People like keeping track of their spending, but not everyone's a fan of digital apps for that. Sometimes, pen and paper feel more real, giving a clearer view of where the money's going. But finding good printable check register pages that fit what someone needs and are easy to use? That can be harder than it sounds. It's about striking the balance between being detailed enough and not overly complicated.

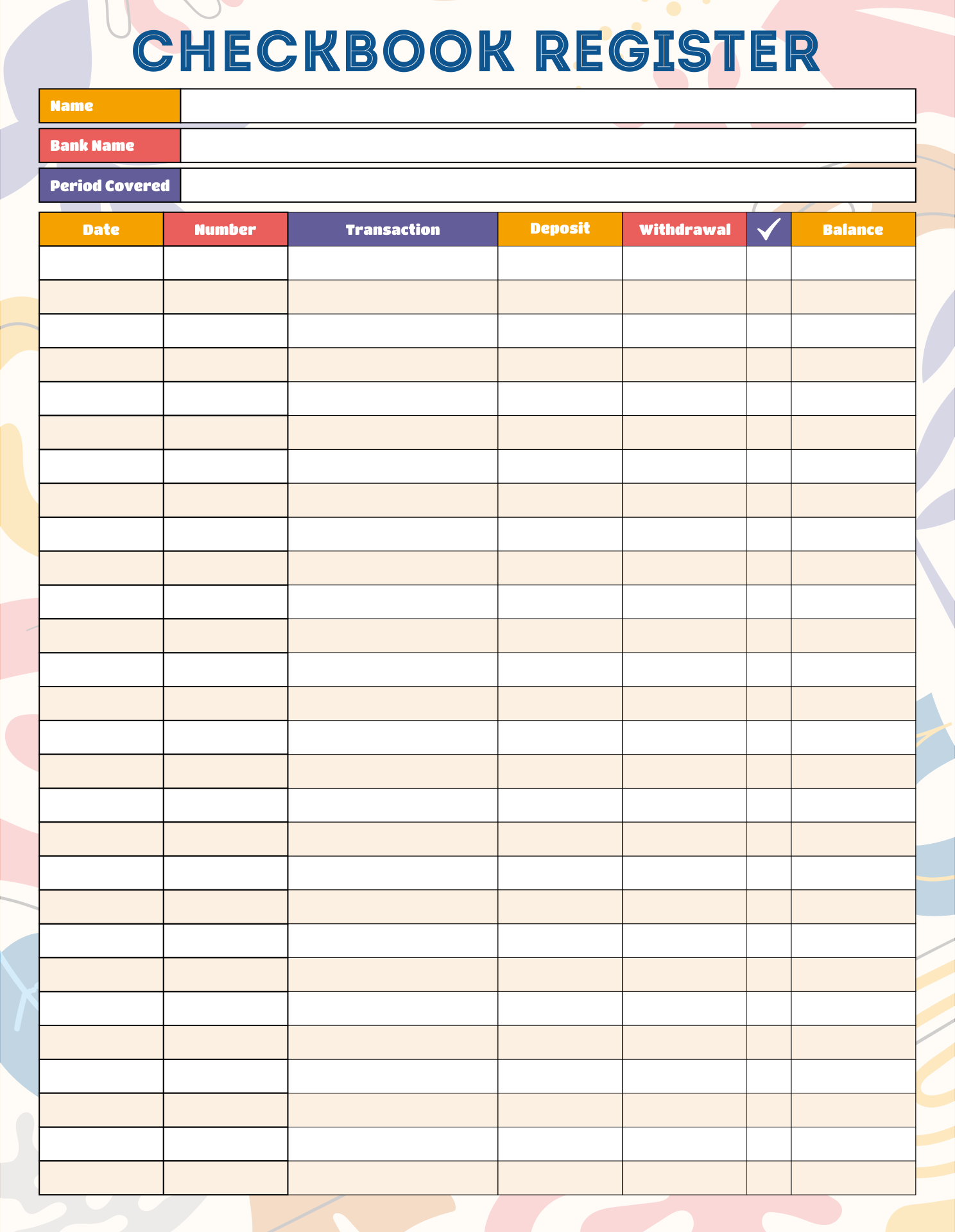

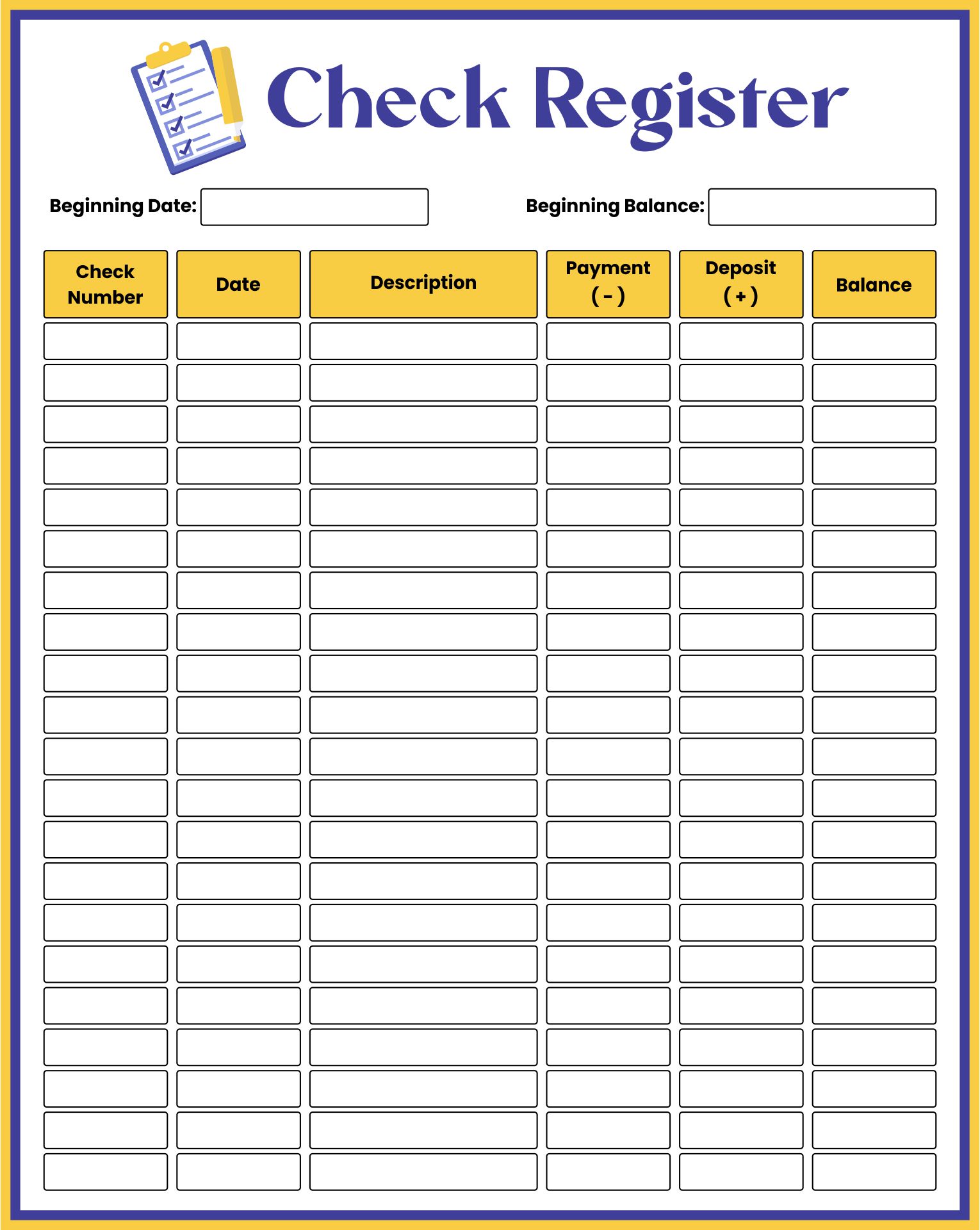

