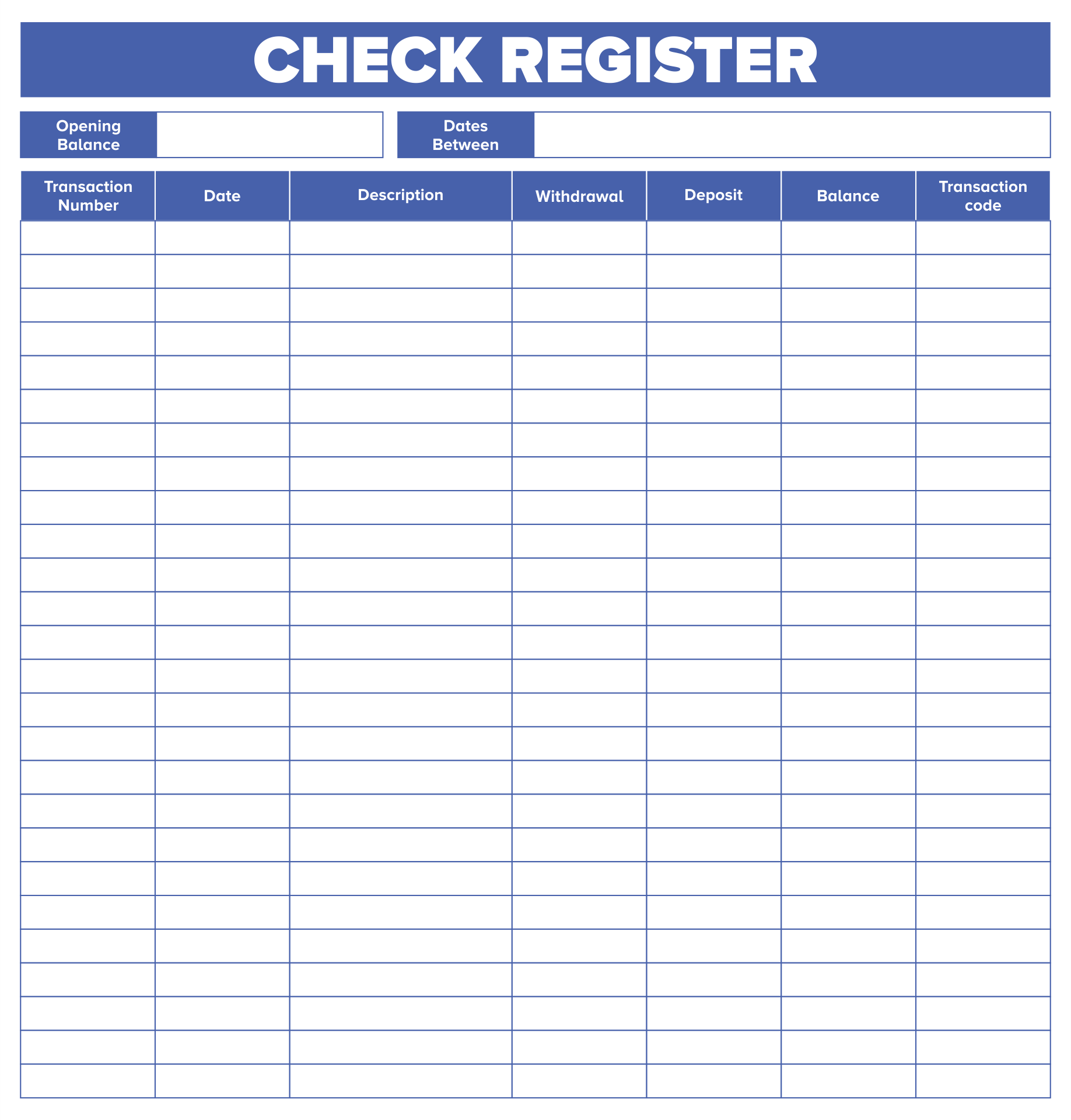

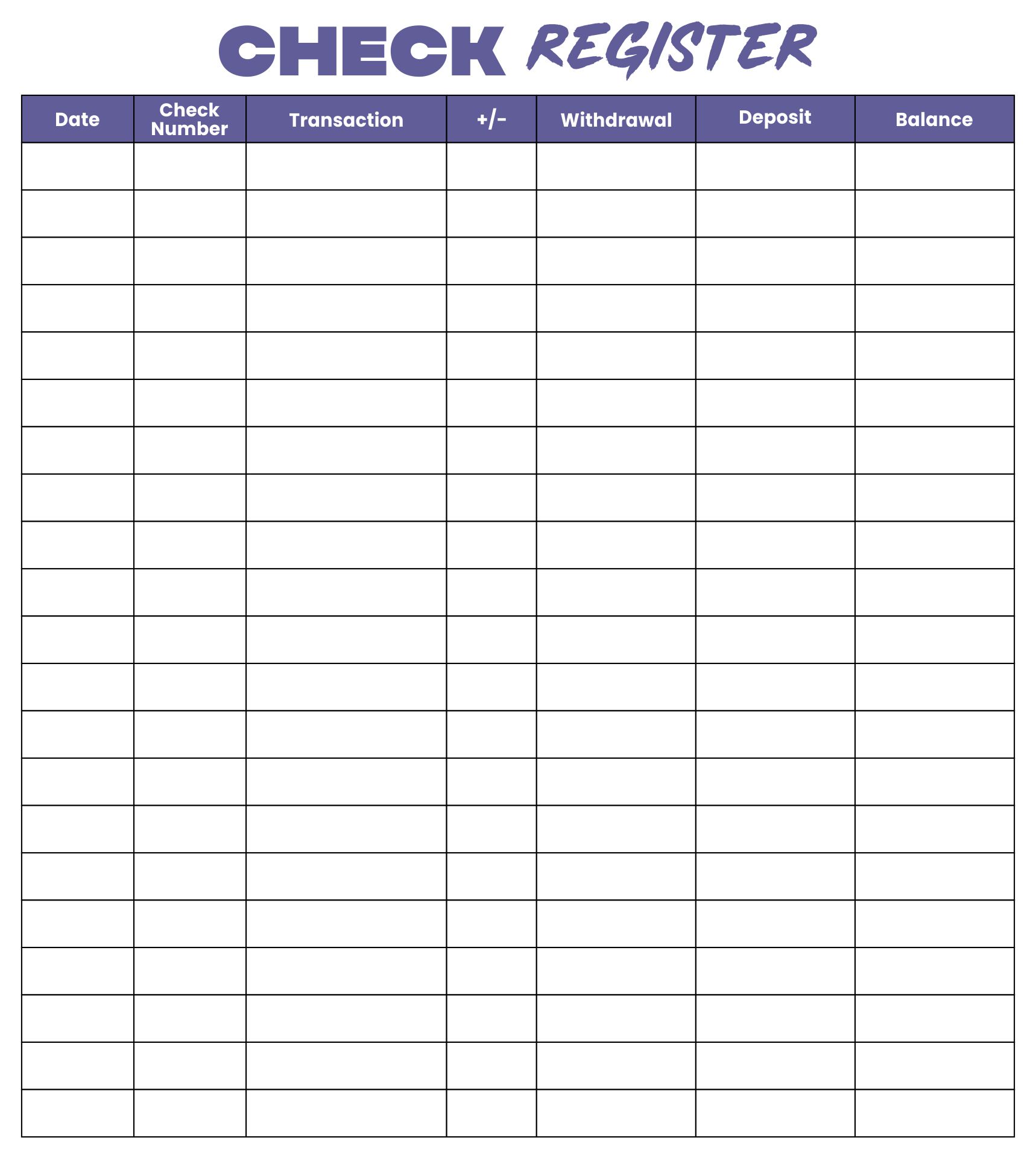

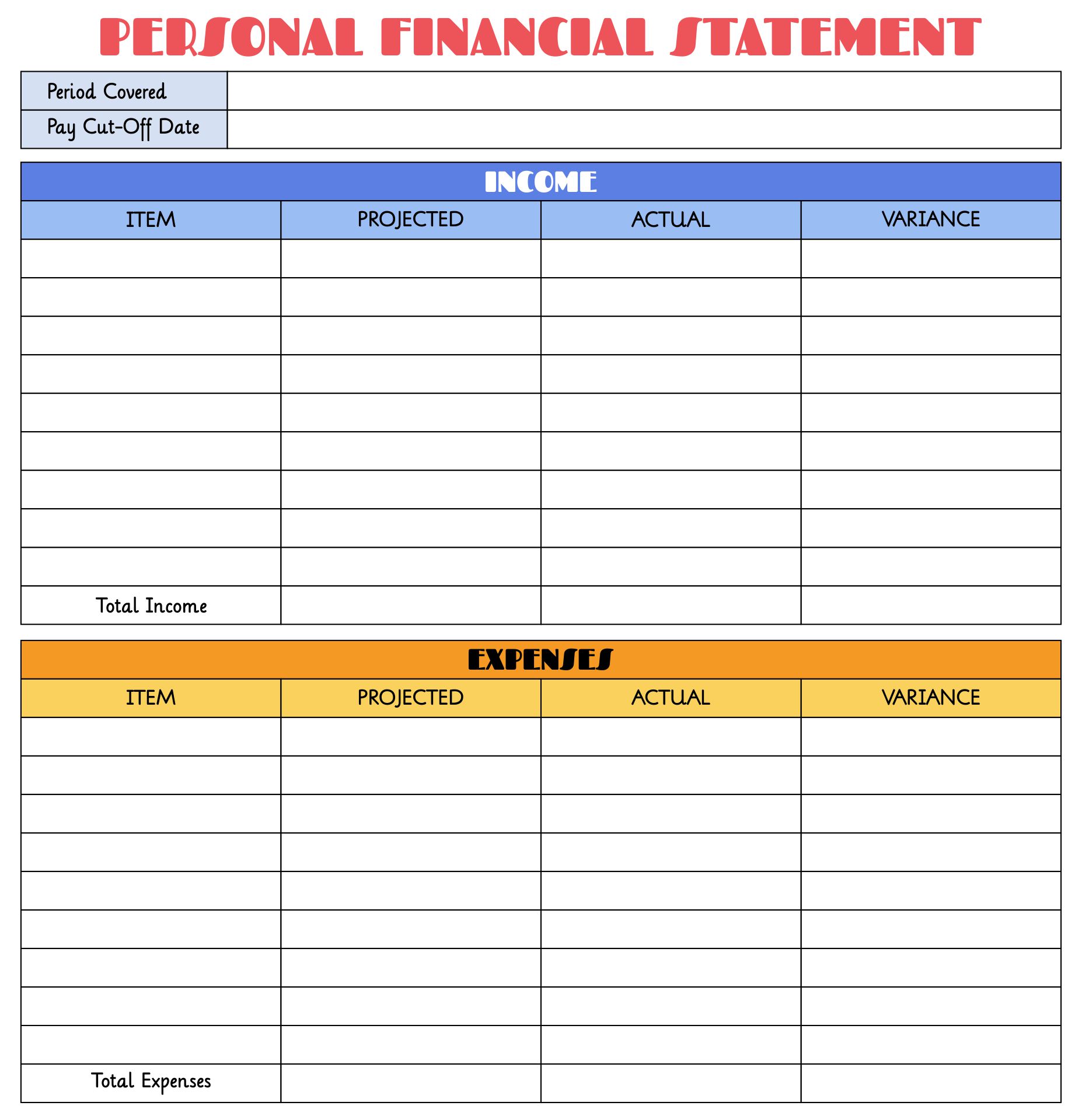

Utilizing this tool can aid you in managing your expenses, recording your transactions and staying on top of your financial goals.

