Running out of pages in a checkbook happens more often than one might think, especially for those who prefer keeping track of finances the old-school way. Finding a new check register in physical stores can be tough. Plus, it’s not always convenient to wait for the bank to send a new one. Need way to keep track of spending and checks without gap in record.

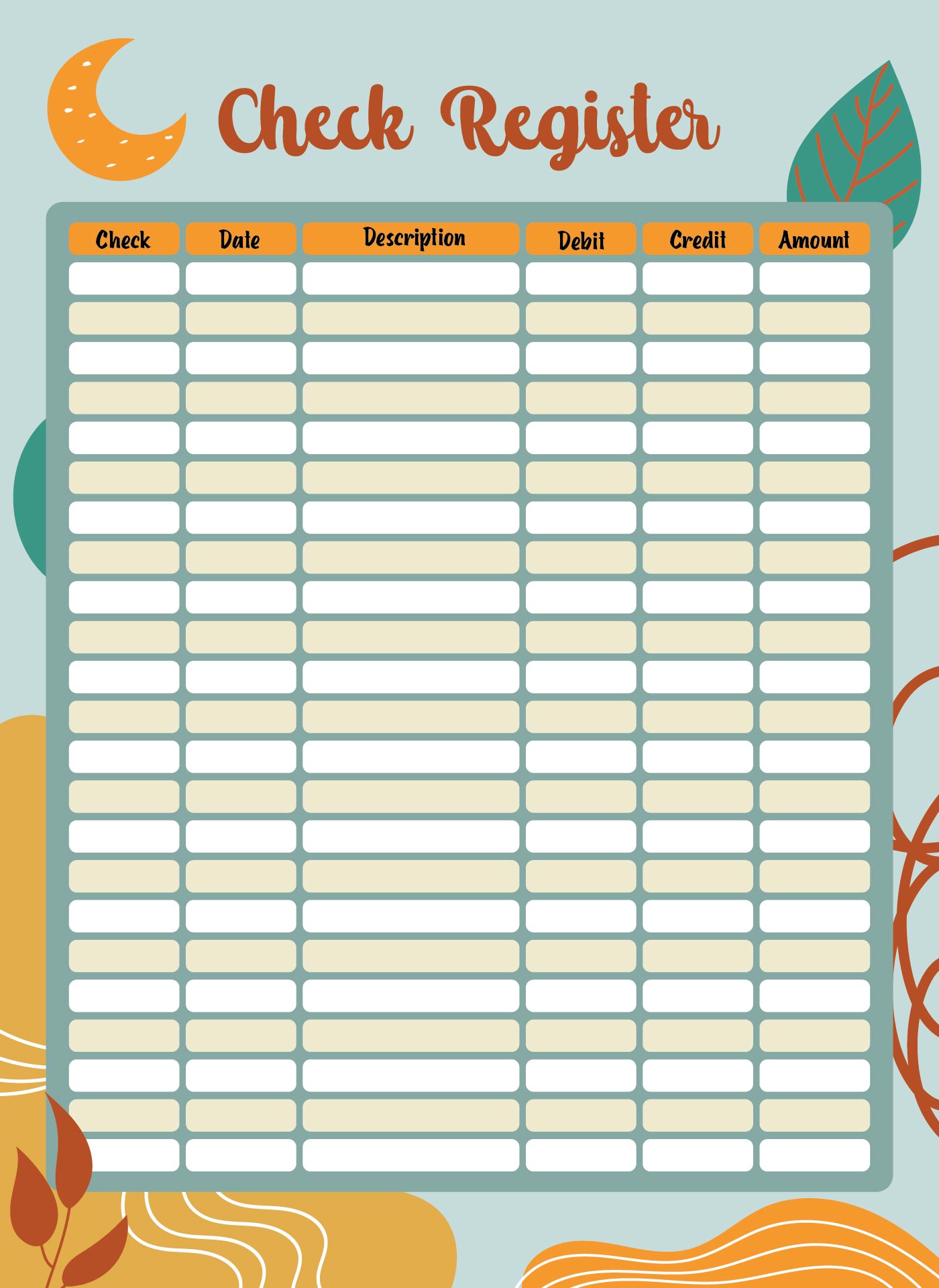

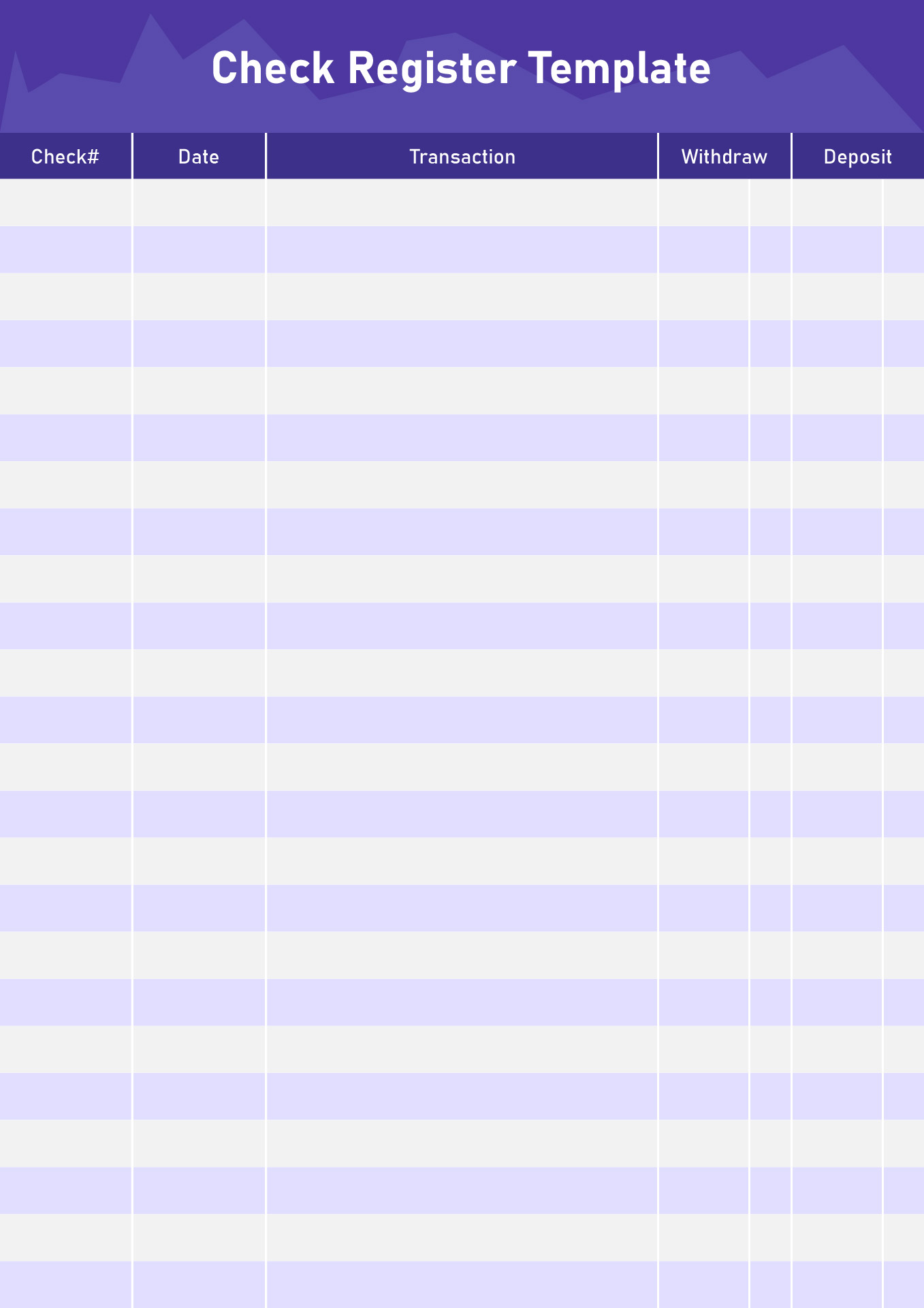

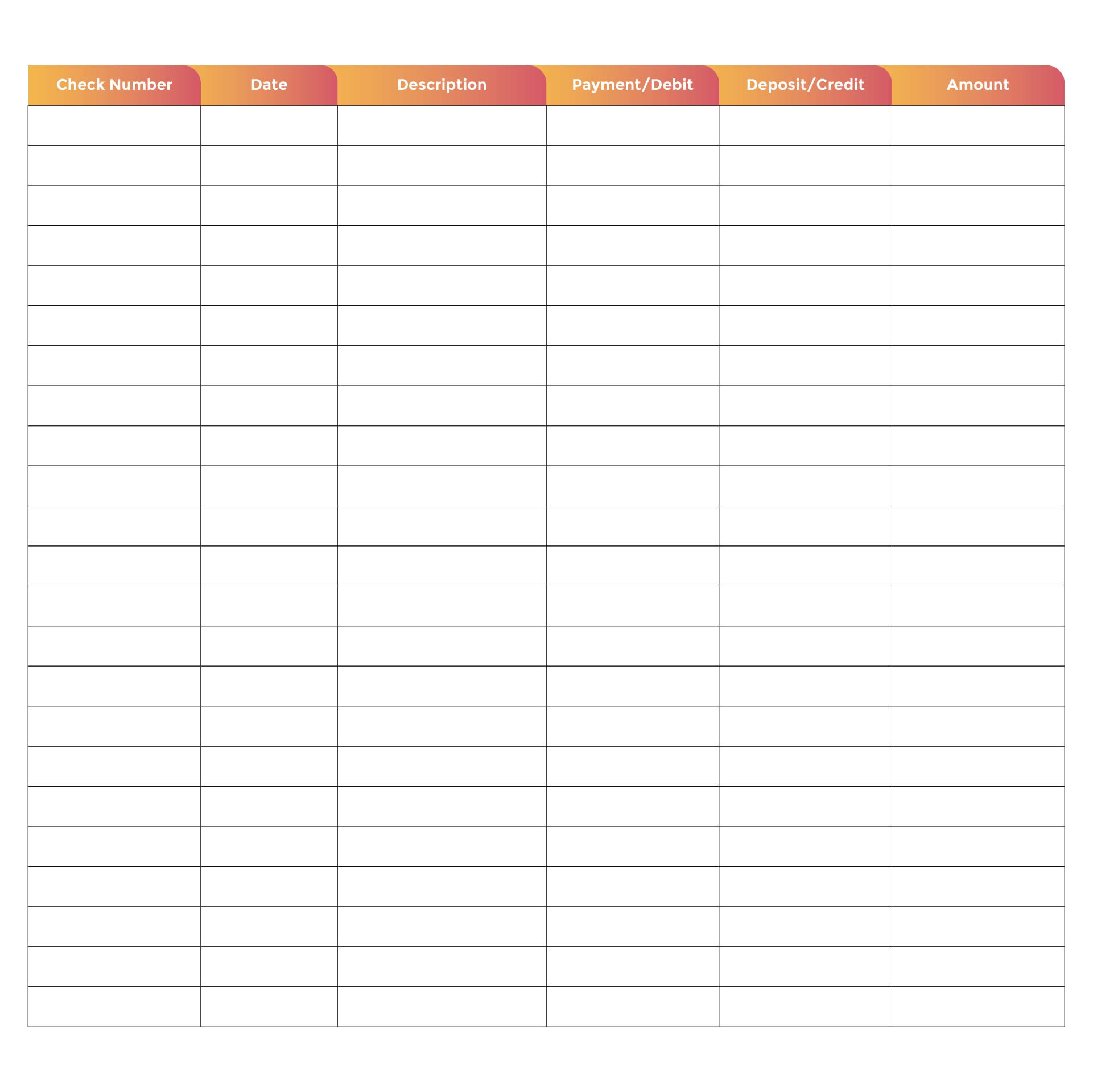

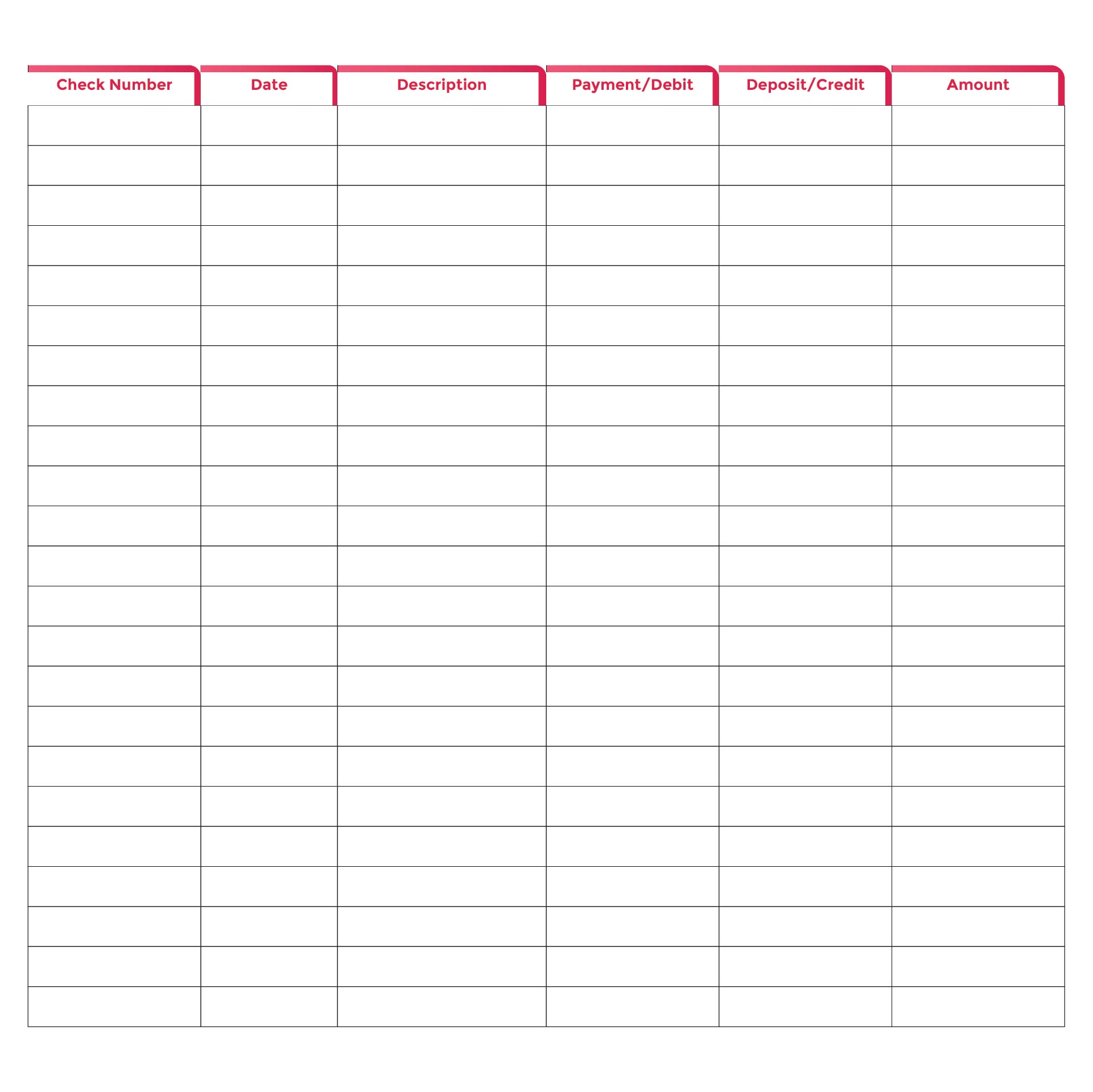

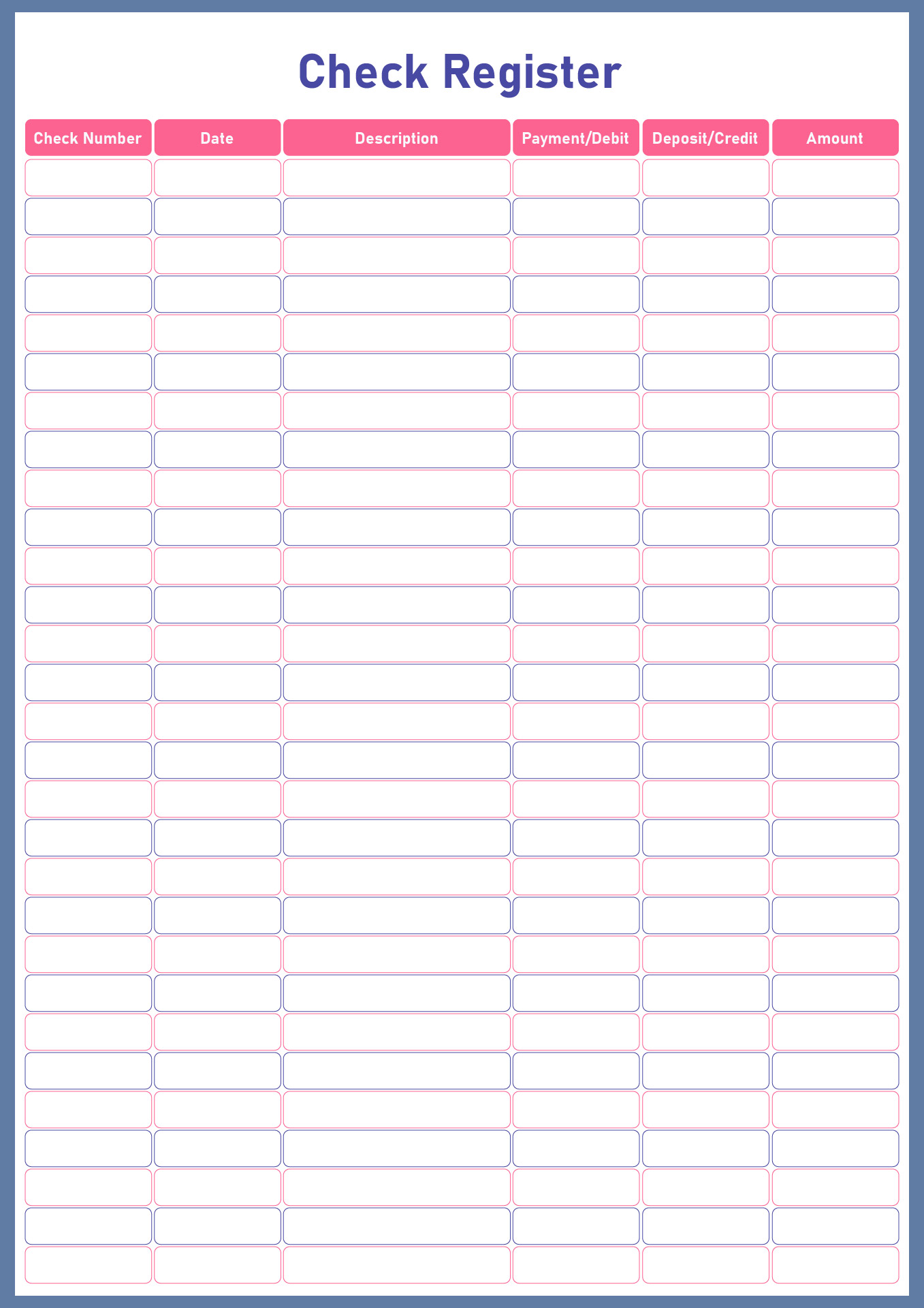

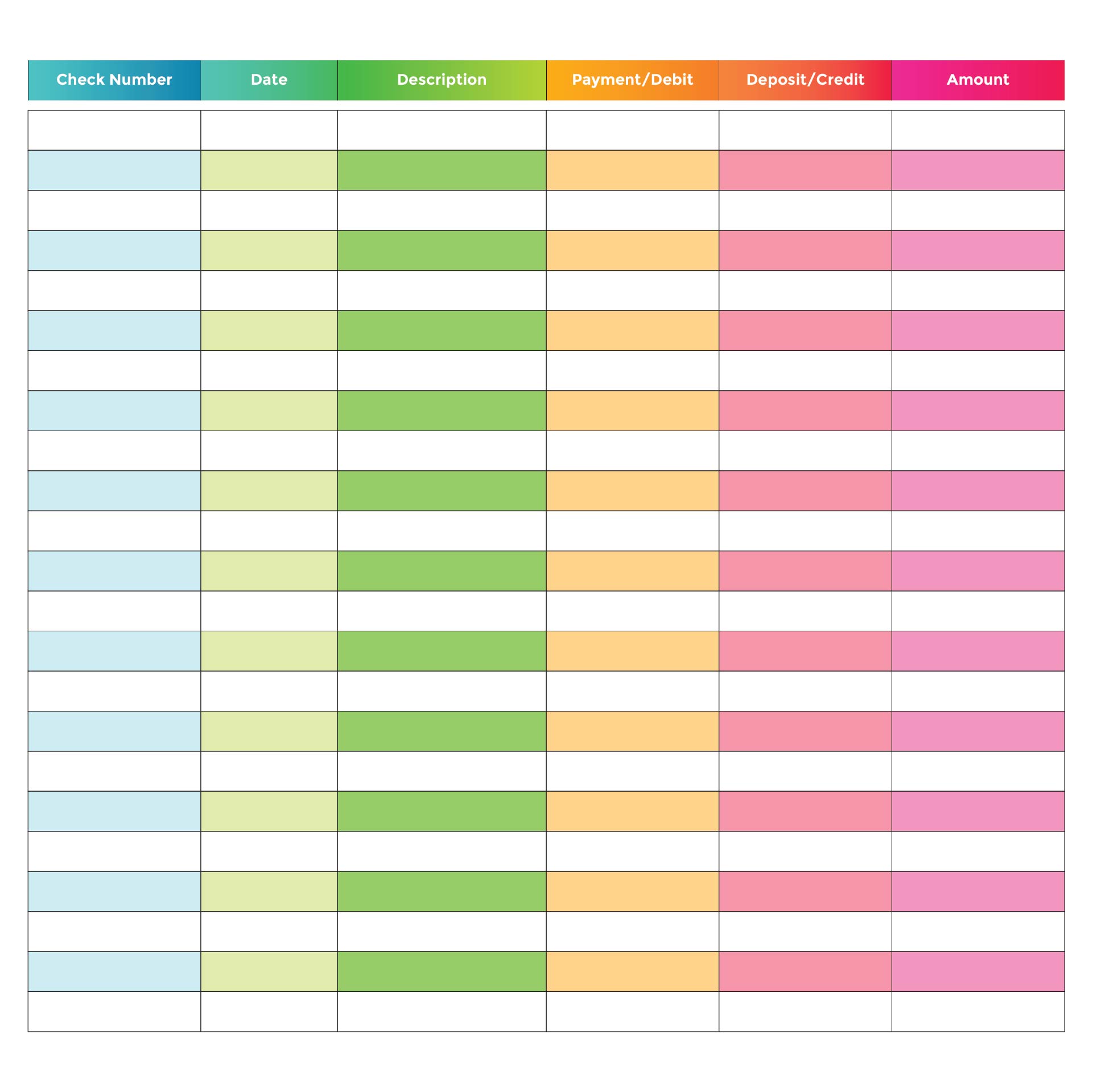

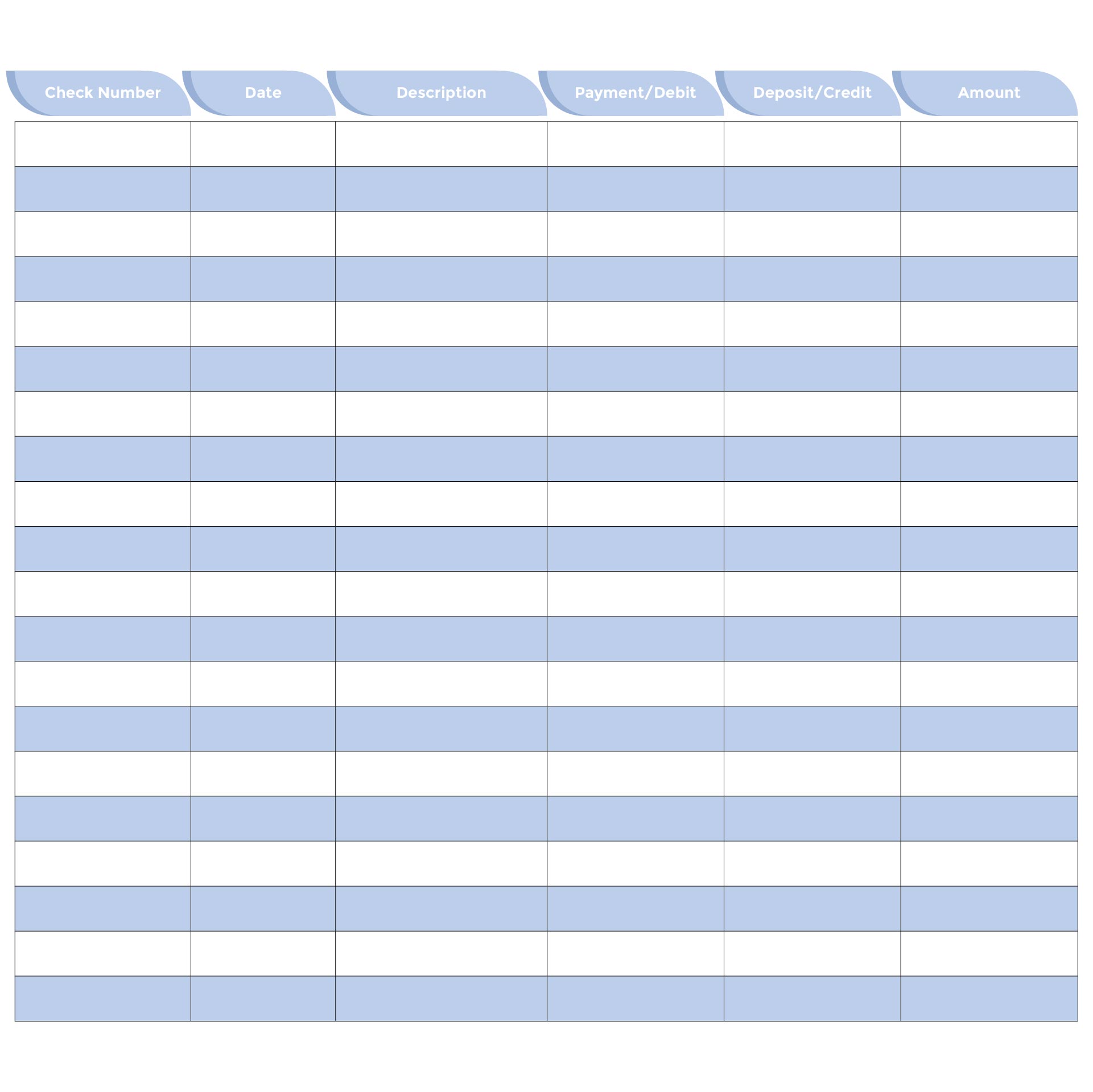

