Folks need a way to track their spending, make sure they ain't bouncing checks. Not everyone's keen on digital apps for managing money. Good old-fashioned paper method still got its fans. Trouble is, finding a simple, printable check register ain't as easy as one might hope. They're wanting something straightforward to print at home, jot down their expenses, deposits, keep it all tidy.

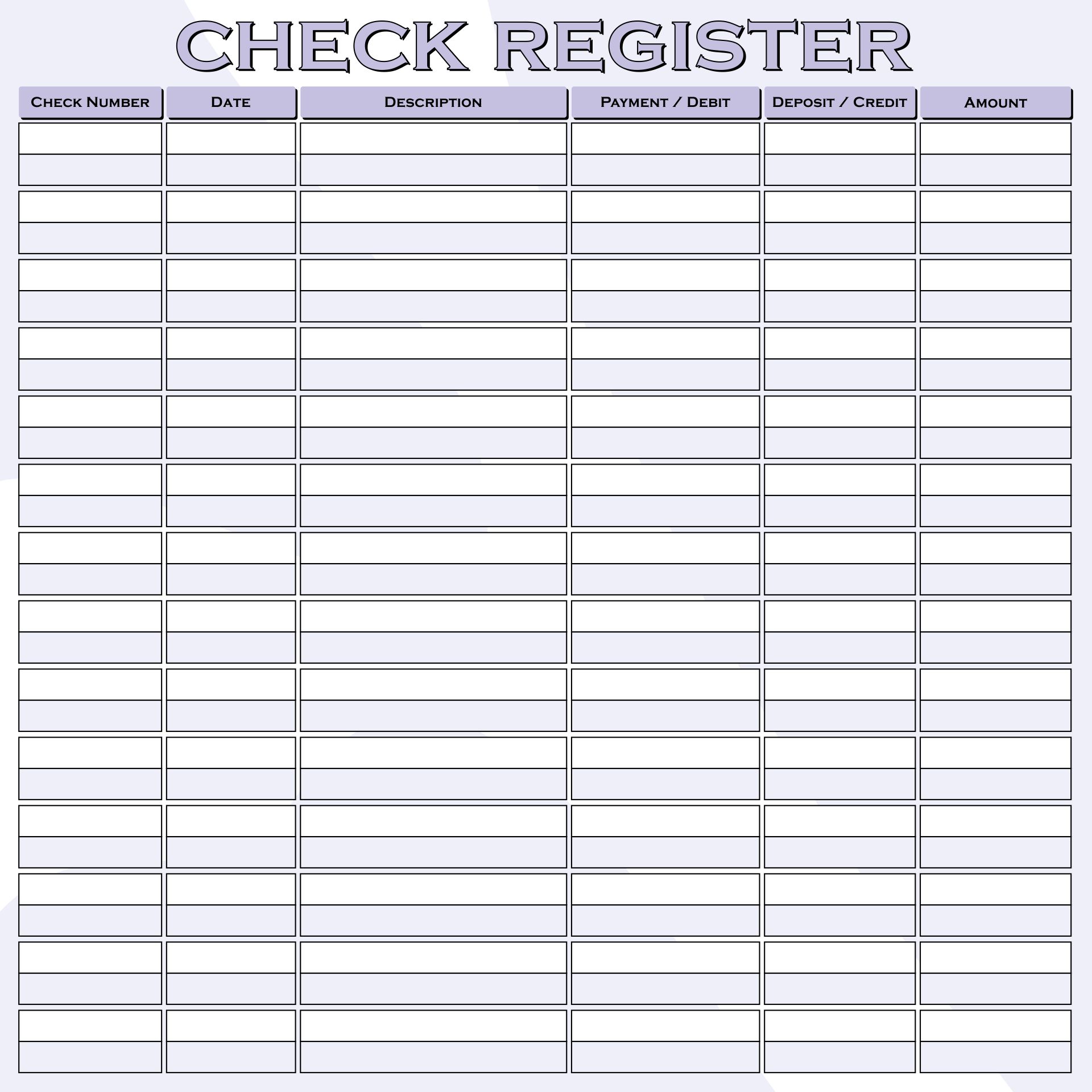

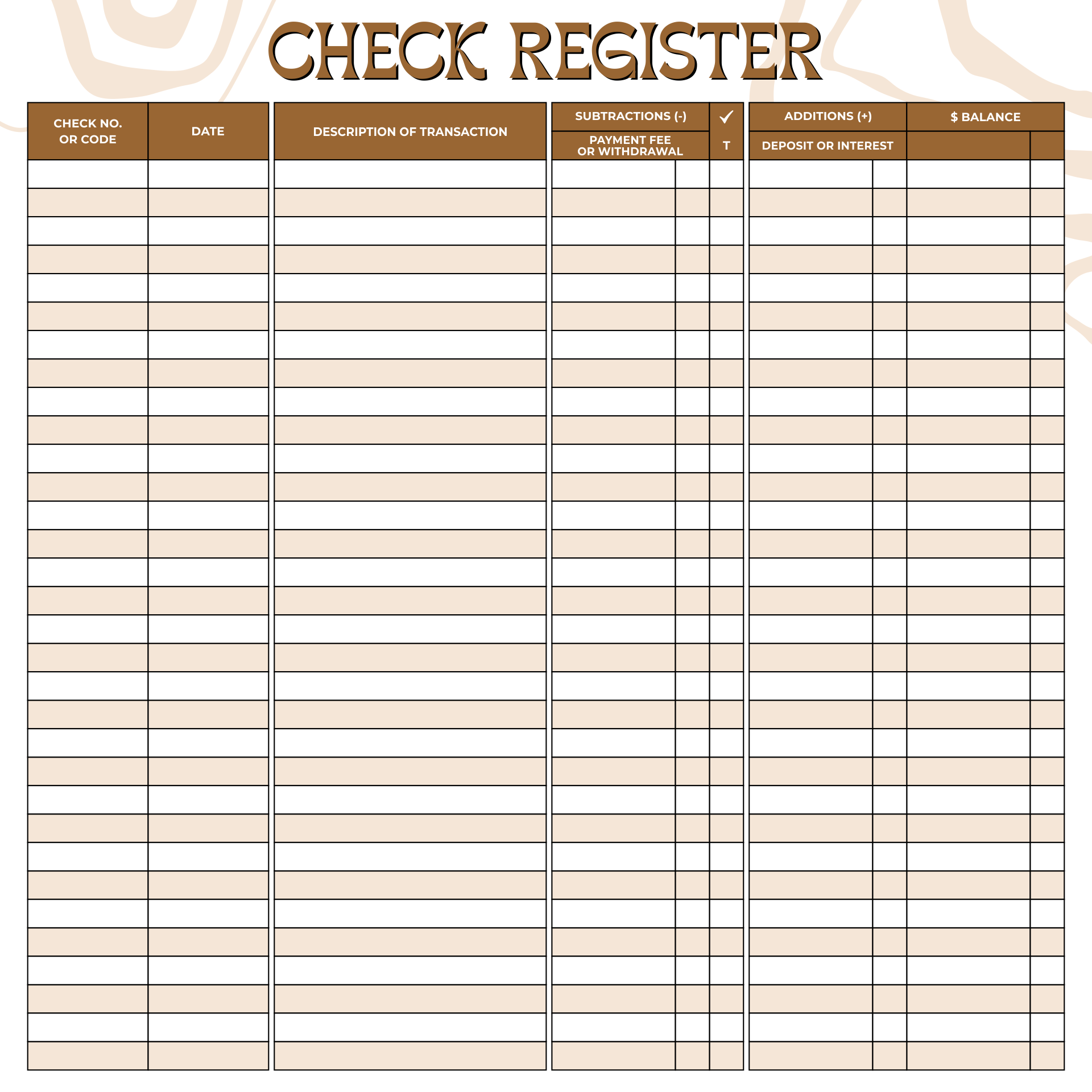

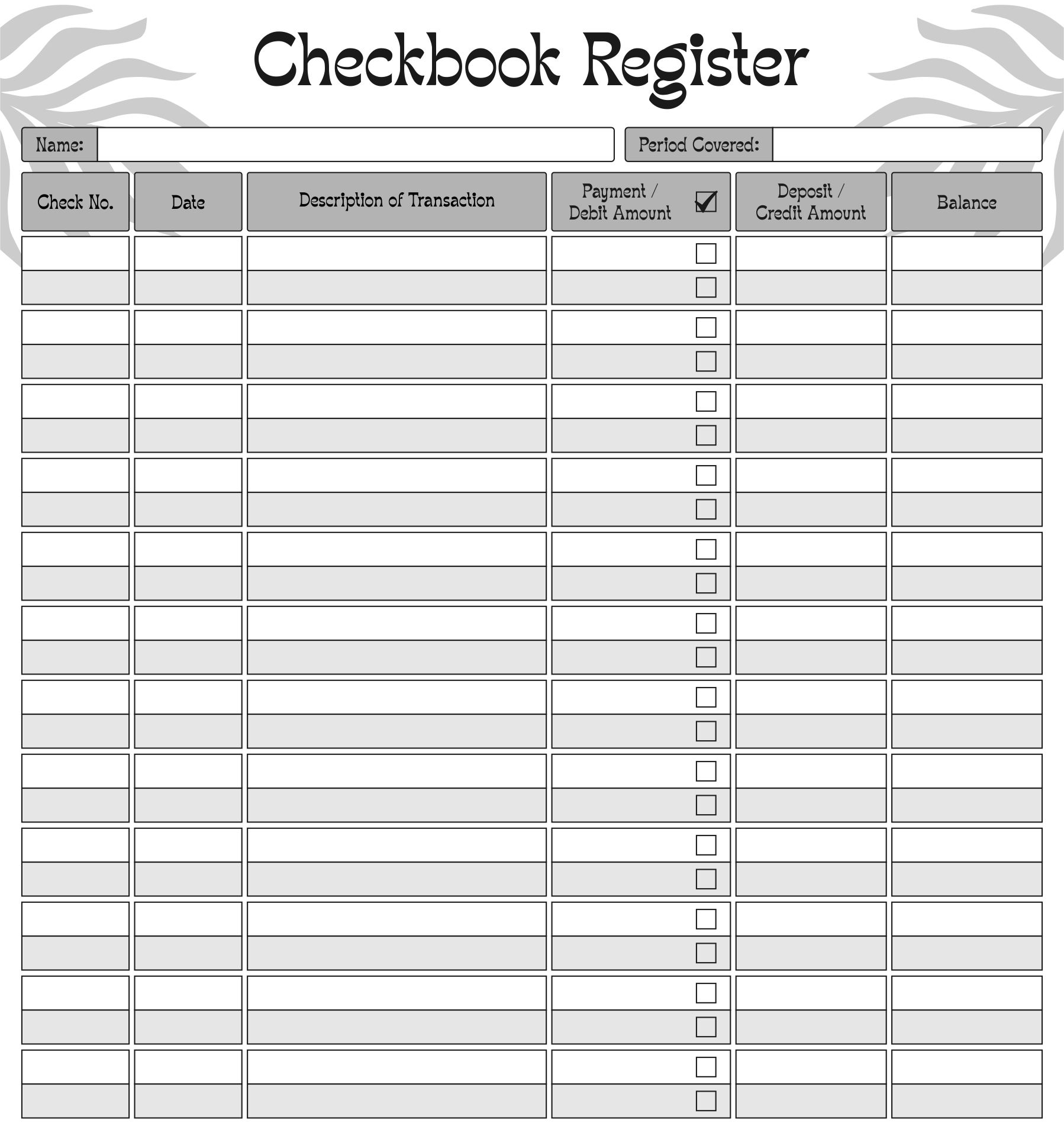

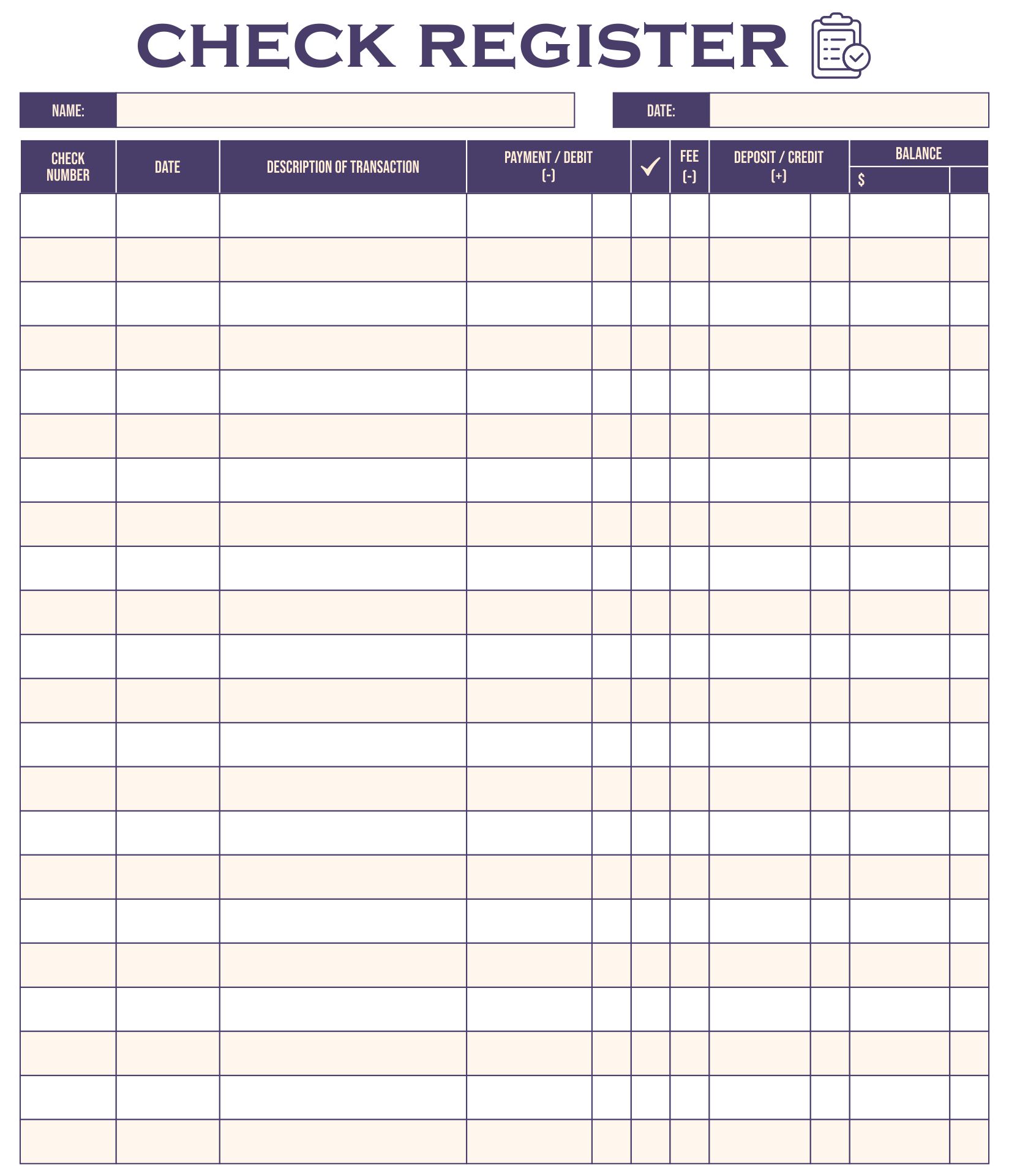

We come up with a simple tool to track spending and manage finances better. The printable blank check register