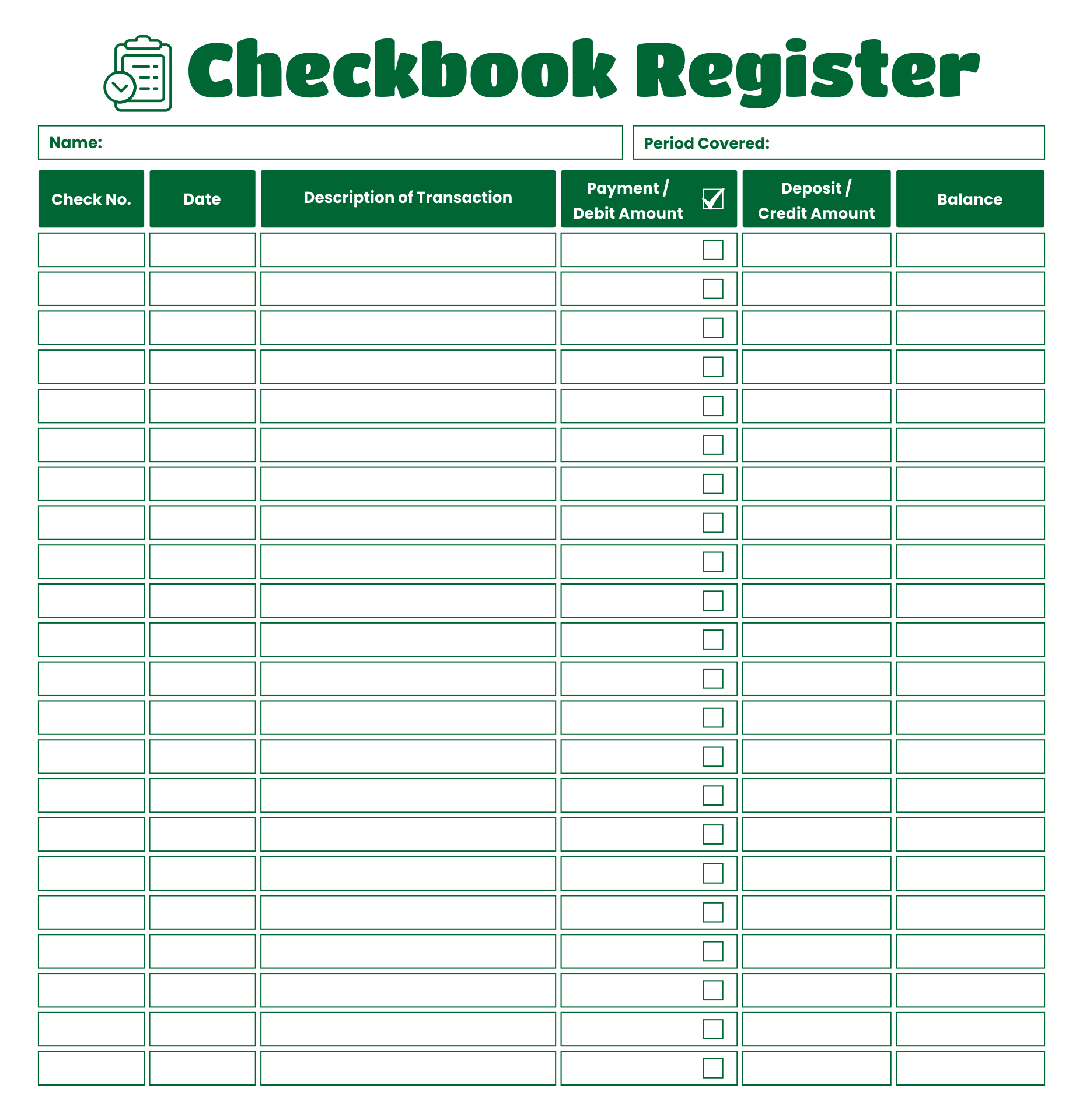

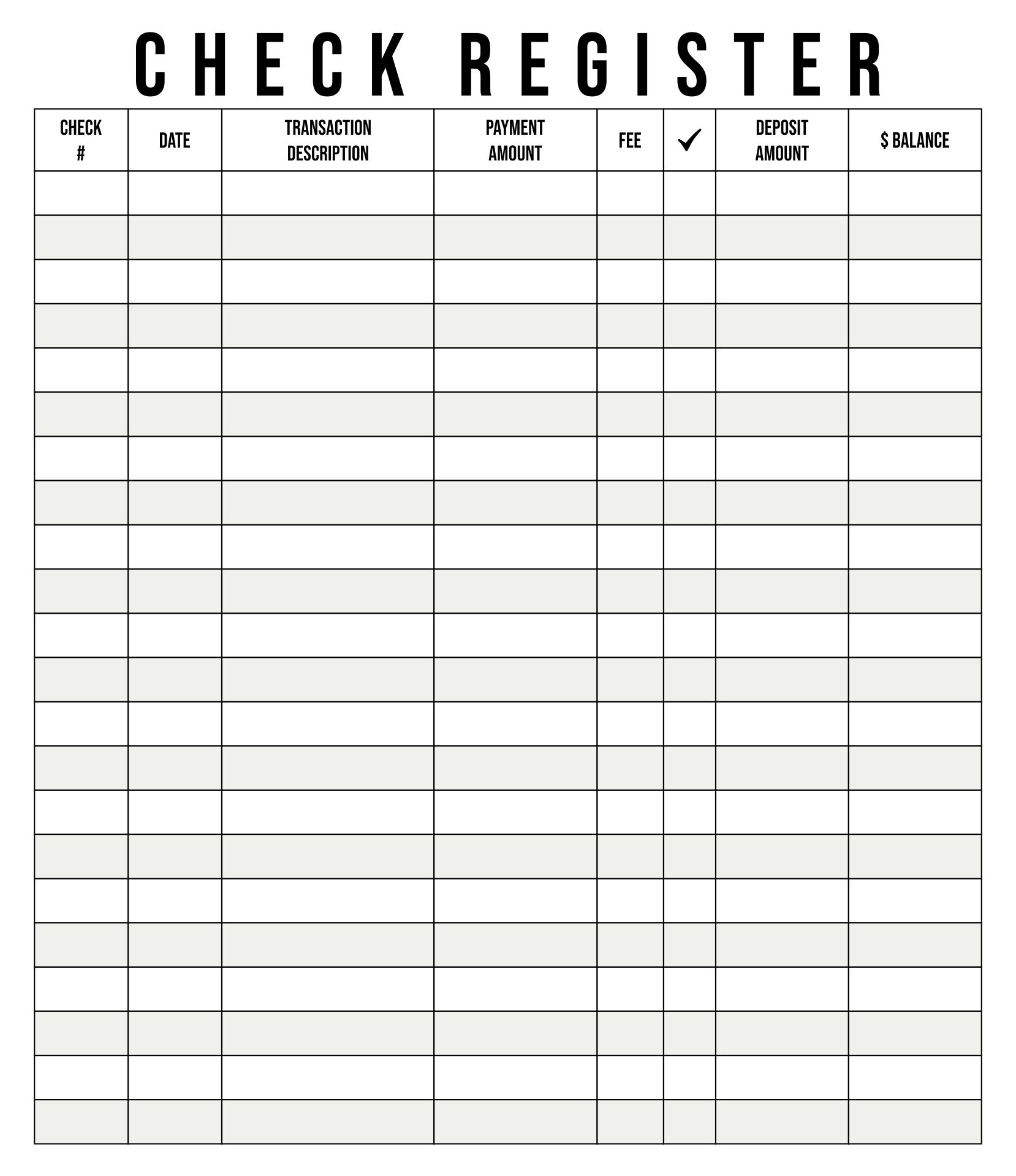

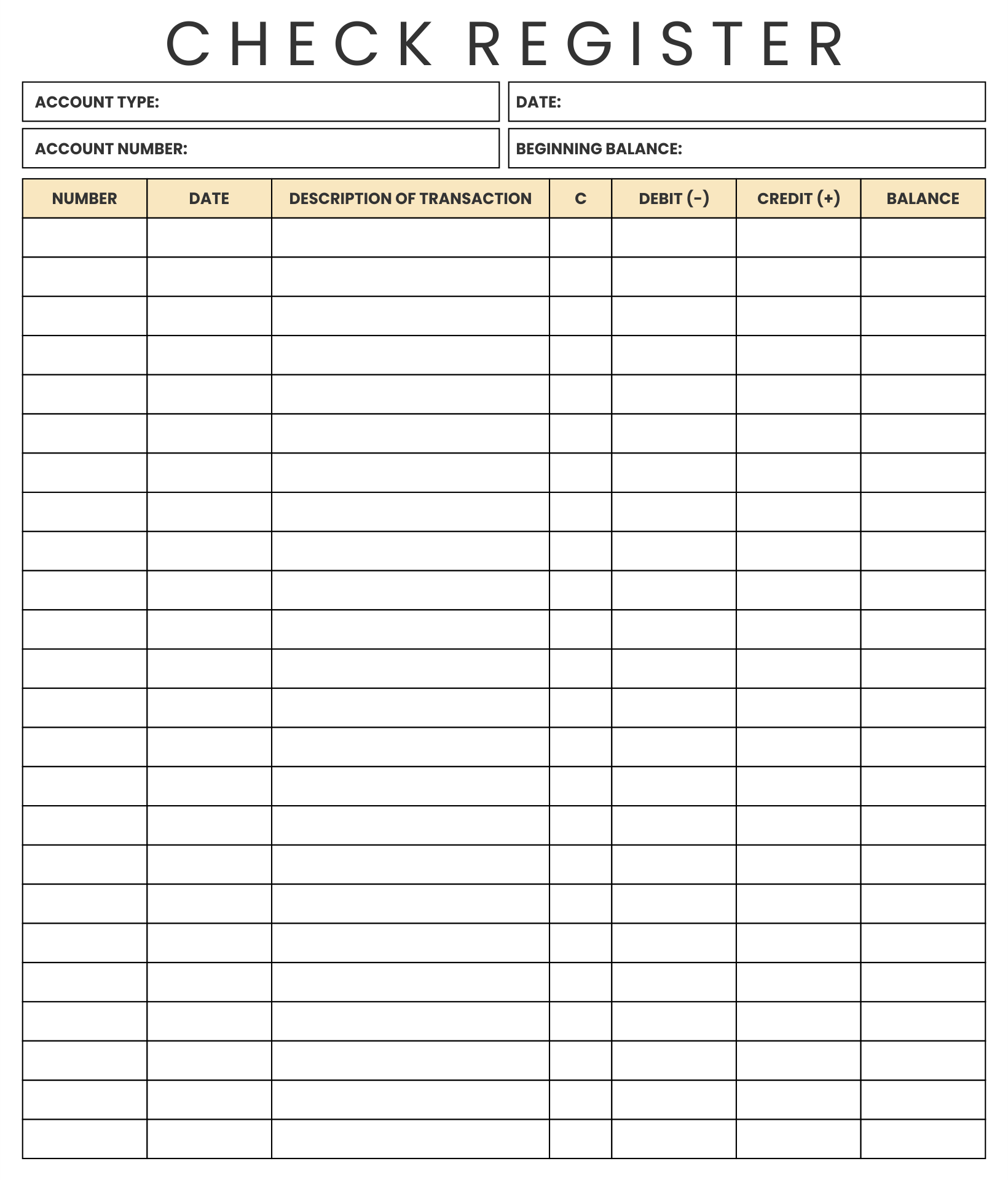