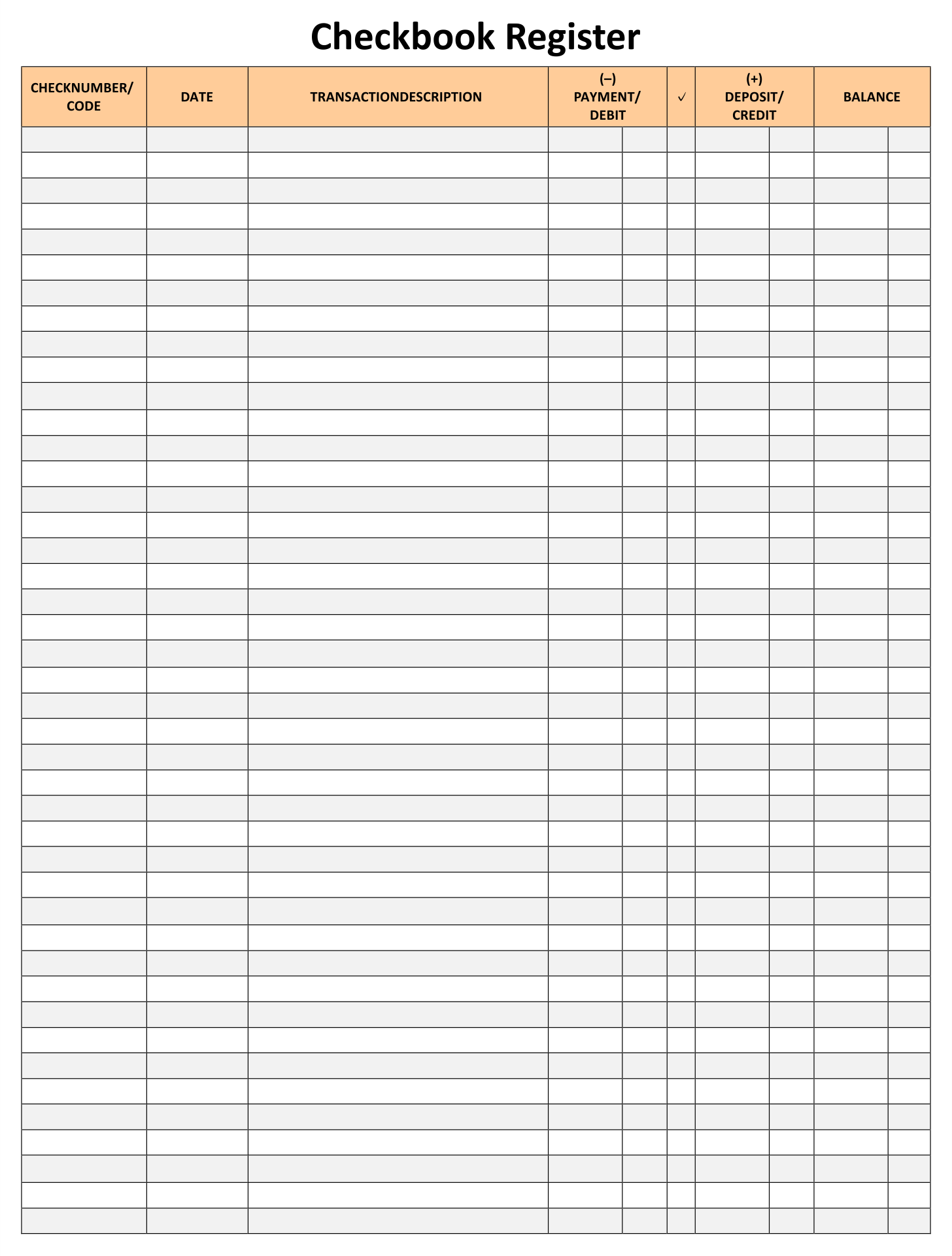

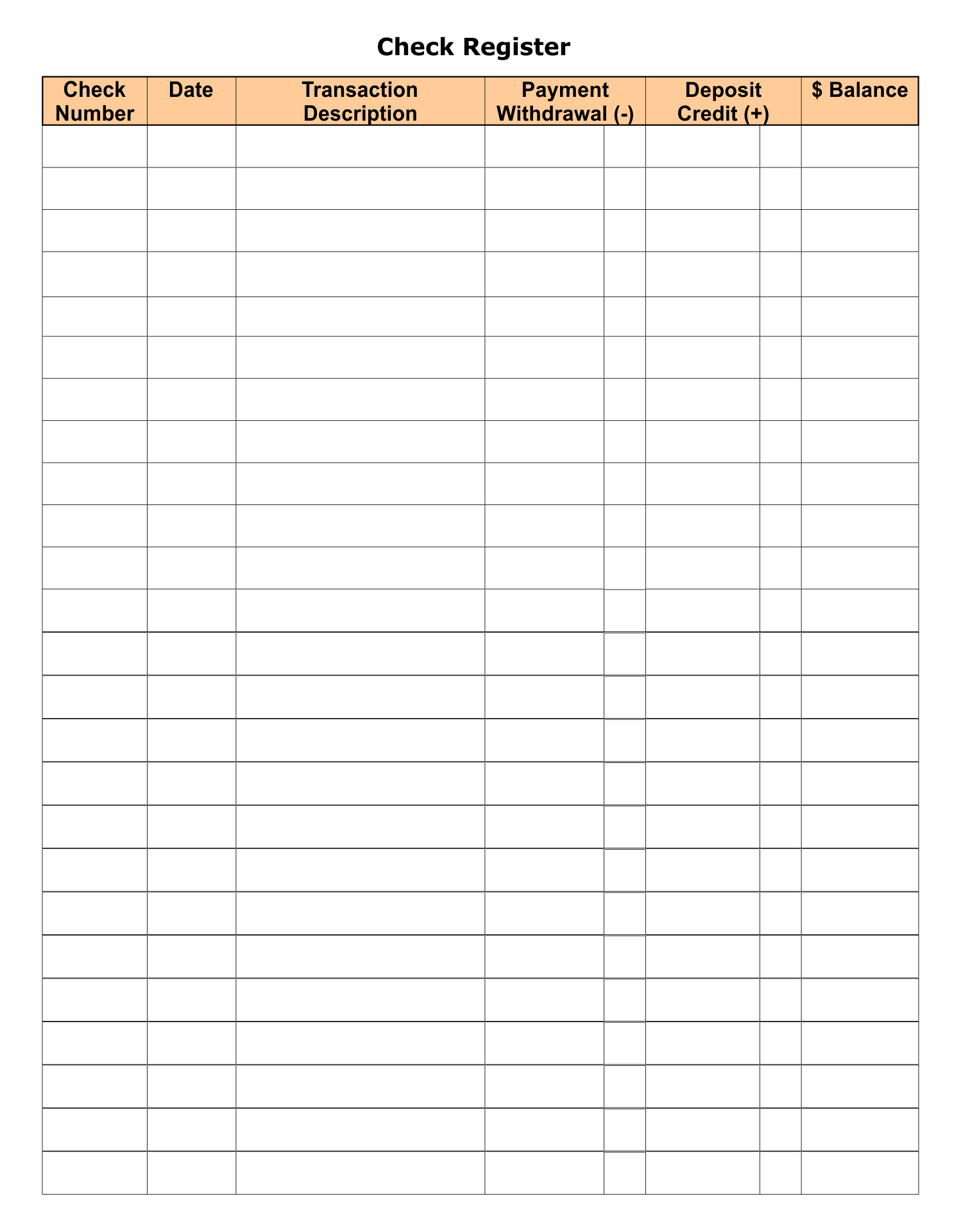

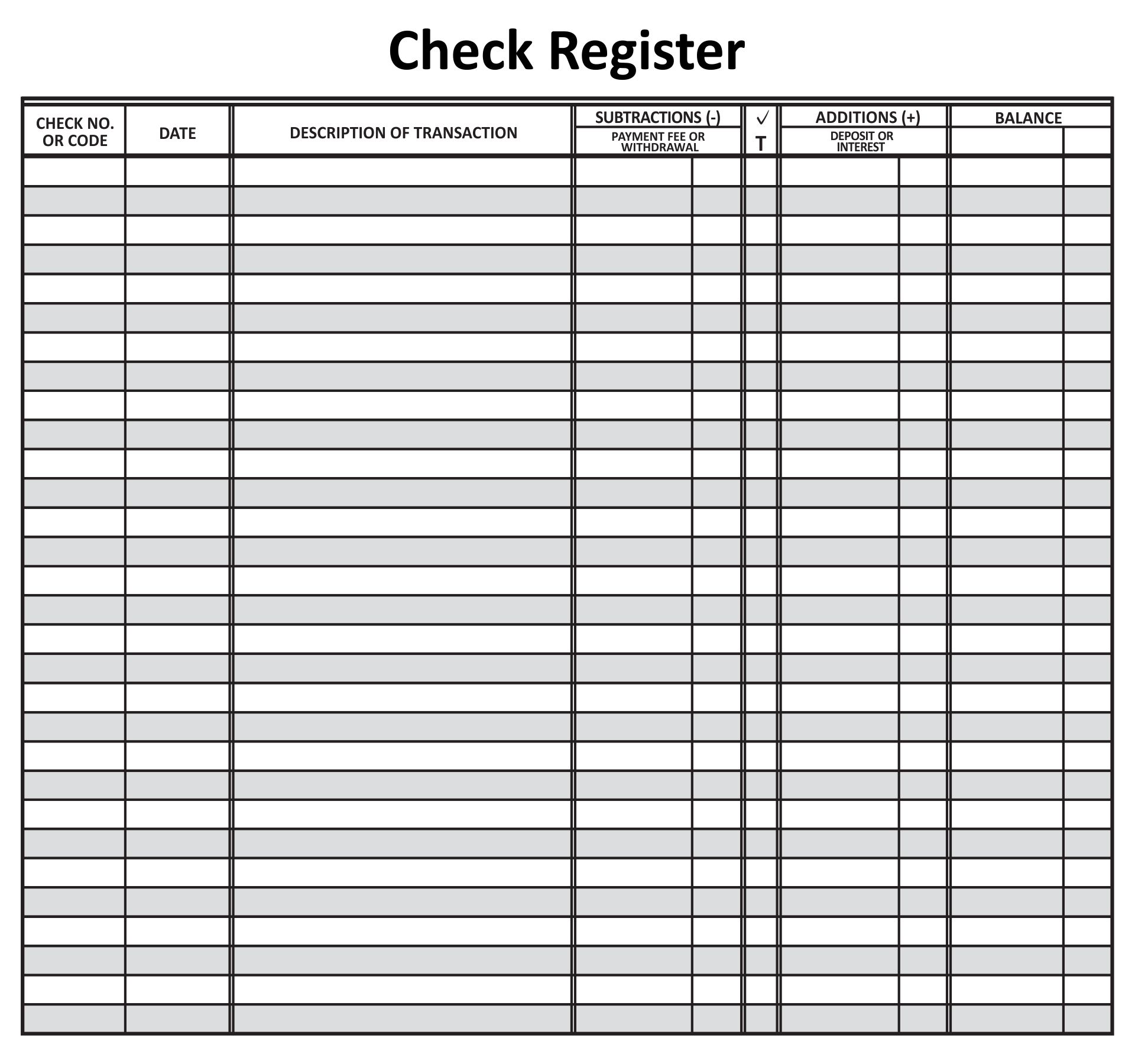

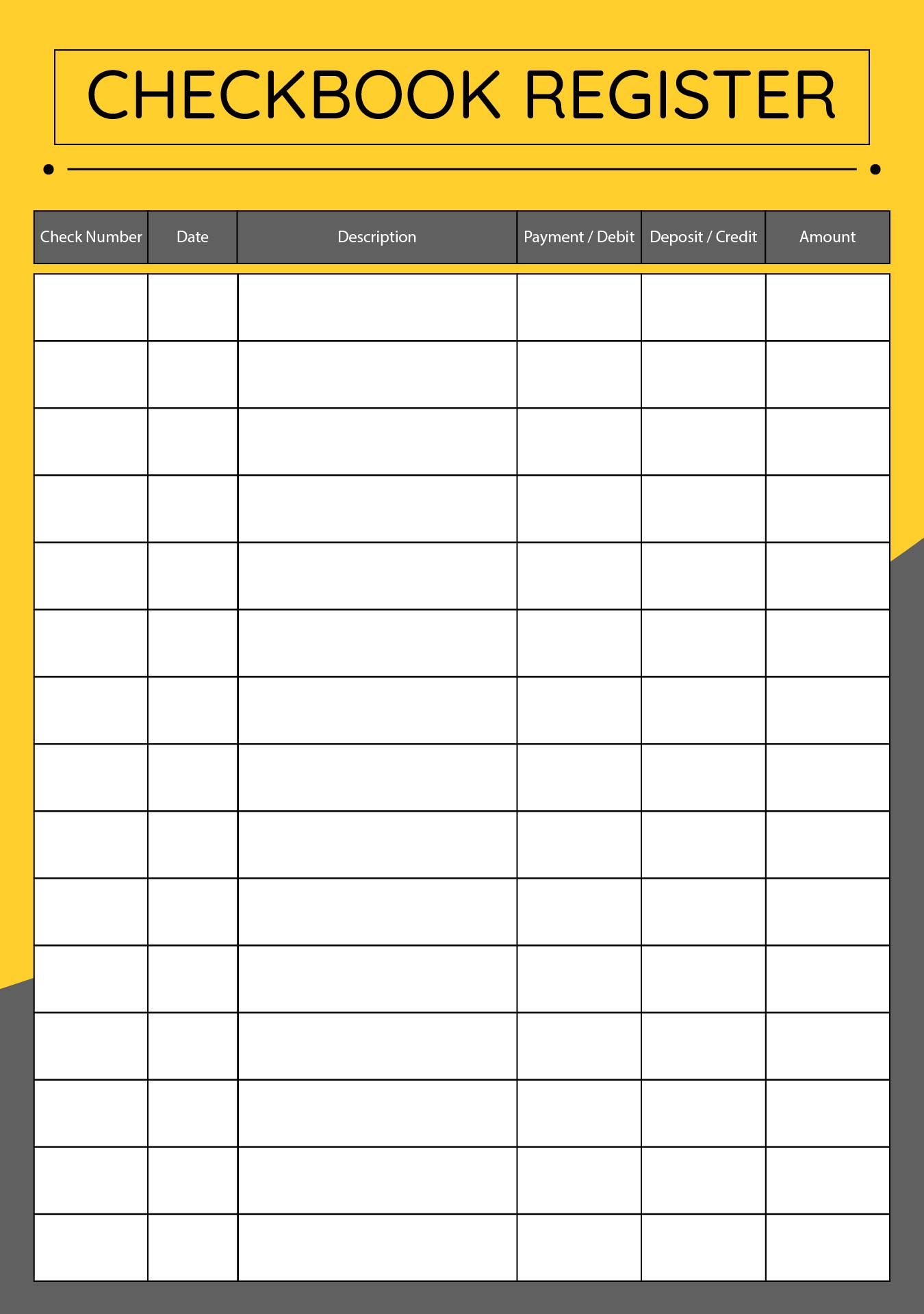

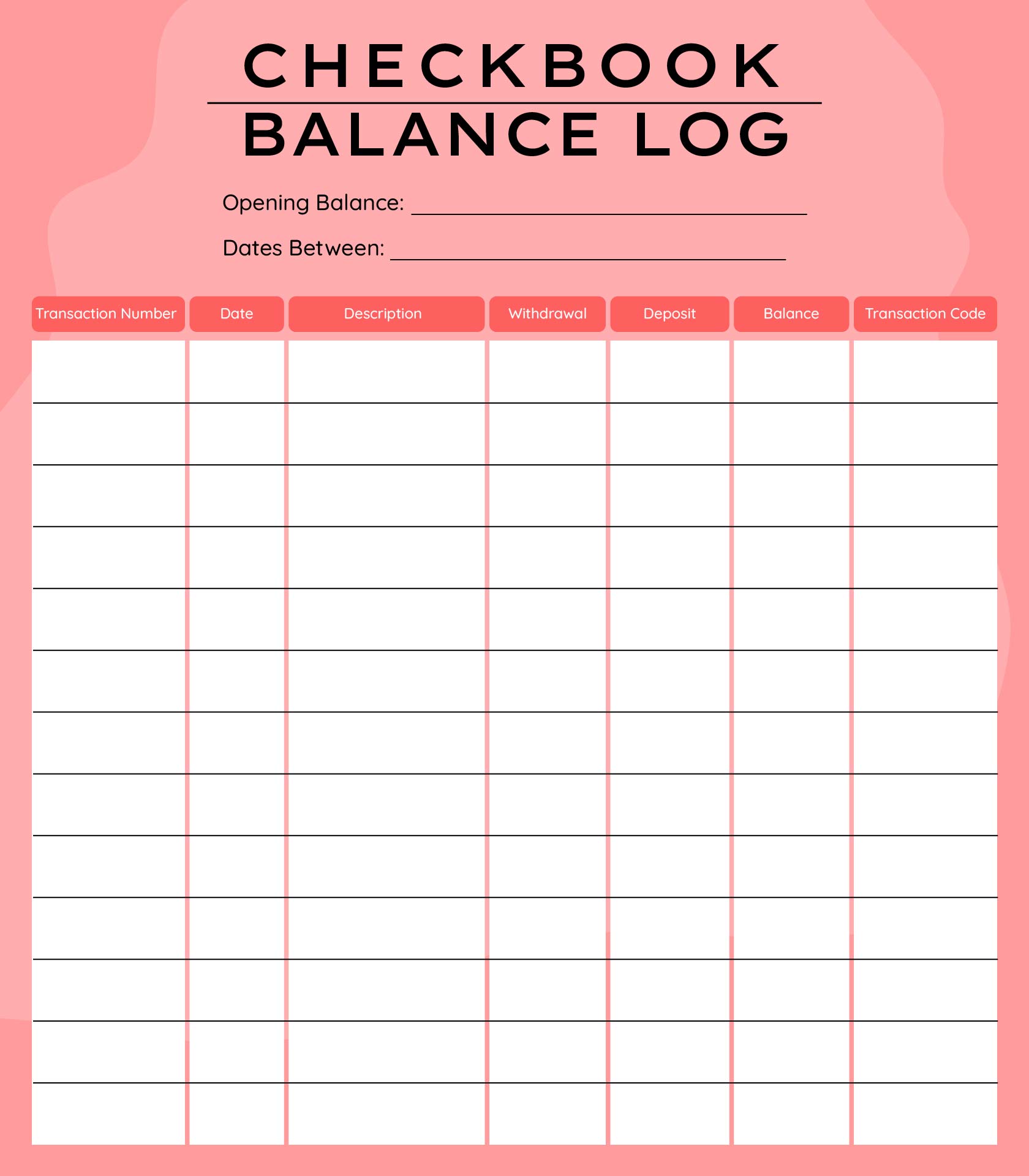

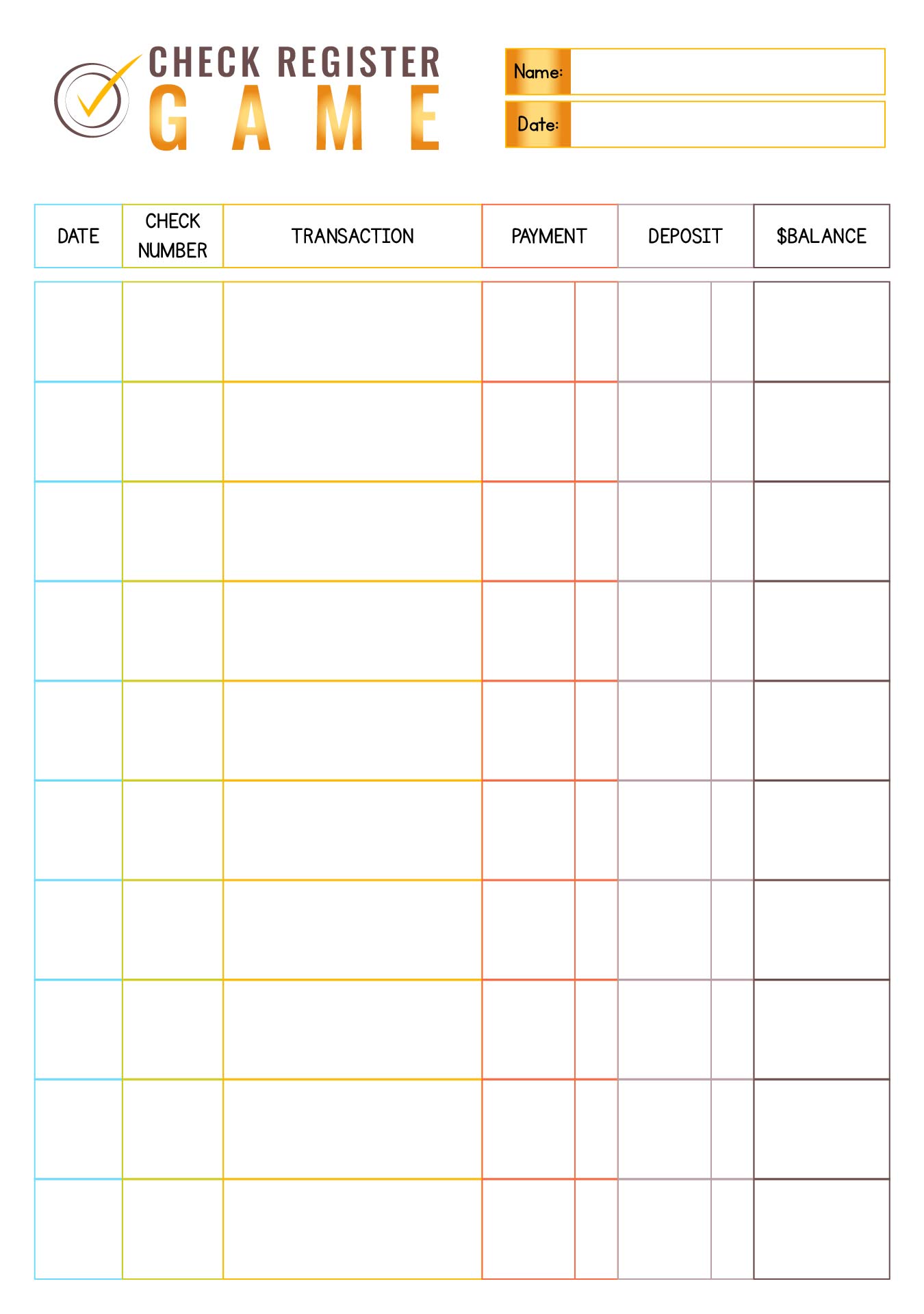

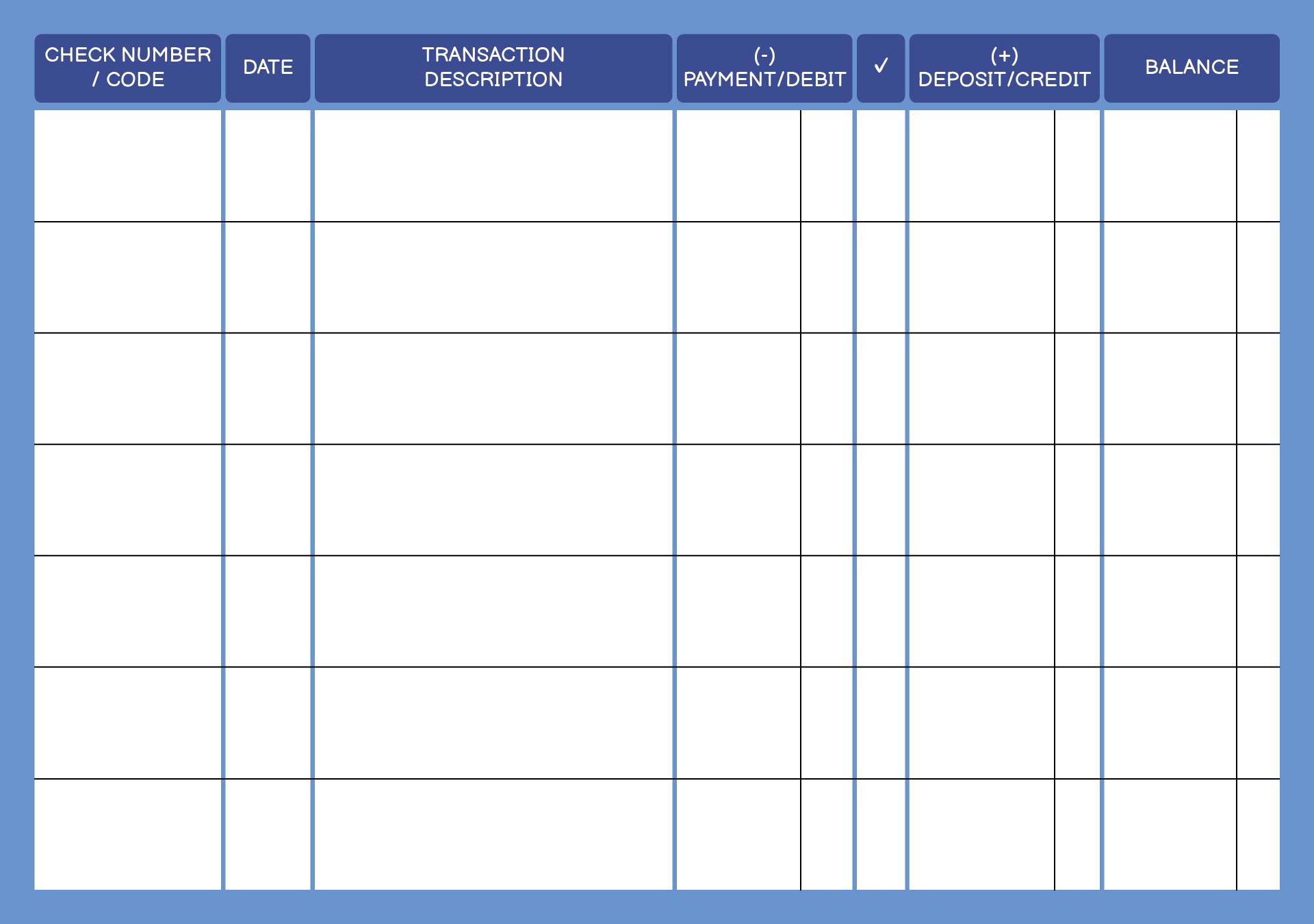

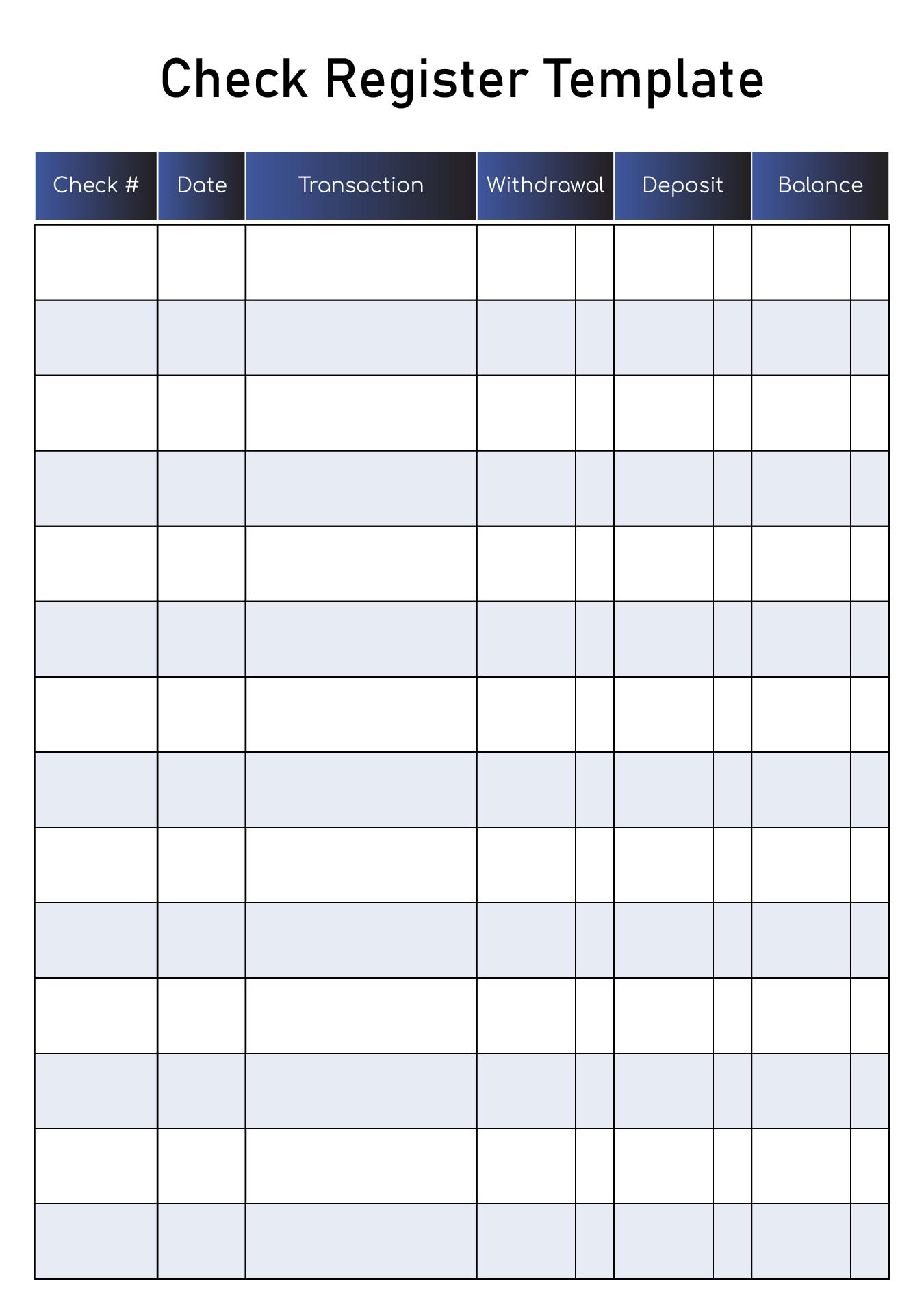

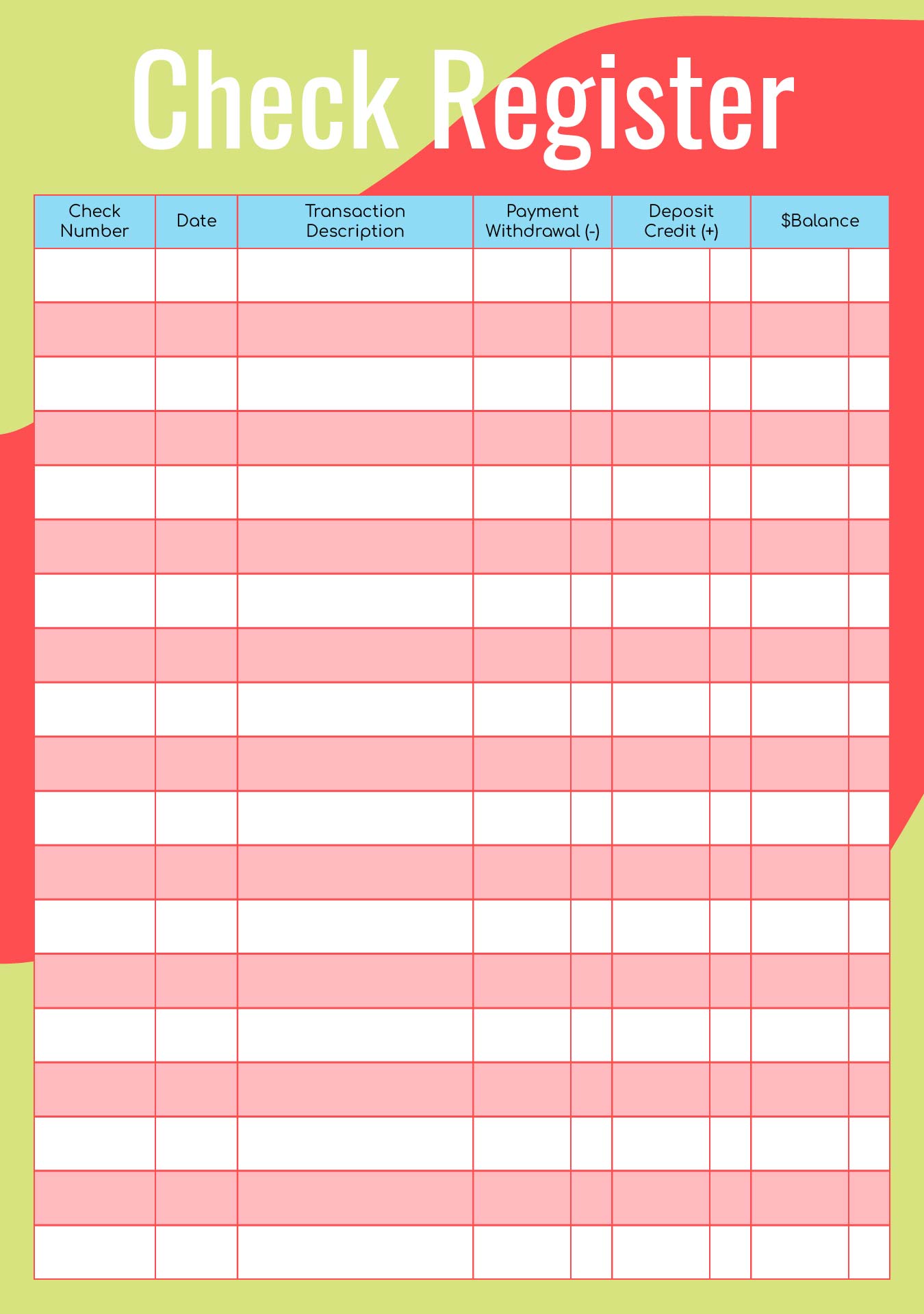

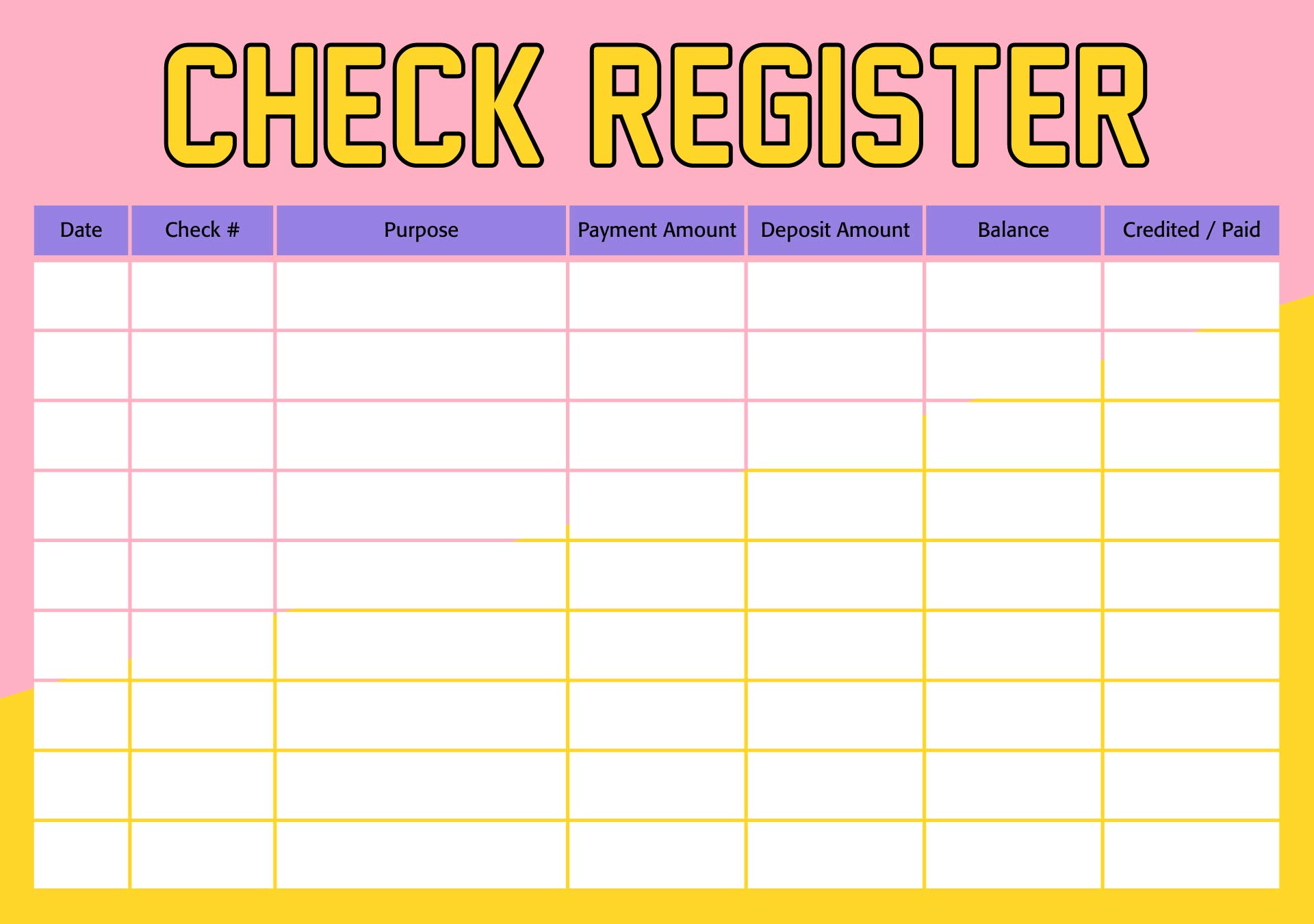

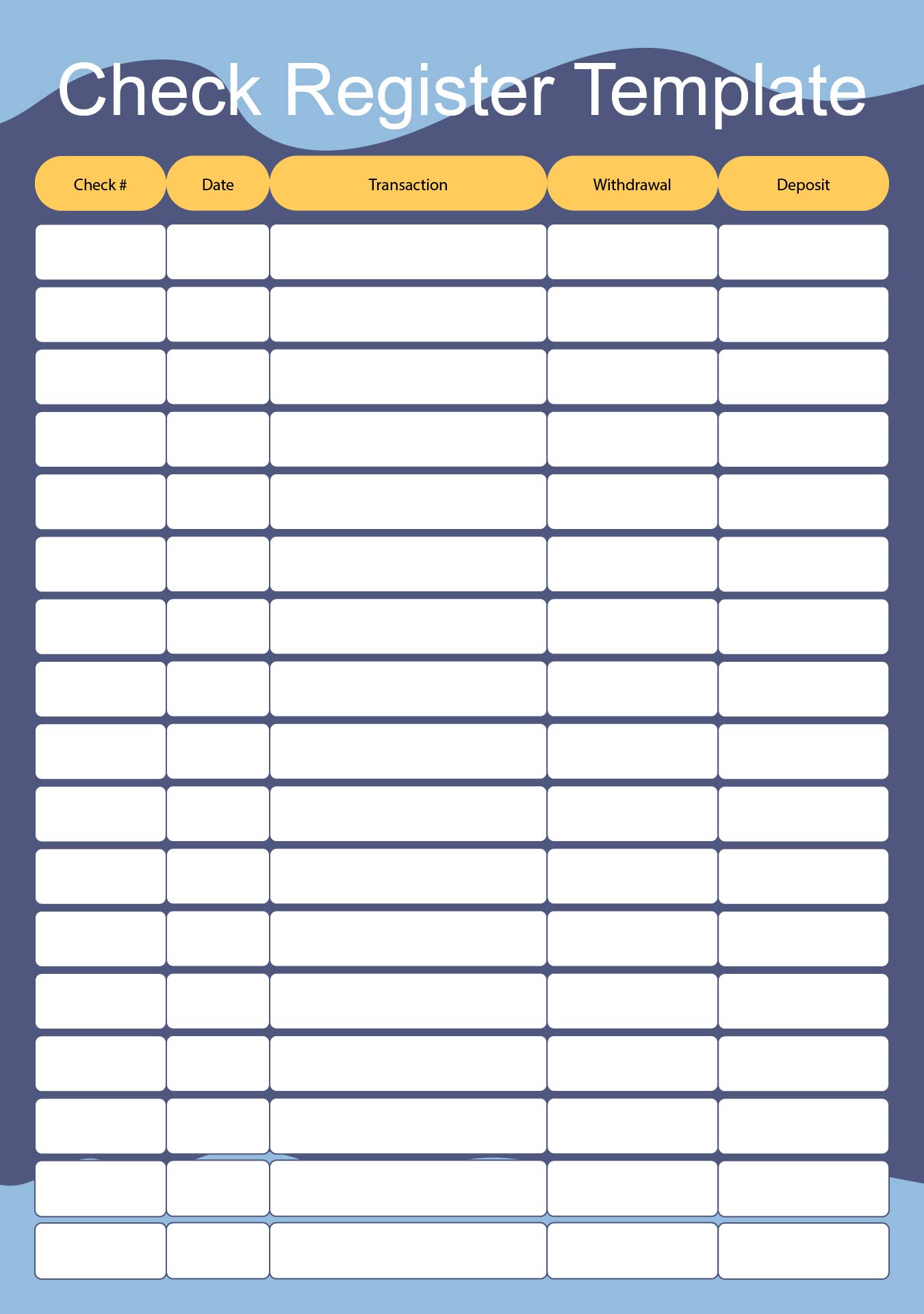

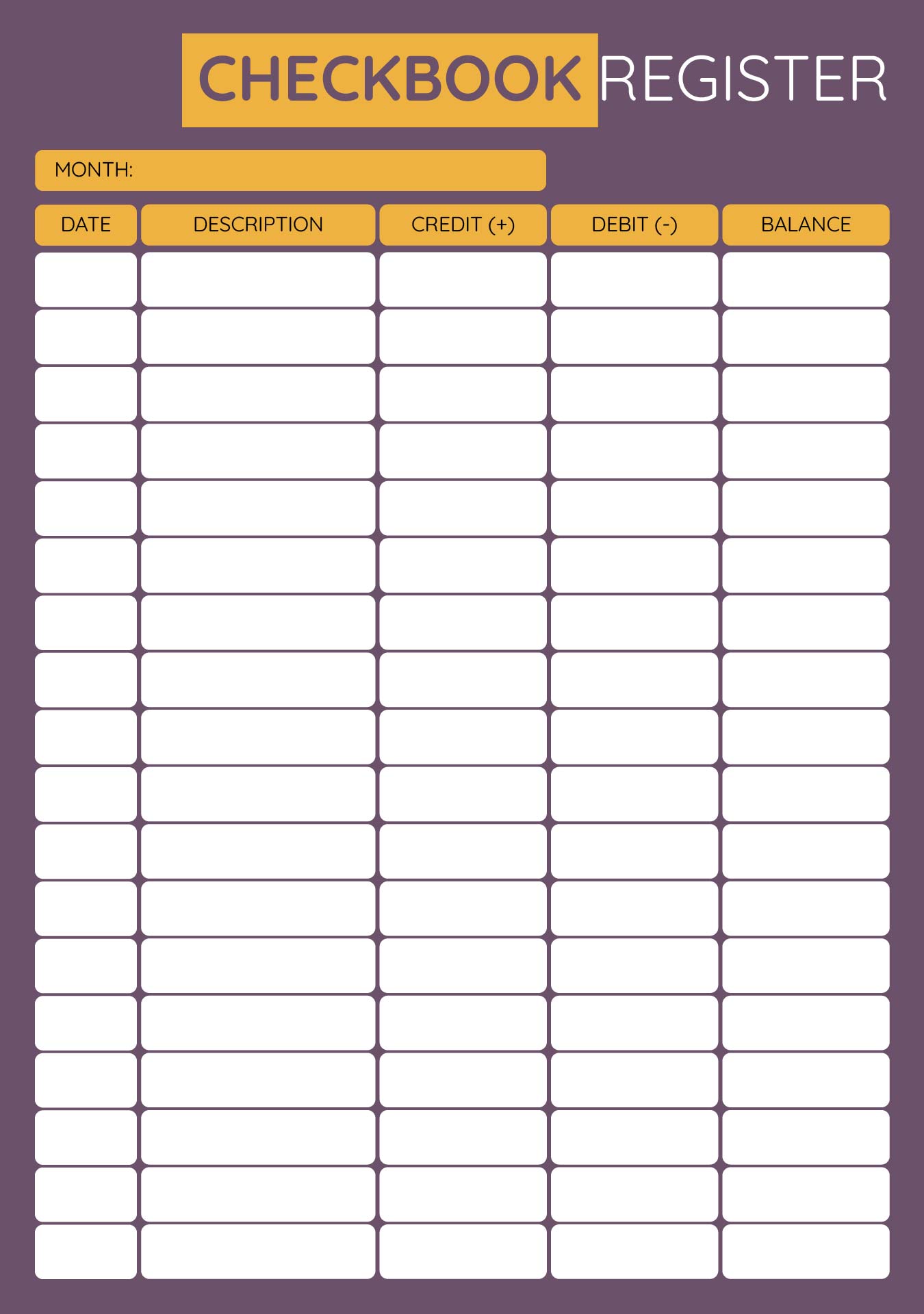

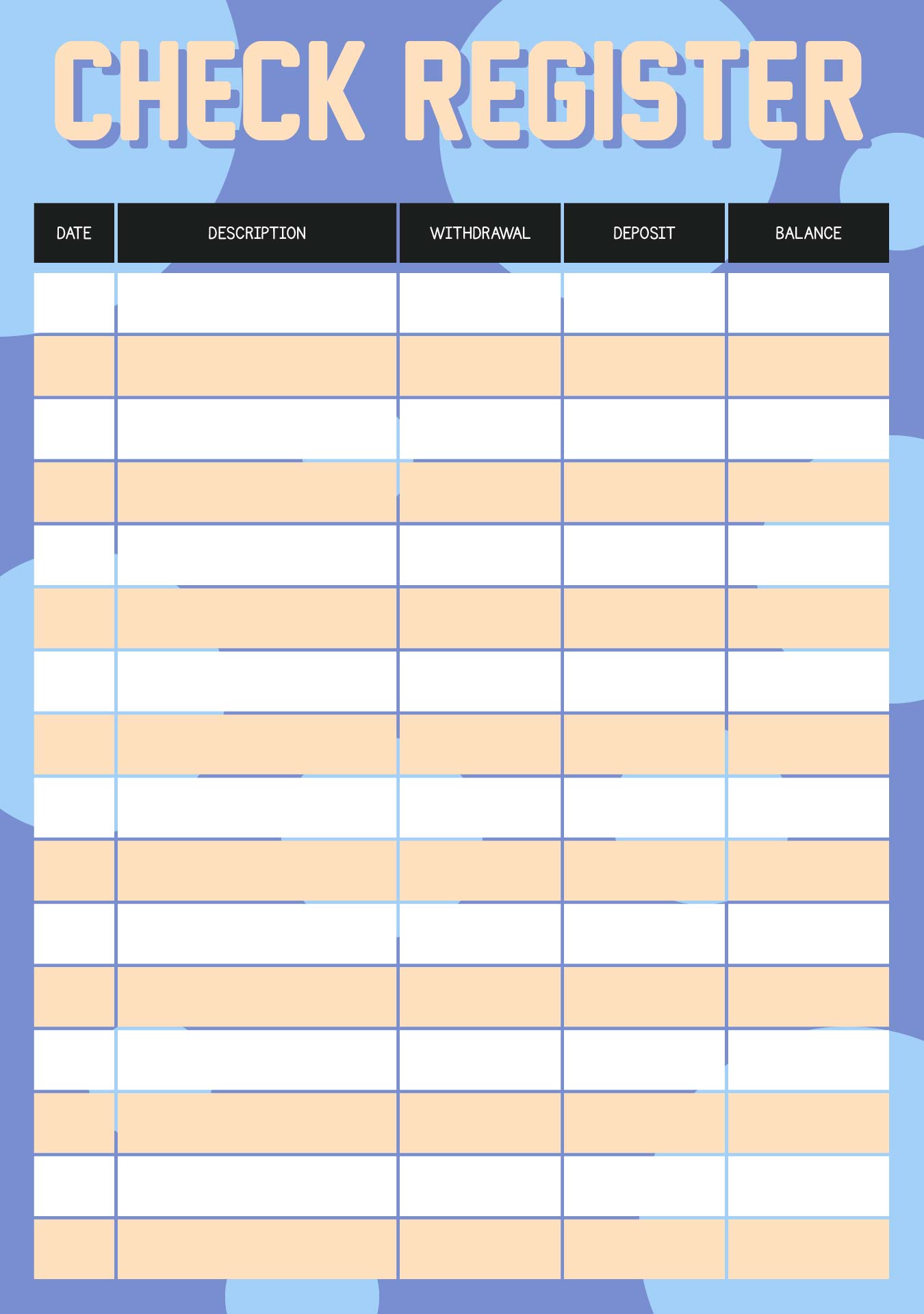

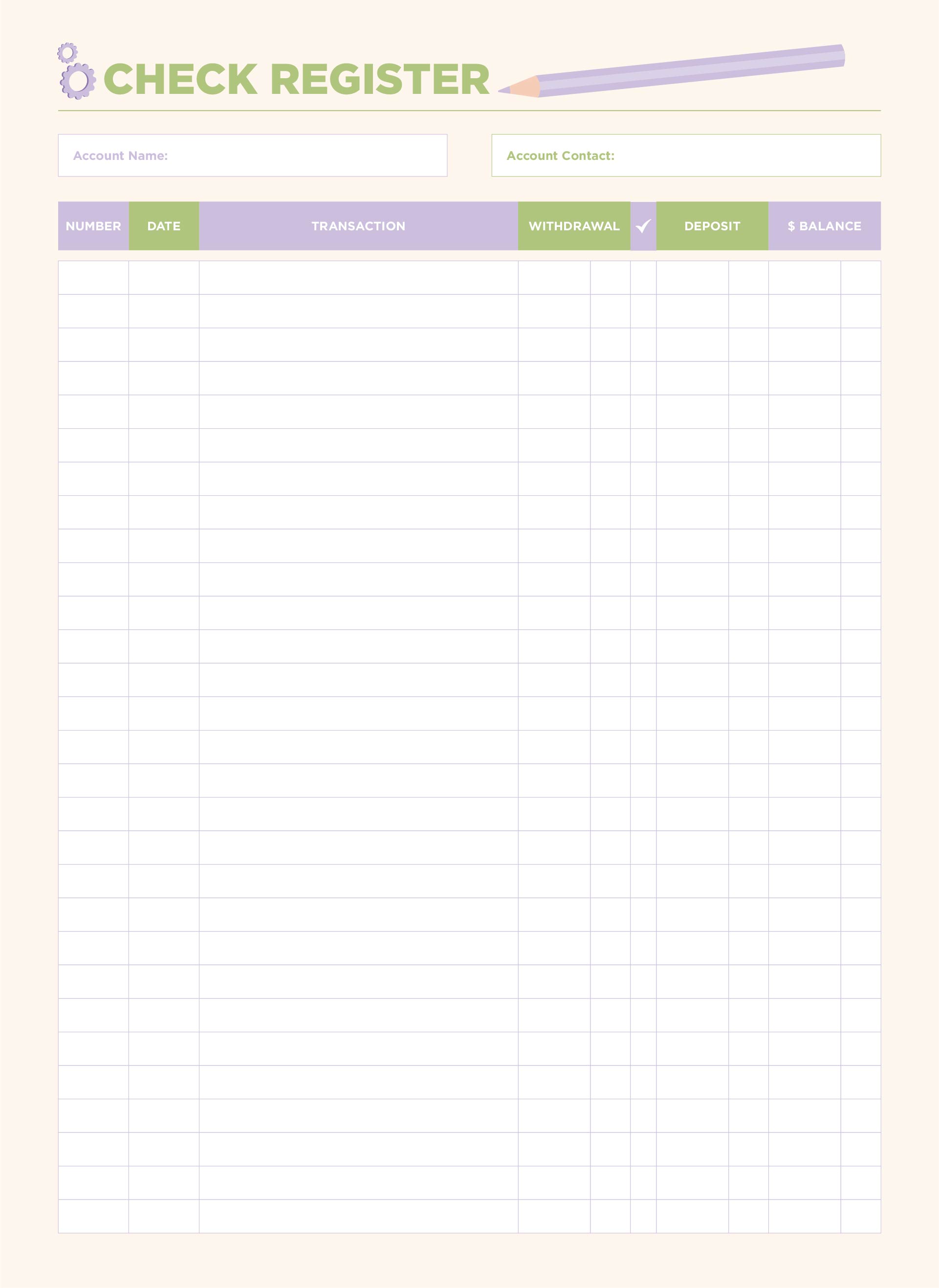

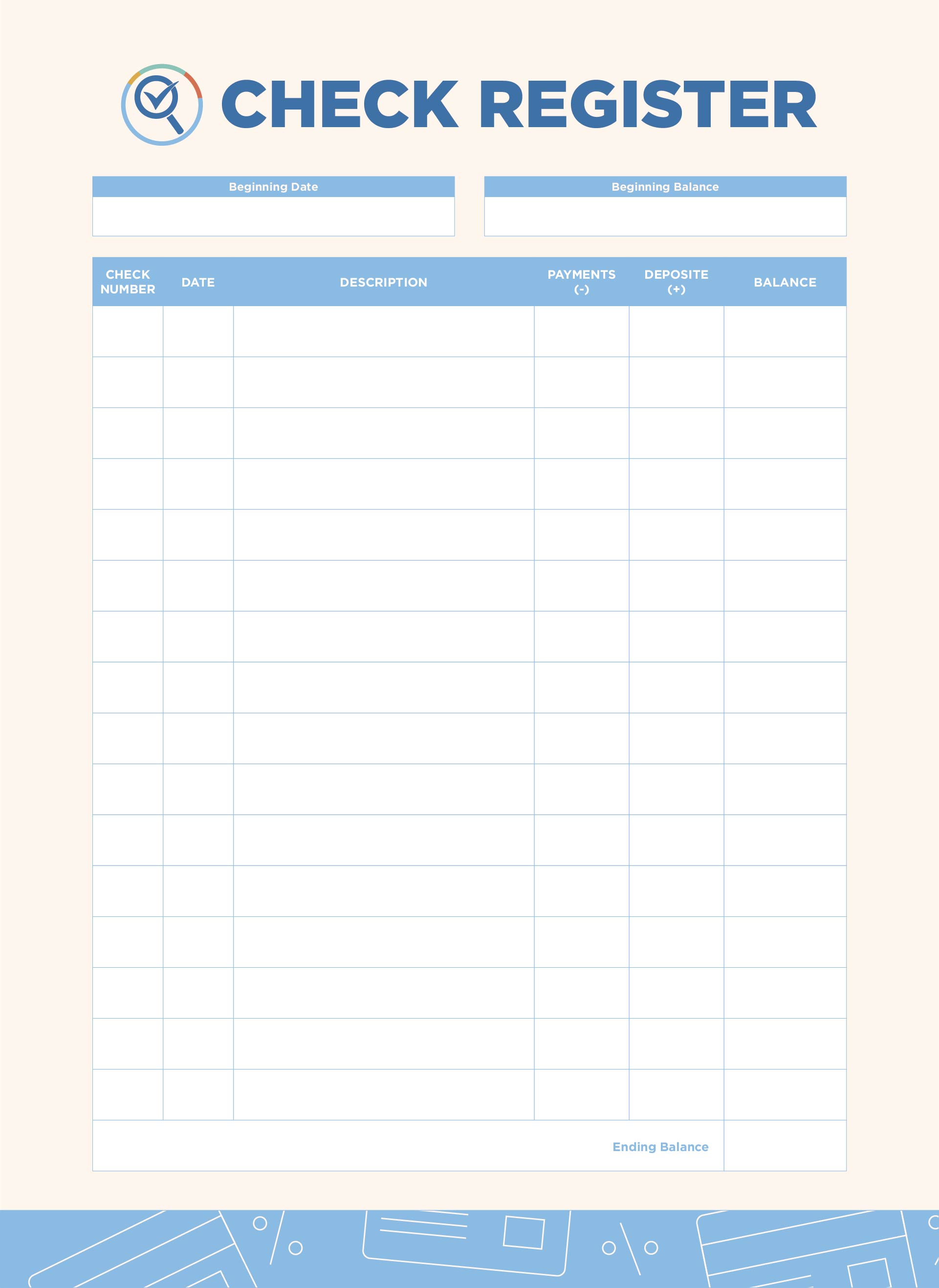

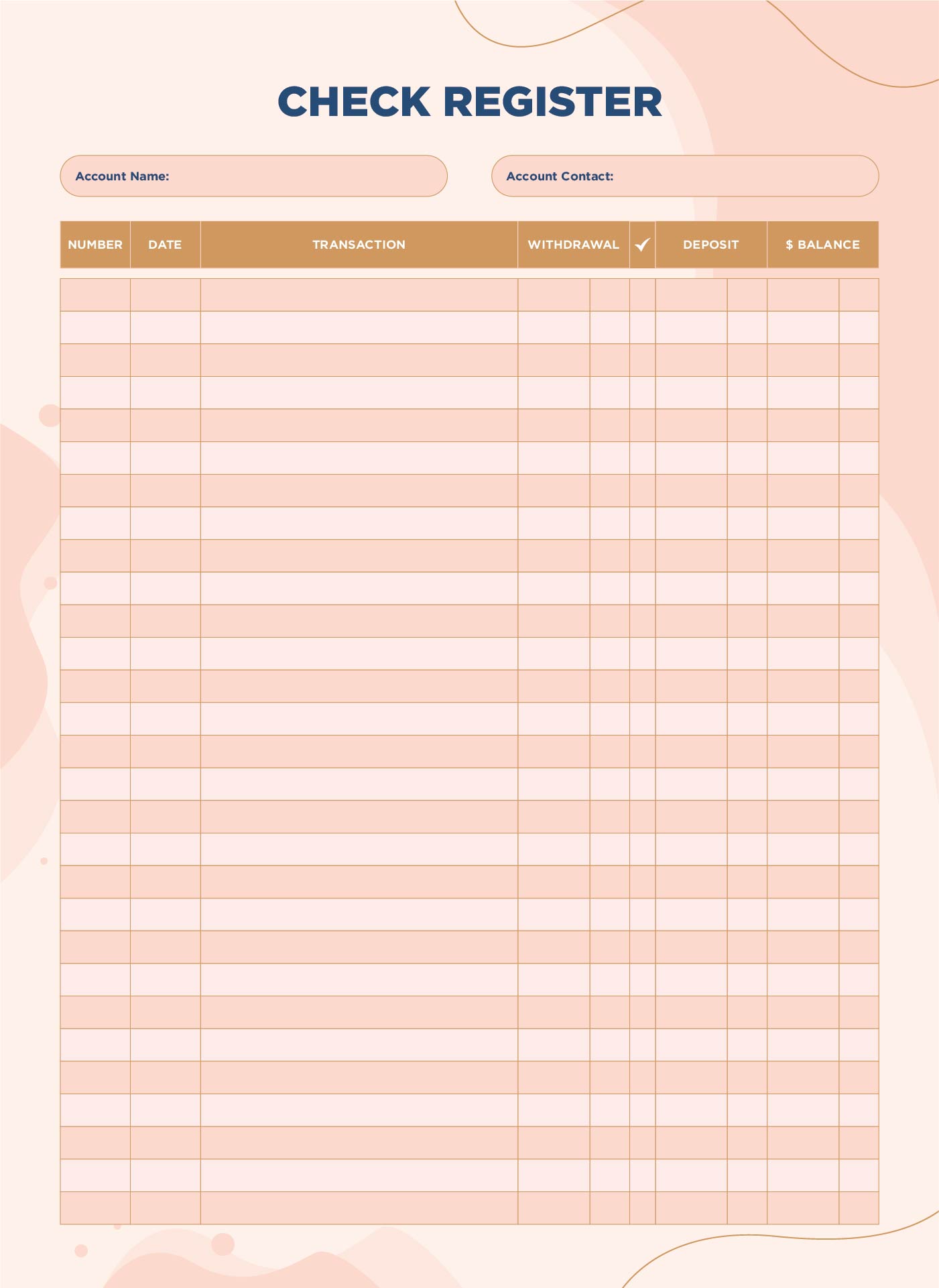

