It's tricky when teaching kids about money and how it works. Real money can't be used for safety reasons and for practicality. Too often, they don't get the feel of handling money which makes learning about transactions and budgeting harder. Need something that looks close to real but clearly isn't, for educational purpose.

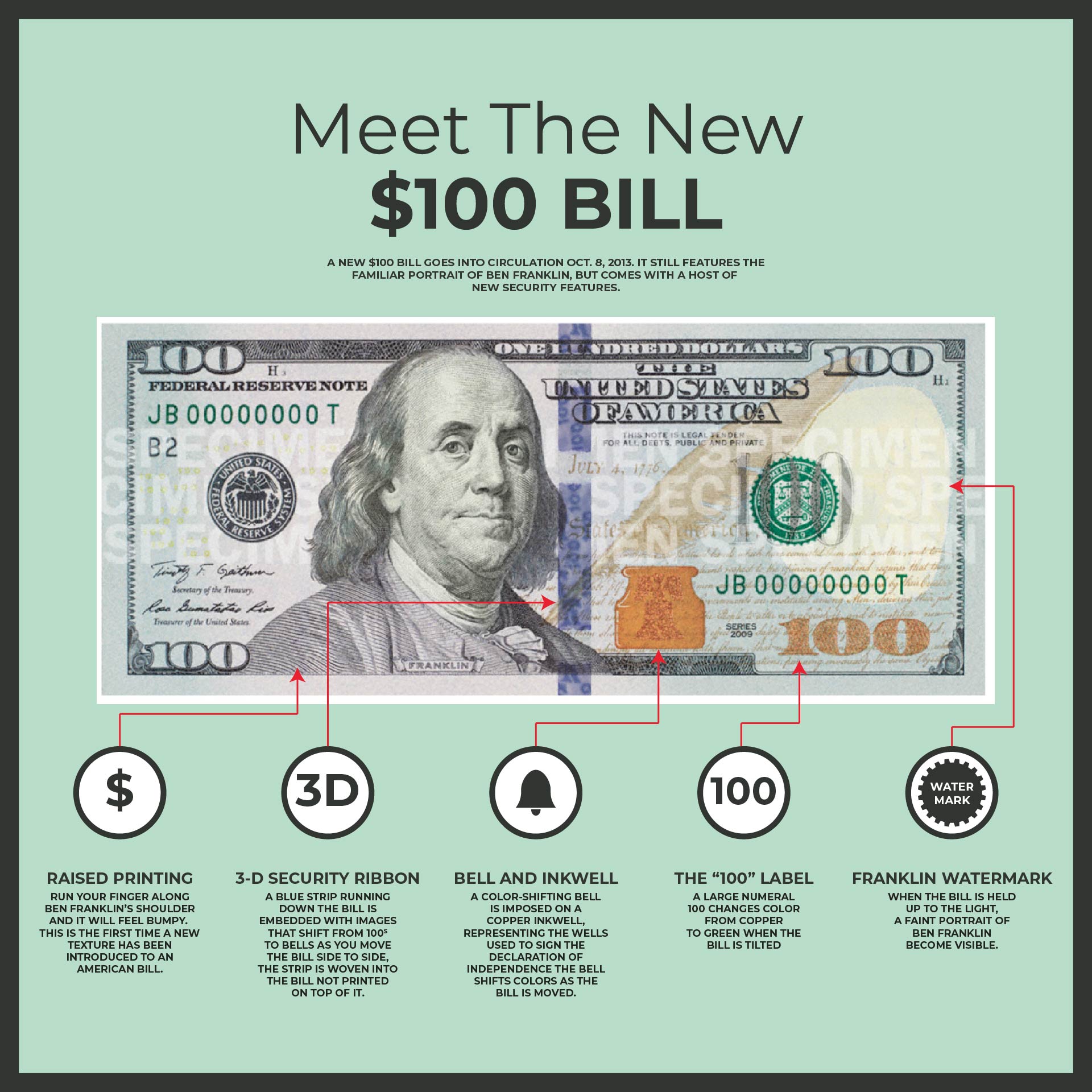

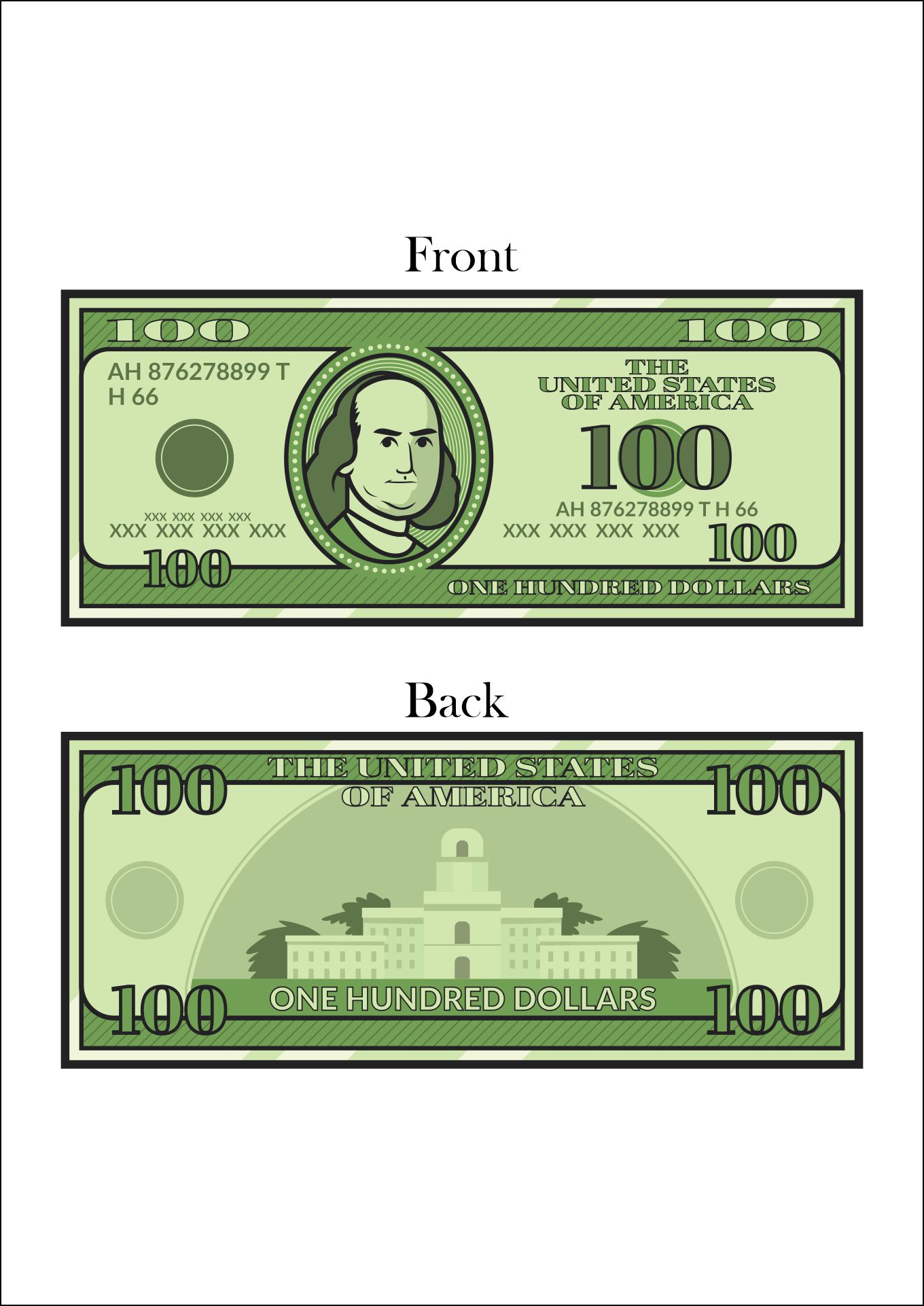

We know it helps to have realistic looking printable money for teaching about spending, saving, and math. Crafting designs that resemble real bills but clearly marked as play money can elevate learning. It lets kids practice with something that feels authentic while keeping it educational and safe. You can use them for math lessons, money management skills, or even as part of a classroom economy system.

Teaching children about the value of money can be made engaging and interactive through various games and activities. Besides using templates of money that look real, are a few examples of games that can help children learn about money:

Monopoly: Monopoly is a classic board game that teaches children about money management, budgeting, and strategic decision-making. It involves buying properties, collecting rent, and making financial choices throughout the game. To play it, you can use printable monopoly template. There are many monopoly money template themes that can be used so kids will love them.

The Allowance Game: This game simulates real-life scenarios by giving children a set allowance and allowing them to make spending, saving, and donating decisions. It helps them understand the importance of budgeting, setting financial goals, and making choices with limited resources.

Money Bingo: Create a bingo game where children have cards with different amounts of money, and you call out the values. The child who completes a row or a full card first wins. This game helps reinforce recognition and counting of money.

Coin Sorting: Give children a variety of coins and ask them to sort them by type (e.g., pennies, nickels, dimes, quarters) or value. This activity helps familiarize them with different denominations and reinforces their ability to count and identify coins.

