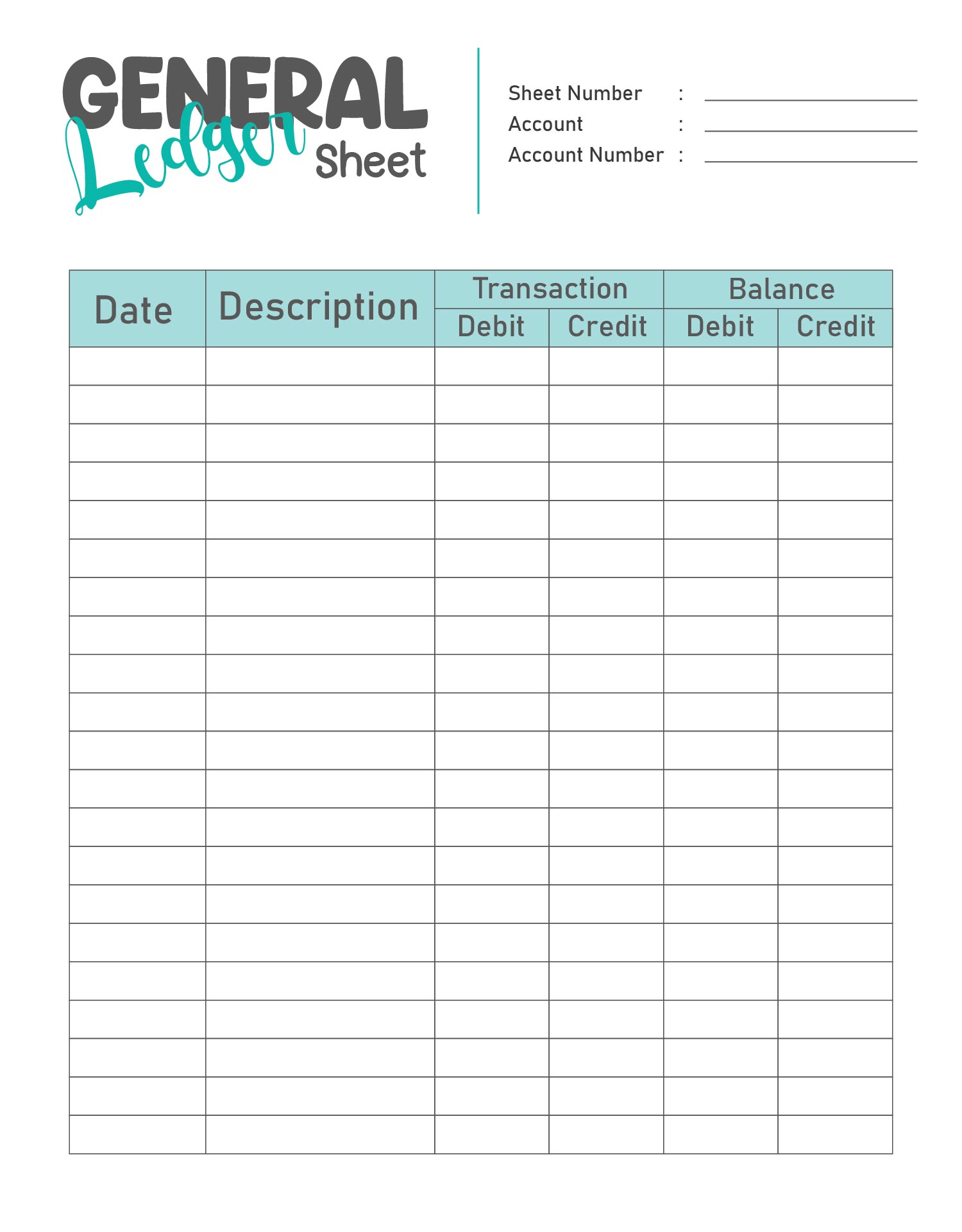

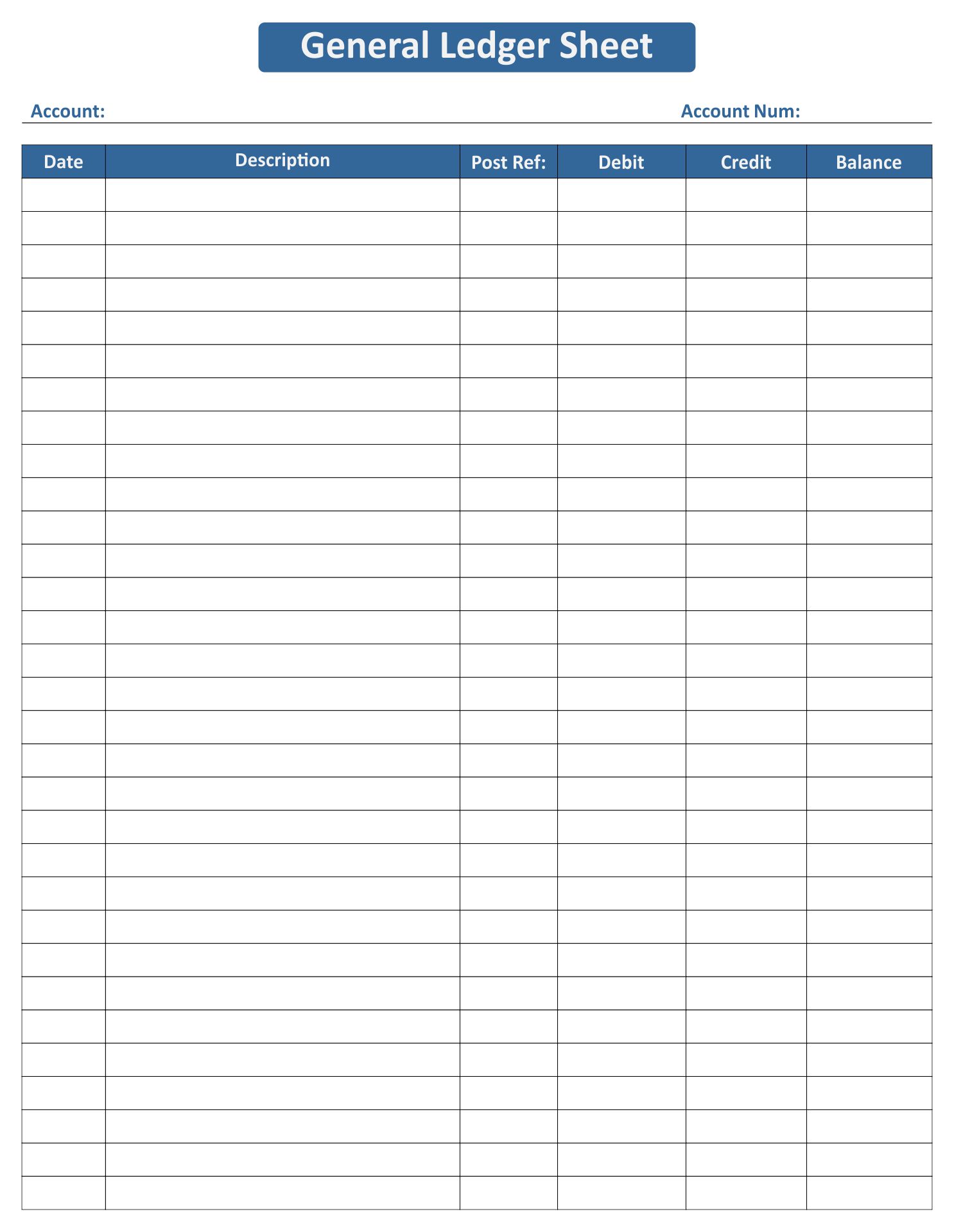

