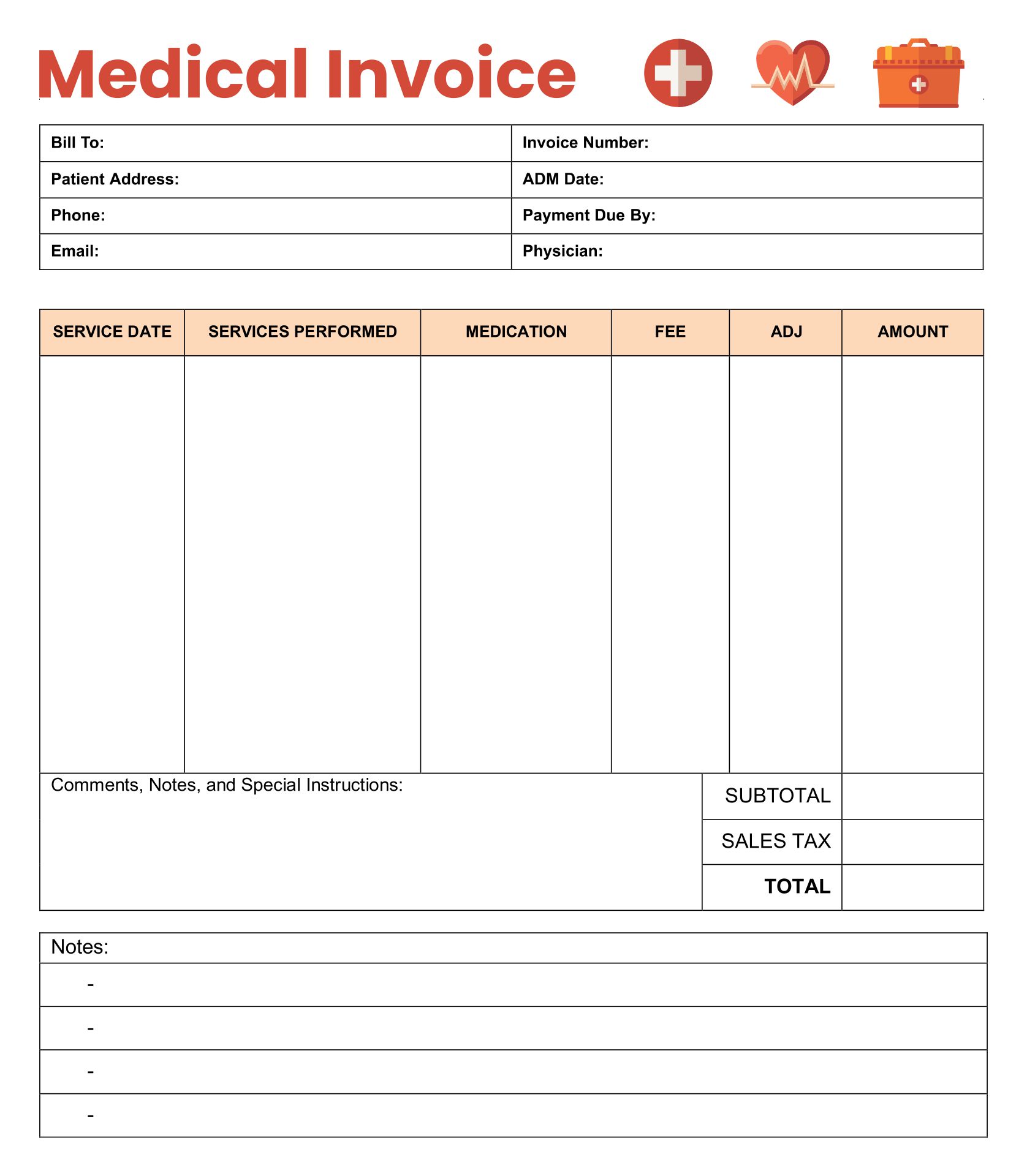

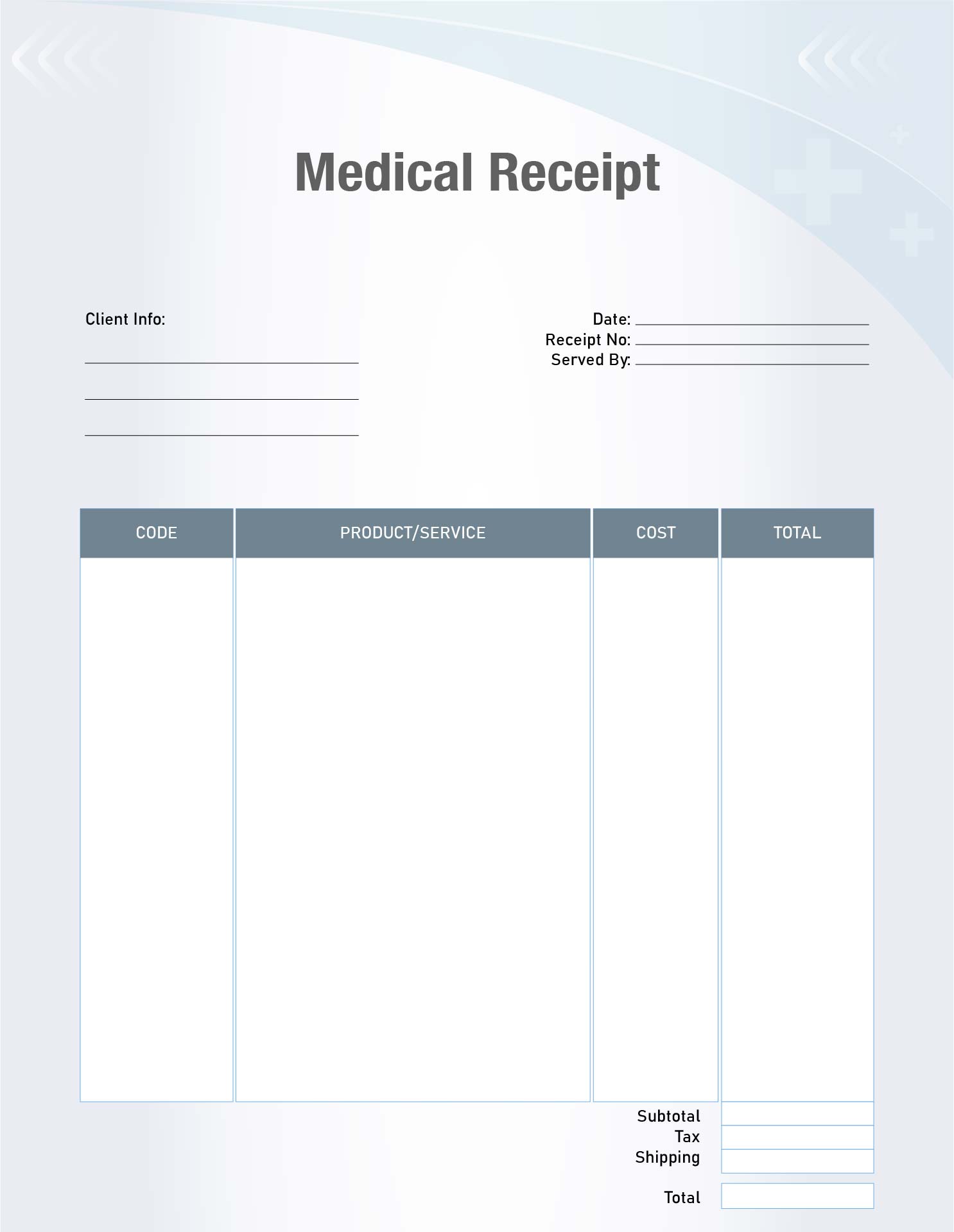

Doctors and patients both need records of their transactions, especially for insurance or tax purposes. Yet, finding a straightforward way to create these records that's both accessible and professional often turns into a bigger task than expected. With no simple solution readily available, patients and healthcare providers alike find themselves in a bit of a bind. They're left looking for an efficient method to produce printable medical receipts that serve everyone's needs.

