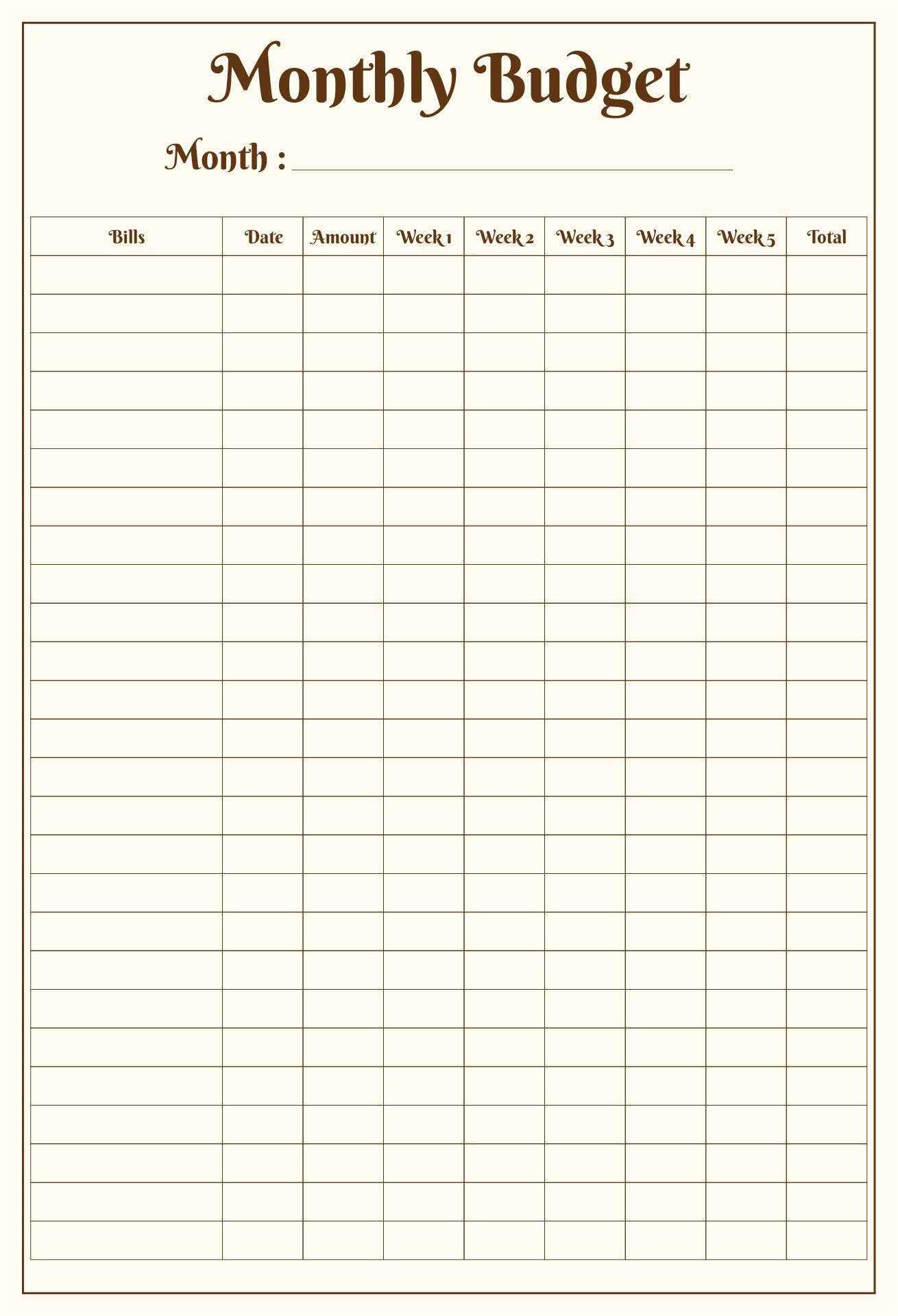

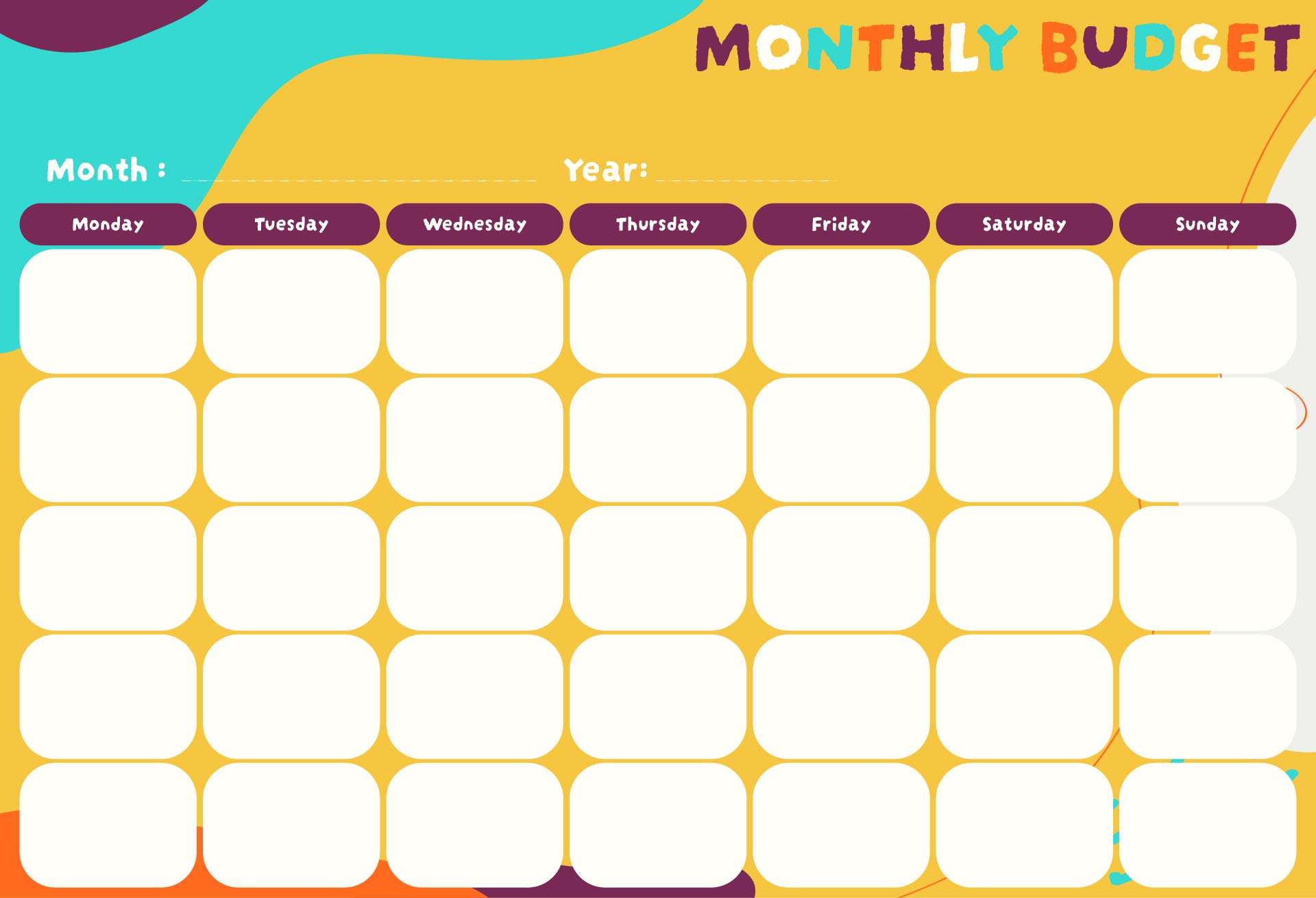

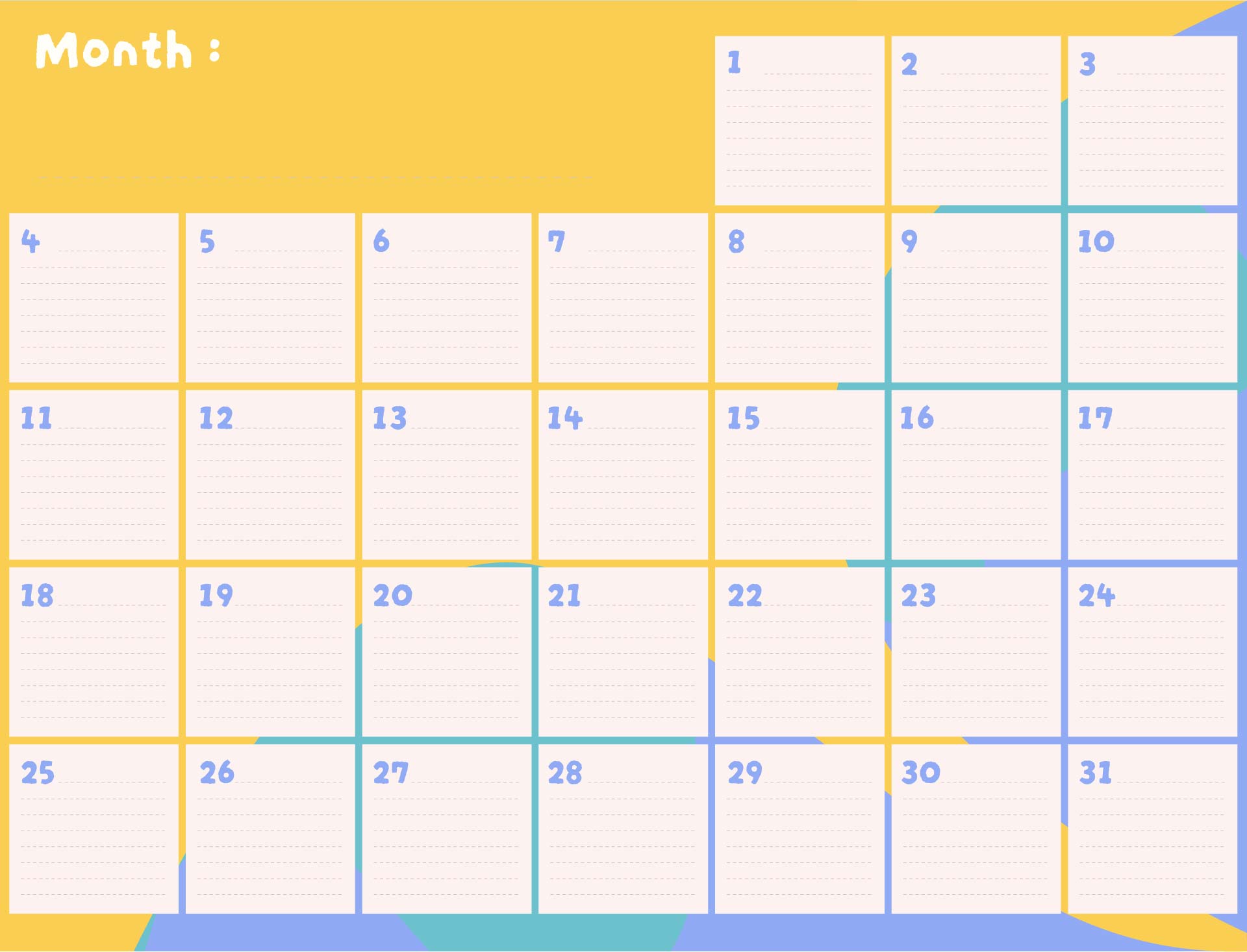

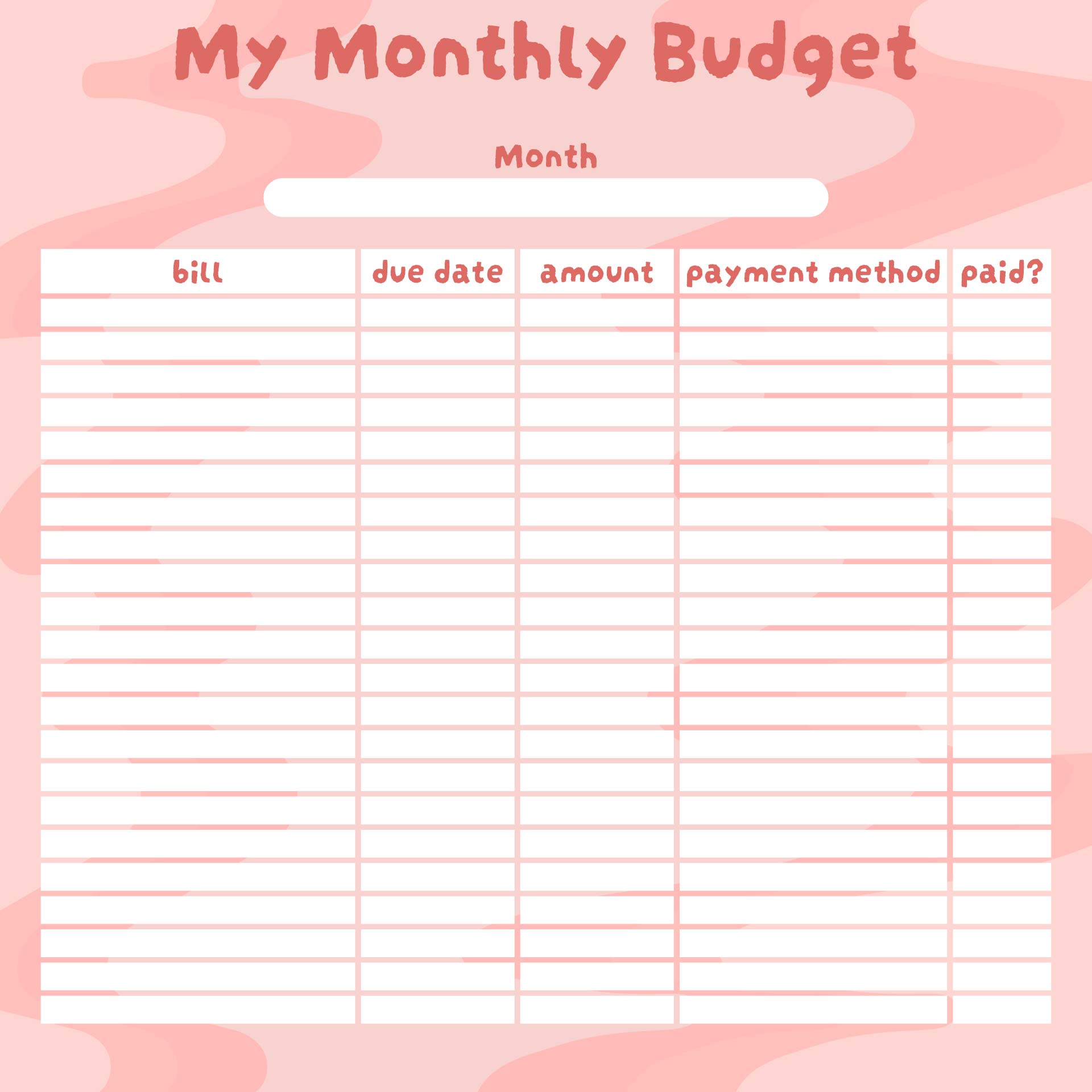

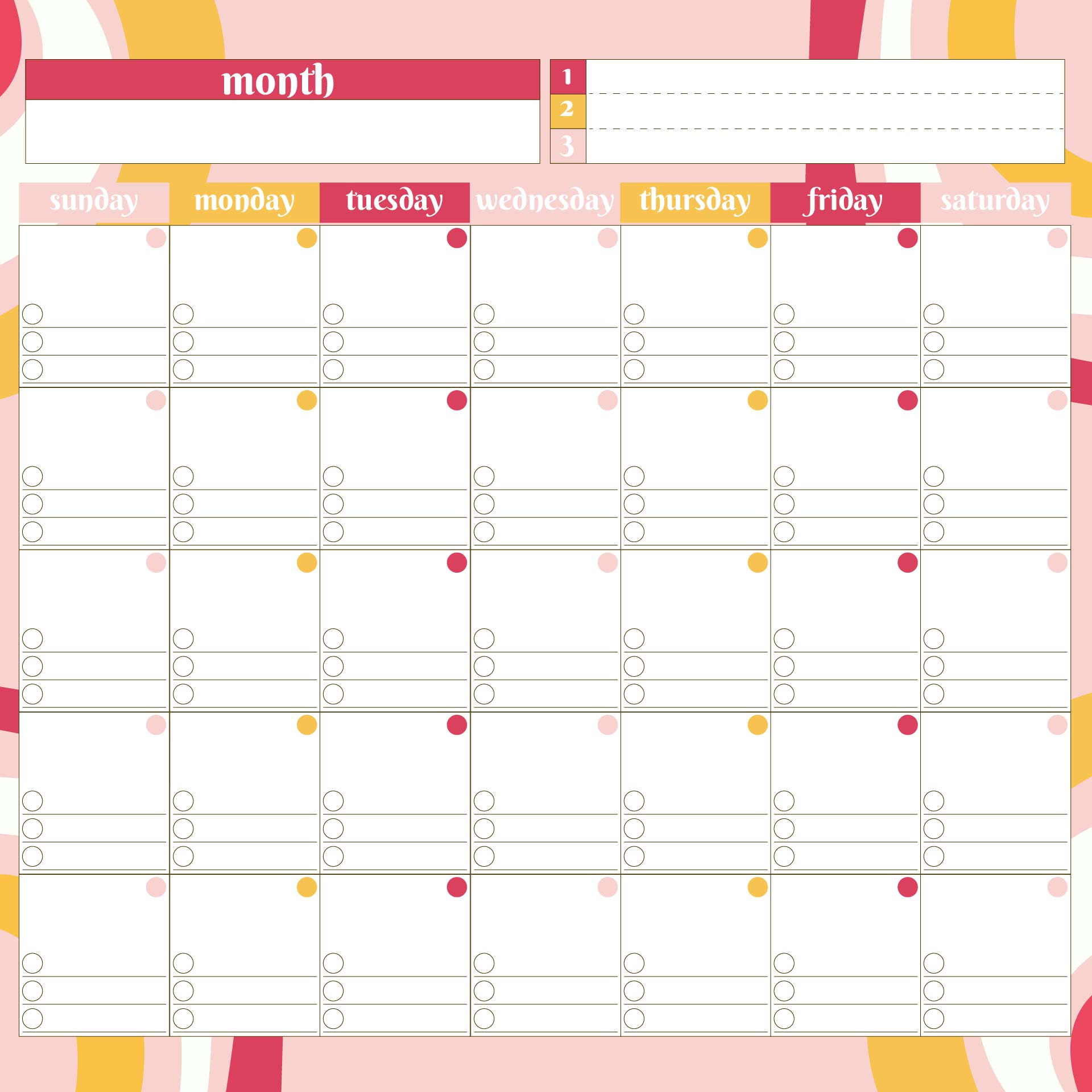

Use our calendar printable to effortlessly track your monthly expenses and income. It's a user-friendly tool that can support your financial management endeavors by making budgeting effortless and efficient.

Our printable monthly budget calendar is a great tool for students. It helps you effortlessly track spending, save money, and ensure timely bill payments. Start personalizing it with your financial details and see how it assists in managing your money more effectively.

A calendar printable monthly budget is a useful tool that allows you to plan out and track your expenses for each month. It provides you with a visual representation of your income and expenses, helping you stay organized and make informed financial decisions. By using this budgeting tool, you can effectively manage your money and work towards your financial goals.

Have something to tell us?

Recent Comments

I absolutely love the simplicity and functionality of this Free Calendar Printable Monthly Budget. It's a practical tool that helps me stay organized and on top of my finances. Thank you for providing such a helpful resource!

Find convenience and organization in your daily life with our free printable monthly calendar and budget template. Easily manage your schedule and finances, simplifying your planning and saving you time.

I appreciate the simplicity and convenience of the Free Calendar Printable Monthly Budget. It's a useful tool that helps me stay organized and manage my expenses effectively. Thank you for offering it for free!