We design printable check registers to help keep track of finances. Easy to use columns for date, description, debit, credit, and balance so everything's clear at a glance. Useful for personal budgeting or small business accounting. Keeps records tidy and simplifies financial management.

Check register is a classic budgeting tool that can be used by college students who just started to learn proper money management for the business owner. It has a sole purpose to help people manage their transactions in an appropriate manner. Hence, it is not surprising that many people are using this as a business and personal finance management.

Even though someone lives alone, they still need to manage their expenses. Through the check register, they can manage their income into the daily expenses, saving, and other necessities. Having proper budgeting when living alone will help people when they should live with other people.

As a business's growth depends on the acquired profit, it is important for the owner to properly manage every transaction that occurs. The owner should understand how to divide each expense to its purpose without creating a damage to the business. Hence, having skills in utilizing budget tracking tools is essential for every business owner.

Many people love to use the check register as a tool to help them in planning their budget, because of its simplicity. It has an element that people nowadays refer to as user-friendly. Meaning, people would not find any difficulty while using them because of the understandable design.

A printable check register is a convenient tool for tracking transactions and managing finances, allowing individuals to record checks written, deposits, and withdrawals with ease. By utilizing a checkbook ledger for printing, users can maintain an accurate and organized record of their financial activities, facilitating better budget management and financial planning.

