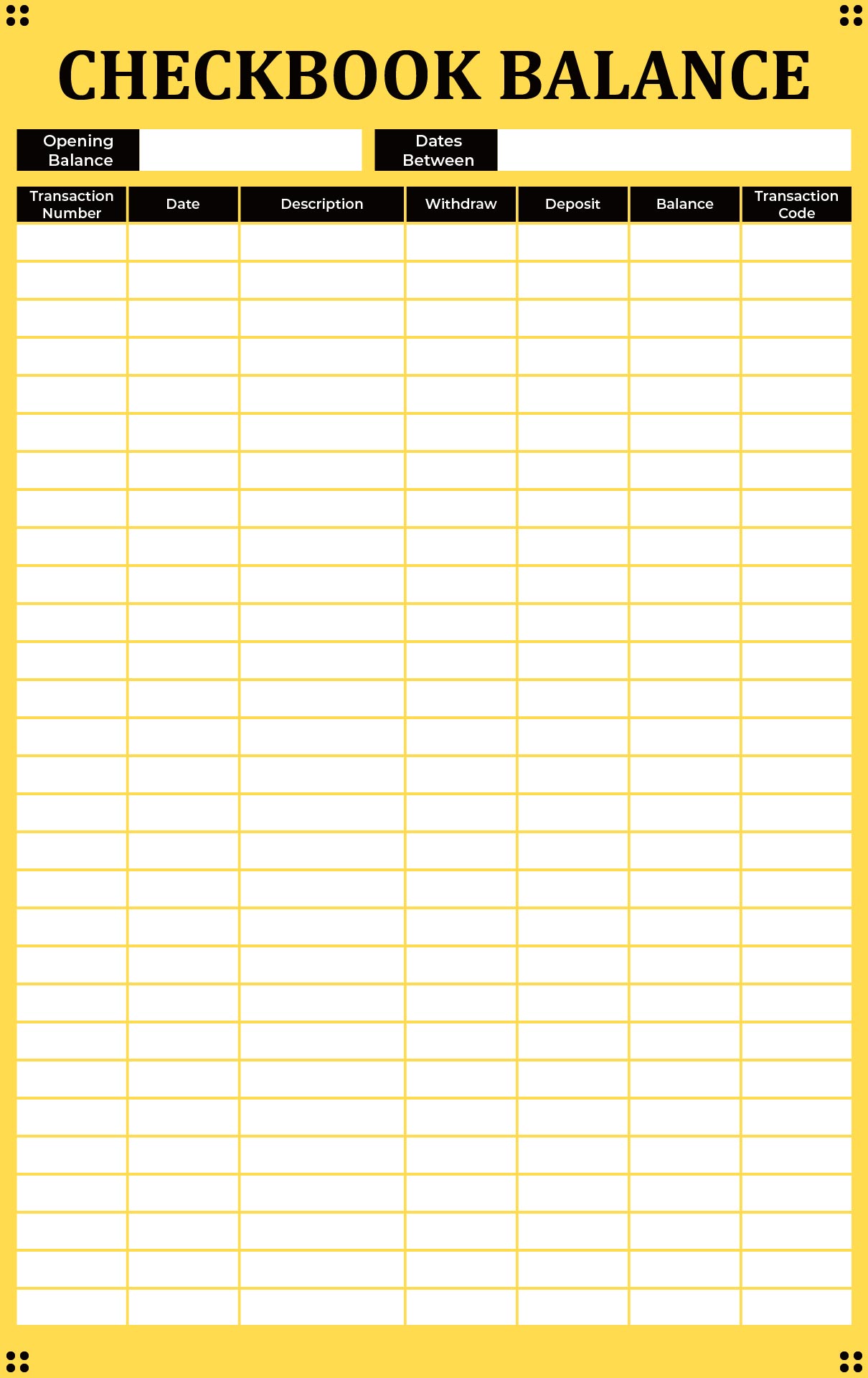

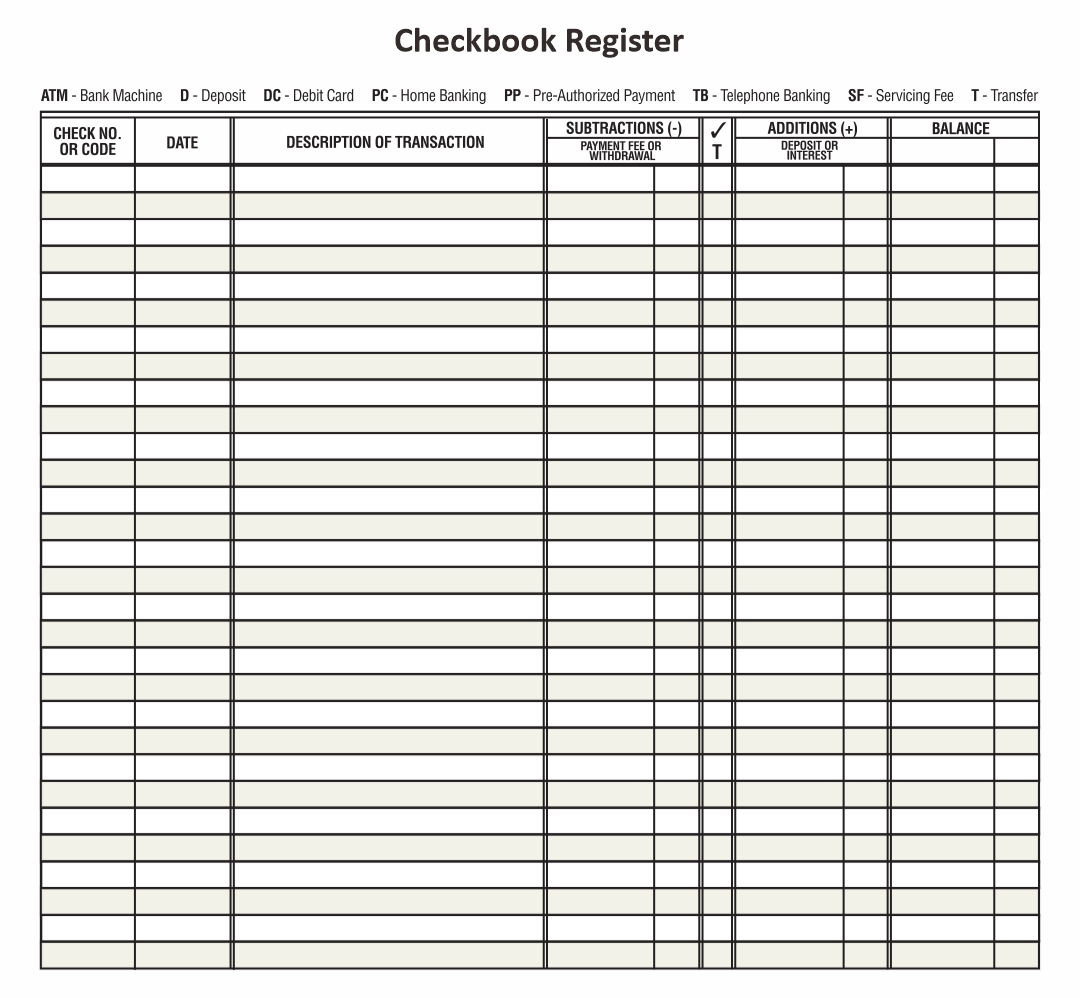

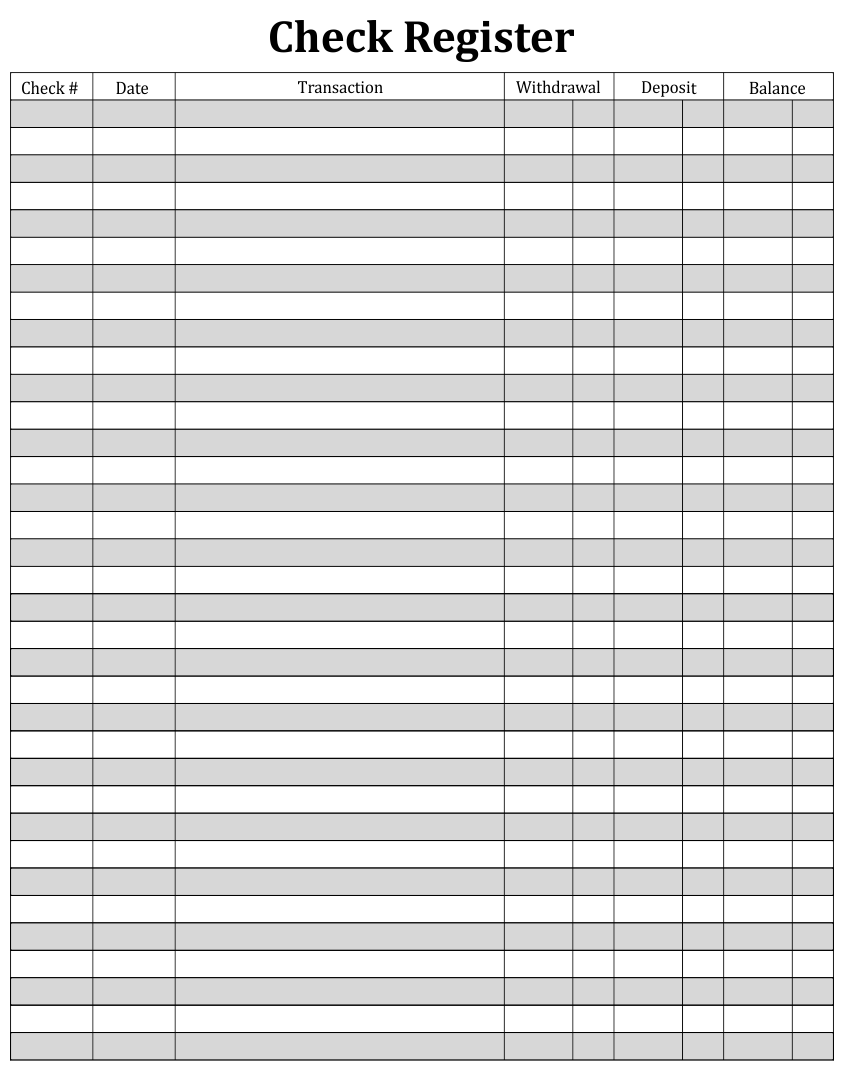