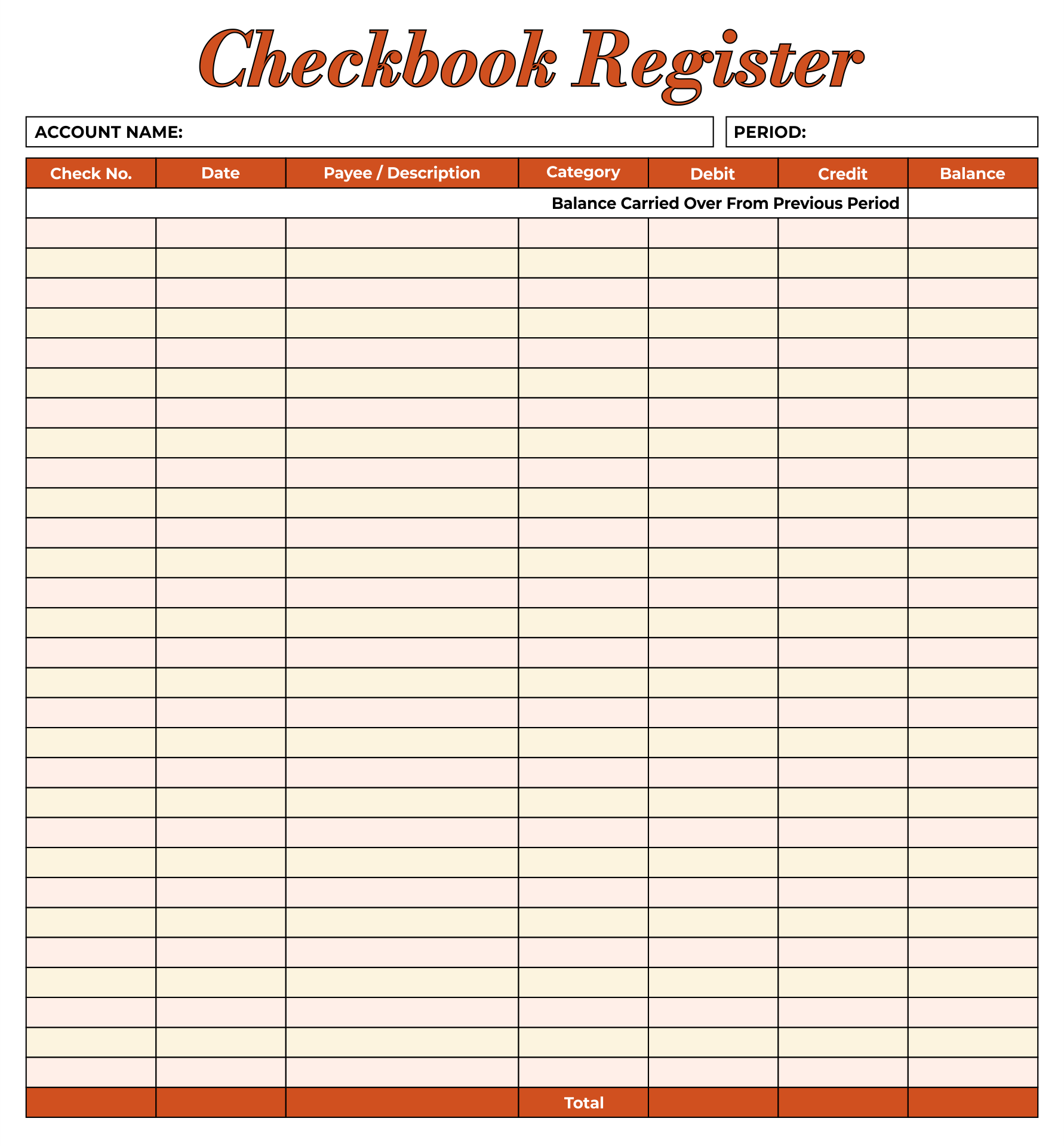

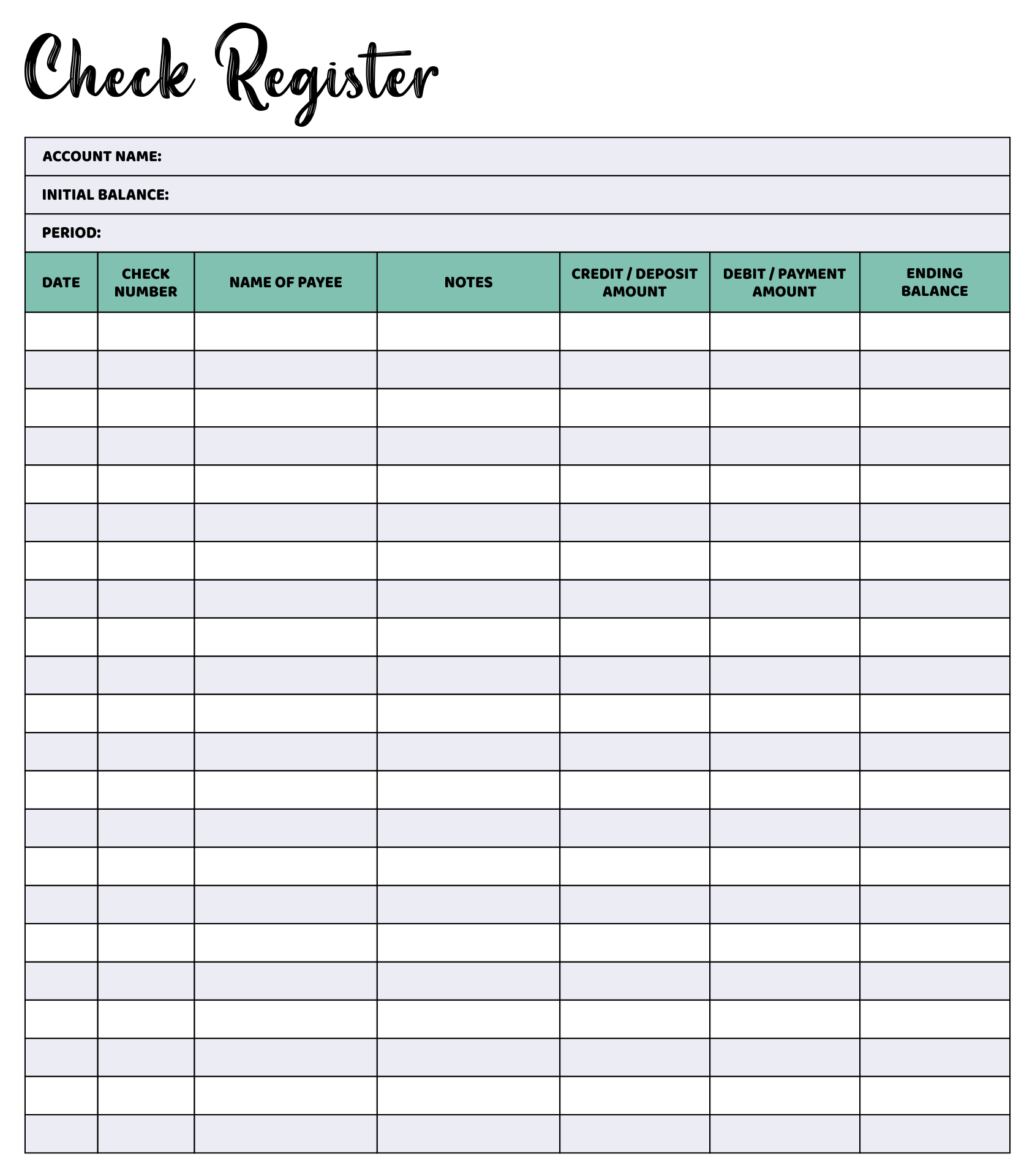

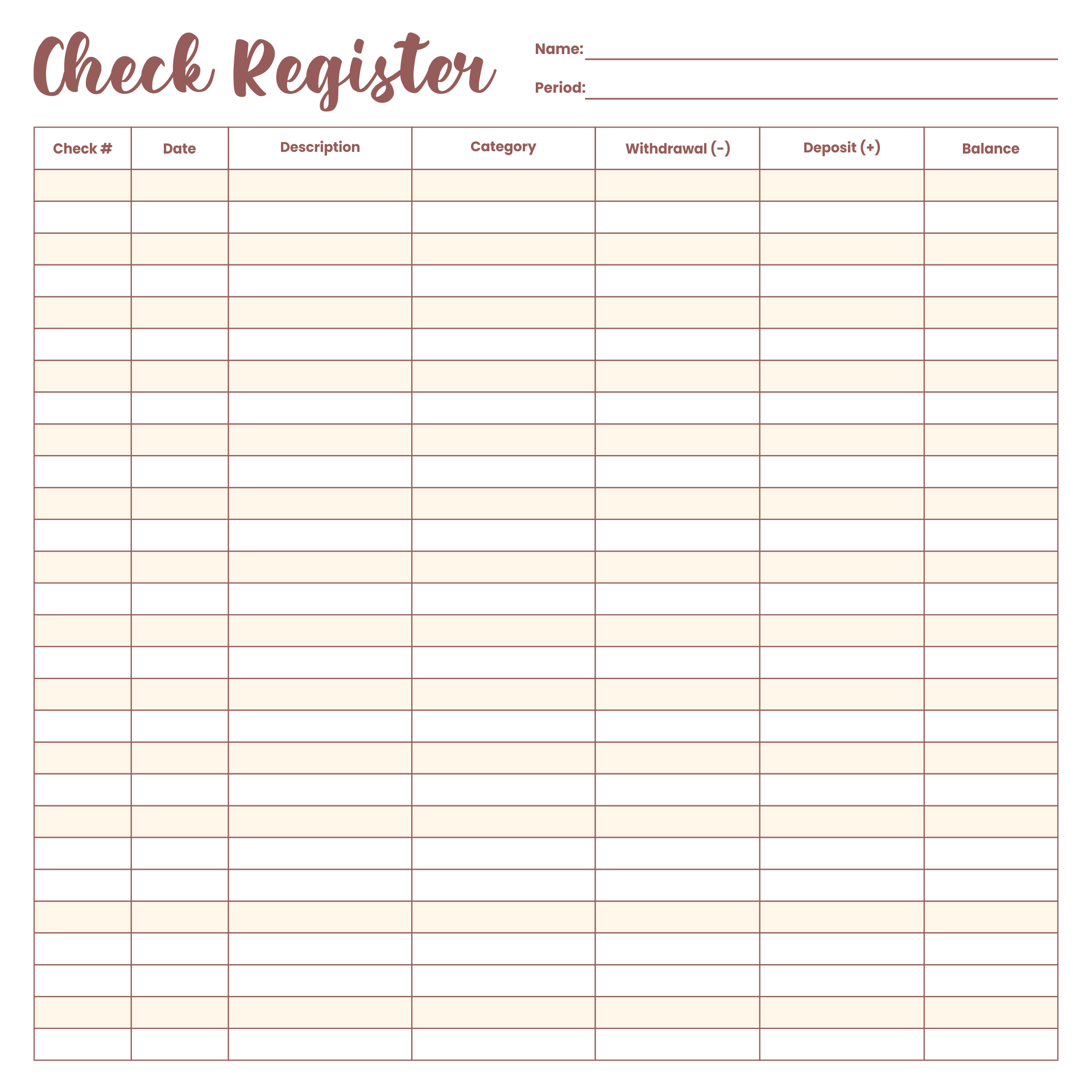

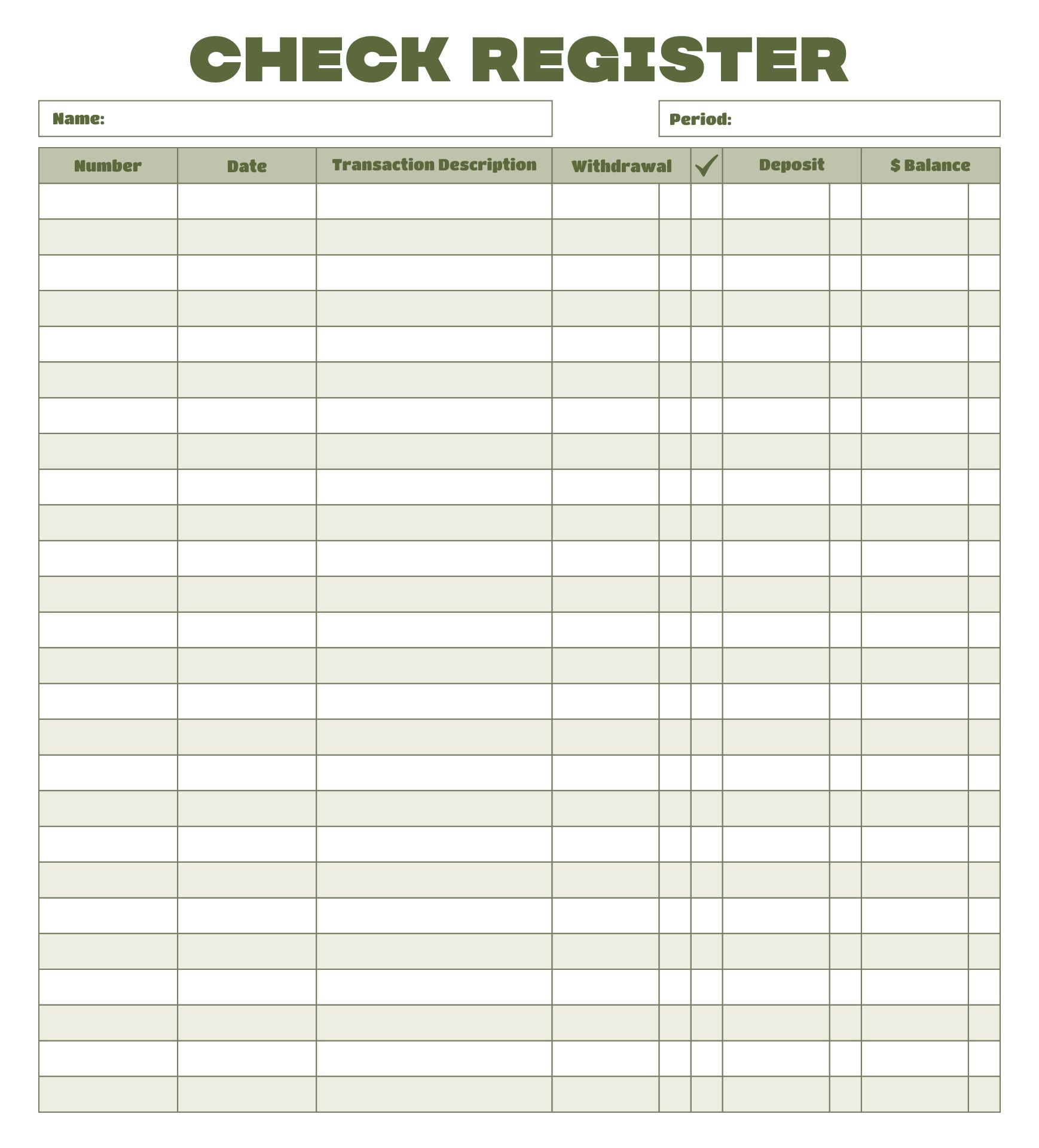

We design printable check register pages for keeping track of finances easily. These pages come in handy formats, making sure space is optimized for noting down transactions, dates, and balances. It helps stay organized and aware of spending habits. Simple to use, they aid in financial planning and monitoring, ensuring you always know where your money is going.