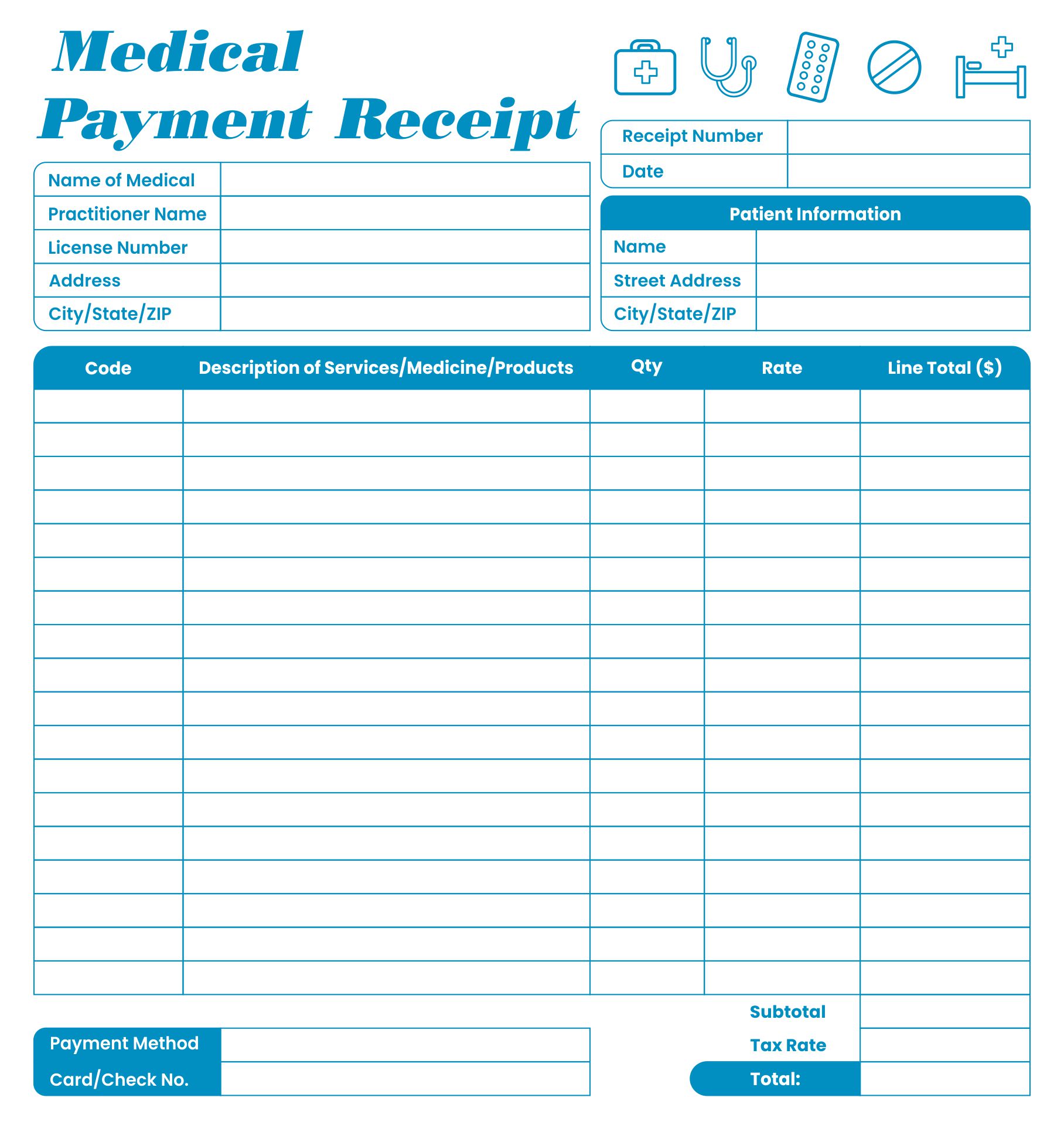

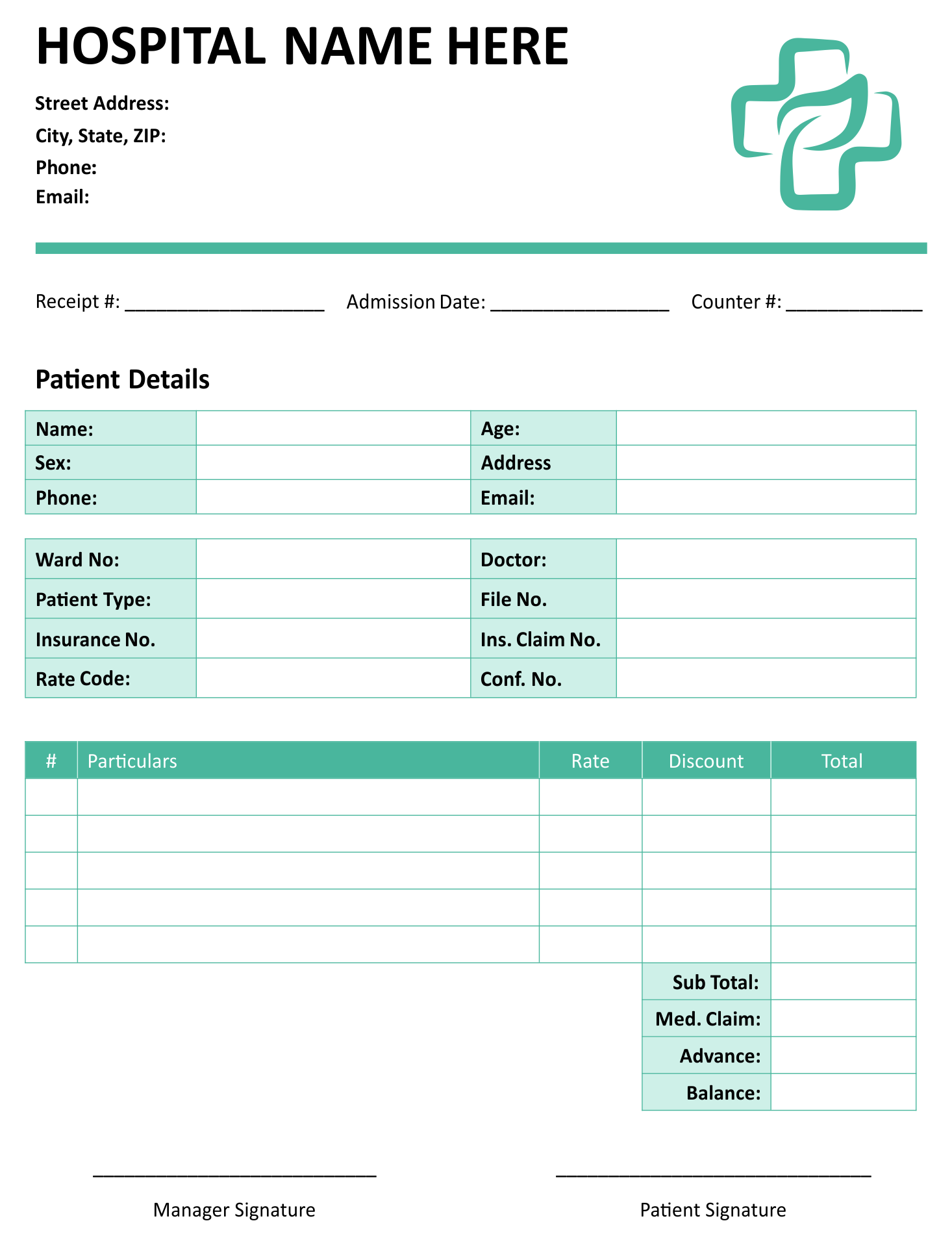

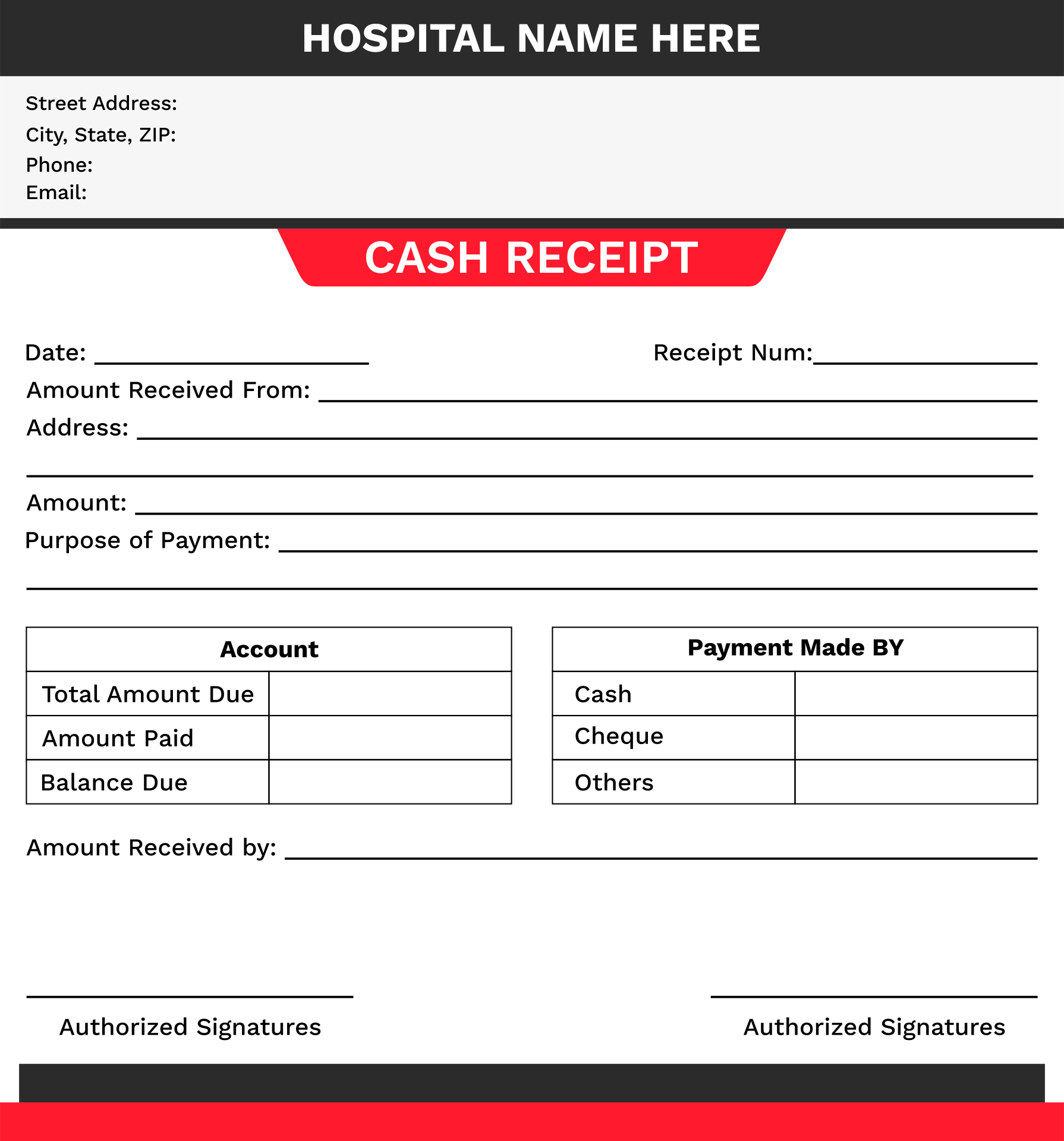

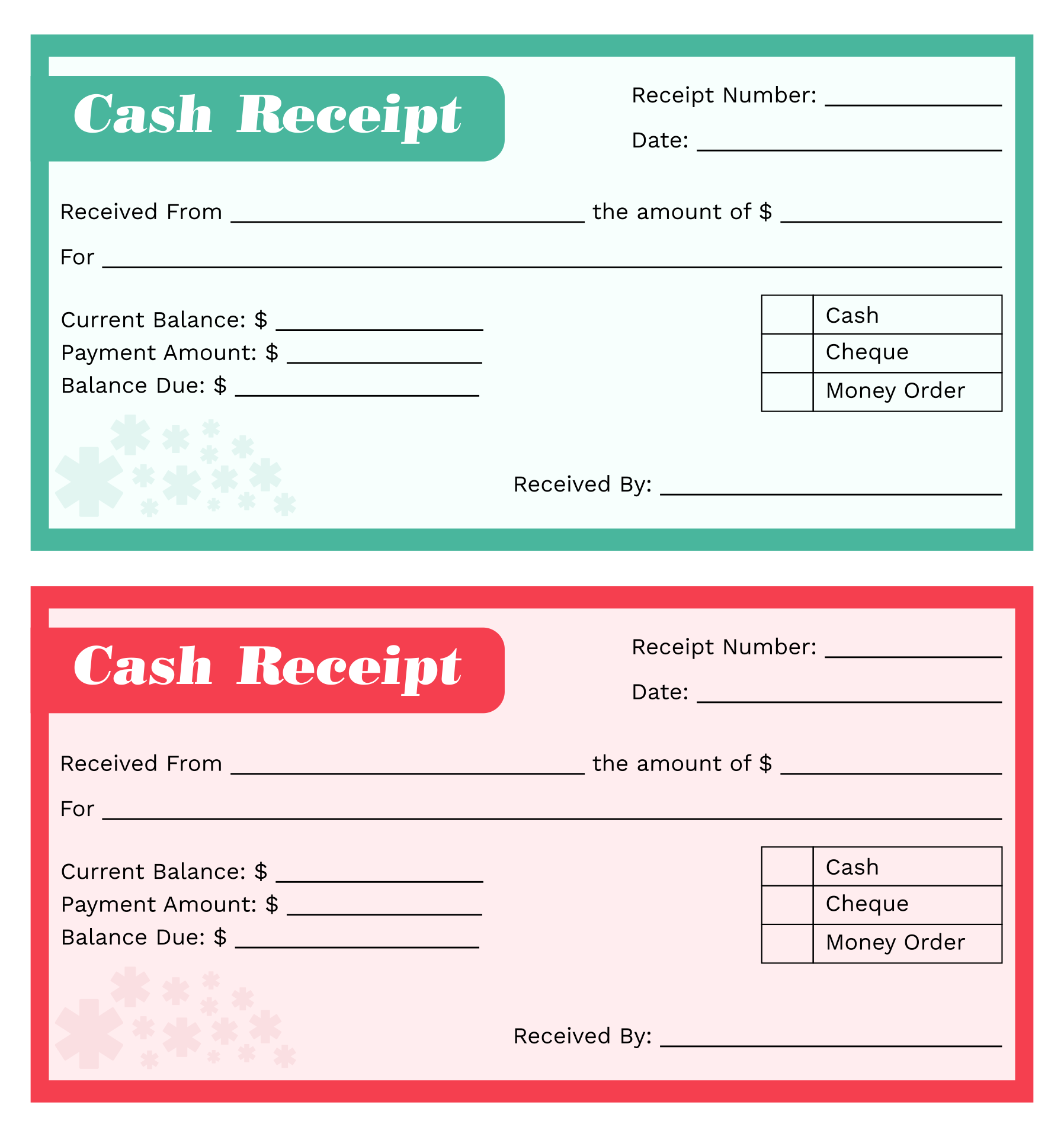

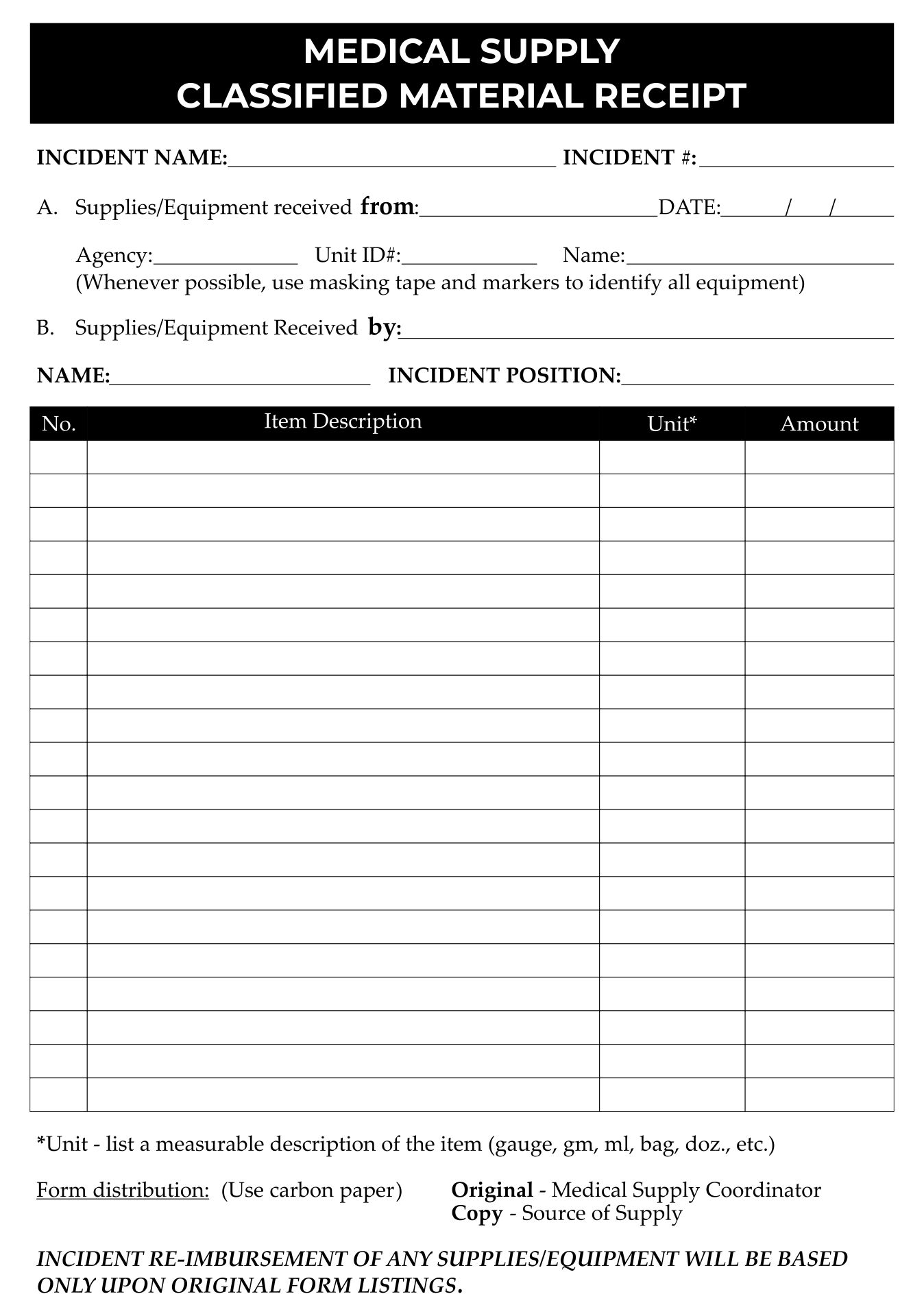

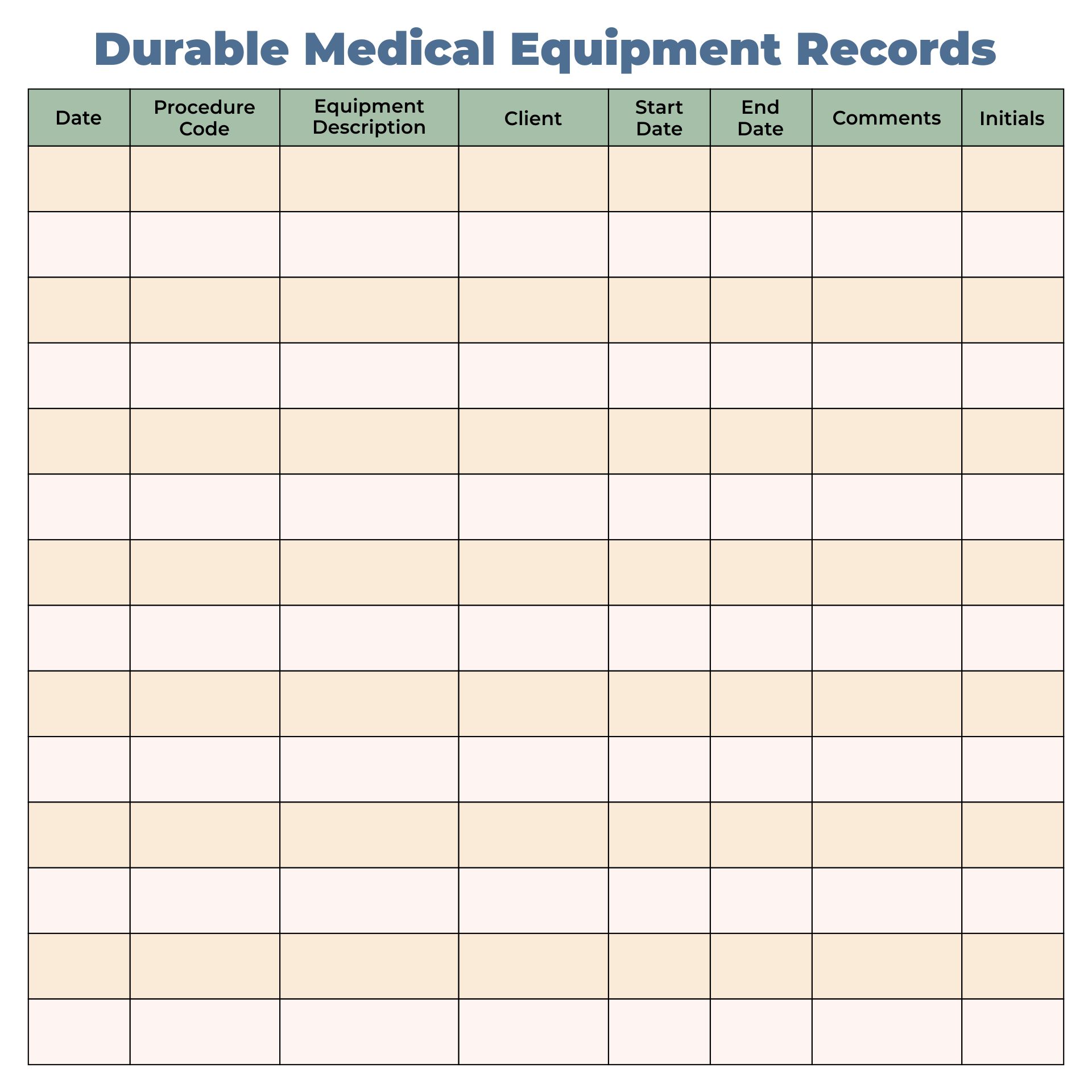

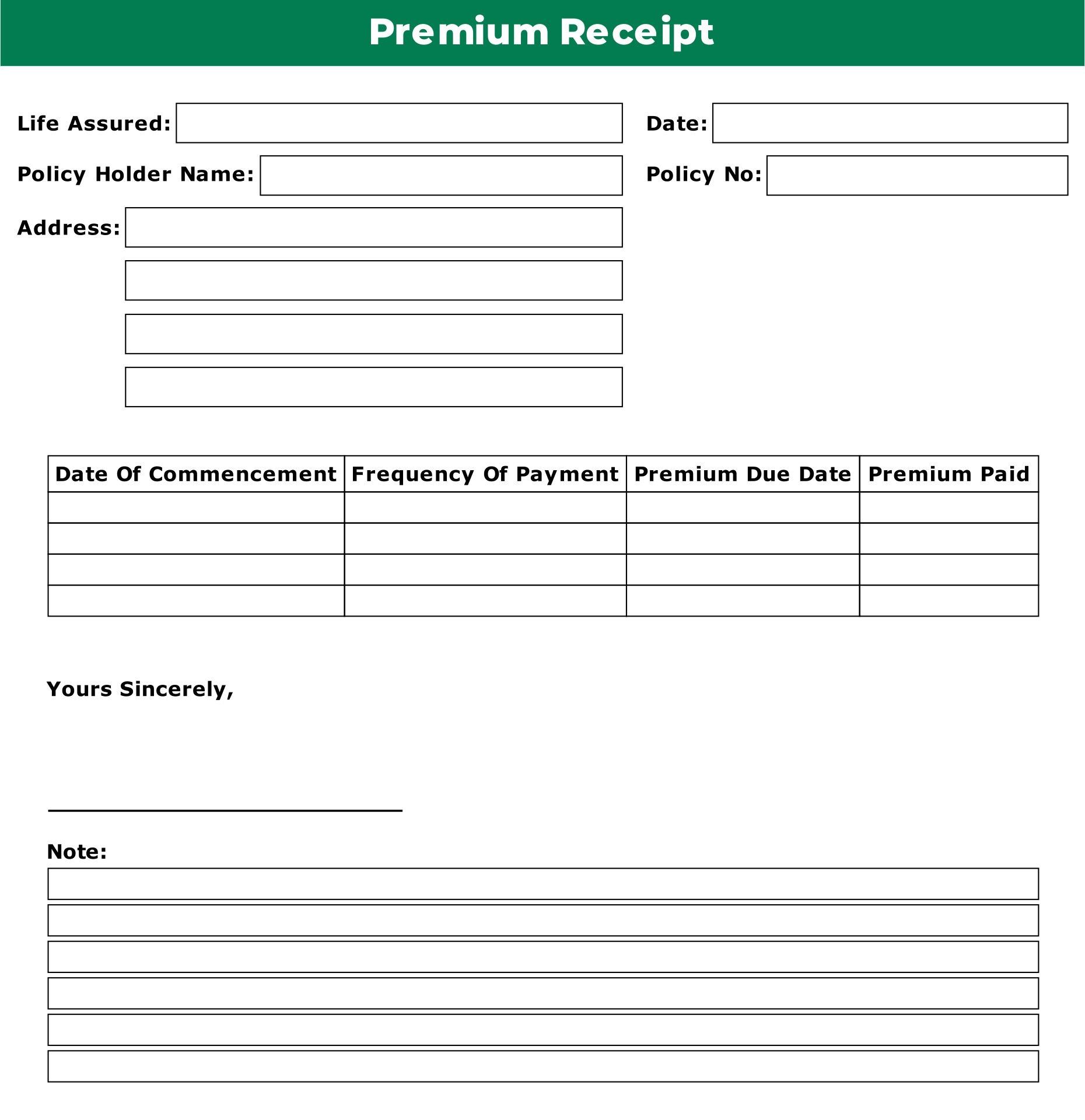

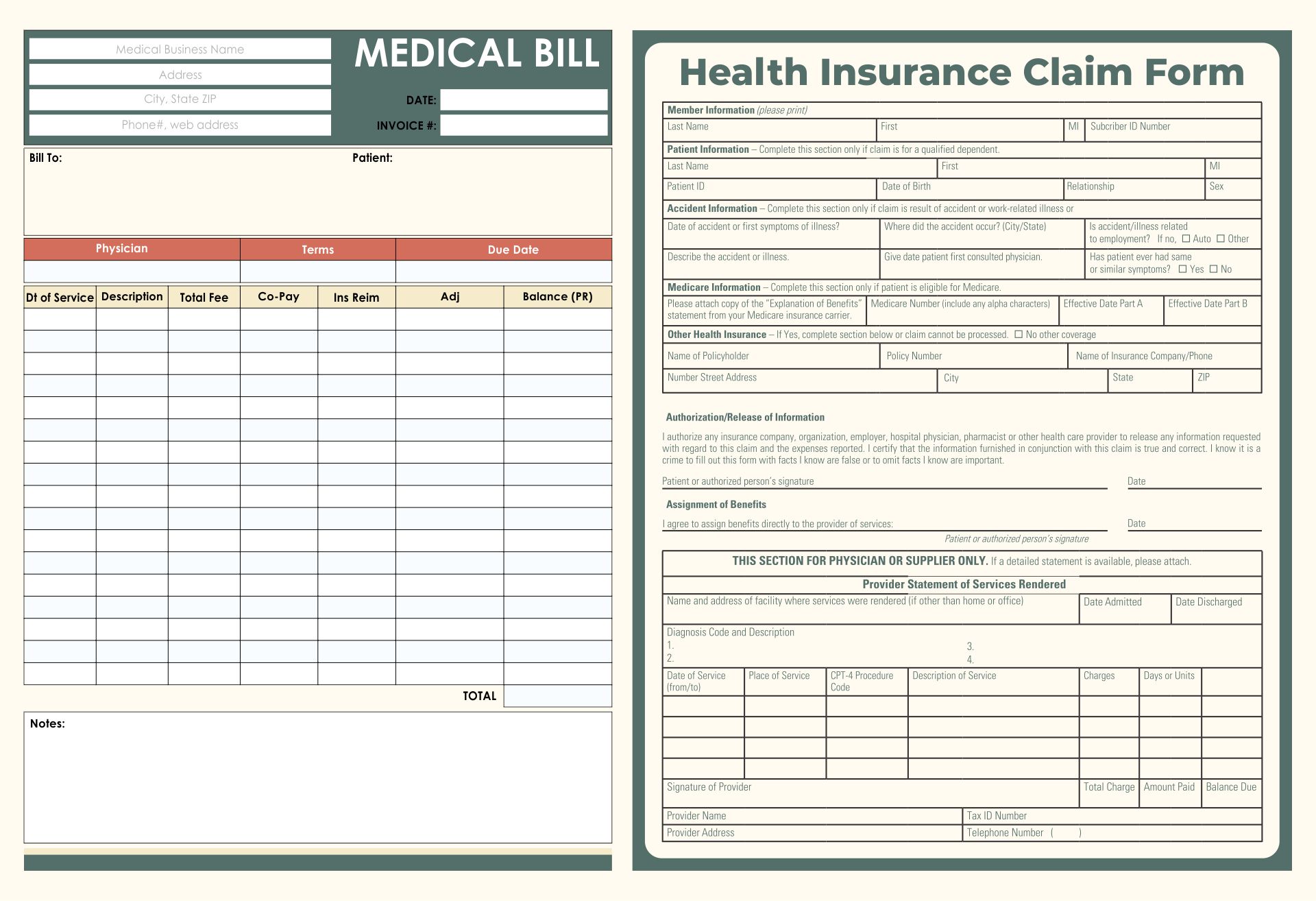

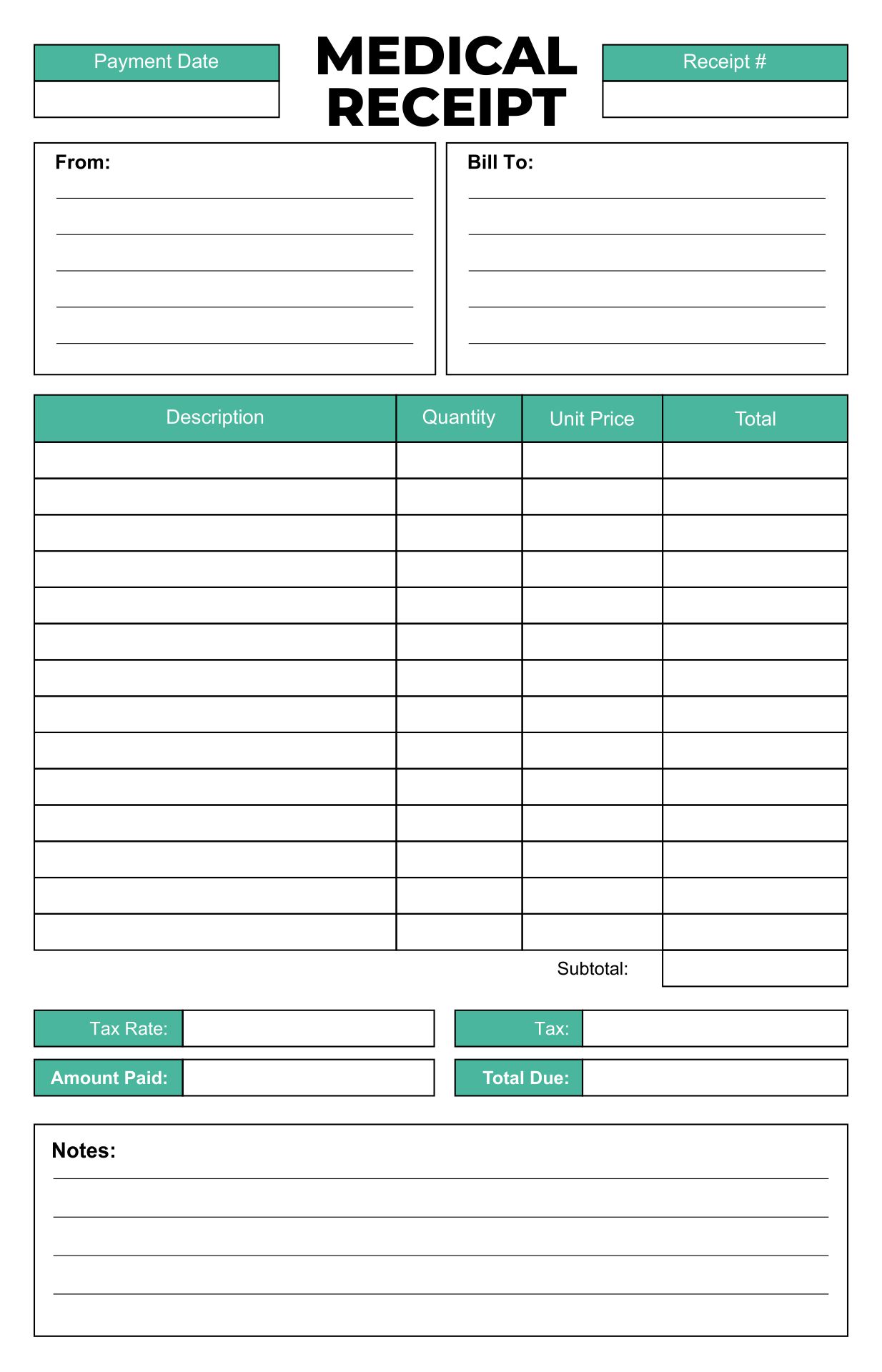

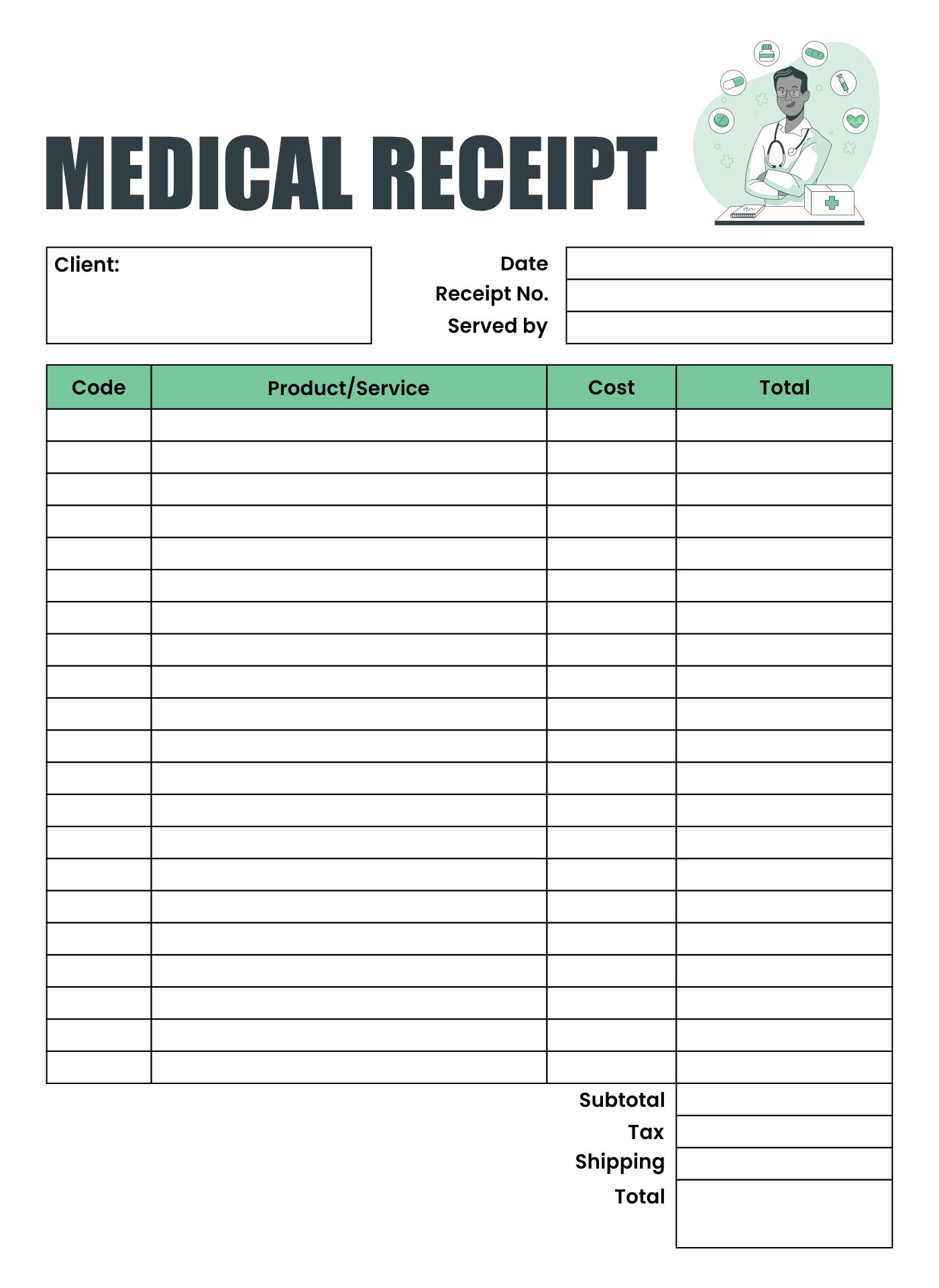

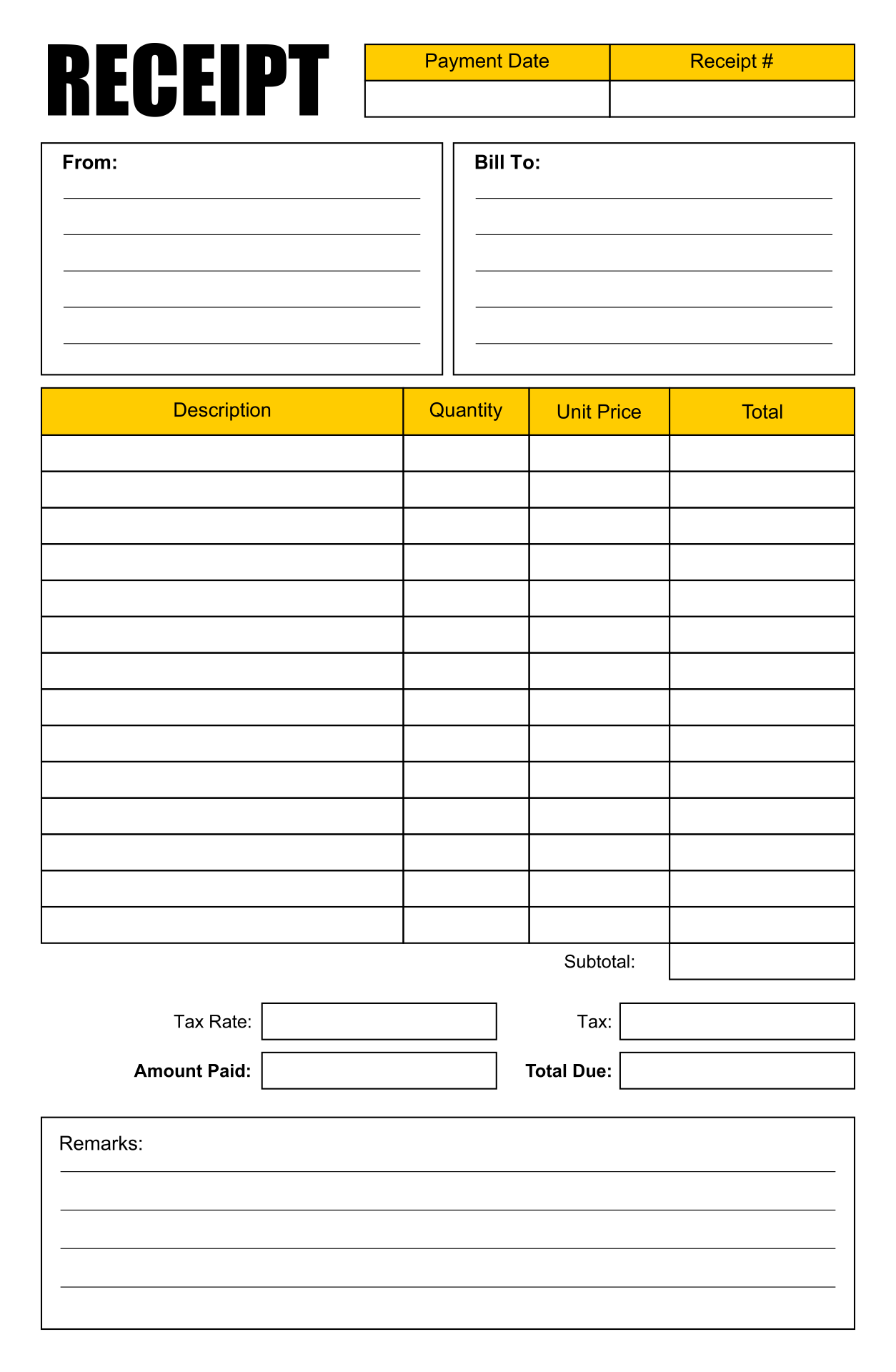

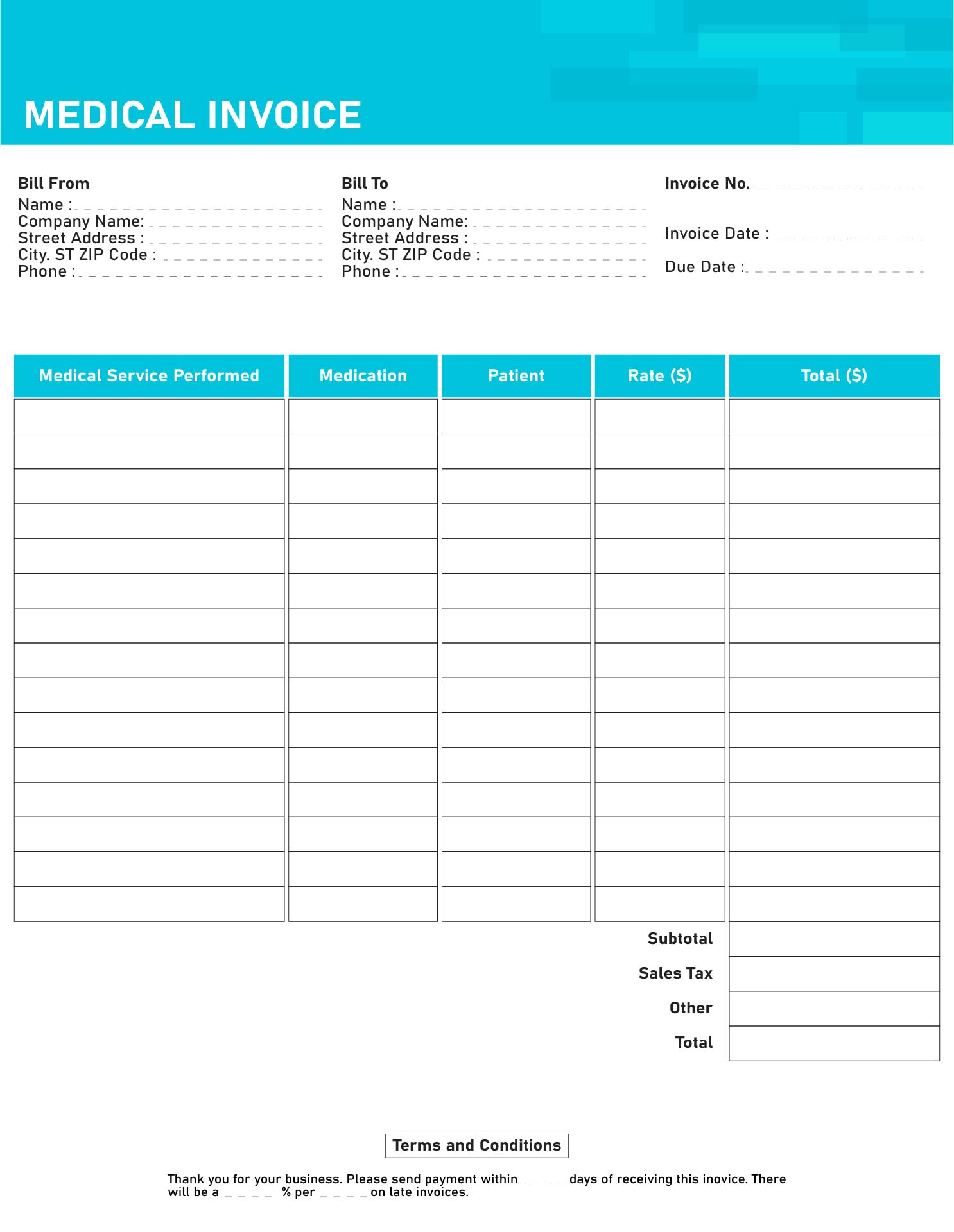

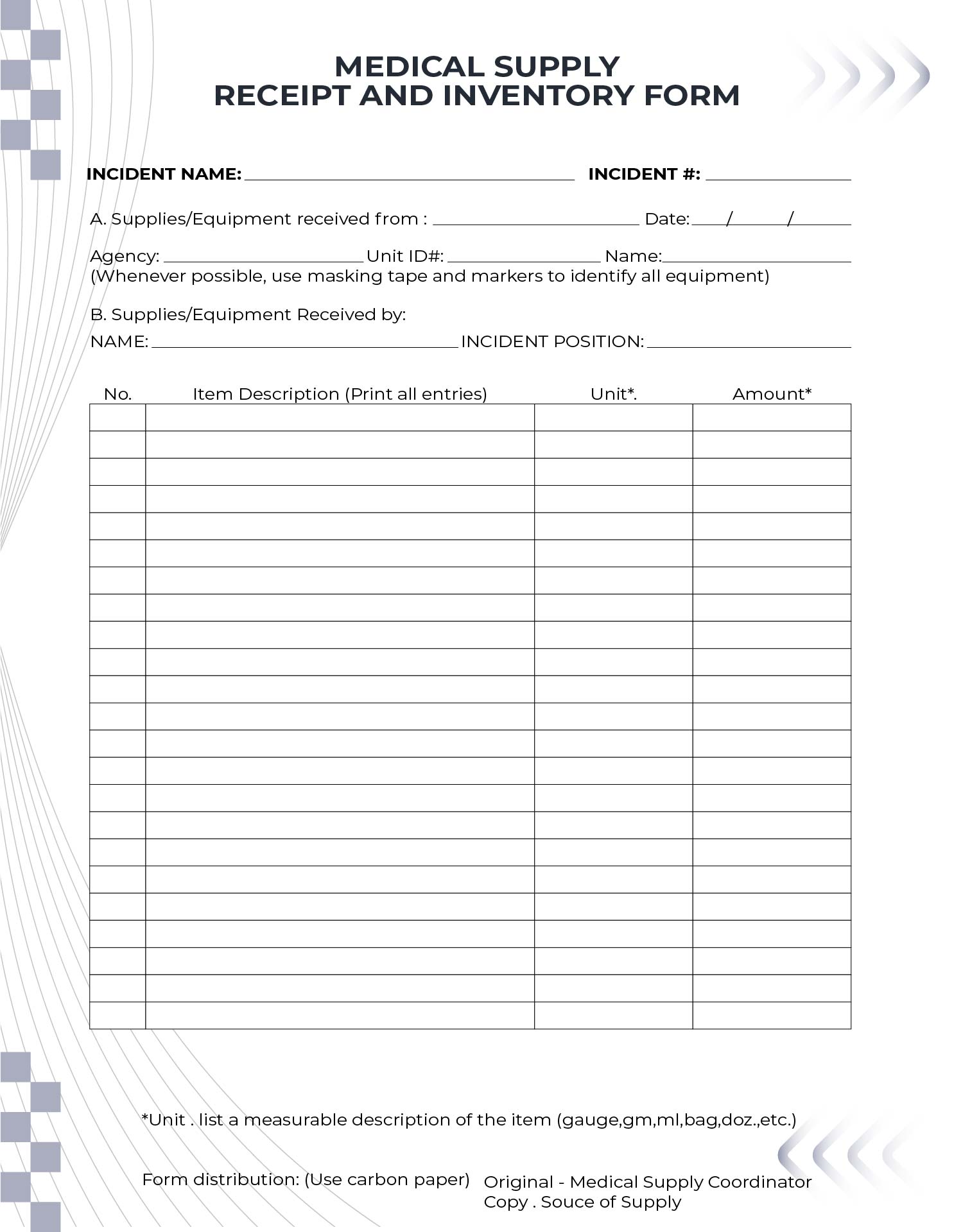

We put together templates for printable medical receipts to help track expenses easily. They’re simple to fill out, and you can keep them for your records. Very