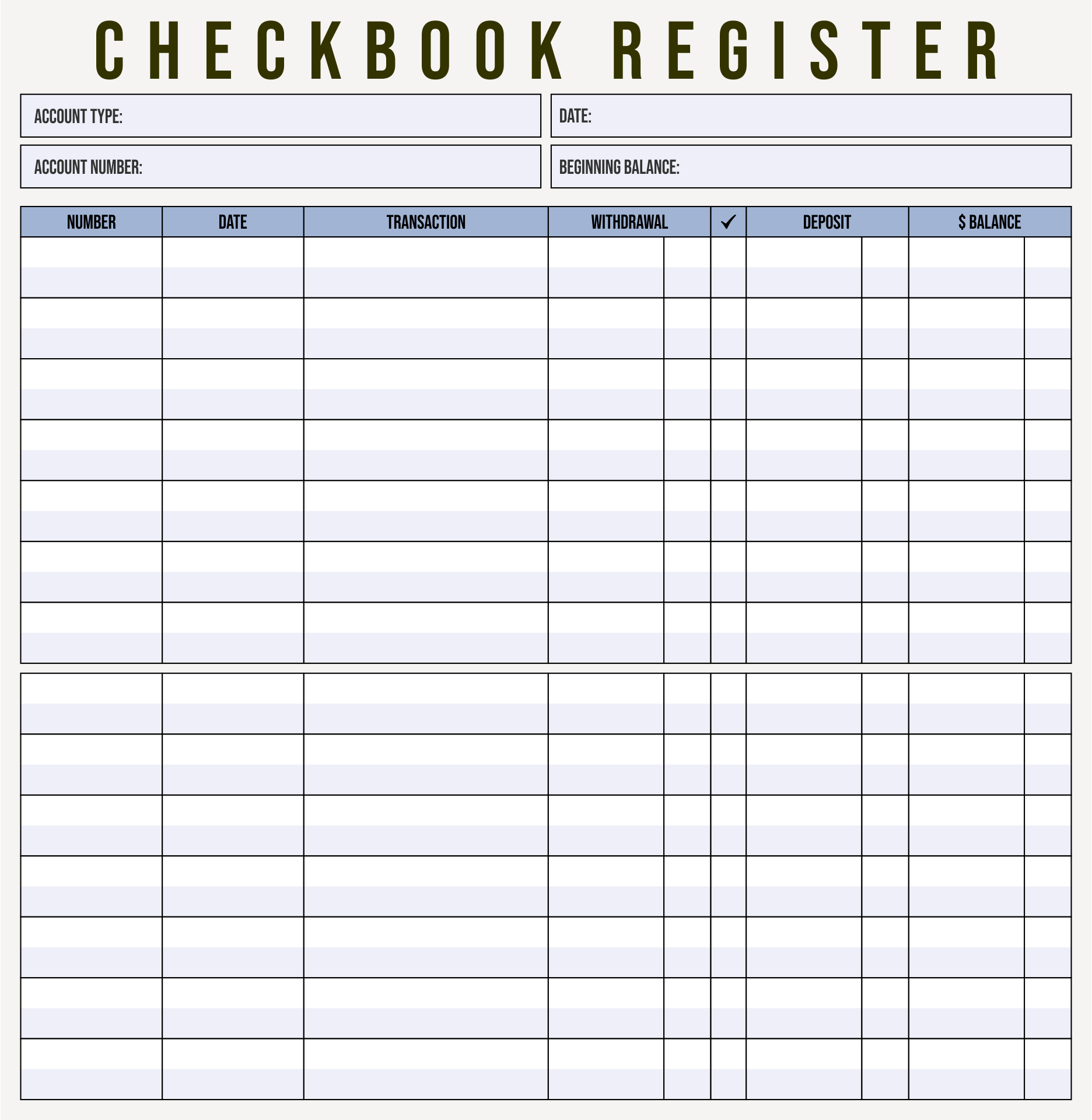

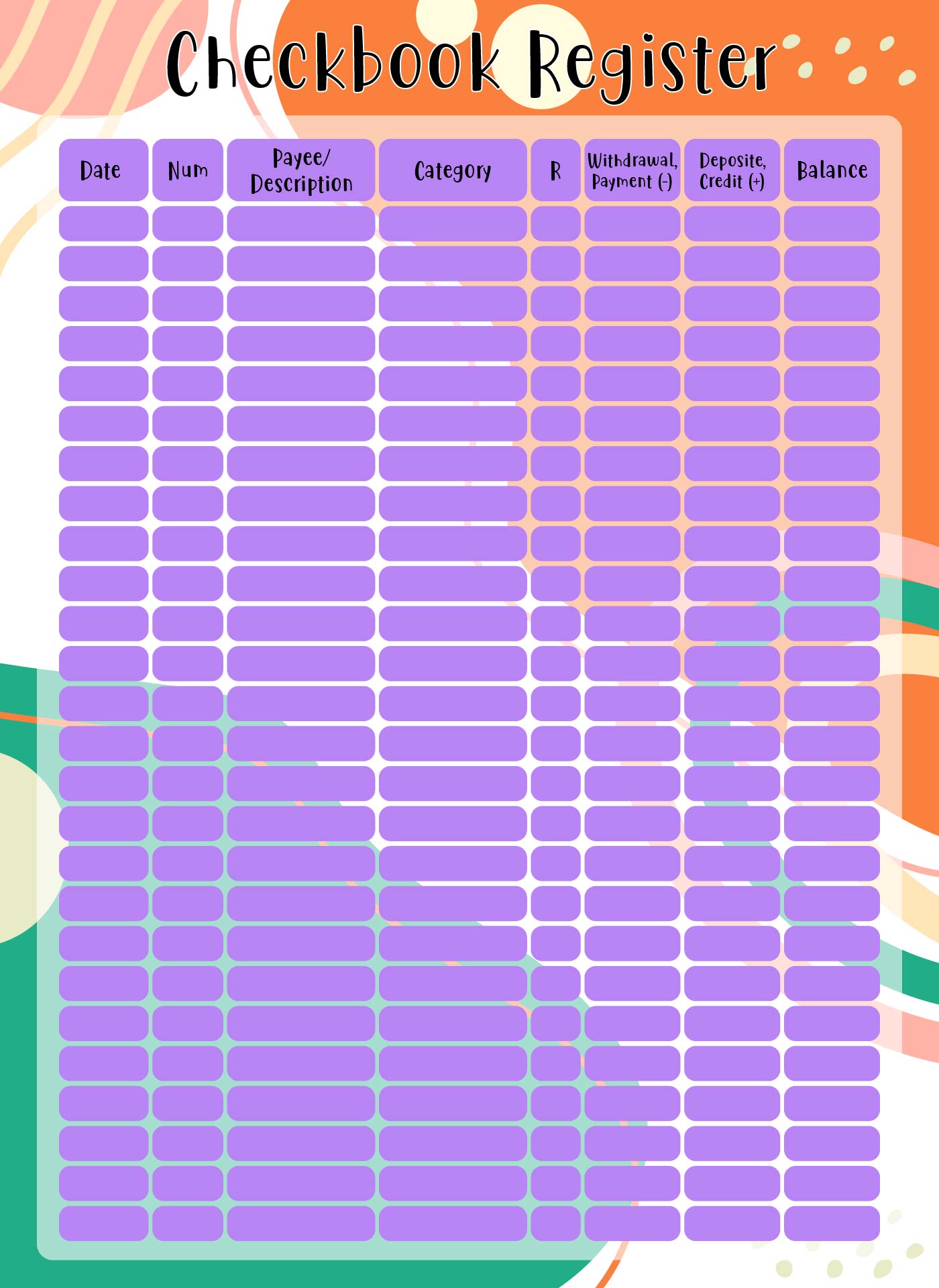

Having a blank-check register template at your disposal allows you to keep a meticulous record of all your financial transactions. This ensures you're always aware of your expenditures and deposits, helping to prevent overdraft fees and fraudulent charges. You can easily track your spending habits, making budgeting more straightforward and helping you to save money in the long run. Keeping such a register is a simple yet powerful tool in managing your personal or business finances effectively.

