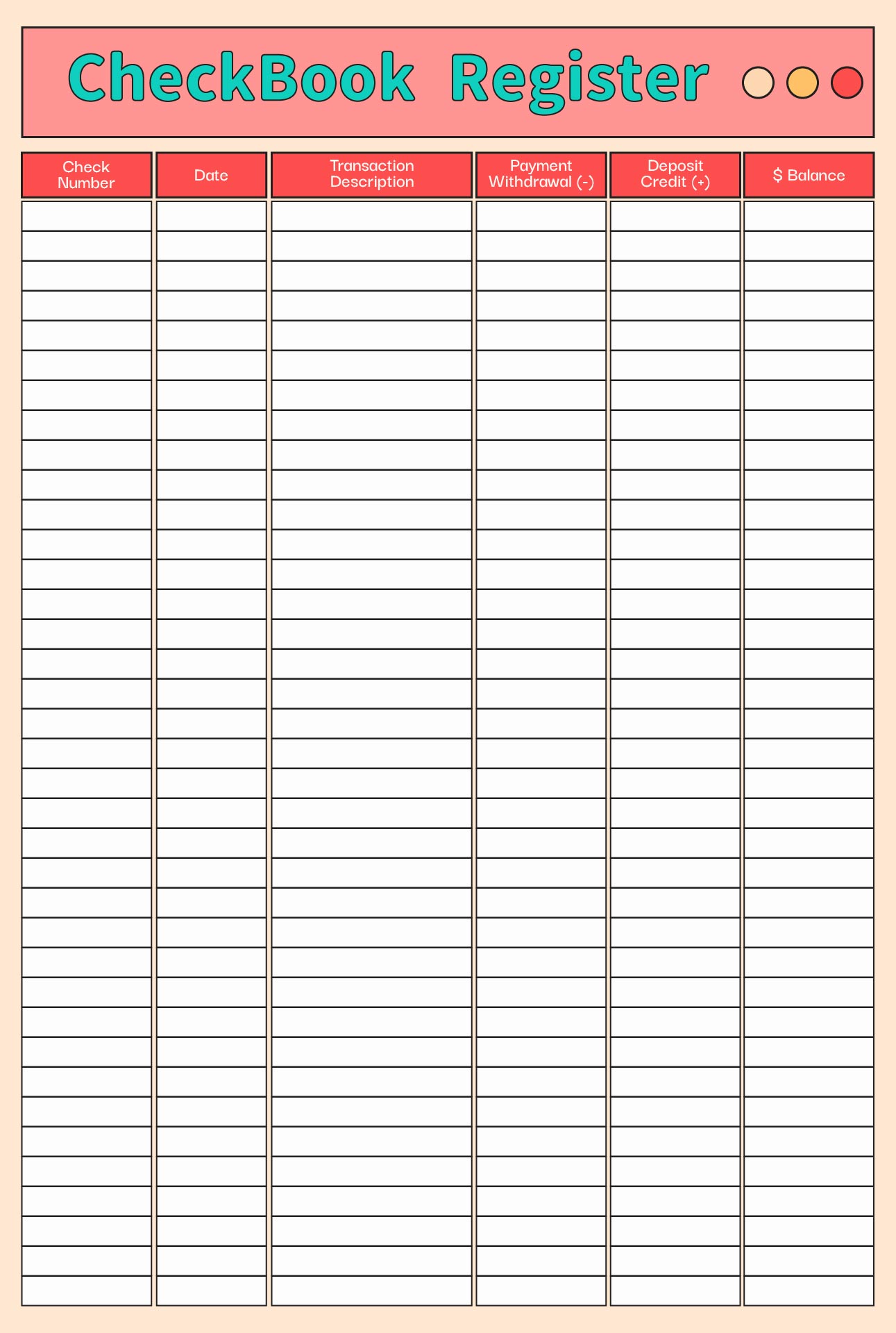

Tracking your transactions via a printable blank checkbook register can contribute to effective personal finance management. This tool aids in monitoring spending, maintaining exact account balances, and fulfilling financial obligations.

A printable blank checkbook register can be a practical tool for teaching children about money management. The templates available online make it cost-effective to help children learn about recording transactions and balanced accounts.

Small business owners can benefit from our printable blank checkbook register designed for expense tracking. Recording expenses gives insights into expenditure, aiding informed financial decisions. A few minutes each day maintains control over finances.

College students can use the printable blank checkbook register to track income and expenses, encouraging financial organization and awareness. This tool facilitates the development of effective money management skills and financially beneficial habits.

A printable blank checkbook register is a useful tool for keeping track of your finances. It allows you to record your transactions, including checks written and deposits made, so you can easily monitor your spending and account balance. With a printable blank checkbook register, you have a convenient way to stay organized and manage your money effectively.

Have something to tell us?

Recent Comments

I appreciate this free downloadable blank checkbook register! It's a simple yet efficient tool to keep track of my expenses. Thank you!

Thank you for providing this free printable blank checkbook register. It's a helpful tool for keeping my finances organized in a simple and efficient way!

A free printable blank checkbook register allows individuals to effectively track and manage their personal finances by recording all incoming and outgoing transactions in a clear and organized manner.