useful for managing healthcare costs or for reimbursements from insurance. Keep everything organized without headaches.

Heart disease is a medical issue that affect your heart condition which include blood vessel, heart rhythm problems, a heart defect that exist since you were born, heart valve disease, heart infection, and heart muscle disease. A healthy lifestyle is a choice that you can take to treat and also prevent the risk of heart disease. The symptom that you might experience when you experience heart disease is explained in the following statements. The build-up of fat in the arteries can slowly destroy your blood vessel and also the heart itself. It causes blocked blood and also narrows your blood vessel which causes heart attack, stroke, and chest pain.

The symptoms in men and women with artery disease might be different. Man, most experience chest pain, meanwhile, women will experience it along with nausea, extreme fatigue, and also shortness of breath. Heart disease also includes the symptoms of the beat in the quickest way, slowly, or even irregularly. It is called heart arrhythmia. Other symptoms that you might experience are dizziness, fainting, light-headedness, and fluttering in your chest.

When you already have heart disease since you were born, it will be detected soon after birth. Kids with health defect signs will have swelling in their legs, pale grey or blue skin color, shortness of breath during feeding, and poor gain weight for the infant. If you have a heart muscle disease, you’ll experience fatigue swelling in the legs, ankle, and feet, irregular heartbeat, dizziness, and fainting.

You are required to go to the emergency room if you experience chest pain, fainting, and shortness of breath. Anticipate this by calling 911 or any medical emergency to seek treatment right away. Heart disease can be caused by many kinds of factors. For example, heart infections were caused by bacteria, viruses, and parasites. There are also several risk factors that can influence to leading heart disease.