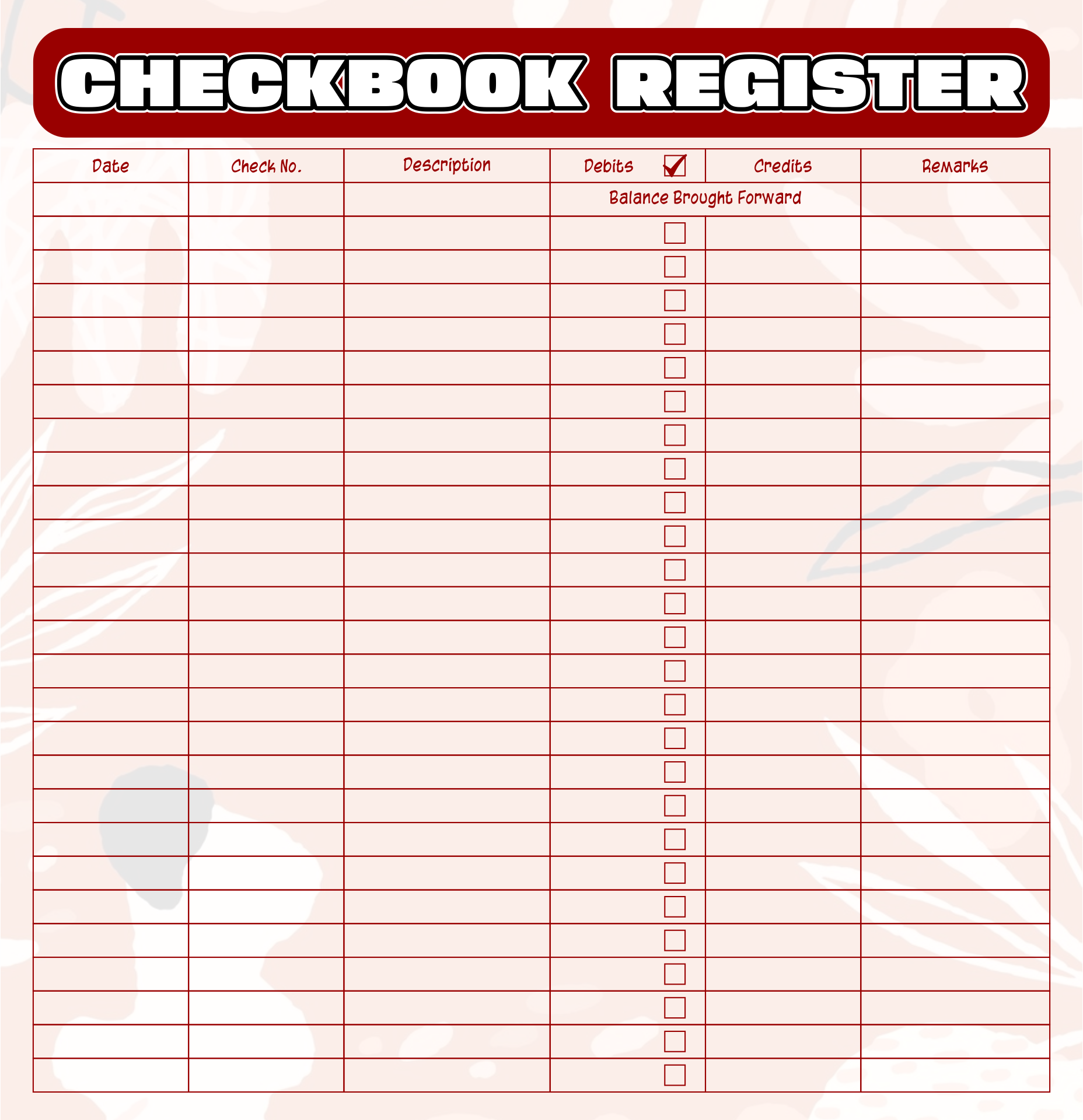

Checkbook registers are useful tools for keeping track of your financial transactions. It's advisable to keep these records for at least a year to account for any potential discrepancies or delayed transactions.

If your account isn't balancing, firstly verify your account status. Always remember to check your transaction record and consider using digital tools or asking assistance from others to manage potential errors. Ensure all your transactions are accurately recorded to prevent discrepancies.

Have something to tell us?

Recent Comments

Get organized with our free printable check register pages, designed to help you keep track of your finances efficiently and easily.

I appreciate having access to these free printable check register pages. They are a helpful resource for keeping track of my expenses and managing my finances effectively. Thank you!

Thank you for providing these free printable check register pages! It's great to have a simple and convenient tool to keep track of my finances.