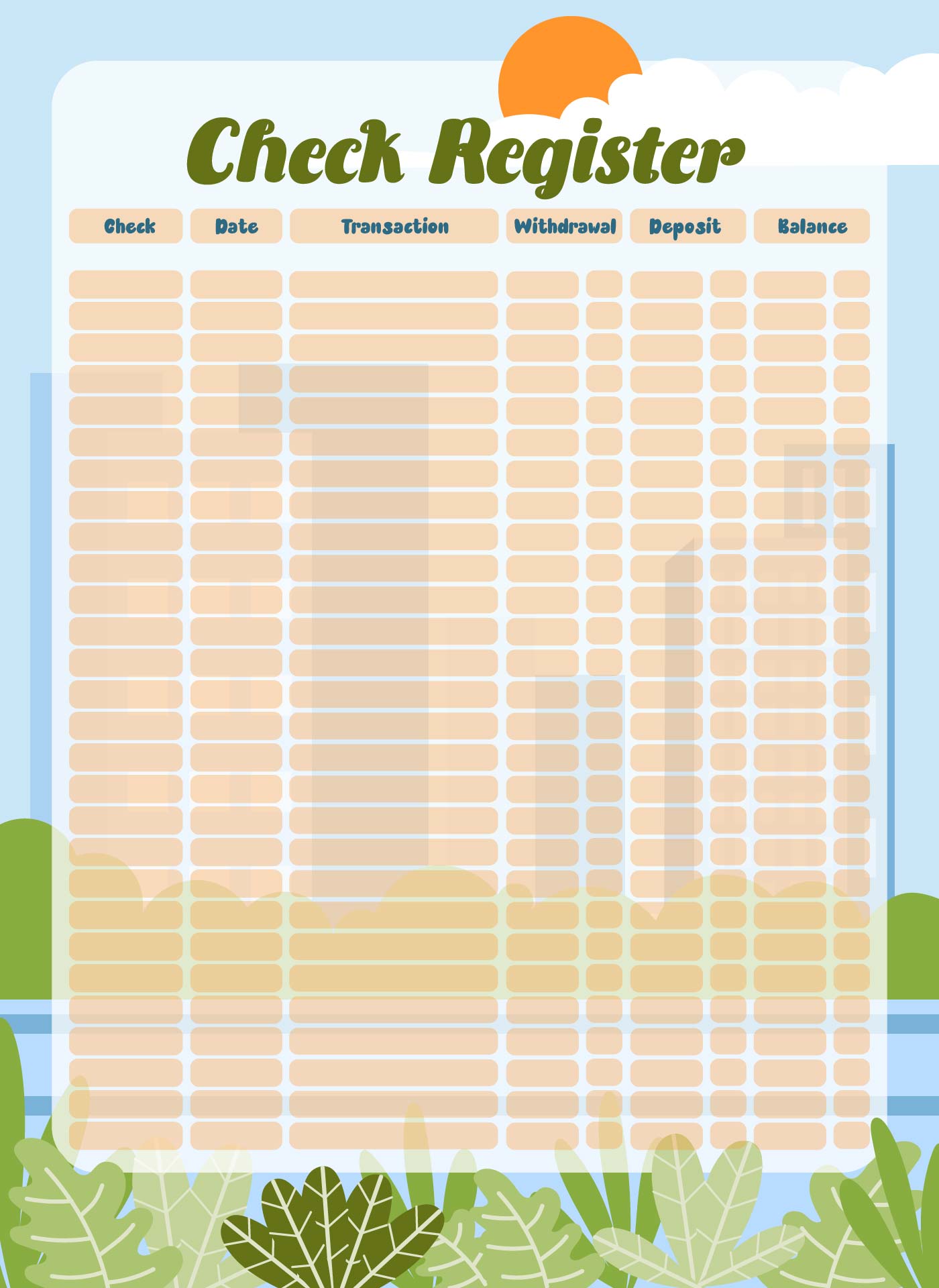

Keeping track of your finances becomes hassle-free with a printable blank check register for your checkbook. You can easily monitor your checking account transactions, helping you avoid overdrafts and maintain a budget. It's a simple yet effective tool for personal finance management.

