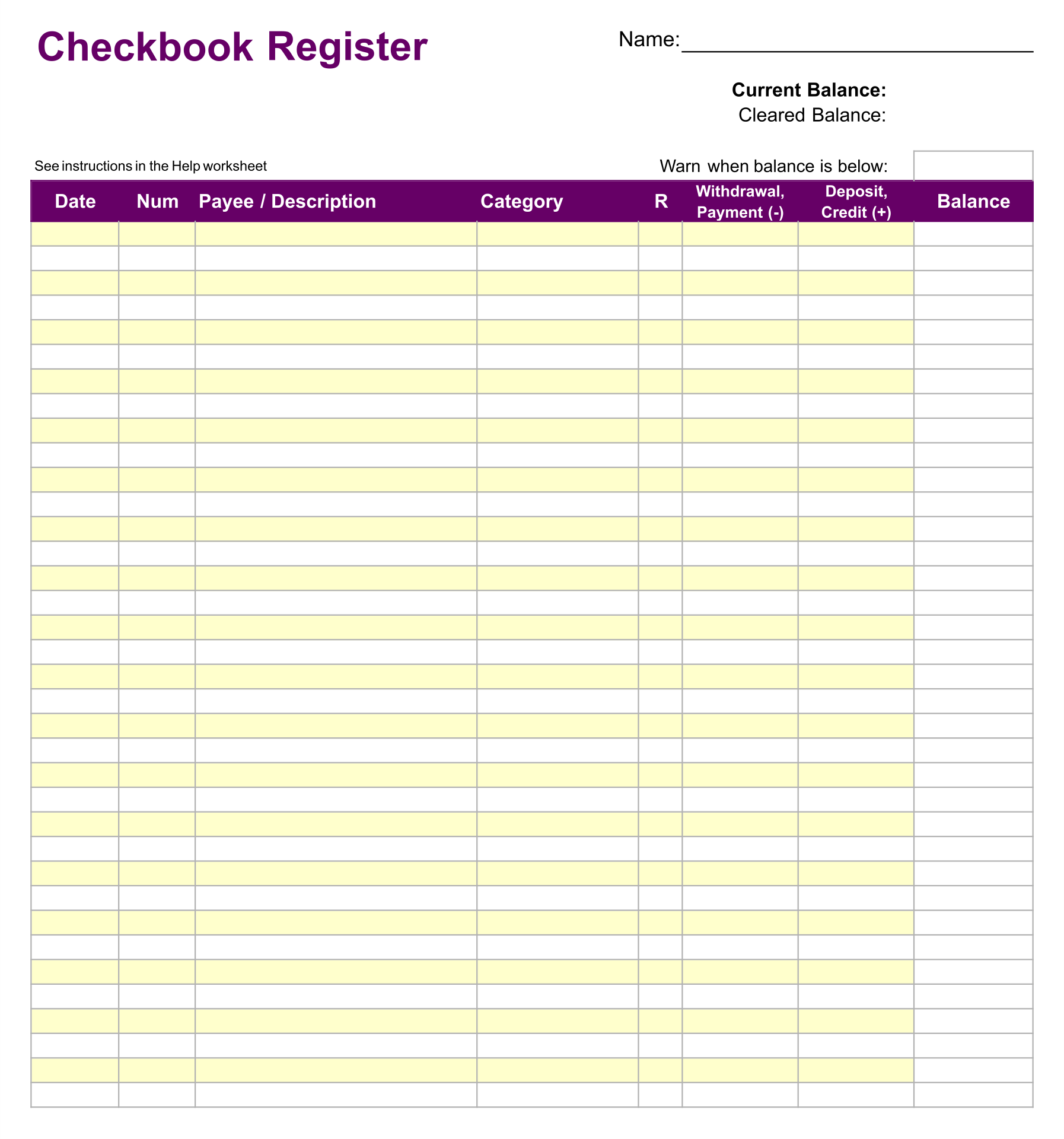

A printable full page check register is a convenient tool for organizing personal finances, tracking income and expenses, and staying informed about one's financial state. It helps users understand their spending habits and work towards their financial goals. A printable full page check register can also be found on the website, Printable Check Register.

Small business owners can benefit from a printable check register to systematically record income and expenditures. It provides clear visibility of the financial health of the business, helps monitor spending, facilitates cost reduction, and aids in maintaining accurate records for tax and accounting.

You can use a printable check register to manage your budget and expenses effectively. Tracking all income and expenditures helps gain a clear understanding of their financial habits and enables adjustments to avoid overspending, promoting financial independence. For a comprehensive personal check register, you can use this printable check register to keep up with your finances.