we designed offers spaces for date, check number, description, and balances. Helps keep everything organized and in one place, making it easy to spot trends or areas where you might need to cut back. Handy for both personal use and businesses wanting to keep a close eye on expenses.

A free printable blank check register provides a convenient way for individuals to track their financial transactions manually, ensuring accurate record-keeping of checks issued, deposits, and withdrawals. You can find these register templates on a variety of websites, for instance, Printablee offers free printable check register pages that cater to personal preference and specific accounting needs. Utilizing these templates allows users the ability to customize and organize their financial information efficiently without needing an advanced software.

A free printable blank check register offers a straightforward solution for individuals to track their financial transactions, ensuring accuracy in their account management. Those seeking a more tailored approach can opt for personalized check register options, which allow customization to suit specific financial tracking needs and preferences.

A free printable blank check register offers a simple yet effective tool for managing finances by keeping a detailed record of all checks written, deposits made, and current account balance. This cost-effective solution aids in budgeting and ensures accurate tracking of expenses without the need for expensive software or apps.

Have something to tell us?

Recent Comments

Thank you for providing this free and helpful resource! It's great to have a blank check register that's easily printable.

Thank you for offering this Free Printable Blank Check Register! It's a simple and helpful tool for staying organized with my finances. Much appreciated!

This Free Printable Blank Check Register is a handy tool to stay organized and keep track of my transactions. Thank you for providing this resource!