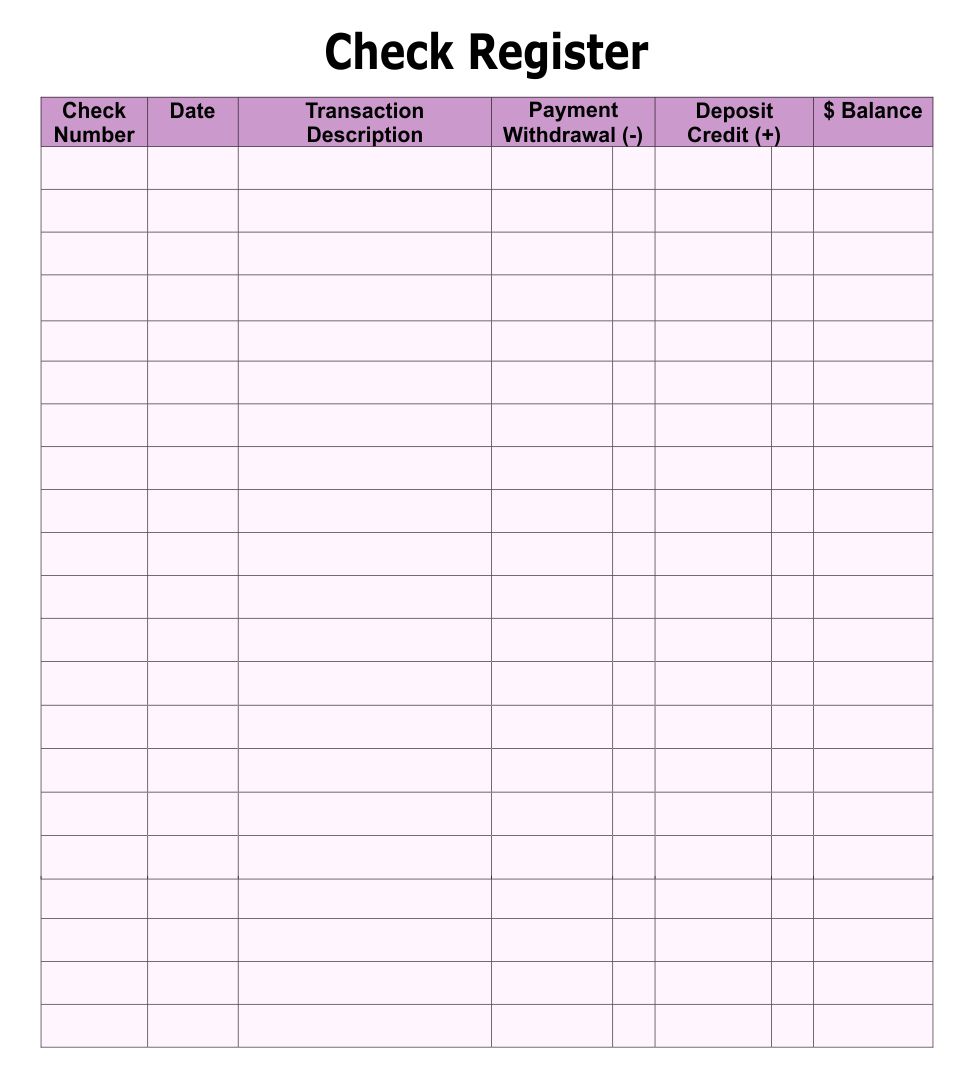

A printable Checkbook transaction register provides a handy way for you to keep track of your check payments, withdrawals, deposits, and current account balance.