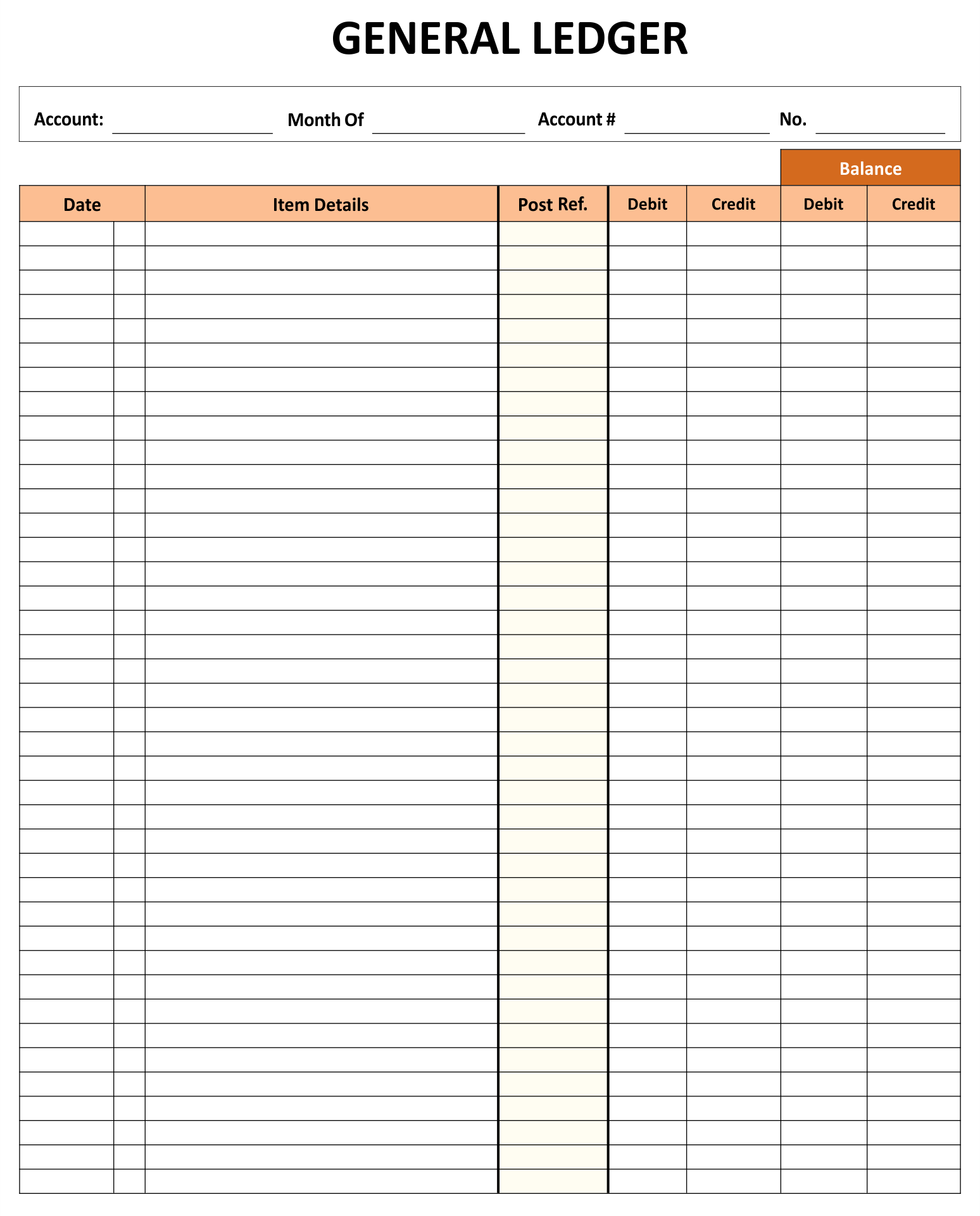

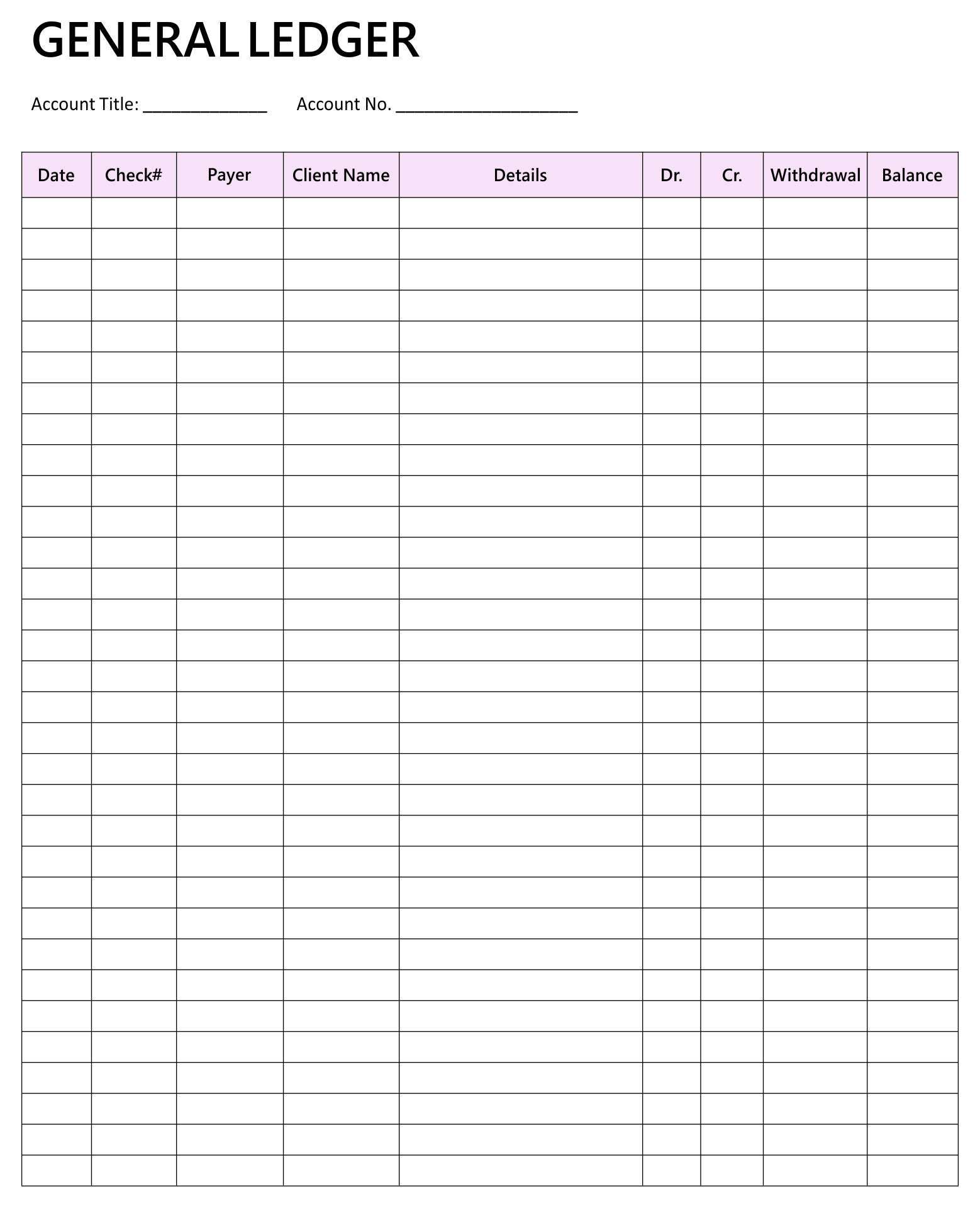