Grocery Store Game: Set up a pretend grocery store at home with price tags for different items. Give children play money and ask them to shop for items within a given budget. They can practice making choices, comparing prices, and calculating totals.

Lemonade Stand: Help children set up a lemonade stand where they can sell cups of lemonade to family and friends. Encourage them to determine the cost per cup, set prices, and keep track of their earnings and expenses. This activity teaches basic entrepreneurship, pricing, and money management skills.

Online Financial Games: Various online games and apps are specifically designed to teach kids about money management. For example, "Bankaroo" allows children to create virtual bank accounts and track their savings, spending, and budgeting.

Remember that financial conversations with children should be ongoing and adapted to their age and developmental level. As they grow older, discussions can go deeper into topics such as investing, banking, credit, and financial planning. See also our printable monopoly money template.

By instilling a strong foundation of financial literacy early on, you are equipping children with valuable life skills for their financial well-being in the future.

Have something to tell us?

Recent Comments

Printable images of money that look real are ideal for settings like movies, TV shows, or theatrical performances where authentic-looking prop money is needed. They provide a convenient and cost-effective solution for creating a genuine visual experience without the need for actual currency.

Great resource for teaching financial literacy and money management skills! The printable money looks authentic and can be used in a variety of educational activities. Highly recommend!

This printable resource is a great tool for teaching financial literacy and money recognition skills. It provides a realistic representation of money, making learning fun and interactive. Highly recommended!