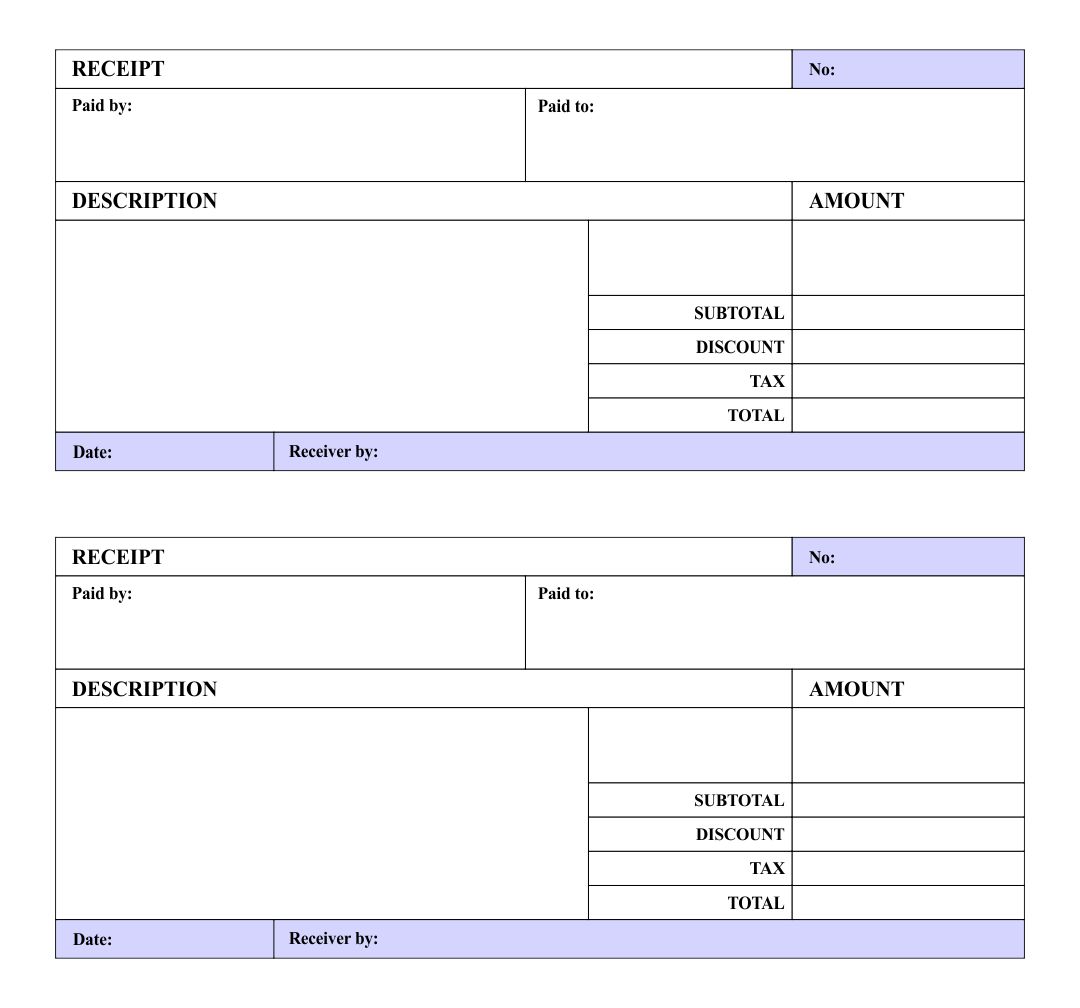

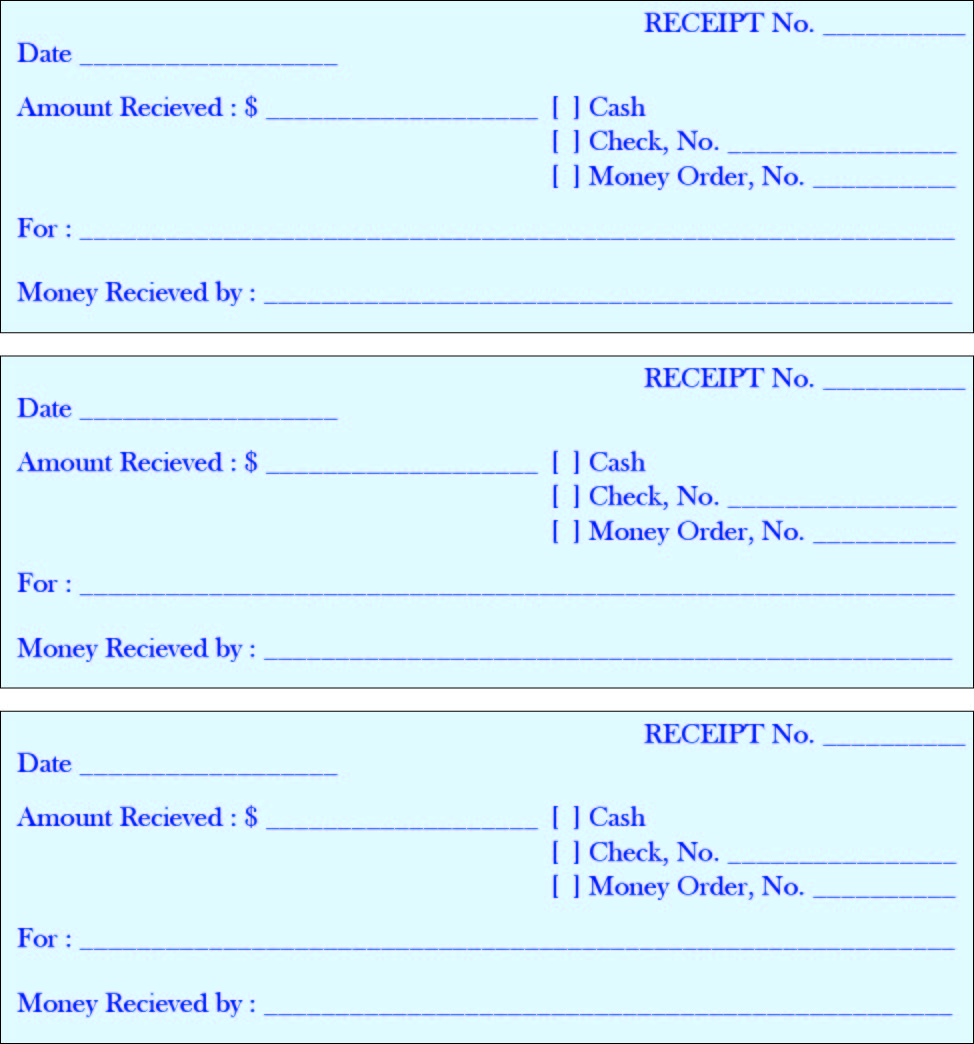

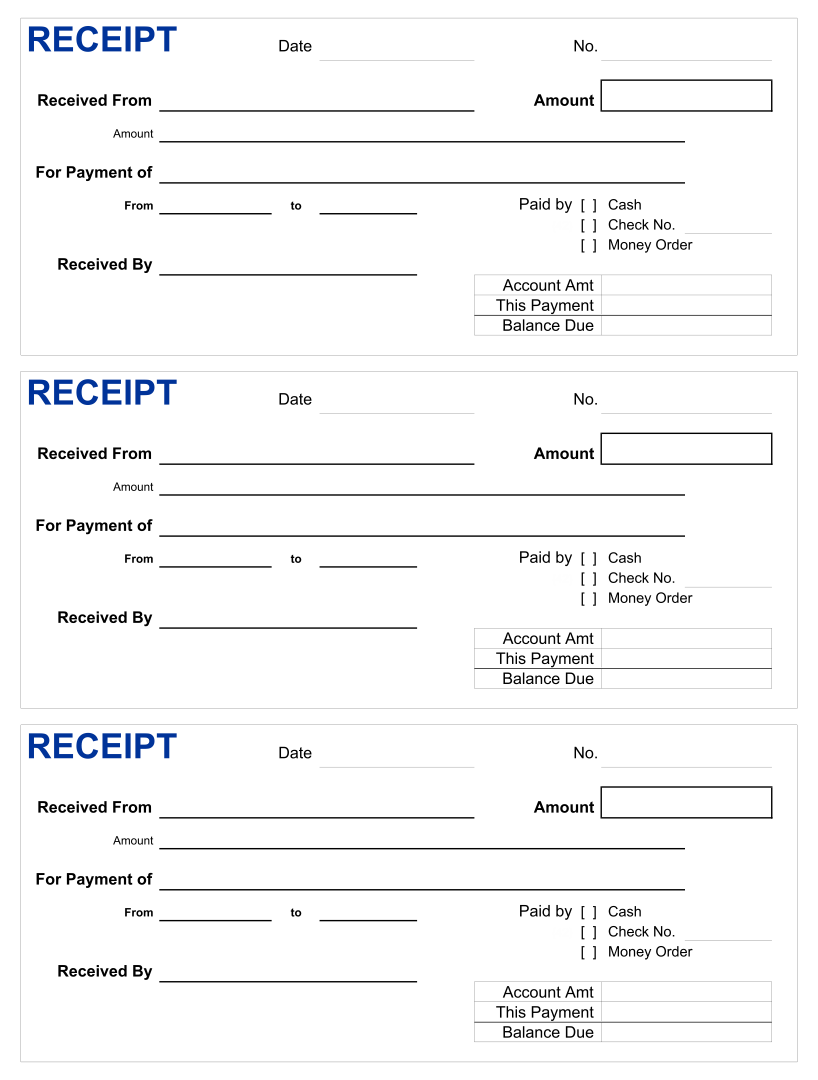

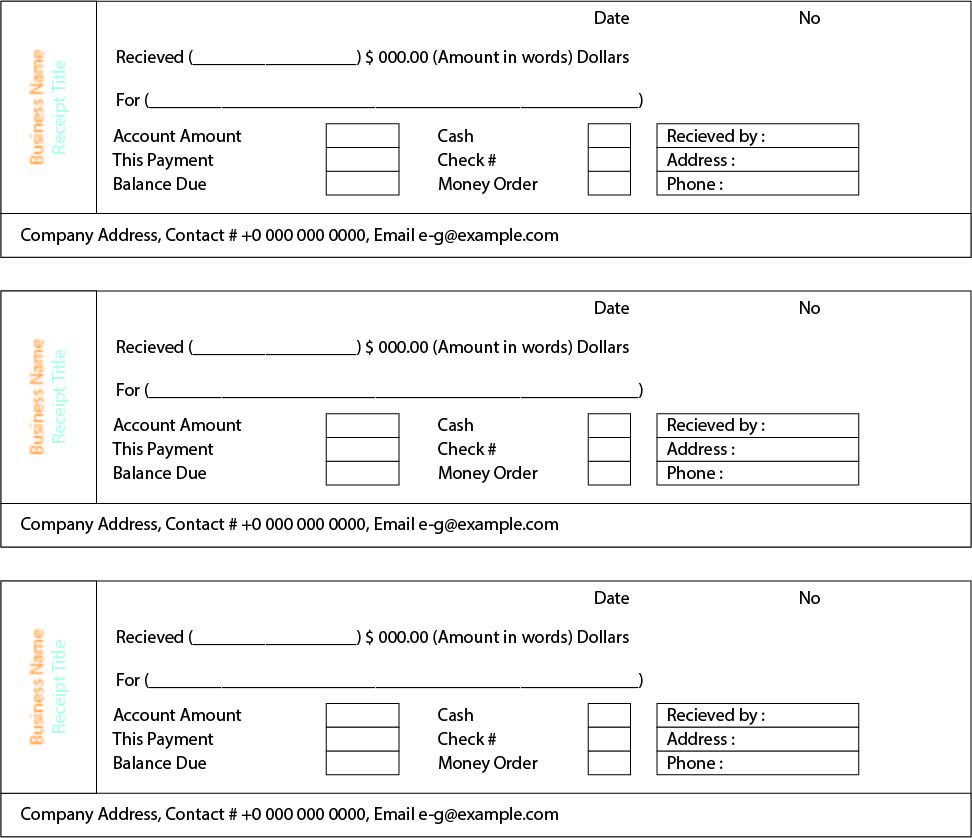

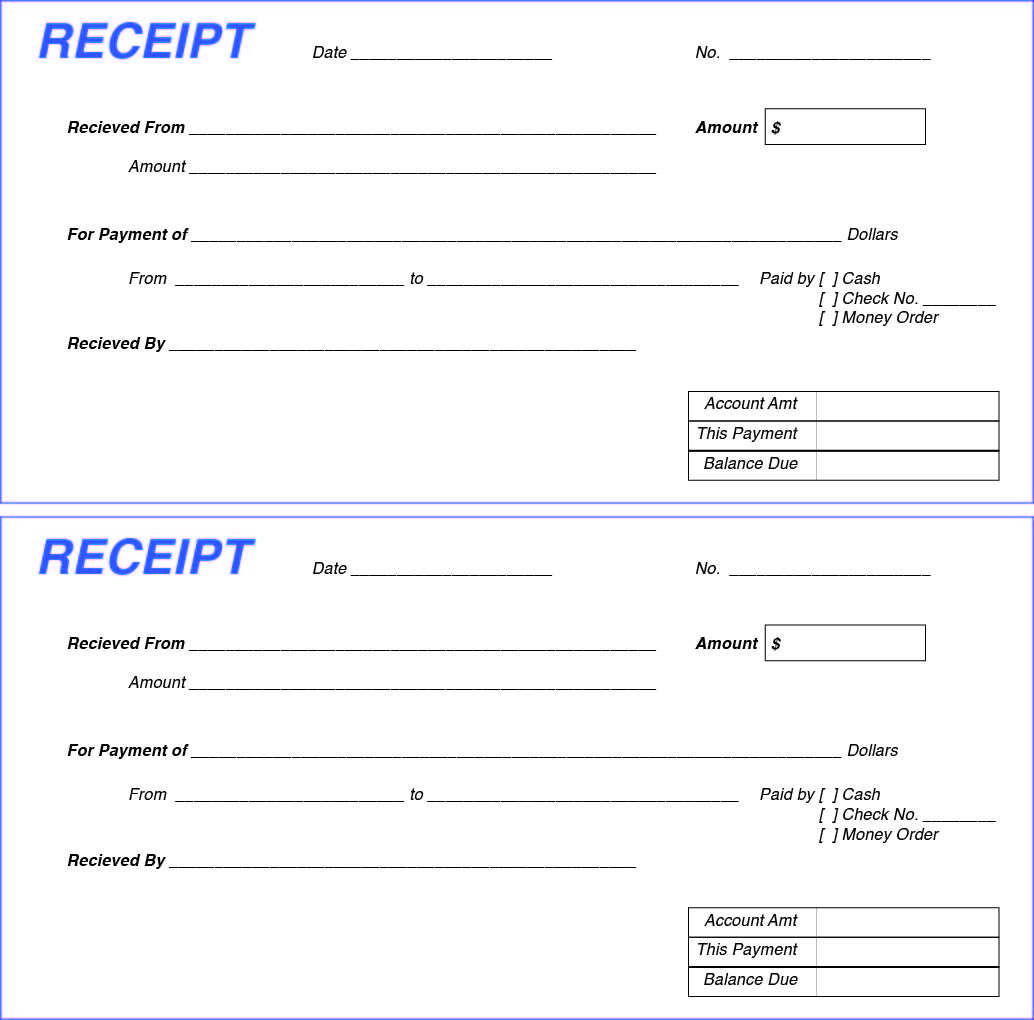

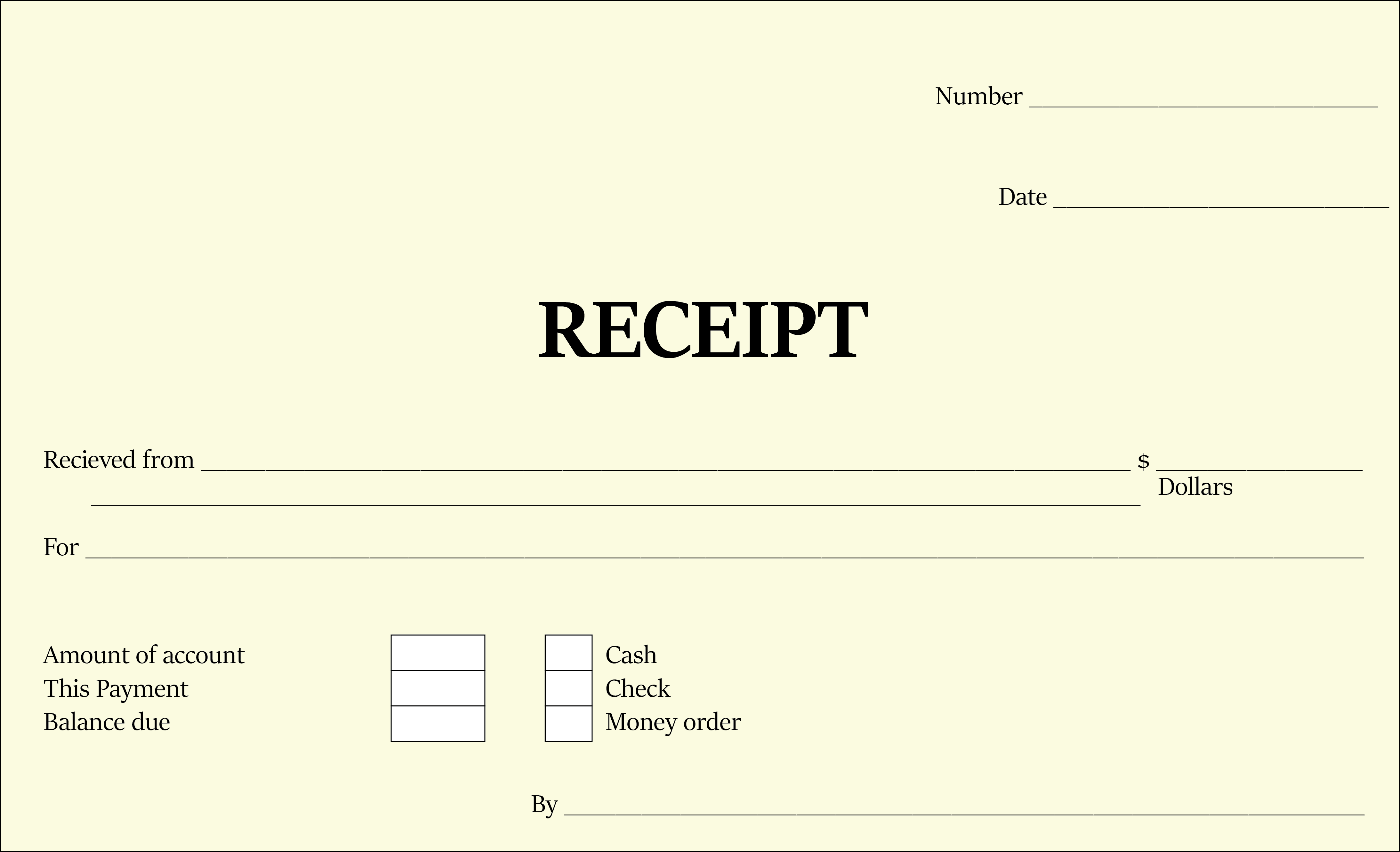