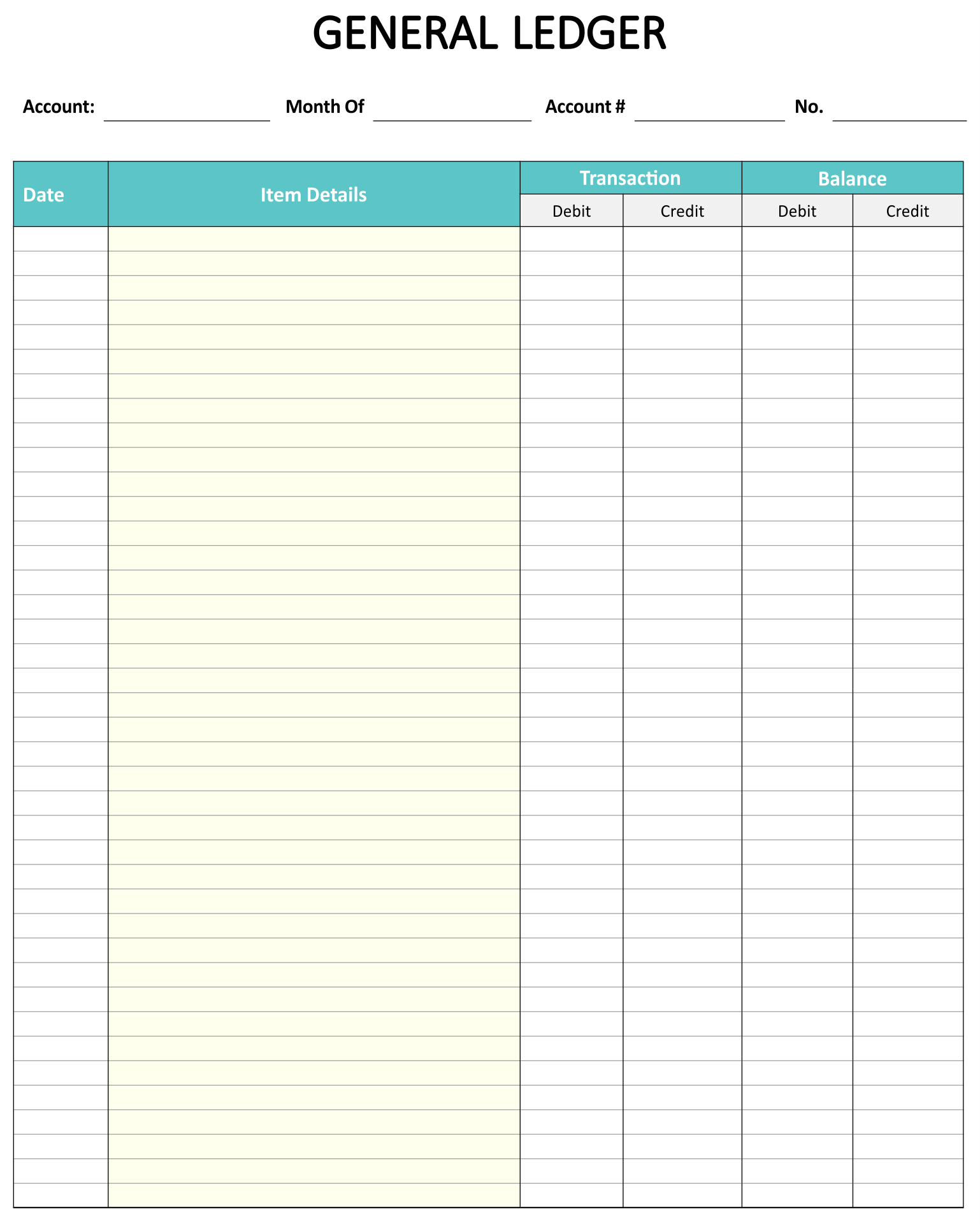

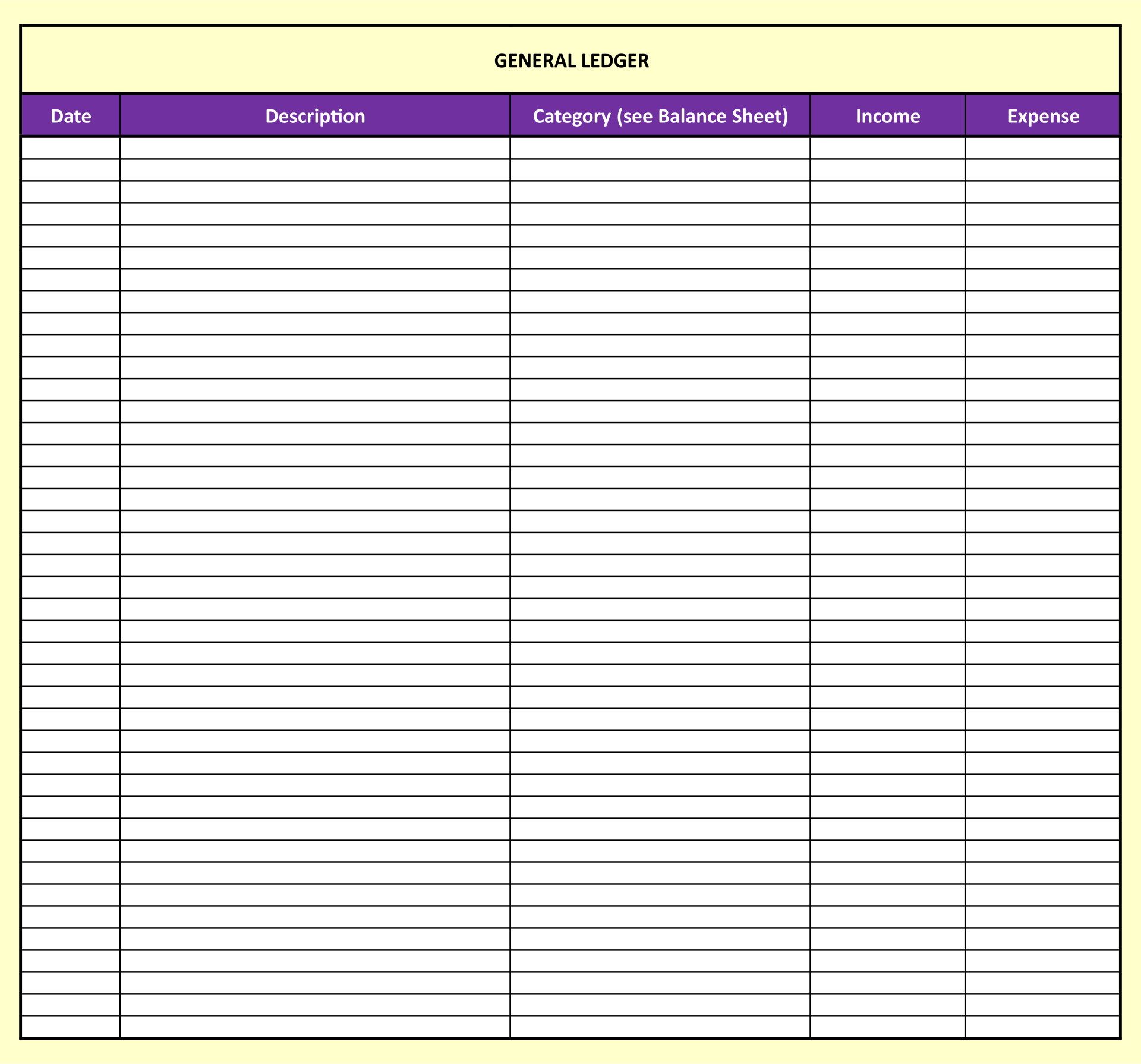