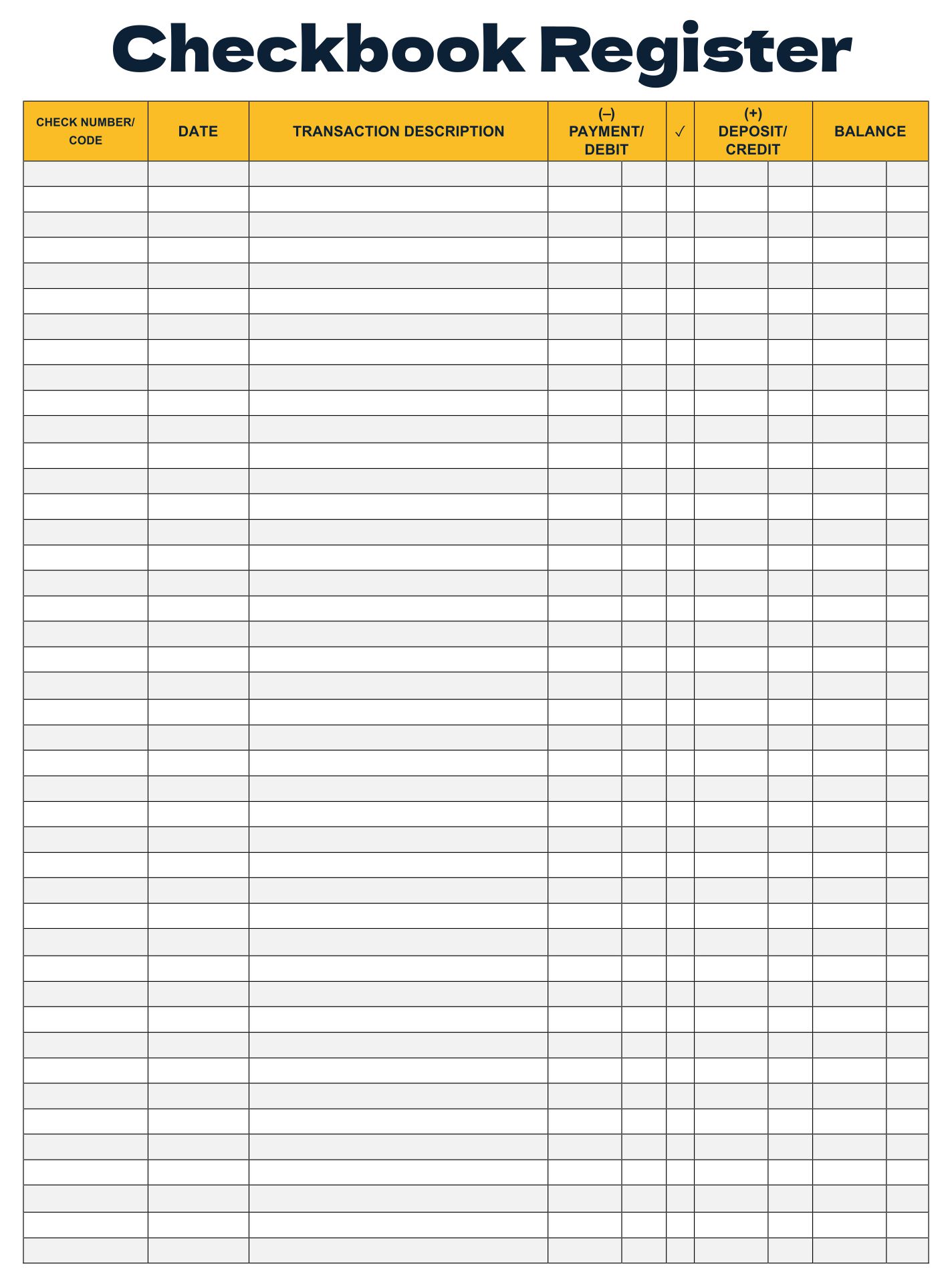

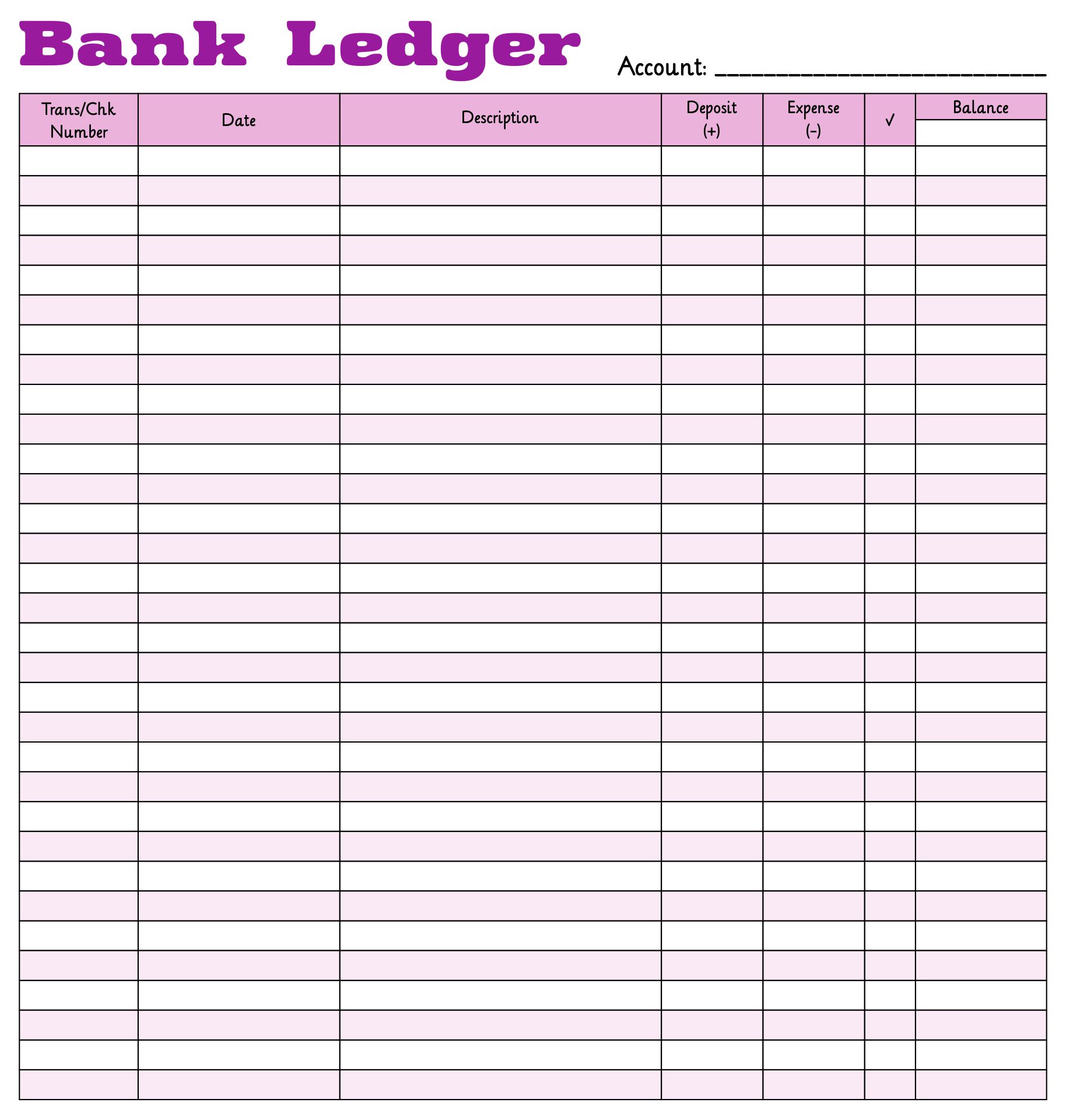

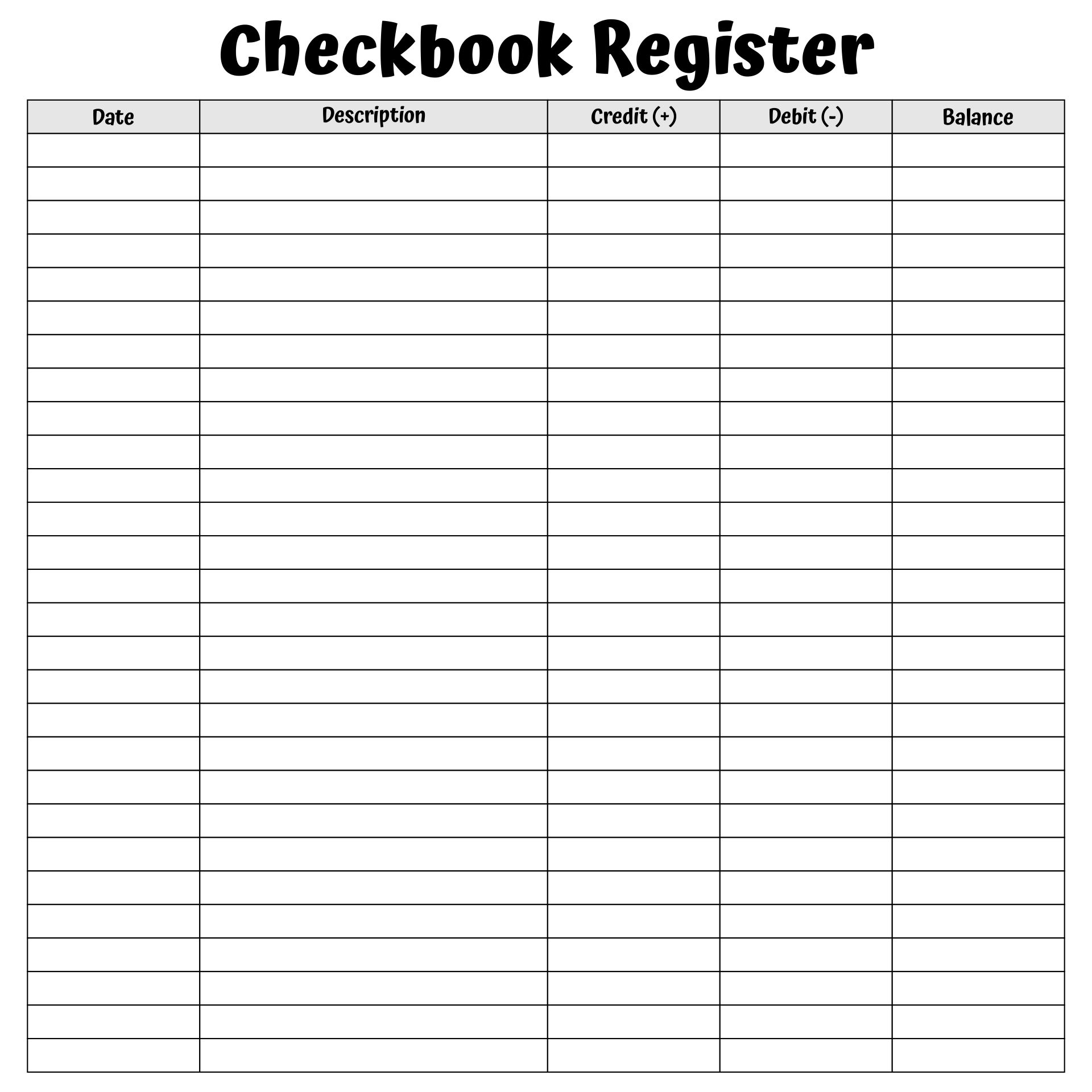

Small business owners can benefit from our free, user-friendly check register template. This simple solution for recording and tracking transactions gives a comprehensive overview of your financial status. Enhance your business's financial upkeep today with this practical tool.