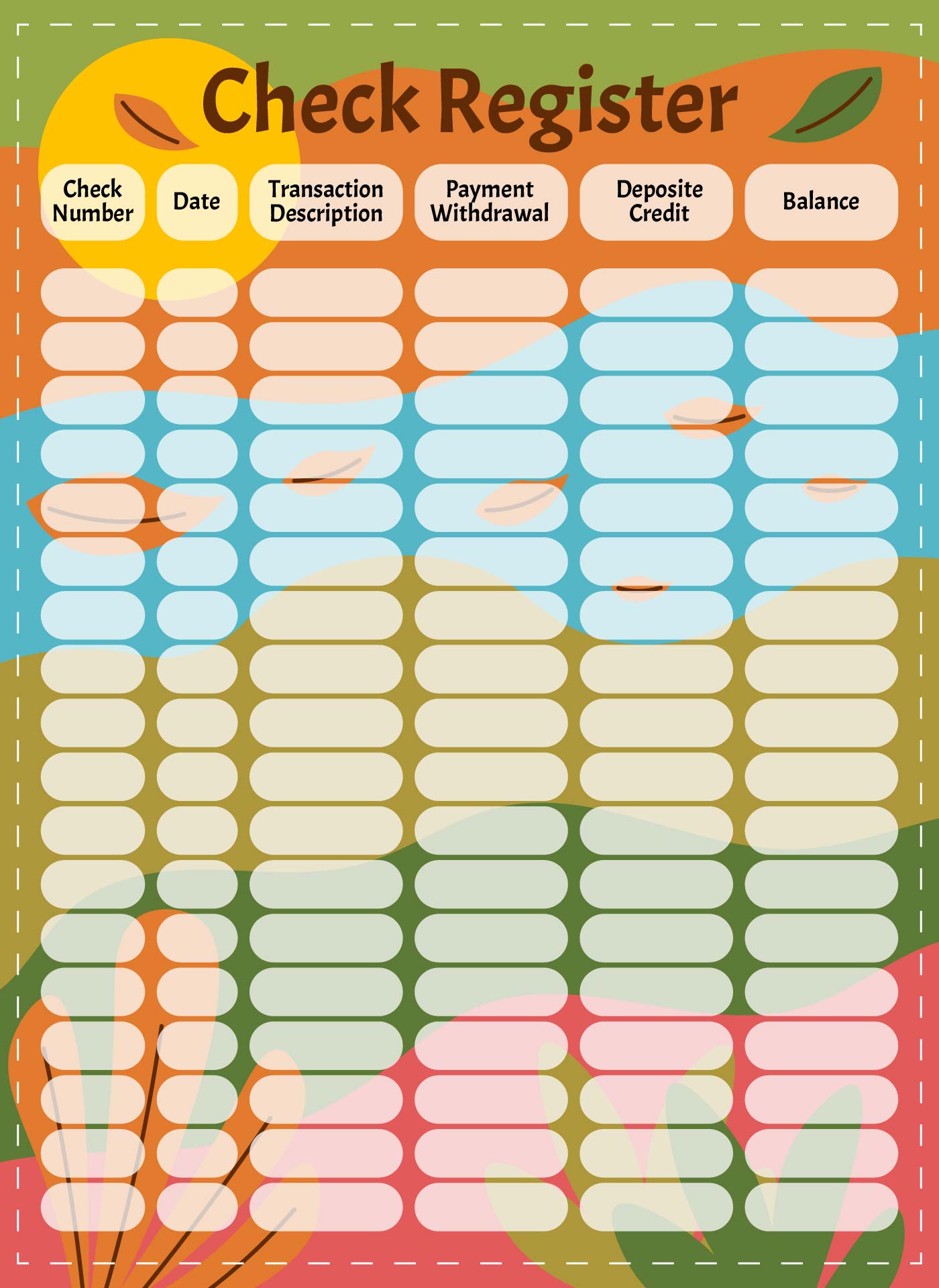

A printable check register PDF allows you to keep an accurate record of all your check transactions digitally or on paper. This accessibility means you can update your financial records anytime, anywhere, ensuring you always know your account balance and spending habits.