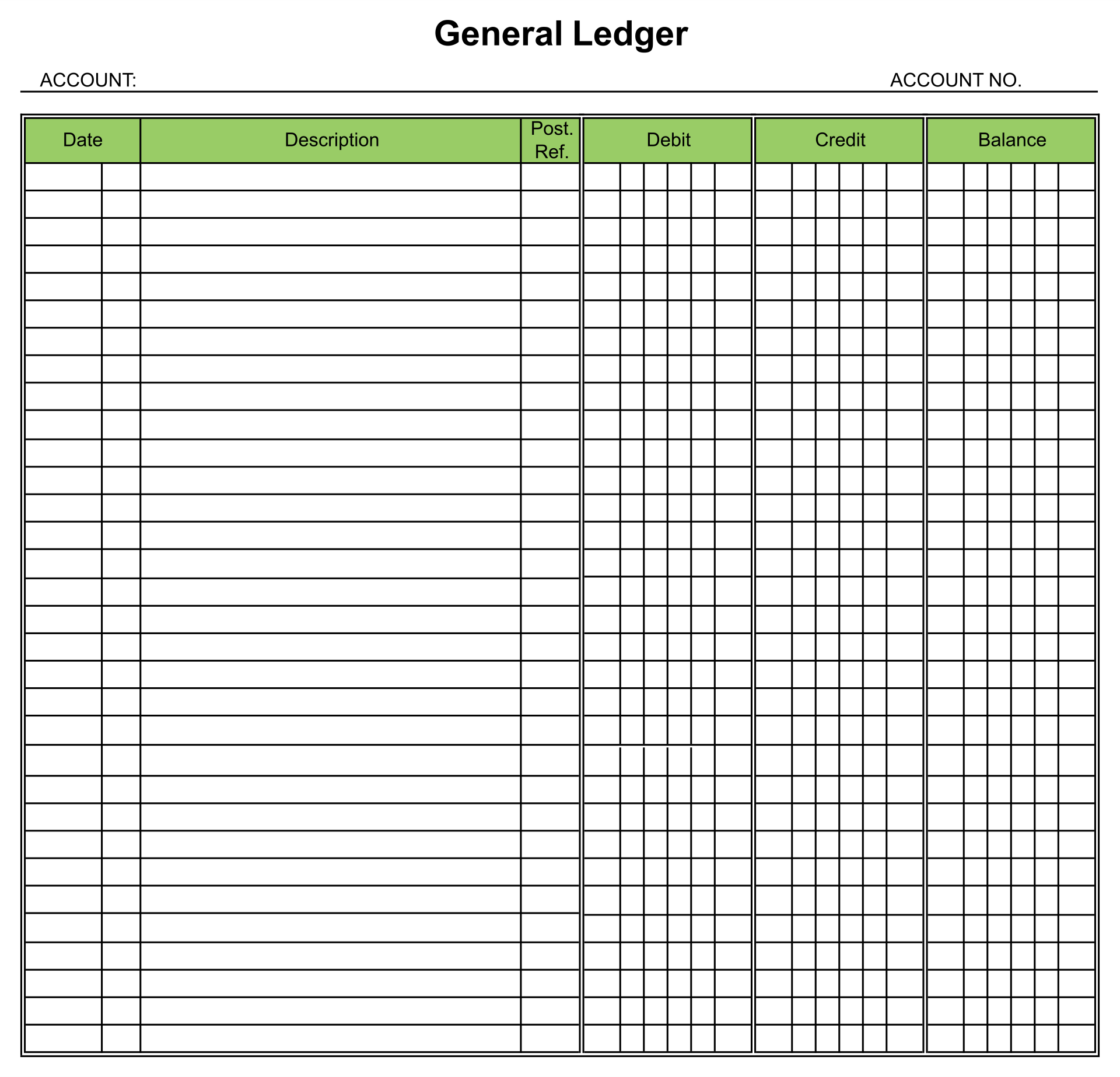

A printable Ledger balance sheet is a practical tool for tracking your financial transactions and ensuring the accuracy of your accounts.

You can easily monitor income, expenses, and balance your books by manually entering your financial data.