Those were family history, age, sex, smoking, poor diet, diabetes, high blood pressure, obesity, cholesterol in high amount, lack of exercise, unrelieved stress, and unhealthy dental. The complication of heath disease that you might experience is heart attack due to the blood blocking in the blood vessel, heart failure which caused your heart doesn’t have enough blood to fulfill your body's needs, and stroke which happen because your brain only gets little blood. If you have already experienced several symptoms, it is better for you to seek the doctor’s help immediately before it’s getting worse.

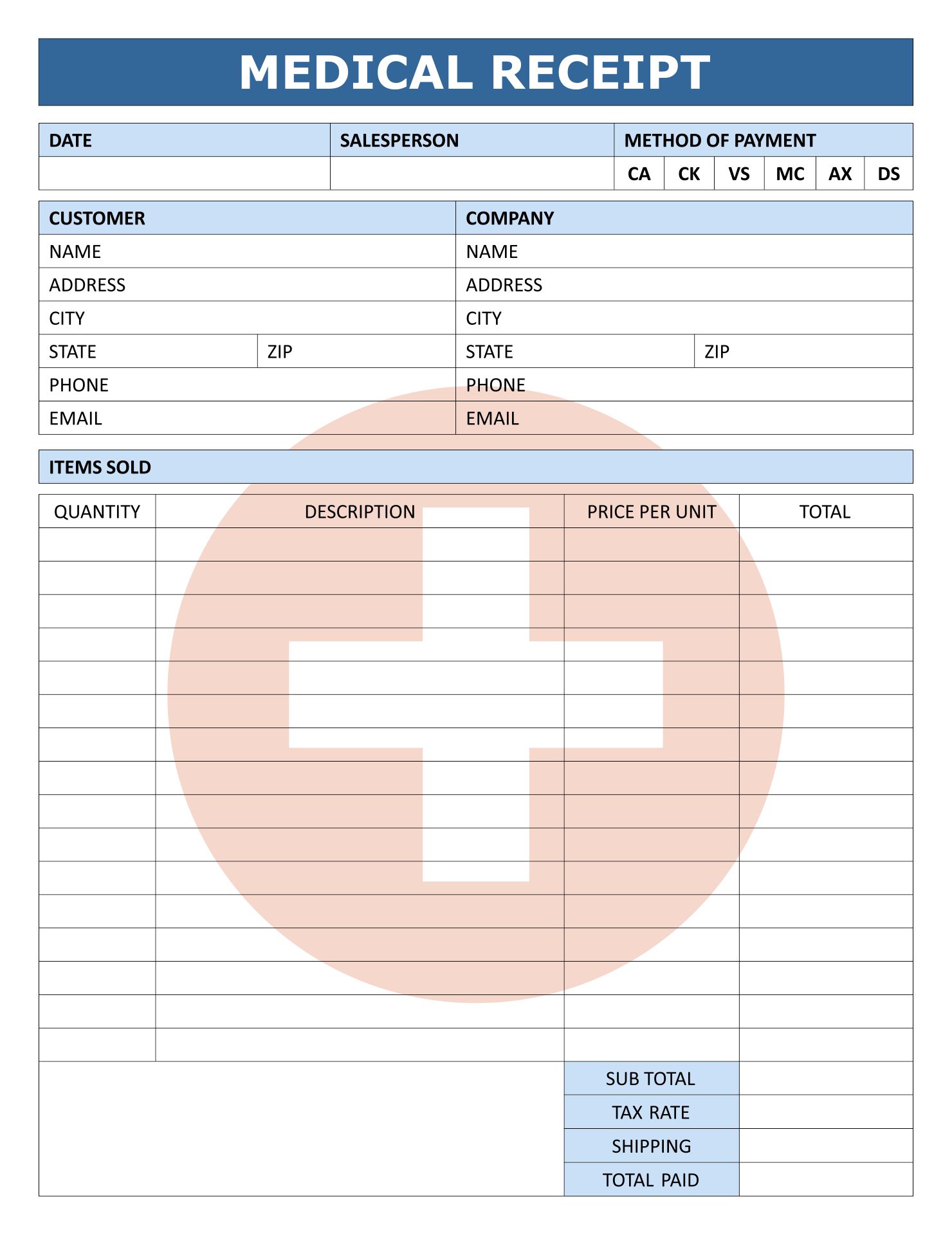

Doctors and clinics give out receipts after appointments or treatments, important for keeping track of medical expenses. Patients often need these receipts for insurance claims or tax purposes. However, creating these receipts takes time and must include all necessary details like treatments, costs, and dates accurately. It's a problem needing a solution to make the process quicker and error-free.

We make it simple for healthcare providers to give patients clear, detailed records of their visits. By designing printable medical receipts, one can itemize services, treatments, and medications easily. This helps patients keep track of their healthcare expenses and understand their charges better. Handy for both provider and patient, ensuring transparency and facilitating smoother transactions.

