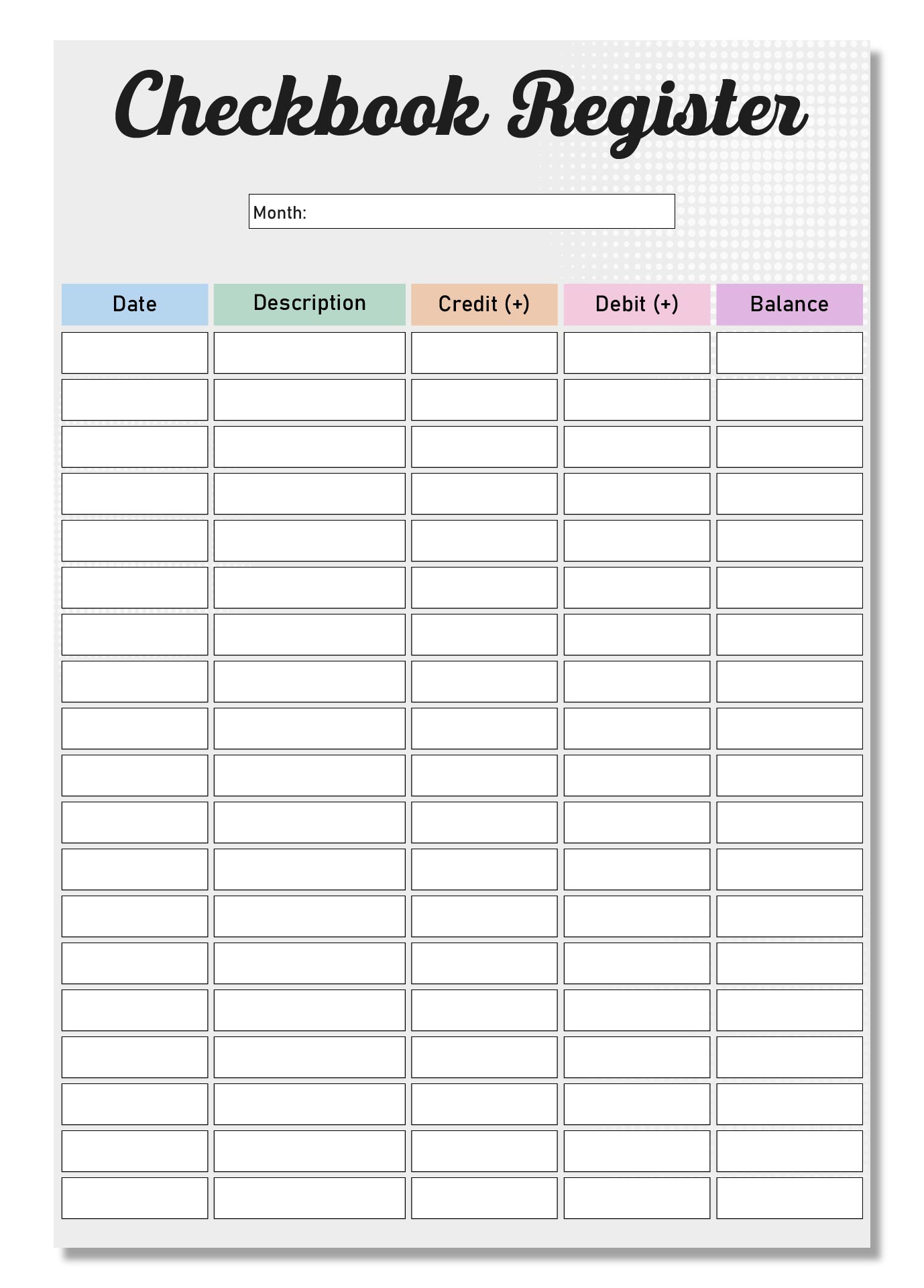

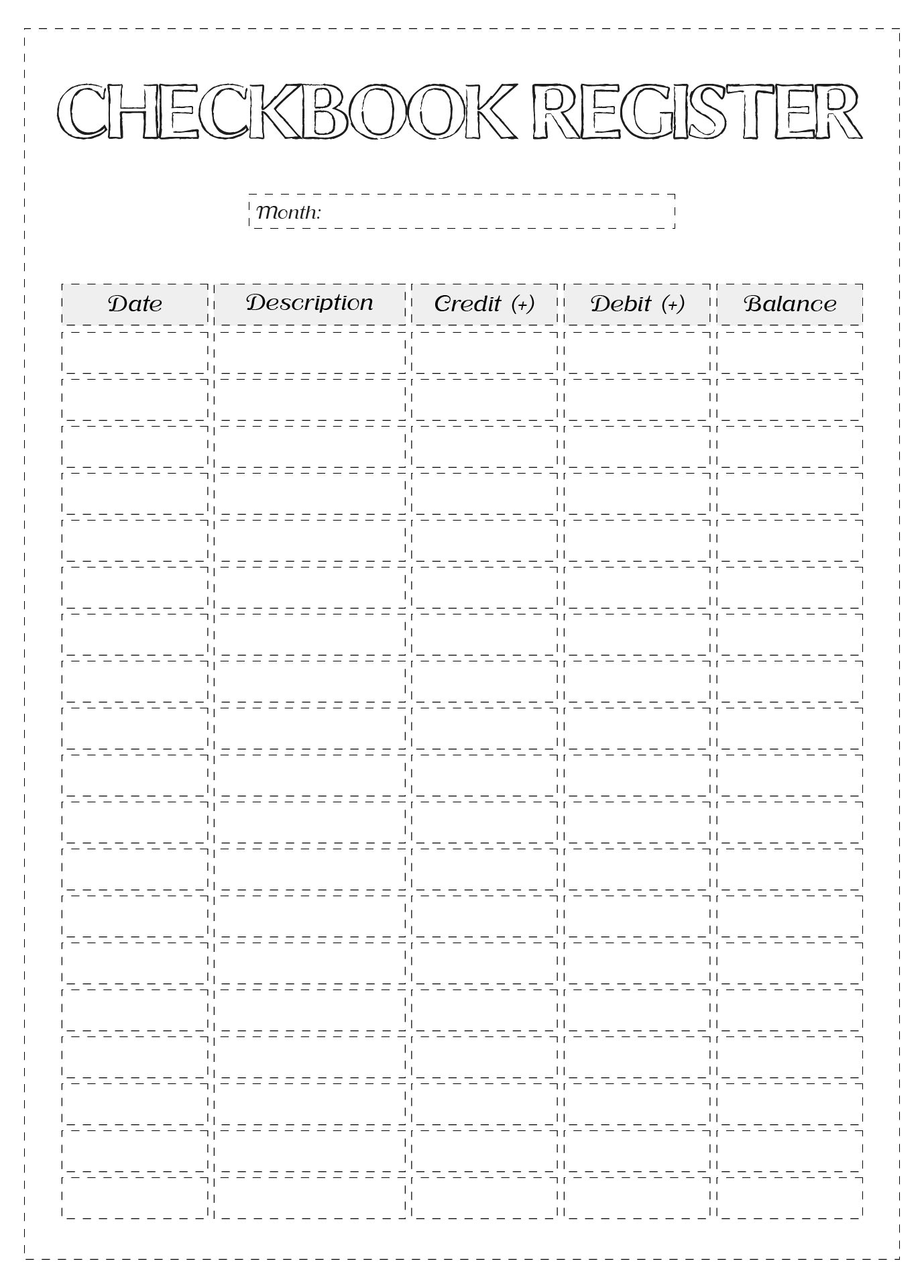

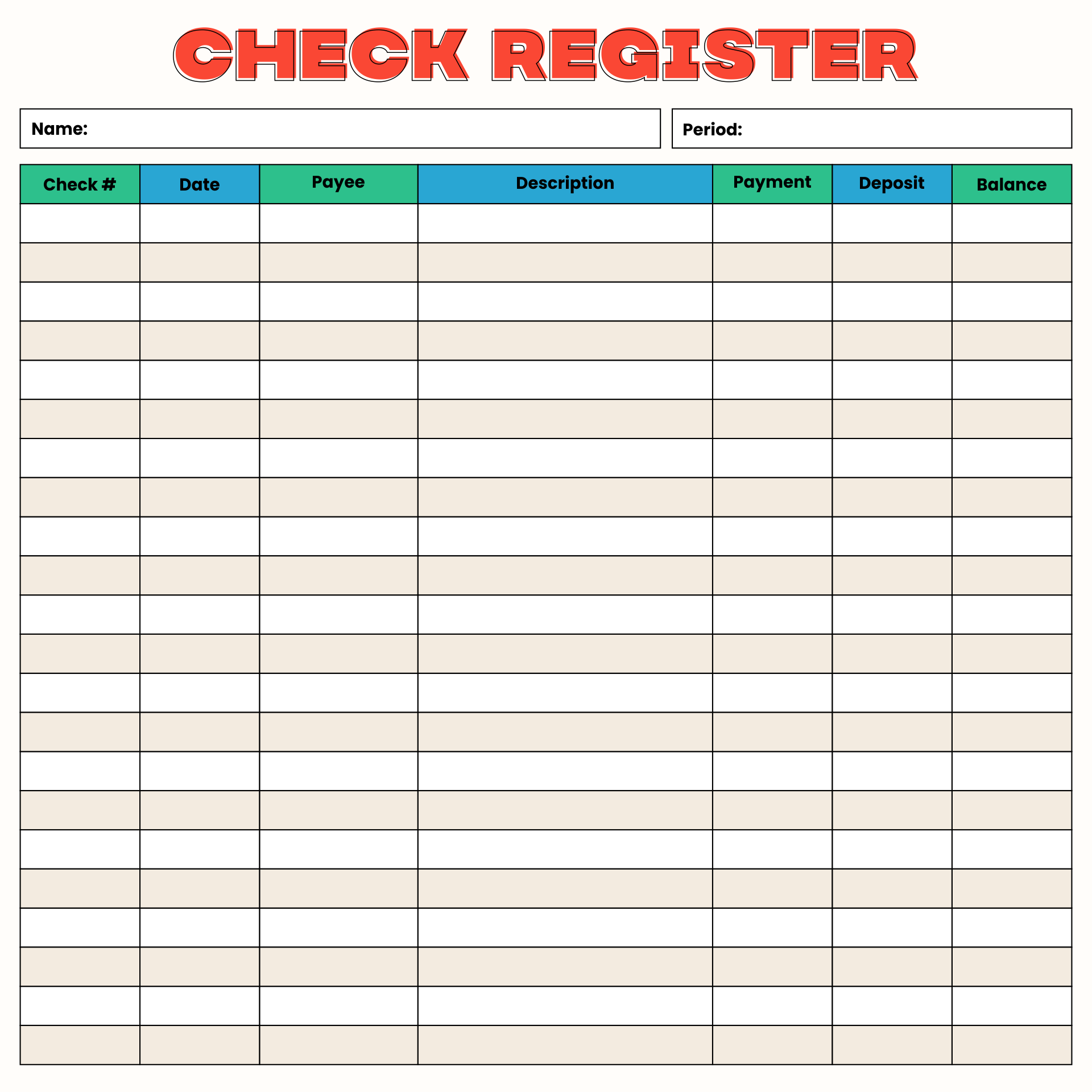

Printable check registers can be a practical tool for managing your finances, keeping track of your spending, and ensuring your bank account balance is always accurate. By using these, you can avoid overdraft fees and spot any unauthorized transactions quickly. They provide a hands-on approach to budgeting, allowing you to see where your money is going and plan accordingly. Keeping a detailed record of your checks and transactions helps in creating a disciplined financial routine, making it easier to achieve your saving goals.

Keeping track of your financial transactions becomes straightforward with a printable check register PDF. This tool allows you to record deposits, withdrawals, and current balances, helping maintain an organized approach to your finances. It's essential for managing your budget effectively and avoiding overdraft fees by ensuring your account balances are always accurate.