This allows for efficient financial management and ensures that you always know the state of your finances without relying on bank statements. By regularly updating your register, you can avoid overdraft fees and better plan your spending and savings strategies.

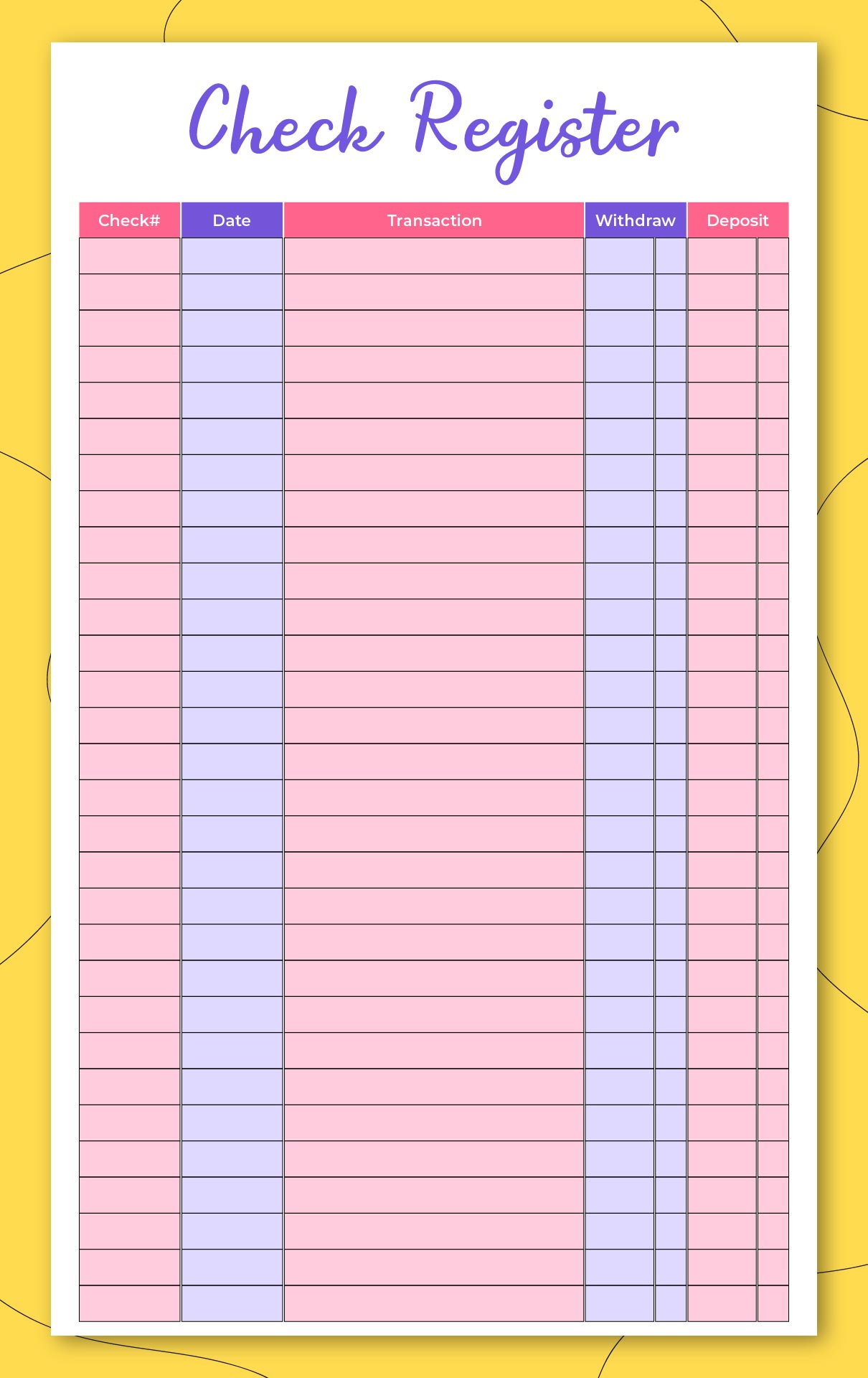

Keeping track of your transactions can be effortlessly managed with printable check register sheets. You can easily record deposits, withdrawals, and balance after each transaction, which helps in maintaining an accurate financial record. Ideal for those who prefer a tangible method of budgeting, these sheets allow for a detailed and personalized approach to managing your finances.