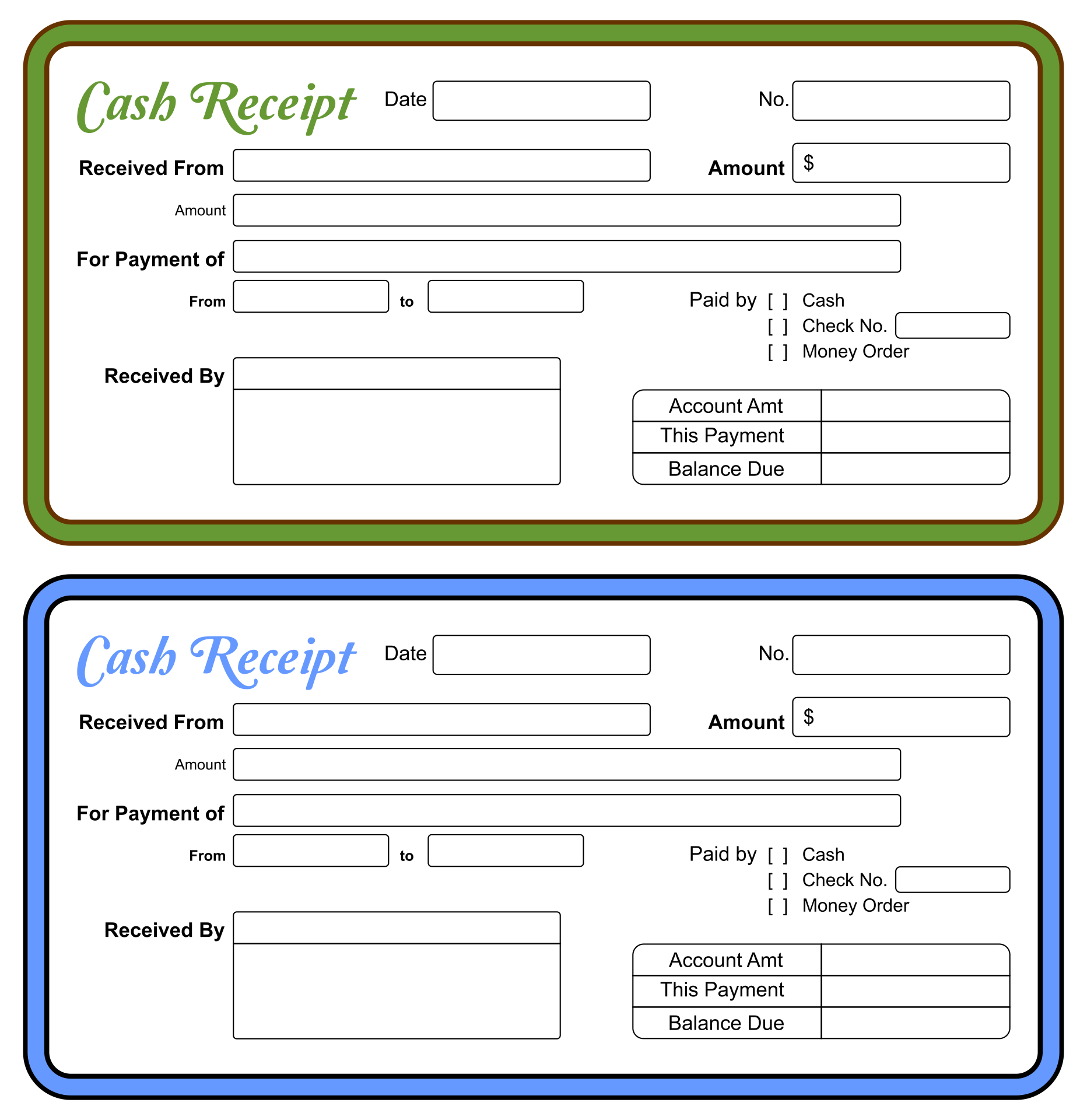

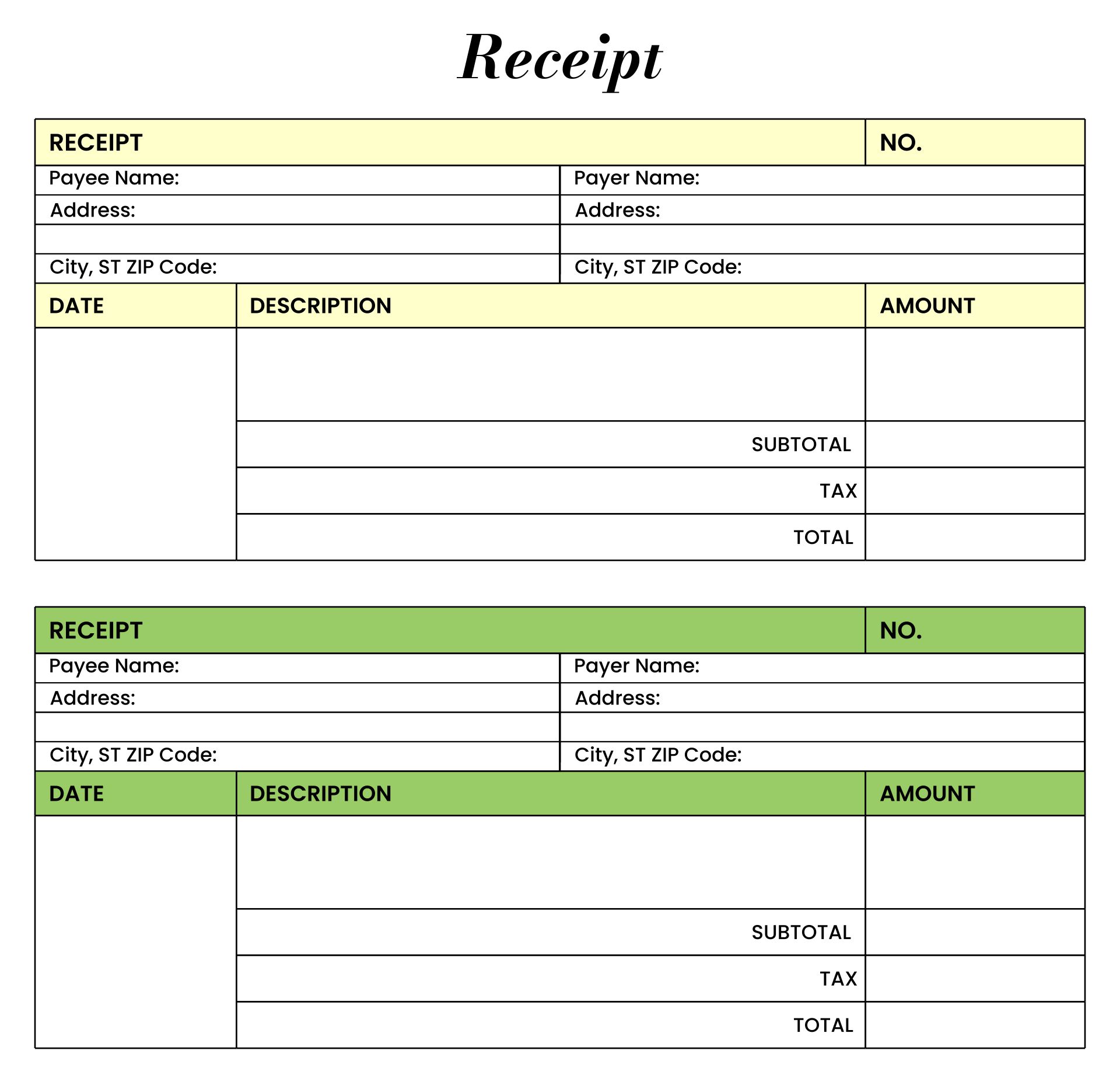

Are you familiar with receipts? Have you ever received a receipt? The receipt itself will be found when you make a transaction where the receipt will write the amount of money that came out in the receipt. As for the definition, a receipt can be defined as clear evidence in writing something that important has been delivered between one and another side. Receipts are also offered in the context of a company deal and share market negotiation, like receipts that vendors and providers often send to clients. In addition, receipts are divided into two categories. They are as follows: Revenue receipts and Capital receipts. First, revenue receipts are those receipts that do not result in a government claim. As a result, they are referred to as non-redeemable. Revenues are divided into two categories: taxed and non-taxed. Direct taxes (personal income tax) and enterprises (corporation tax) have been distinguished from indirect taxes such as customs duties (taxes placed on products transported into and exported out of India), excise taxes (duties placed on products made within the country), and service taxes. Several direct taxes, such as gift tax, wealth tax, and estate duty (now abolished), have never earned a significant amount of money, and are therefore referred to as paper taxes. Meanwhile, capital receipts are assets received by a firm that are not earnings in nature and lead to an increase in the company's total capital. These are money created through a company's non-operating operations, and they are reported on the balance sheet rather than the income statement. They are non-recurring in nature, which means they do not even happen on a daily basis and can't be used for revenue sharing. Capital receipts are not utilized to develop cash reserves, unlike revenue receipts, which can be used to do so. They lead to increases in obligations or a loss in assets in a business. These types of receipts have no impact on an organization's total profit or loss and are recorded on an accounting system, which means they are recorded as soon as the right of receipt is acquired.

Have something to tell us?

Recent Comments

Simple and convenient, these Printable Medical Receipts are a great tool for keeping track of my medical expenses. Thankful for this resource that helps me stay organized!

This printable medical receipts resource is a simple yet essential tool for keeping track of my medical expenses. It provides a convenient and organized way to maintain a record of my healthcare transactions. Thank you for this helpful resource!

Thank you for providing these printable medical receipts! They are a valuable resource for keeping track of healthcare expenses and have made my record-keeping more organized.