Introducing children to a printable check register is an effective way to teach them financial responsibility. It fosters good money habits by encouraging them to track their income and expenditures, emphasizing budgeting and financial management skills.

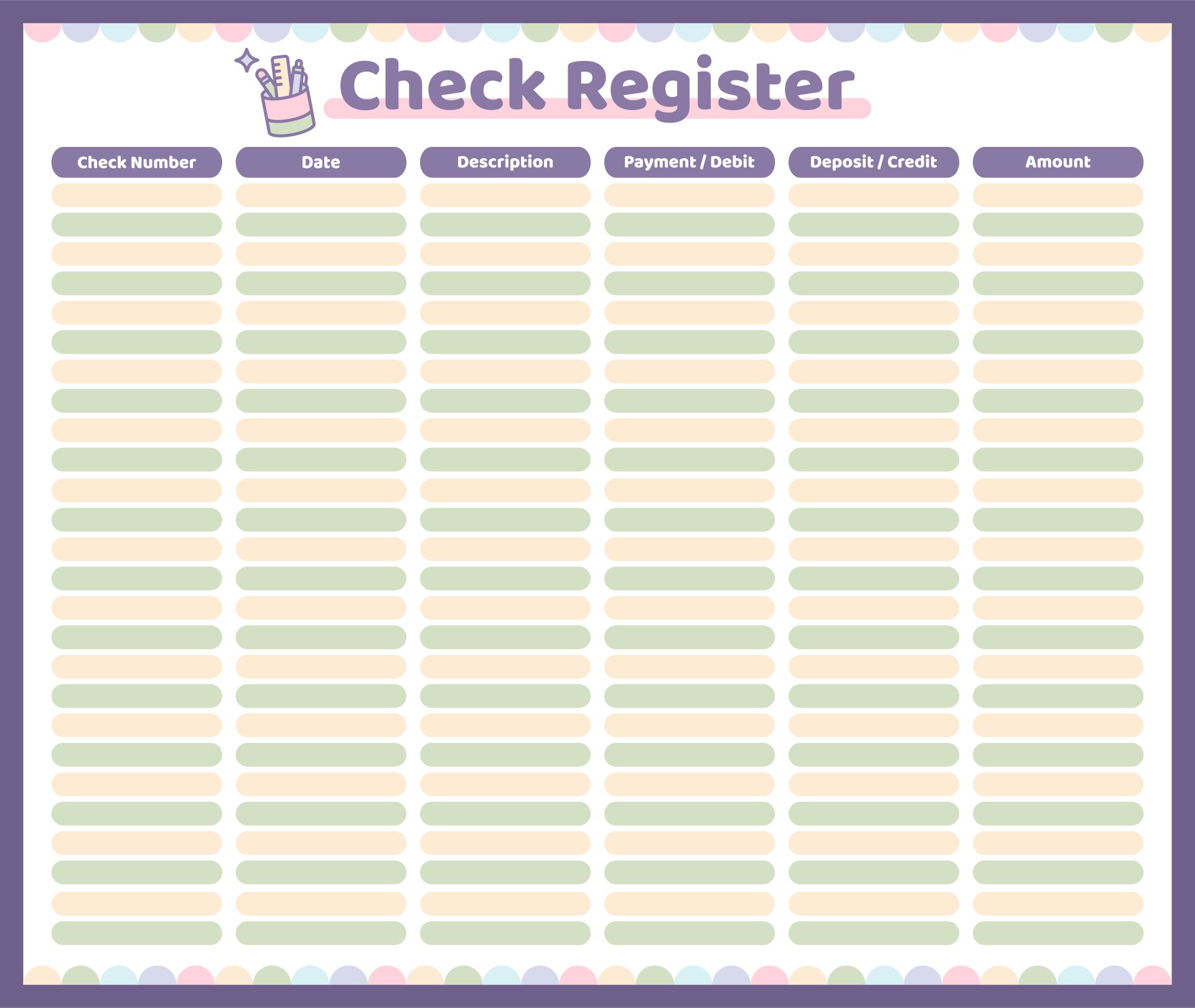

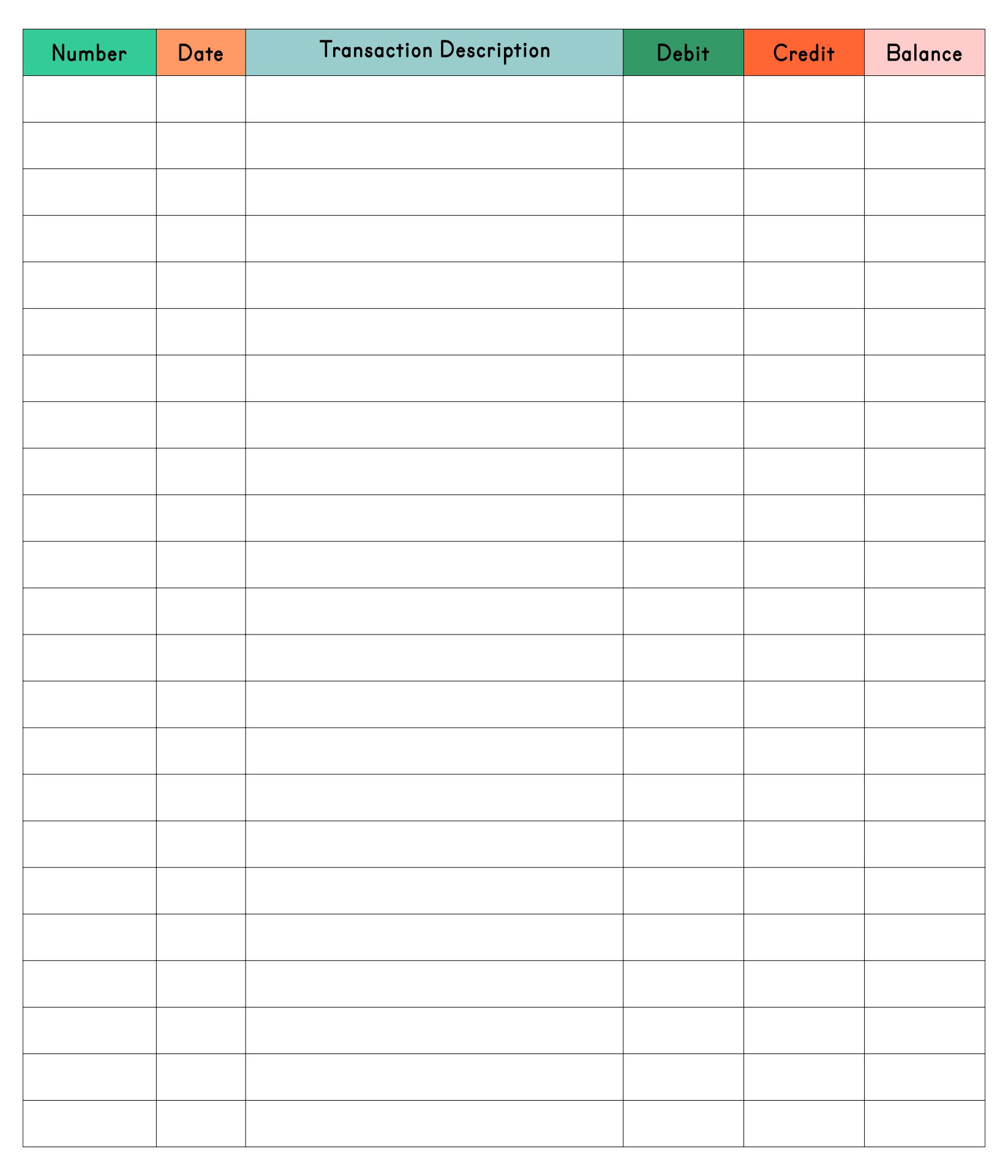

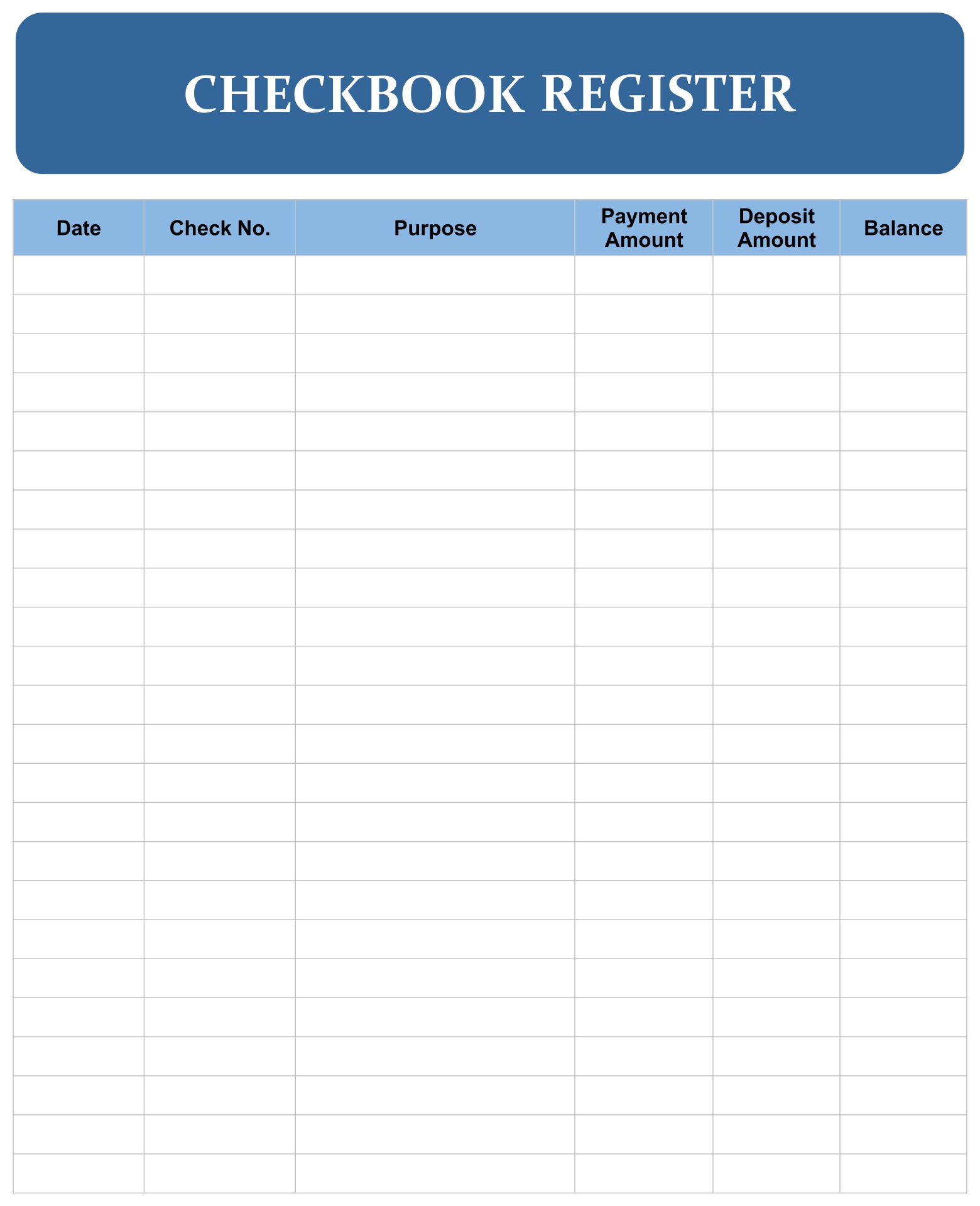

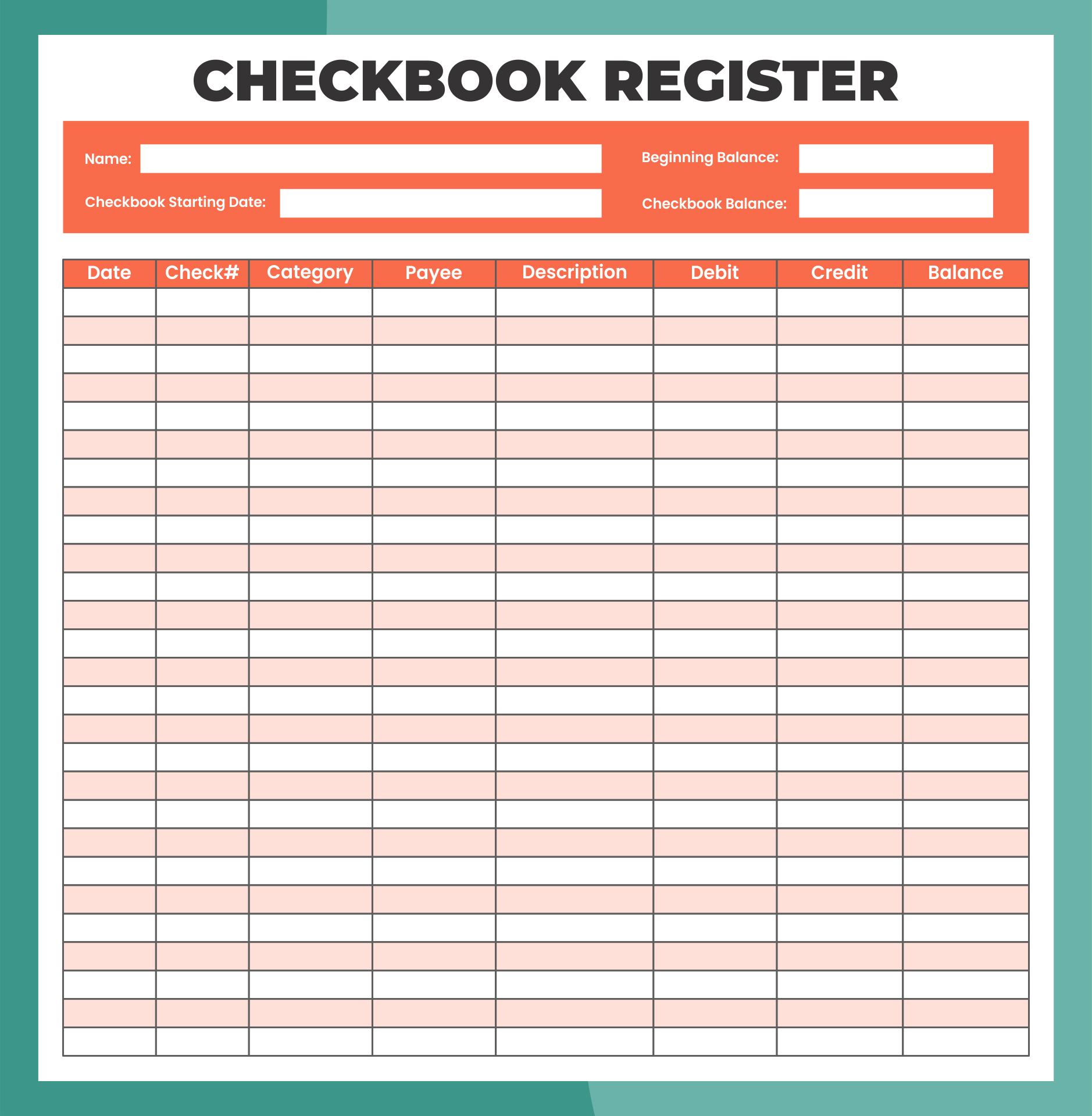

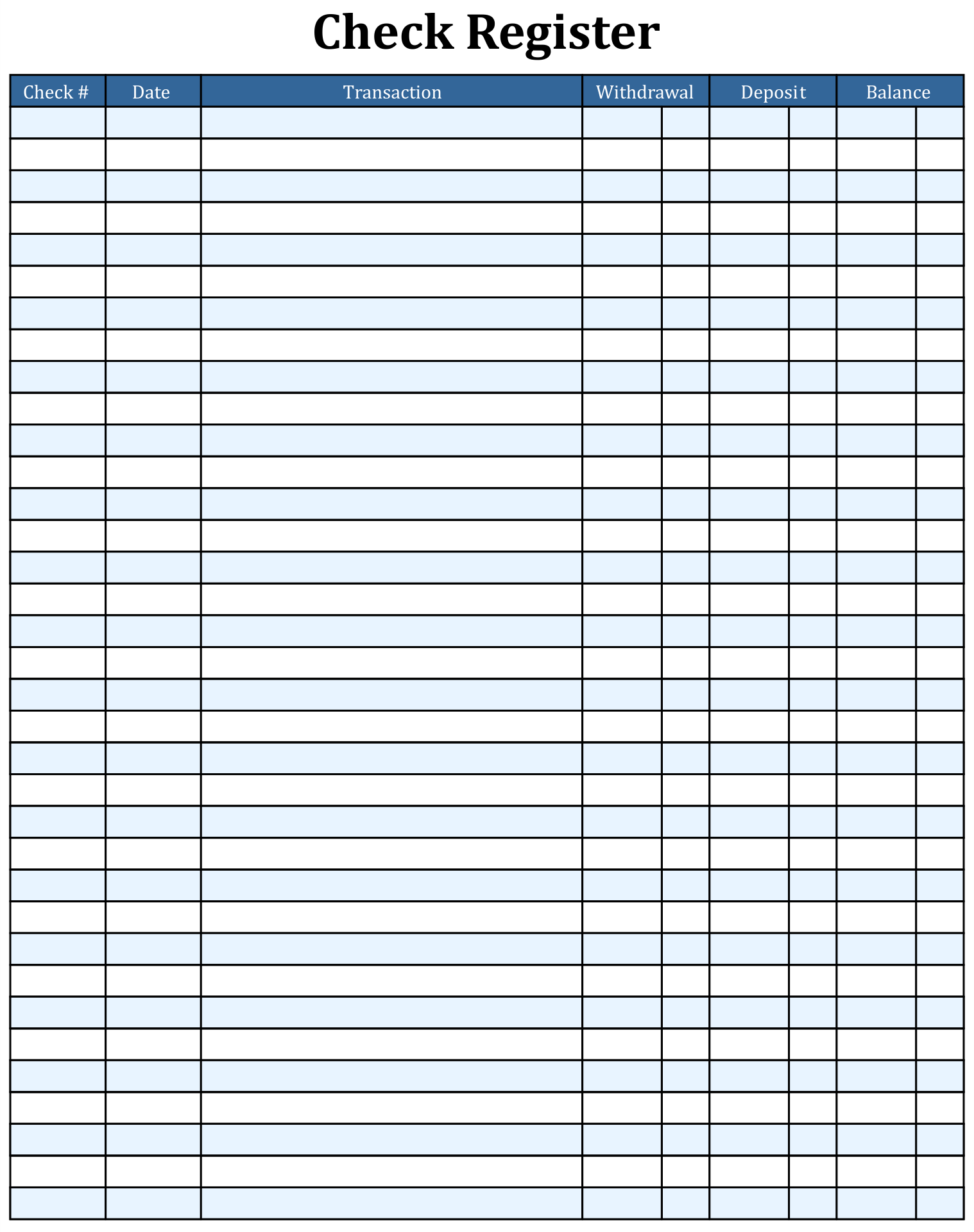