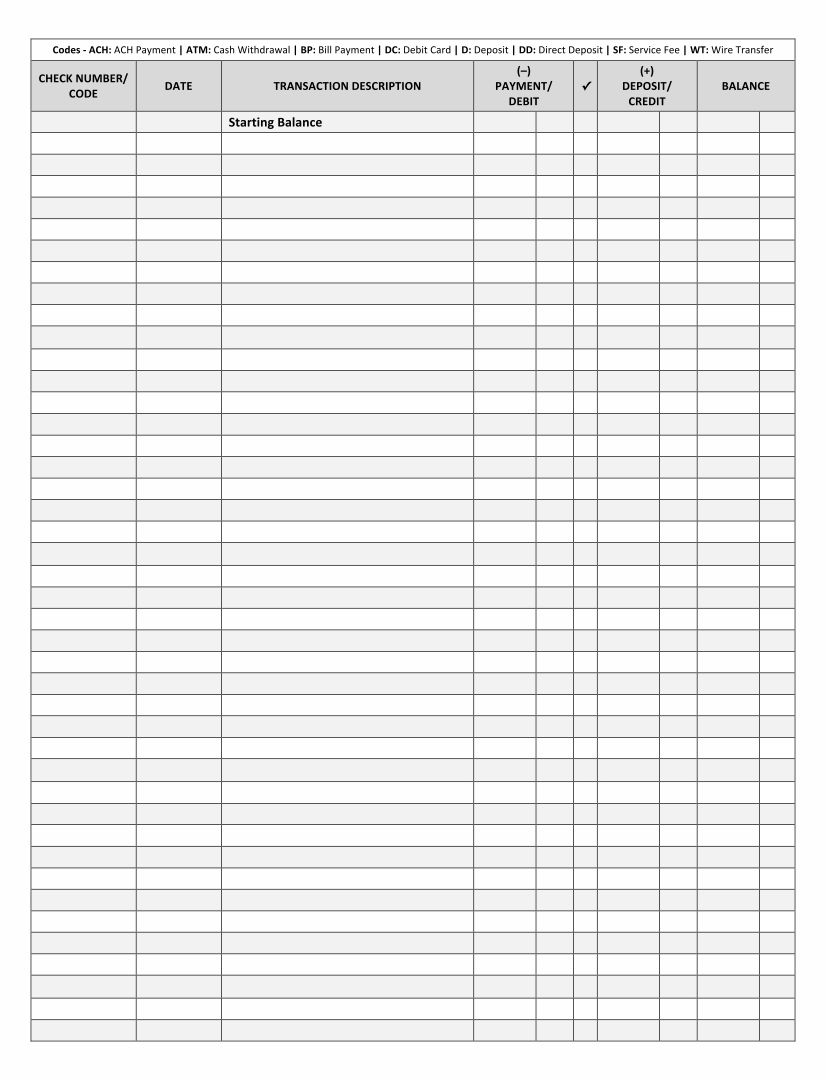

Using a printable check register PDF simplifies the process of monitoring your spending and bank transactions. It provides a structured format where you can log each transaction, helping you to see your financial activity at a glance. This tool is excellent for anyone looking to have a clear overview of their financial status, ensuring that you stay on top of your budgeting goals.

Printable checkbook register templates are essential for anyone aiming to keep an orderly record of their financial transactions. These templates offer columns for date, check number, description, and amounts for deposits and withdrawals, making it straightforward for you to track your financial movements. It's an effective way to avoid overdrafts and manage your spending, keeping your finances in check.

Have something to tell us?

Recent Comments

I absolutely love using the Checkbook Transaction Register Printable! It's been incredibly helpful in keeping track of my finances and ensuring I stay organized. Thank you for this useful resource!

This printable Checkbook Transaction Register is a useful tool for tracking your finances efficiently. It simplifies the process and helps me stay organized. Highly recommended!

I appreciate the simplicity and clarity of the Checkbook Transaction Register Printable. It's a helpful tool to stay organized and keep track of my financial transactions without any unnecessary complexities.