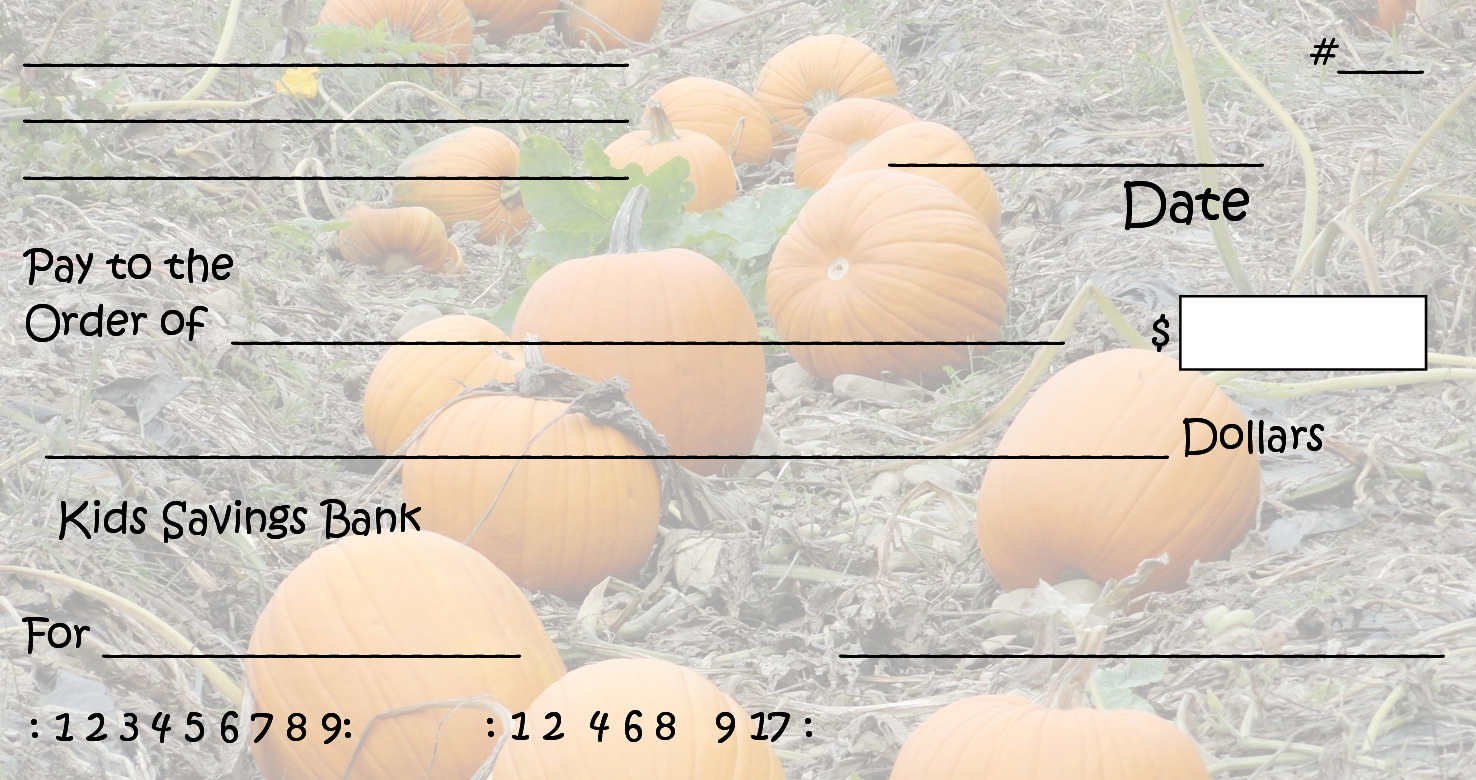

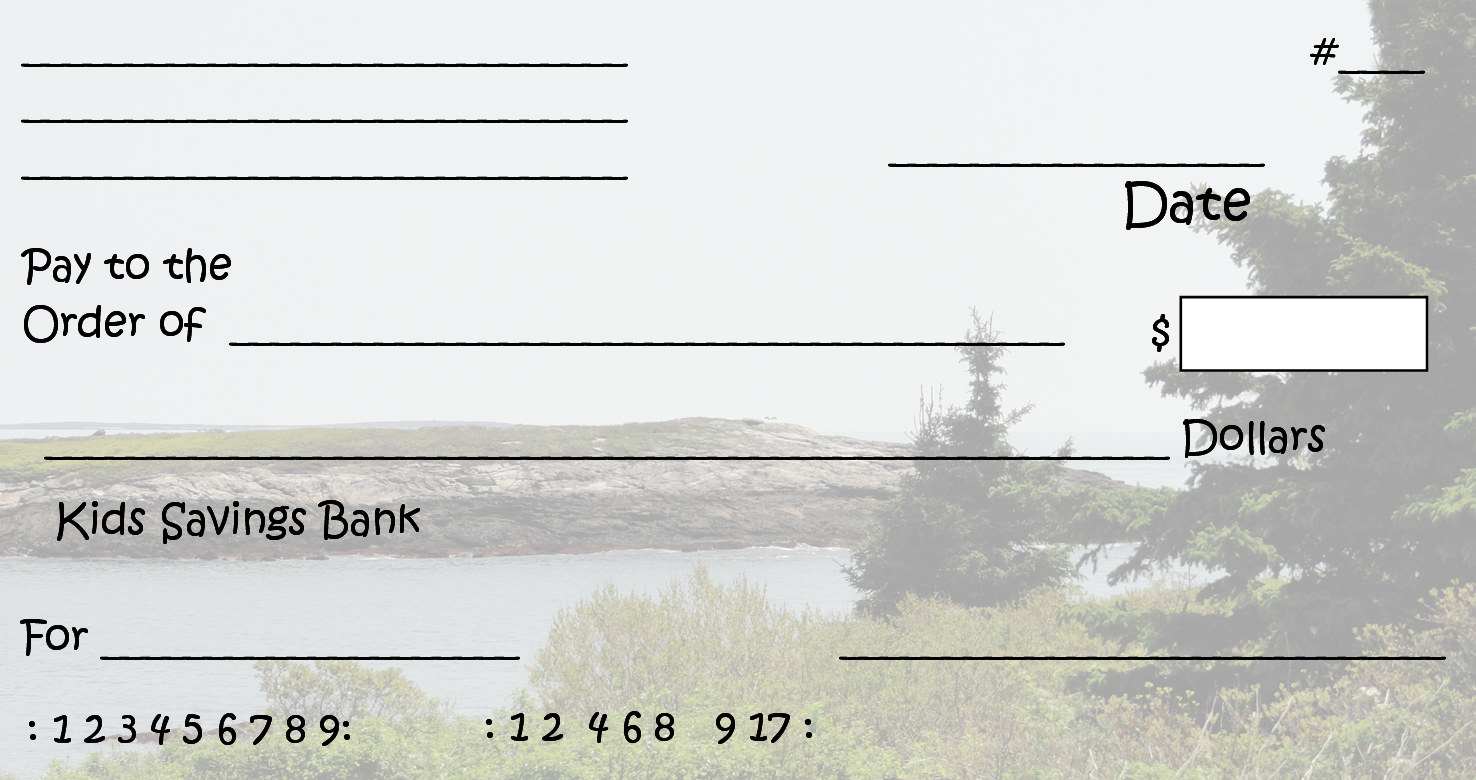

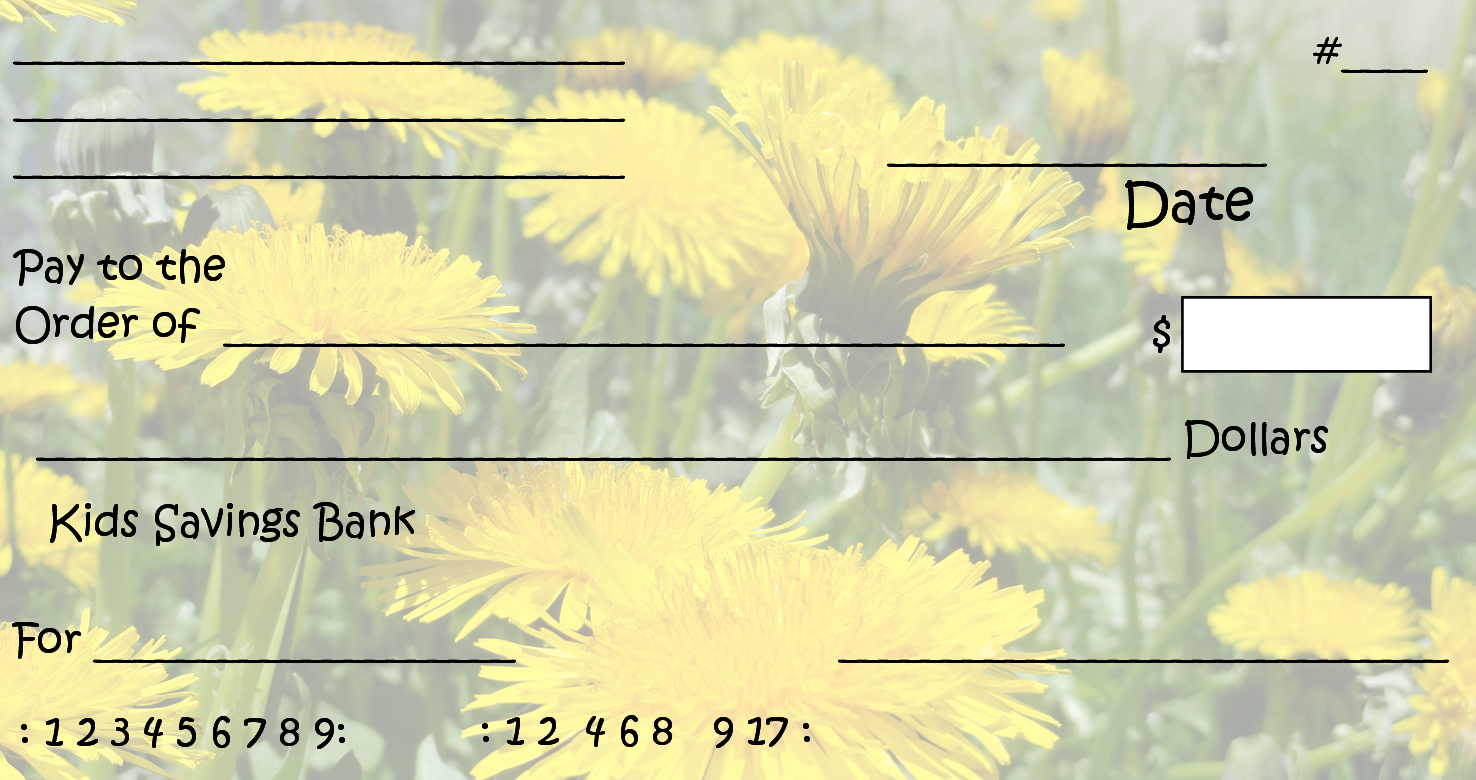

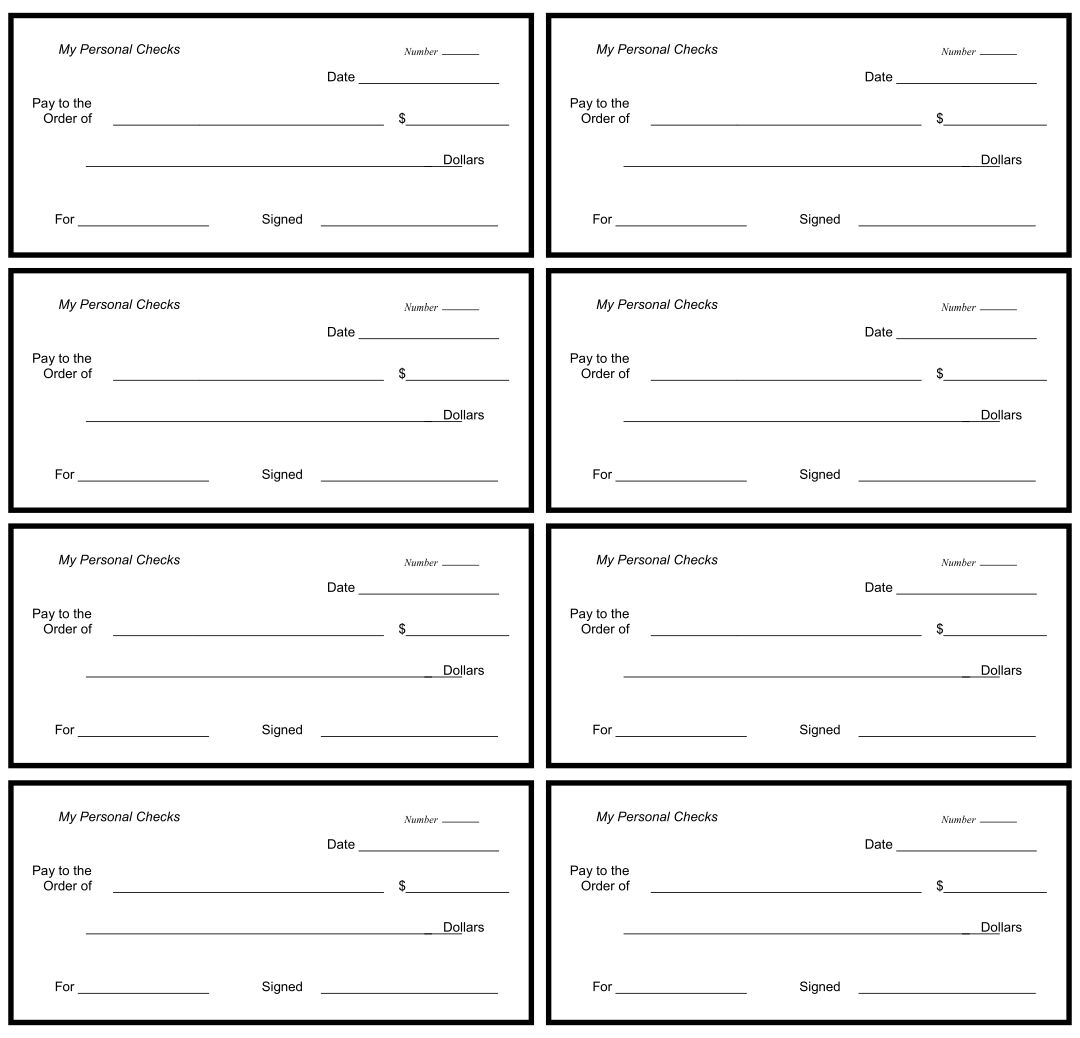

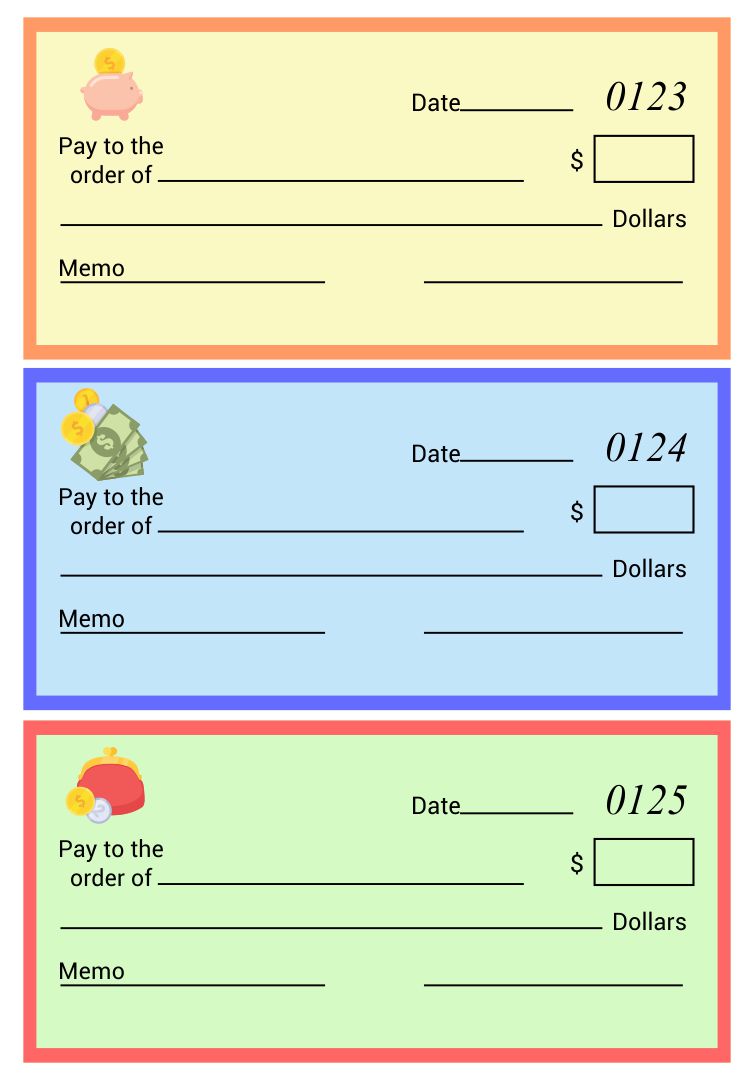

Printable Play checks are a fantastic tool for teaching children about money management, basic arithmetic, and the concept of transactions. By using these, you can create a fun and educational experience that helps young ones understand the value of money, how to write checks, and the basics of banking in a hands-on manner. Your kids can practice making purchases, receiving change, and even running their own pretend store or bank, fostering both math skills and financial literacy from a young age.

Printable pretend checks can be a practical tool for teaching children about financial literacy and the basics of handling money. By using these checks in play or educational settings, you can help kids learn how to write checks, understand transactions, and grasp the concept of budgeting in a hands-on manner. This can be an engaging way to introduce them to key financial skills early on.

Play blank checks offer a creative and interactive method for educators and parents to teach financial responsibility. You can customize these checks for various teaching scenarios, from simple buying and selling games to more complex banking role-plays. This not only makes learning about money management fun but also prepares them for real-world financial decisions.

Your ability to access printable check templates allows for a versatile range of educational and organizational applications. From teaching young students about financial transactions to managing household budgets or small business activities, these templates serve as a handy tool. They encourage learning through practice and can be customized to fit specific learning objectives or financial planning needs.

Have something to tell us?

Recent Comments

Printable play checks for kids provide a fun and interactive way for children to learn about money management while engaging in imaginative play.

These printable play checks for kids are a wonderful resource to teach financial literacy in a fun and interactive way. Thank you for providing such a useful tool!

Printable play checks for kids provide a realistic and engaging way to introduce the concepts of money and finance, helping children understand the value of saving and budgeting while having fun.