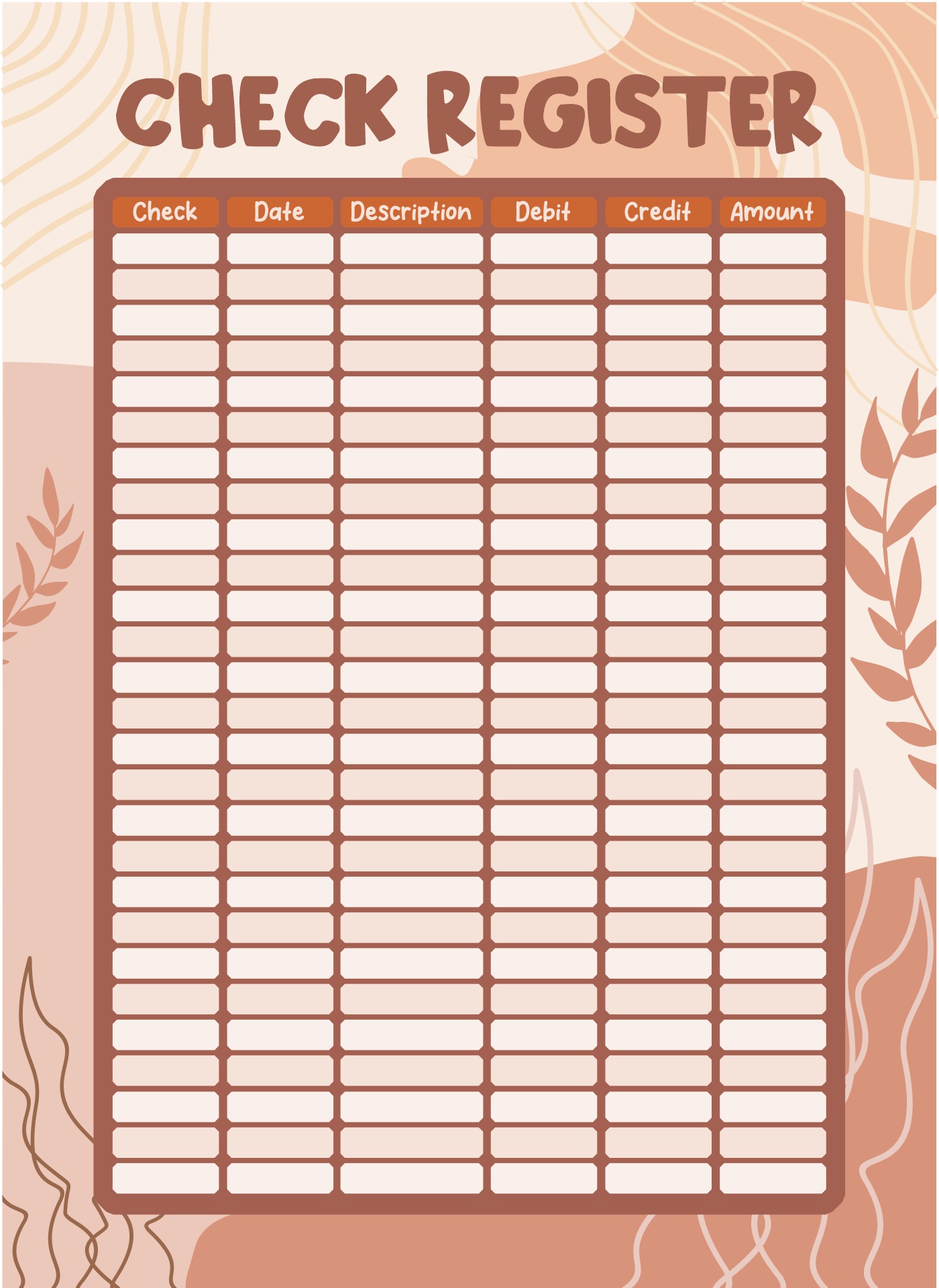

Using a blank check register to print helps you create a customized financial tracking system. Without the constraints of pre-filled entries, you have the flexibility to tailor your record-keeping to fit your specific needs, making it easier to stay organized and in control of your finances.

A blank-check register template printable can serve as a meticulous way for you to keep track of your financial transactions. It allows you to record all checks issued, deposits, and withdrawals, helping ensure your bank account balance is always accurate. By consistently updating your check register, you can avoid overdraft fees and manage your budget more effectively. This tool is especially beneficial for those who prefer a tangible record of their finances or are not inclined to use digital budgeting apps.

Have something to tell us?

Recent Comments

Great solution for keeping track of my finances! The blank-check register template is simple and easy to use. Thank you for providing such a useful resource!

Great printable resource for keeping track of my finances! The blank-check register template is clean and simple, making it easy to record transactions. Highly recommended!

The blank-check register template printable is a helpful tool for keeping track of your finances and organizing your checkbook, providing a simple and convenient way to manage payments and balances.