This method promotes a deeper understanding of your finances, allowing for better budgeting and financial decision-making. Plus, having a physical copy provides a solid backup and a tactile way to engage with your financial planning.

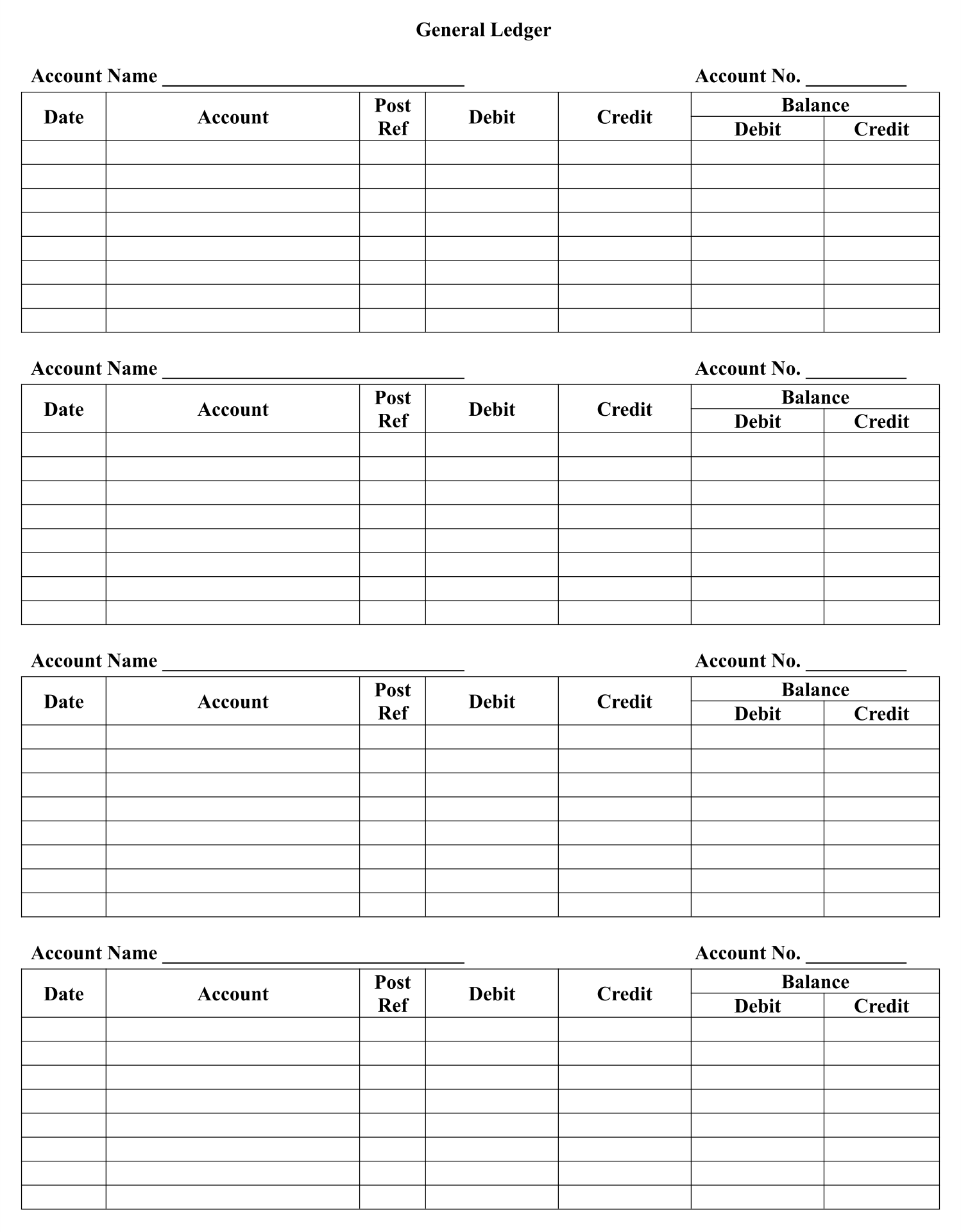

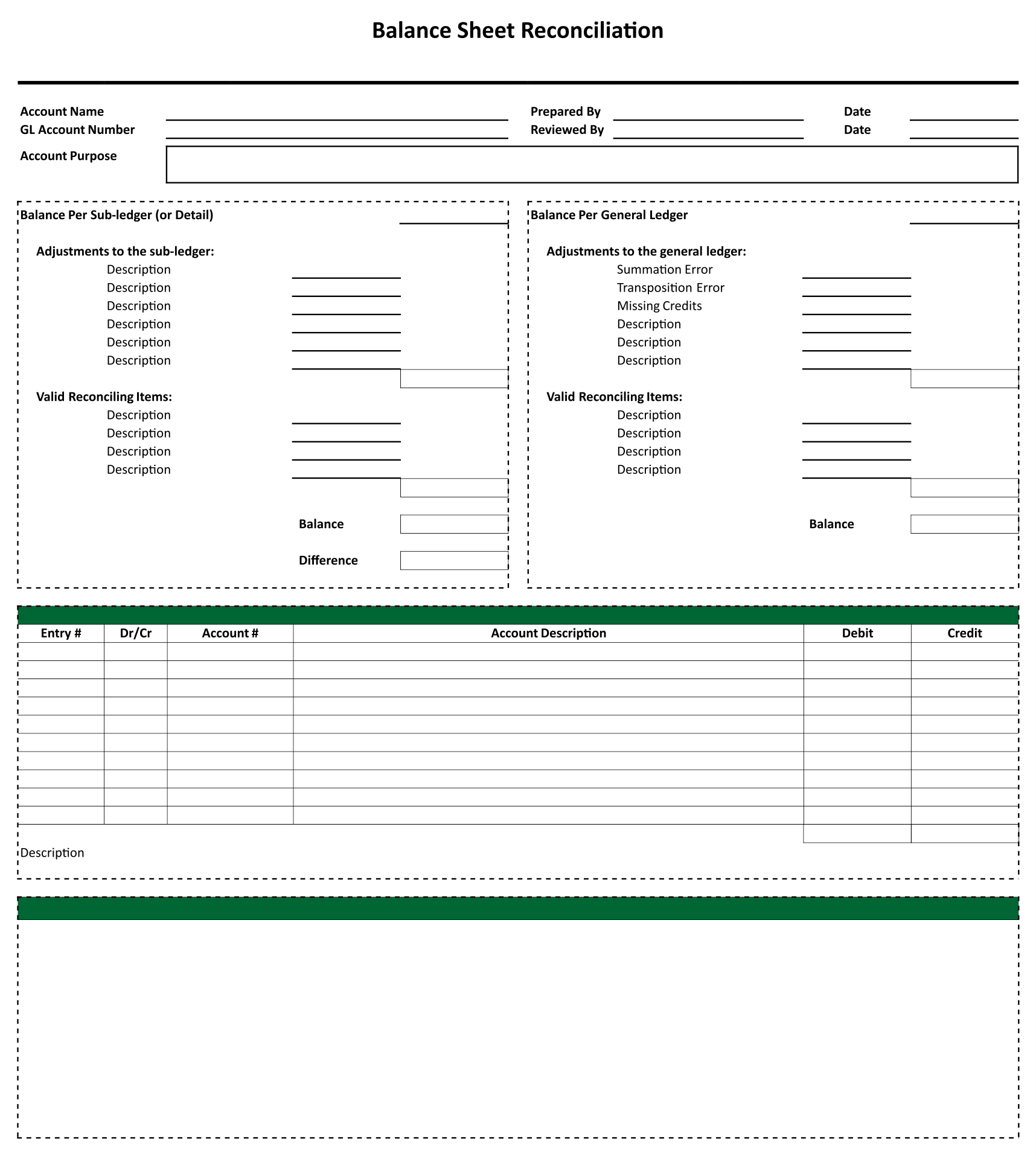

Keeping track of your financial transactions is streamlined with a printable general ledger balance sheet. You can easily record and categorize your business transactions, ensuring accuracy and readiness for financial reporting or analysis. This tool aids in maintaining a clear view of your financial standing, crucial for informed decision-making.

Accessing a ledger balance sheet without any cost allows you to effectively manage your finances without the need for expensive software. This free resource can help you monitor your income and expenses, providing a snapshot of your financial health, and helping you to spot trends or areas requiring attention.

Reconciling your general ledger balance sheet is vital for catching discrepancies early and ensuring the accuracy of your financial records. This process helps in verifying that your reported amounts are correct, supporting transparent financial reporting and compliance. It's a step towards safeguarding your business's financial integrity.

Have something to tell us?

Recent Comments

Thanks for sharing this free printable ledger balance sheet! It's a useful resource for keeping track of expenses and maintaining financial clarity. Appreciate the convenience and simplicity it offers.

I really appreciate the Free Printable Ledger Balance Sheet! It's such a helpful resource to keep track of my finances efficiently. Thank you for providing this valuable tool.

This free printable ledger balance sheet is a helpful resource for keeping track of financial transactions. It's simple and convenient to use, making it a great tool for maintaining a clear overview of your finances.