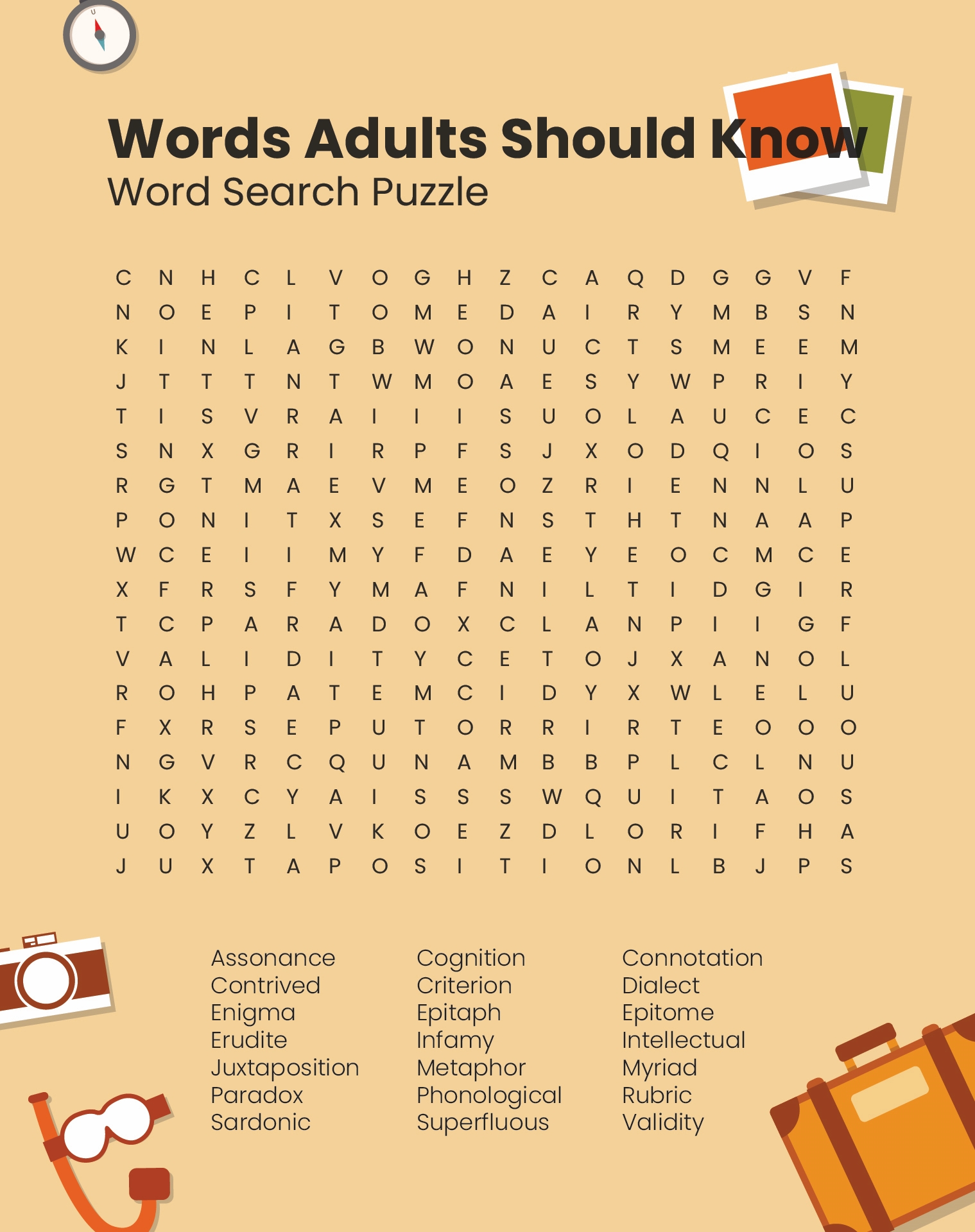

Printable Word Searches searches for adults can sharpen your cognitive skills and enhance vocabulary in a fun and engaging way.

These puzzles are perfect for a relaxing break or to keep your brain active, improving problem-solving abilities and attention to detail.

You can easily find puzzles tailored to your interests or skill level, making it a personalized brain exercise. Enjoy them during your leisure time or as a daily mental workout to keep your mind sharp.

Finding entertaining ways to challenge your mind during the colder months can be enjoyable with Winter Word Search printables designed for adults. These puzzles not only help you relax and unwind but also enhance your vocabulary and cognitive abilities as you search for hidden winter-themed words. They can be a delightful activity for cozy evenings at home.