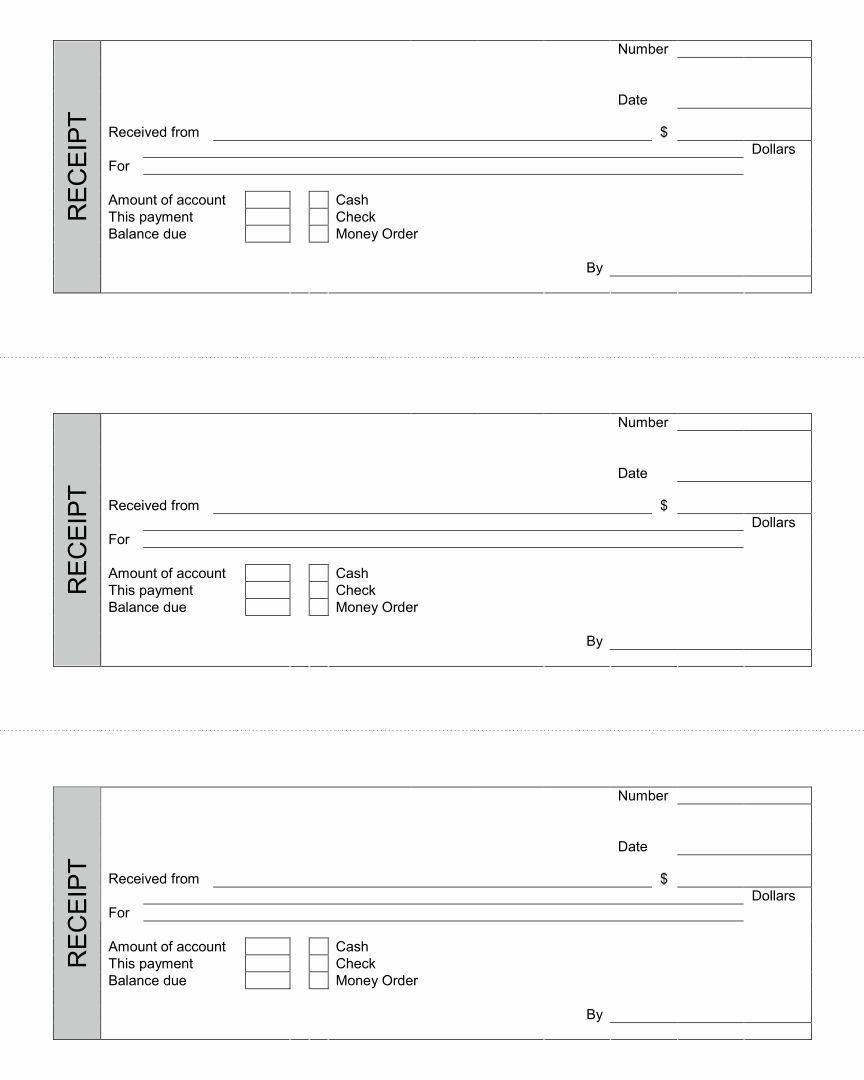

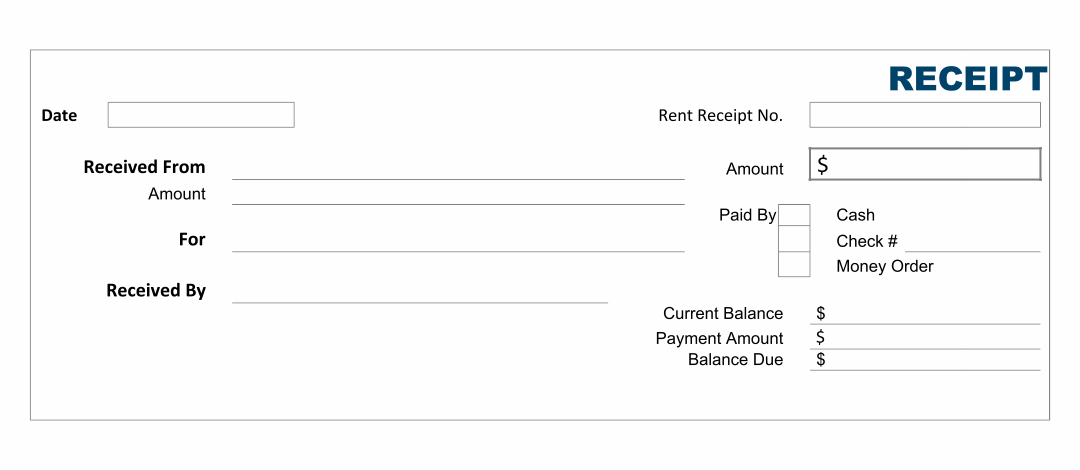

Printable cash receipt templates offer a convenient way for small business owners to track and record cash transactions.

These templates can be customized with relevant details, helping maintain accurate records and provide professional, organized receipts. A beneficial tool in enhancing your record-keeping process.

A printable money receipt cash is a convenient document that allows you to record cash transactions. It can be used by individuals or businesses to issue a receipt to customers or to keep track of personal expenses. By providing a professional-looking receipt, you can easily document your financial transactions and ensure accurate record-keeping.

Have something to tell us?

Recent Comments

Thank you for creating this helpful Free Printable Money Receipt Cash resource! It's great to have a convenient template to keep track of transactions. Appreciate the effort!

Appreciate the simple and efficient layout of this Free Printable Money Receipt Cash resource. It's a convenient tool that saves time and keeps my financial records organized. Thank you for providing it!

Thank you for providing this helpful resource! It's great to have access to a free printable money receipt that can assist in organizing my finances. Keep up the good work!