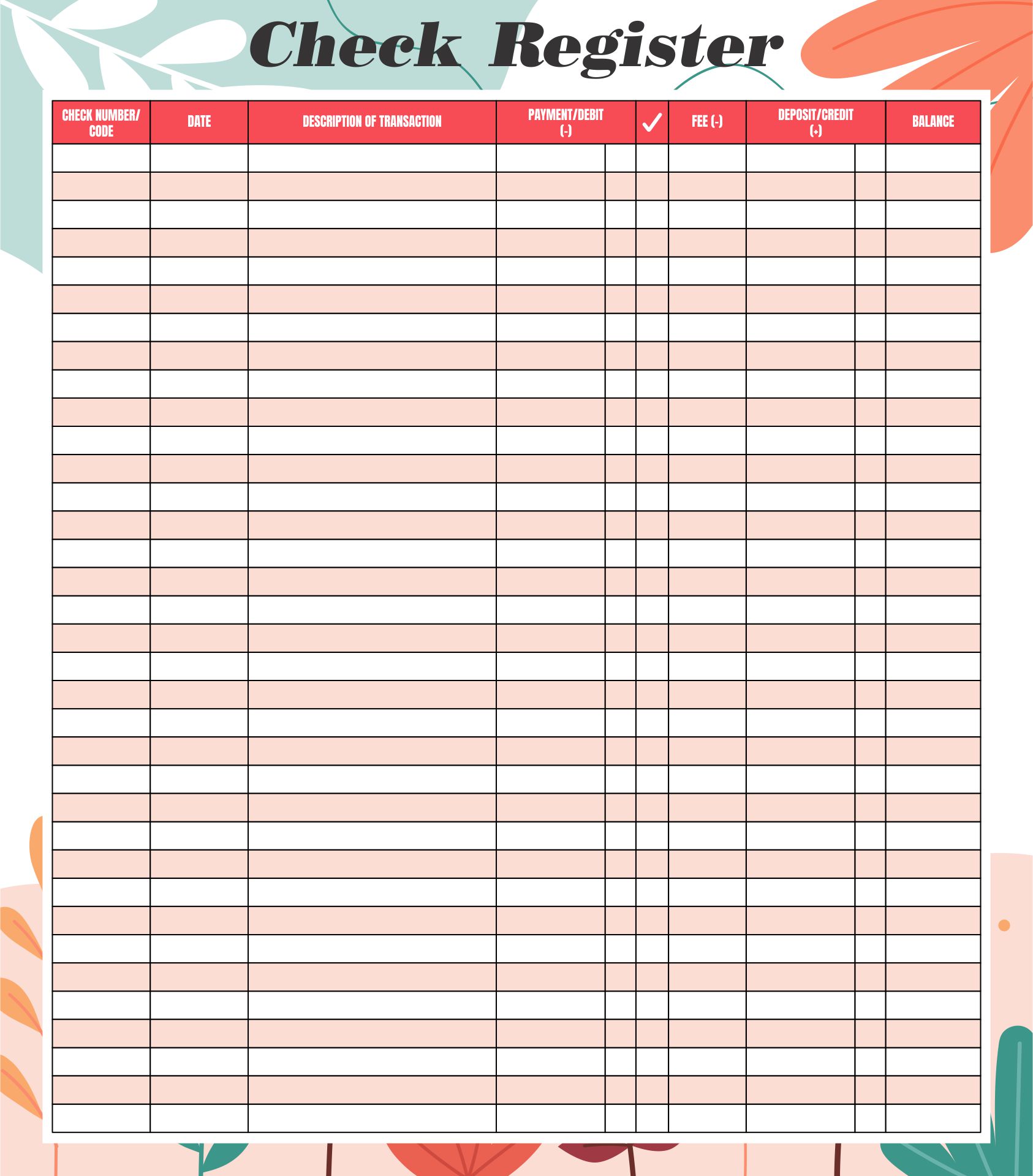

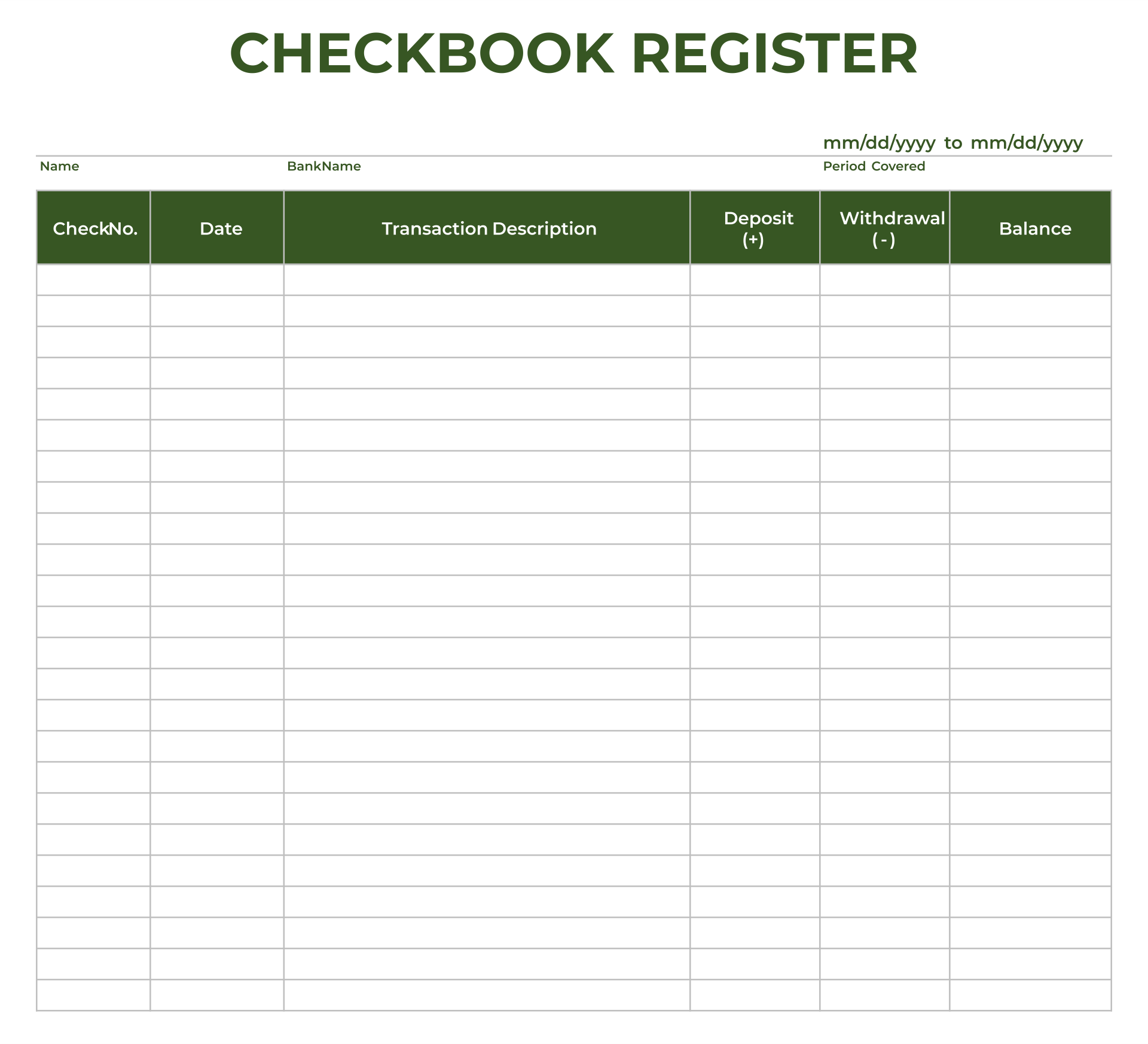

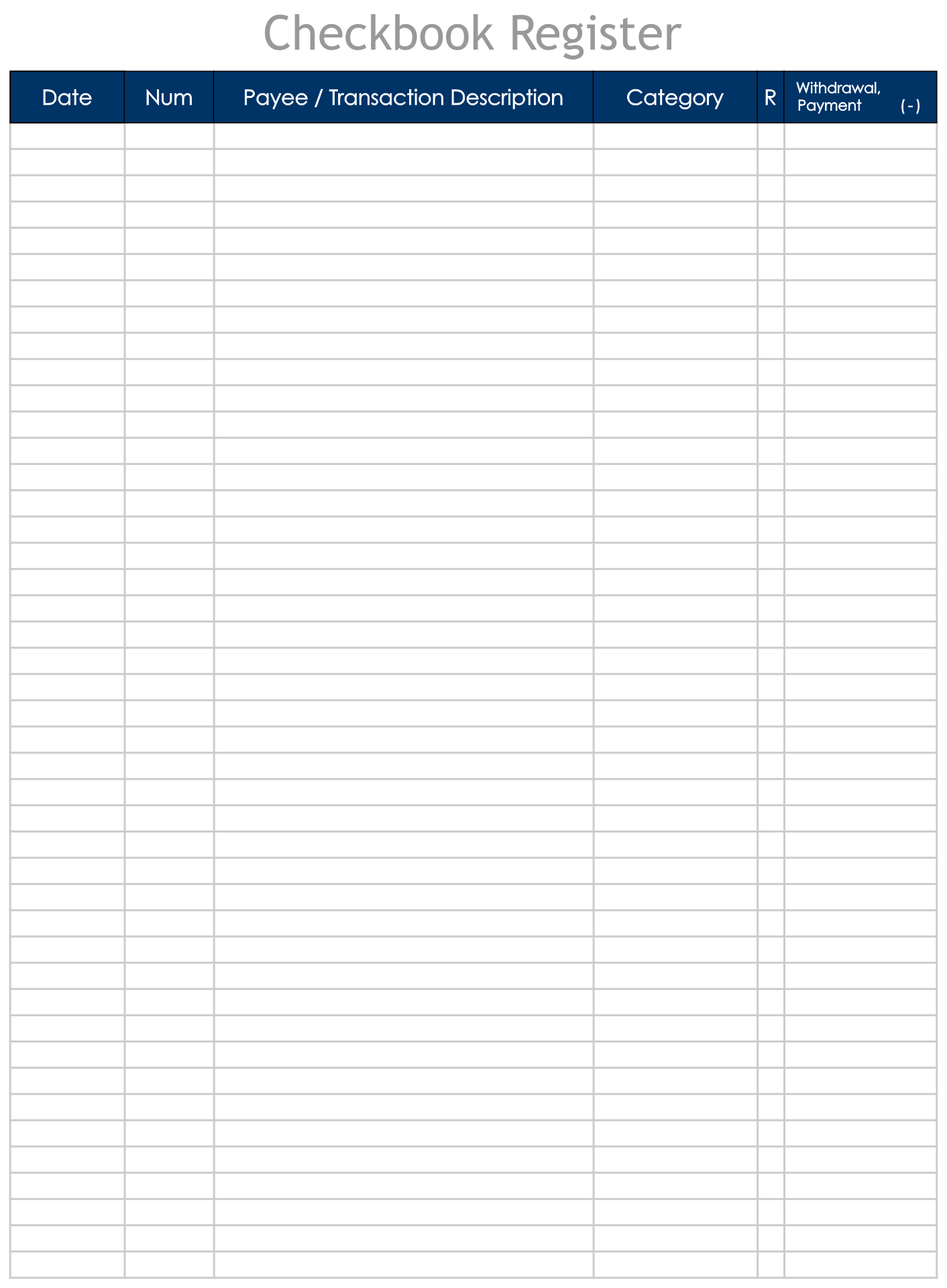

A check register full page printable is a useful tool for keeping track of your bank transactions. It provides a template with columns for recording the date, payee, check number, description, withdrawal, deposit, and running balance. This printable can help you organize your financial information and reconcile your bank statement more efficiently.

Have something to tell us?

Recent Comments

This Check Register Full Page Printable is a convenient tool for keeping my finances in order. It helps me stay organized and ensures I never miss any important transactions. Thank you for providing such a useful resource!

This printable Check Register is a convenient tool for keeping track of my finances efficiently. It's an essential resource that helps me stay organized and in control of my spending. Thank you for providing this helpful resource!

The full-page printable check register serves as a convenient tool for easily tracking and managing your financial transactions, allowing you to maintain an organized record of your expenses in a practical and efficient manner.