A printable check register offers an accessible way for individuals to track their checking account activities, including deposits, withdrawals, and current balances, helping them manage their finances efficiently. Custom check register templates allow users to personalize their tracking, tailoring columns and spaces to fit specific needs, such as budget categories or transaction types, for a more organized financial overview.

A free printable check register allows for easy management of finances by tracking transactions including checks, deposits, and withdrawals. It's a useful tool for avoiding overdraft fees and to maintain financial health. If you want to manage your finances effectively, opt for this handy Printable Check Register.

Small business owners can use a free printable check register to record all transactions and oversee their budget effectively. This tool supports accurate record keeping and informed decision making for business growth.

A check register helps college students manage their finances by tracking expenses and budget. Regular updates on date, description, and amount of transactions provide control over finances with confidence. For more insight, you can refer to our article titled "Free Printable Check Register Book".

Smart financial management, including optimal budgeting and achieving financial goals, can be facilitated with a free printable check register. It allows tracking and adjustment of spending patterns for better financial management.

Have something to tell us?

Recent Comments

This free printable check register is a helpful tool for keeping track of my finances. It's user-friendly and allows me to stay organized with my expenses. Thank you for providing this resource!

I really appreciate this free printable check register! It's such a helpful tool to easily keep track of my finances in a simple and organized way. Thank you for providing this resource!

Thank you for sharing this convenient Free Printable Check Register! It's a practical and hassle-free tool to keep my finances organized. Much appreciated!