Your children can learn more about their faith in an engaging manner with Printable Bible Word Search Puzzles. These puzzles make the stories and characters of the Bible accessible and fun for kids, improving their reading and comprehension skills while providing them with valuable biblical knowledge.

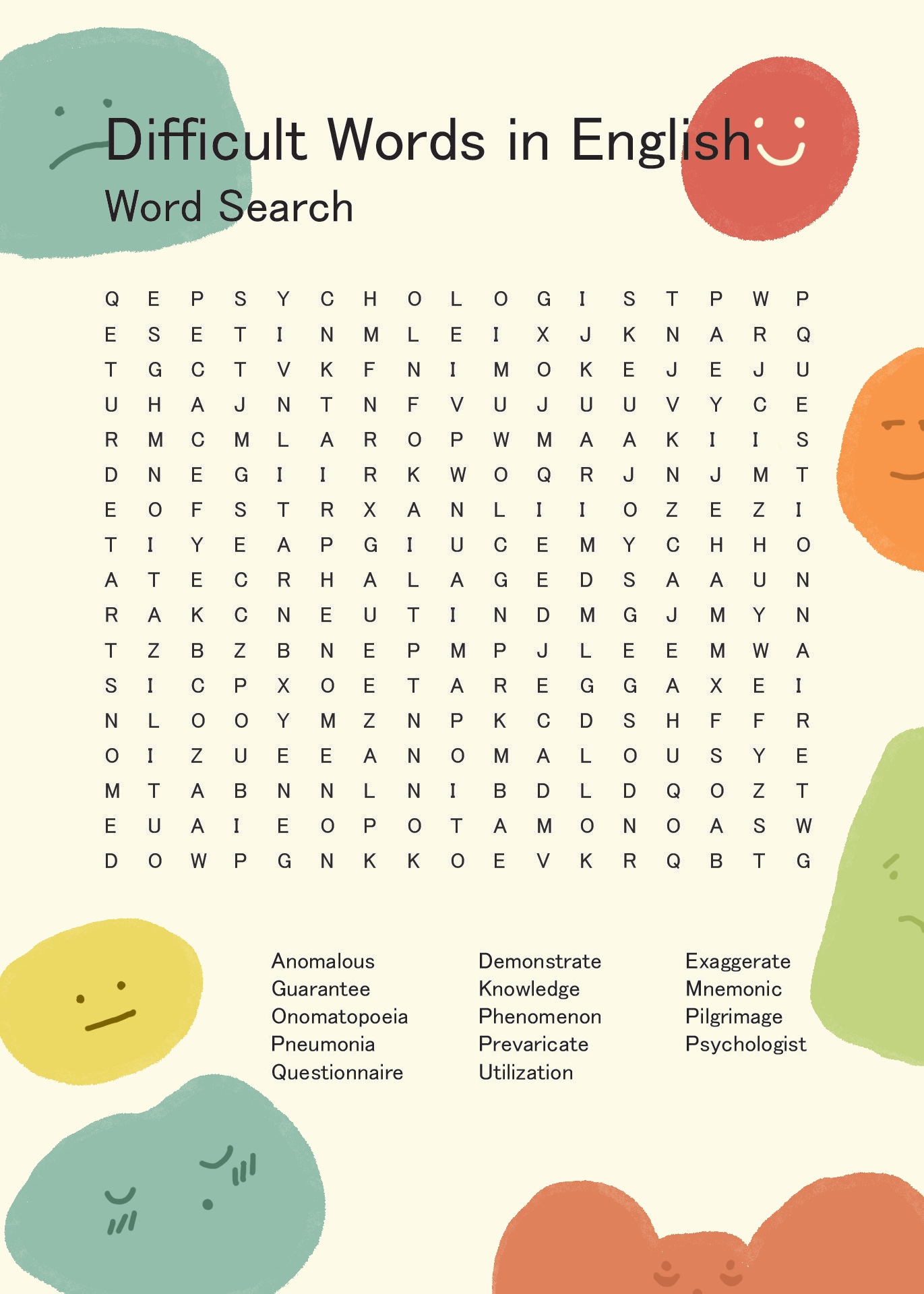

If you're looking for a mental workout, hard Word Search puzzles available for printing can provide a challenging and satisfying experience. They test your patience and sharpen your focus while helping you discover and learn new words. This might be your go-to activity to stimulate your brain and pass the time productively.

Have something to tell us?

Recent Comments

Printable word search puzzles for adults are a great way to engage in a fun and challenging activity, improving cognitive skills and offering a relaxing mental break.

I found the Printable Word Searches Puzzles for Adults to be an enjoyable and brain-stimulating activity. The puzzles are well-designed, providing a great balance of challenge and fun. It's a great way to relax and exercise my mind.