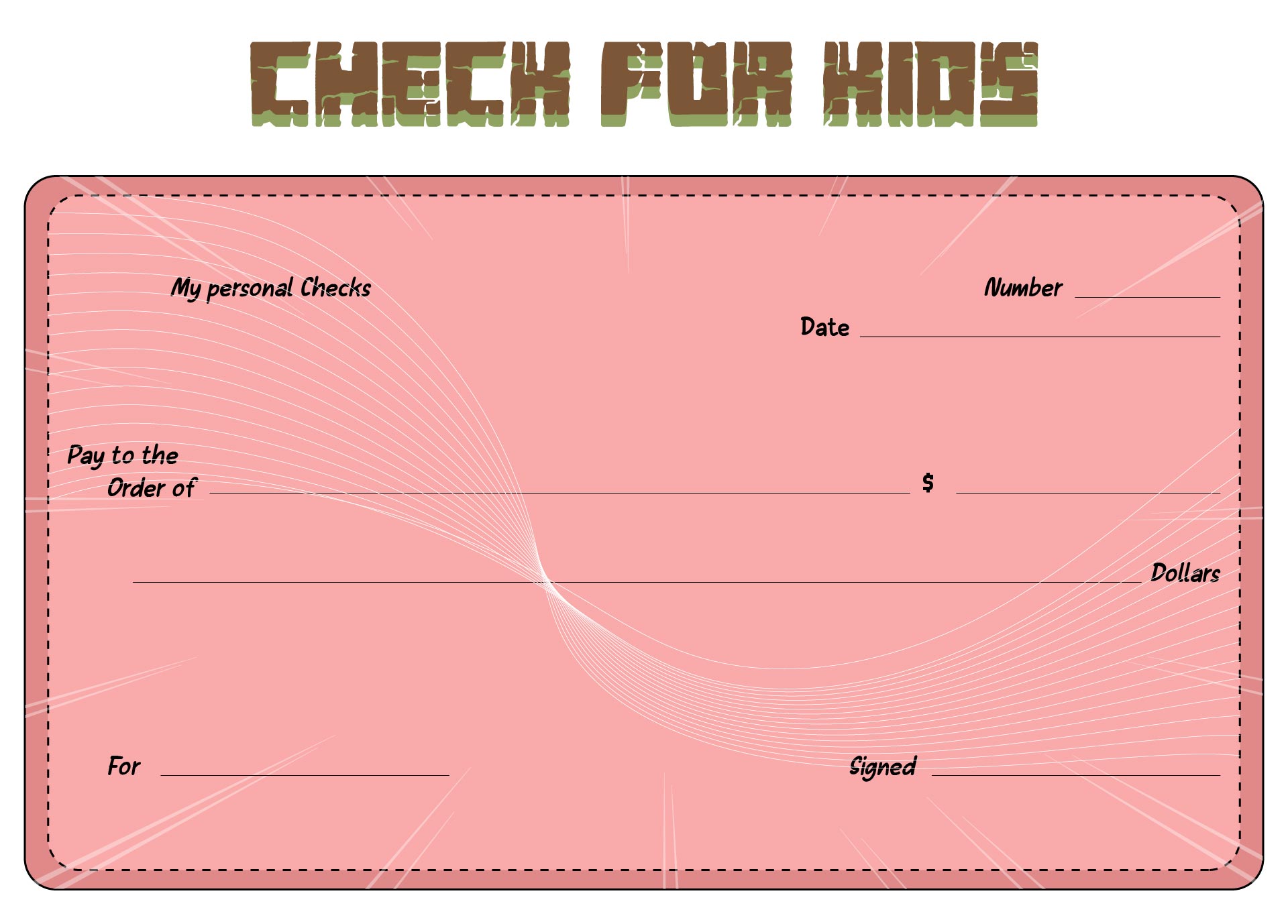

A printable blank check template for kids is an excellent educational tool that introduces them to the basics of banking and money management. Through role-playing and practical exercises, your children can learn about financial responsibility, how to fill out checks correctly, and the importance of record-keeping in personal finance.

Printable checks for kids offer a fun and interactive way to teach young ones about financial literacy. By using these checks in games or as part of a practical life lesson, you enable them to understand transactions, the concept of currency, and the significance of banking in everyday life. This hands-on approach makes learning about money management engaging and accessible for children.

Have something to tell us?

Recent Comments

Printable check registers are a useful tool for keeping track of your finances, allowing you to easily record and monitor your expenses and deposits in a clear and convenient format.

Check registers are an essential tool for keeping track of your finances, and printable ones allow you to easily record your transactions and manage your budget in a convenient and organized way.

I really appreciate having the Play Printable Check Registers resource! It's a simple and convenient way to teach kids about financial responsibility.