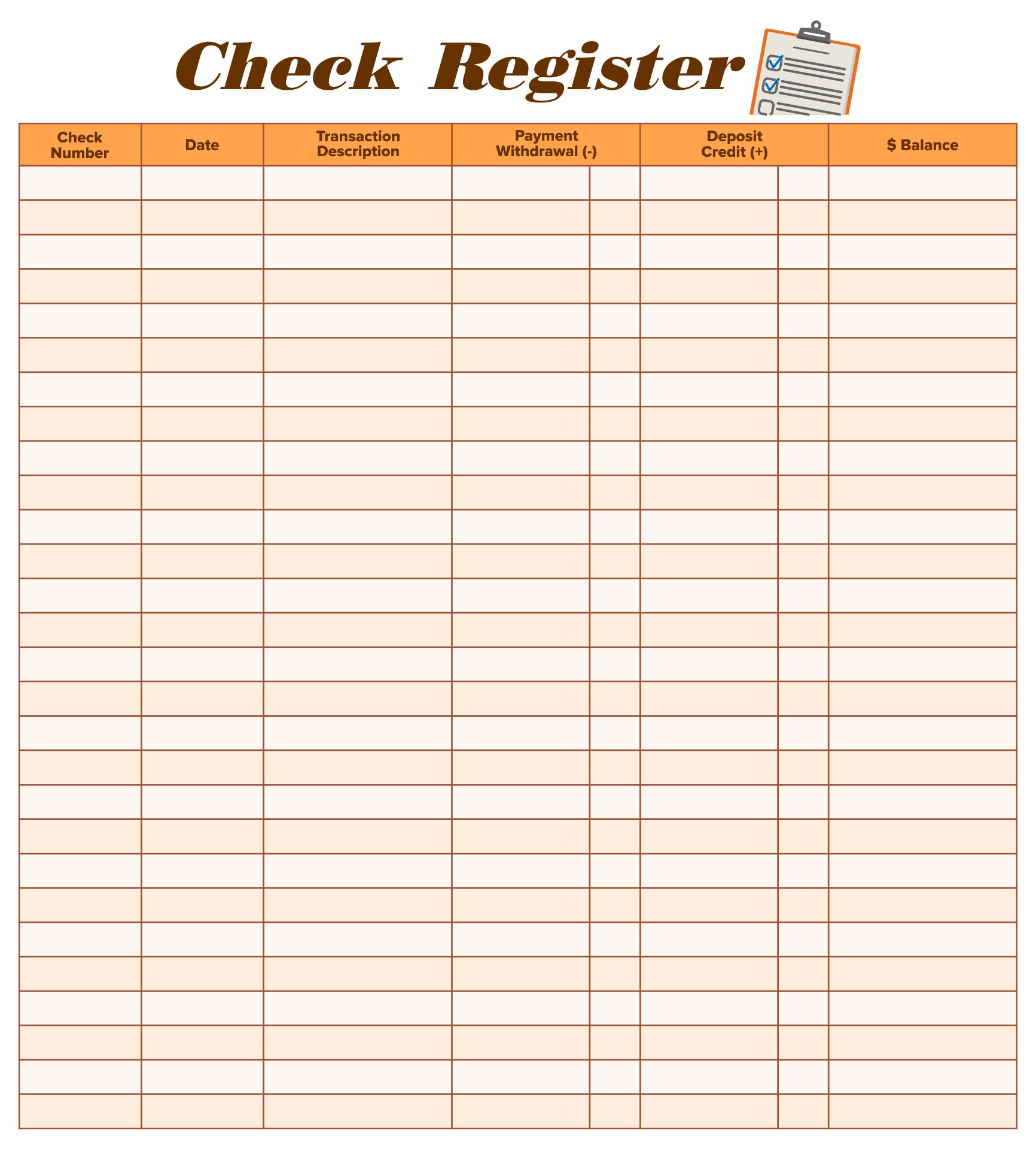

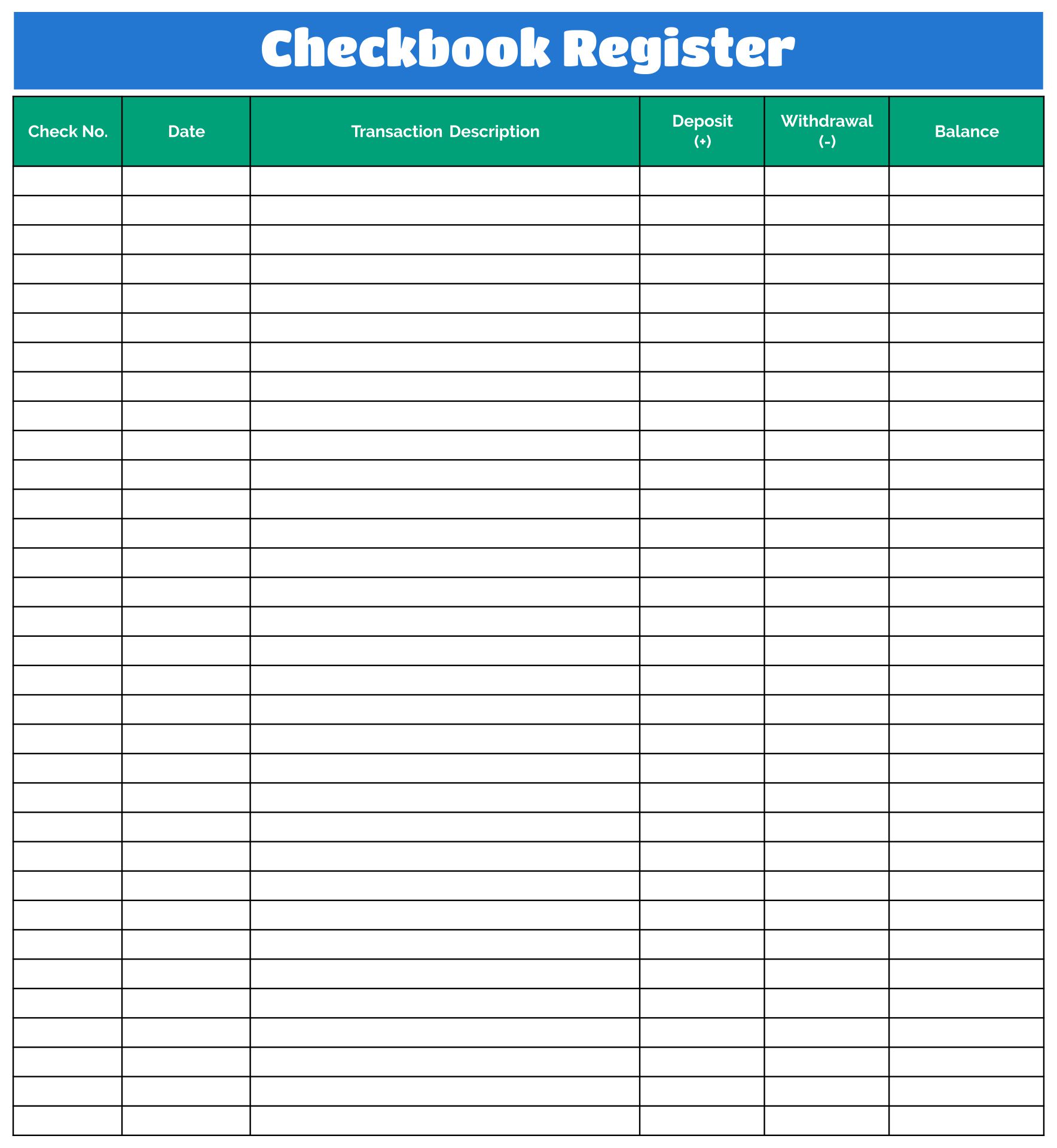

Our free large printable check register is an excellent tool for college students aiming to improve personal finance management. By providing a clear overview of income and expenses, it aids in making adjustments to spending habits and prioritizing financial objectives.

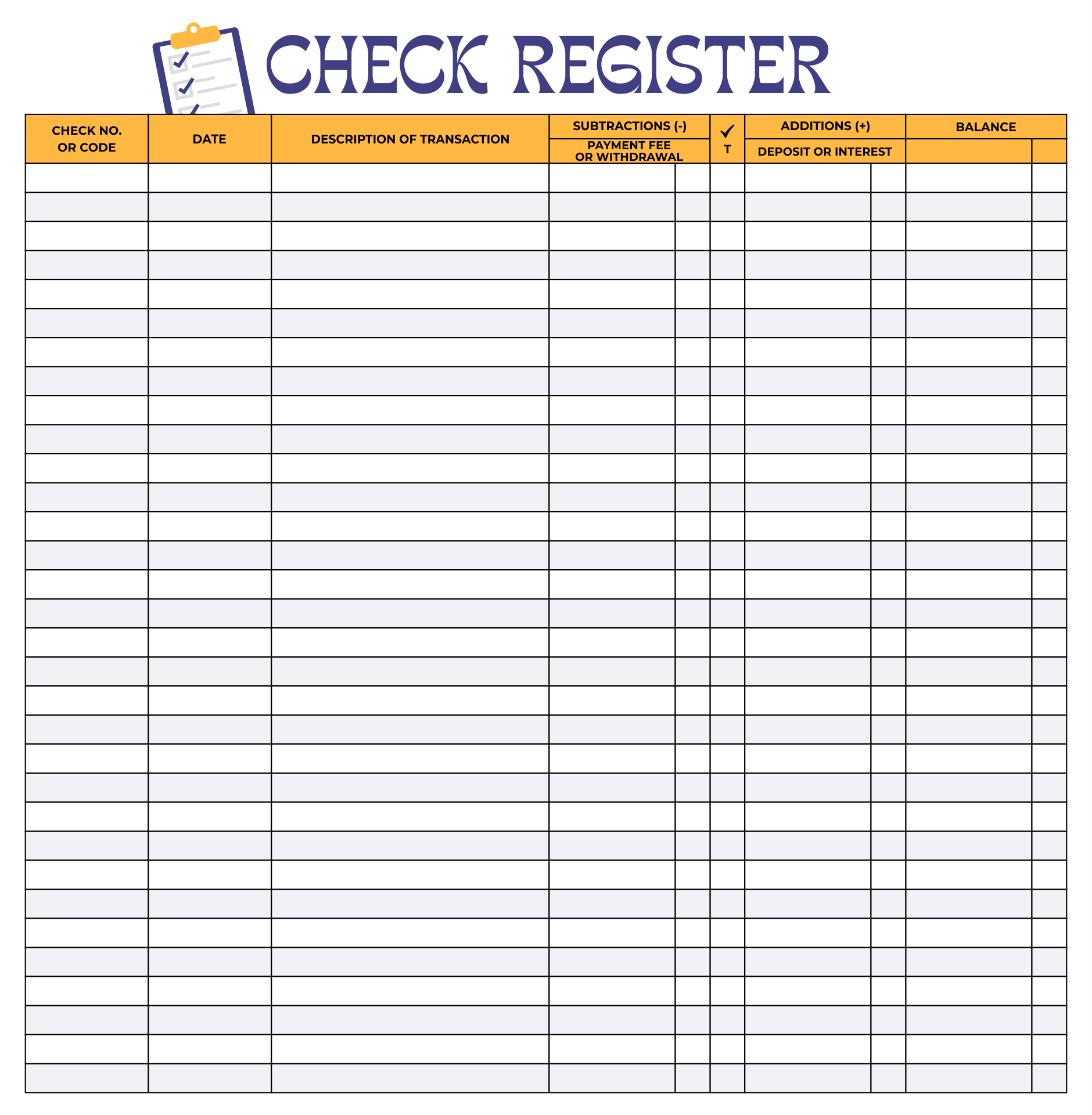

Teaching money management to children is vital for their financial future. Our free large printable check register can be a helpful tool for parents to guide their children in tracking expenses, learning budgeting, and making responsible spending decisions.

A large printable check register is a useful tool for keeping track of your finances. It provides space to write down the details of each check including the check number, date, payee, and amount. This can help you monitor your spending, balance your checkbook, and ensure that all transactions have been recorded accurately.

Have something to tell us?

Recent Comments

Thank you for providing this helpful resource! It's great to have a free, large printable check register that is easily accessible. It will certainly simplify my finances and make tracking my expenses so much easier. Well done!

Thank you for providing the Free Large Printable Check Register! It has been incredibly helpful for keeping track of my finances in a clear and organized way.

This free printable check register is a helpful tool for keeping track of my finances. Thank you for providing it!